What I'm thinking about: The most counterintuitive business lessons from 11 hours with Alex Hormozi…strategies that feel wrong but unlock the next level of growth.

Alex Hormozi is a small/medium business strategist who has sold multiple companies for 8-figure exits, manages Acquisition.com (a private equity firm whose portfolio earns over $250M in annual revenue), and recently set the world record for non-fiction book sales with his $100M Money Models launch.

I had stunningly won a slot to the one-day live affiliate workshop at the Acquisition.com HQ, one of the bonuses during the aforementioned book launch. 100 of us were invited to attend, and the top 10 affiliates got 30 minutes each of fireside chat time with Alex, plus dinner with him and his wife, Leila, that night. A killer bonus, credit to the top 10!

I wasn’t sure what to expect or who would be there.

Turns out, Alex was primarily involved for the whole day, delivering nonstop value, which is typical for most of his team's live workshops. If anything, my high regard for Hormozi increased further, and I already considered him to be one of the all-around best entrepreneurs in the world, and perhaps the single most articulate when it comes to describing business strategy/tactics (applicable to land and real estate businesses too).

This wasn’t a feel-good conference. No “ra-ra” stuff. Quite the opposite; I came away almost sick to my stomach considering the changes I needed to make in my business — growth requires pain. That’s the price.

I’ve NEVER taken this many notes at a live event. Being mindful of reading time and attention span, I could’ve just listed bullet points of all of the key takeaways, for you to nod your head, and then forget 90% of them 10 minutes later. But my goal for these articles has been to help change your business (and life) for the better, including my own.

That requires letting each chosen topic “breathe,” and I expand upon the most critical points below.

(If you're interested, Alex's team compiled key segments of this event in this video).

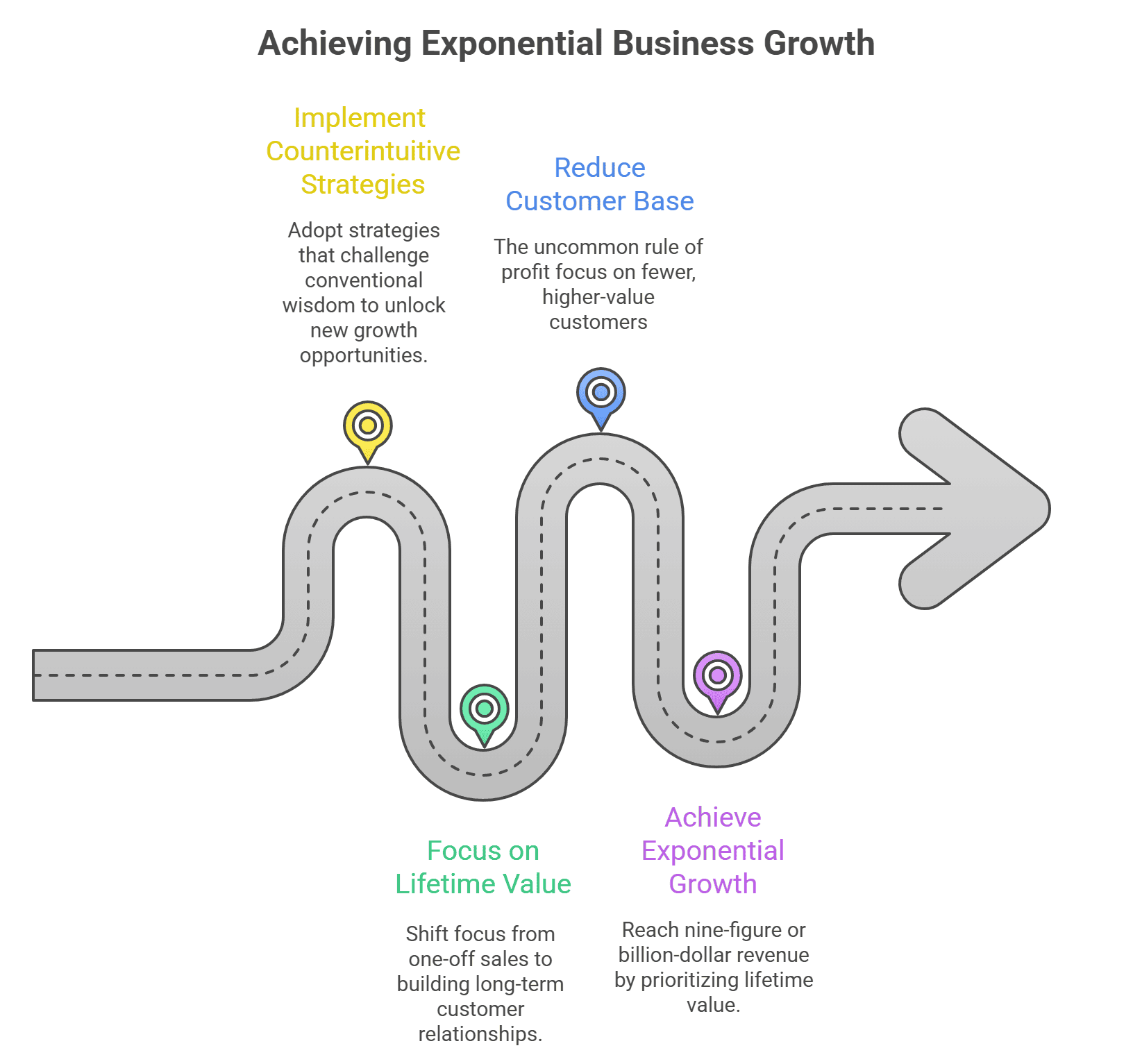

The Growth Paradox: Why Your Strategies Are Keeping You Stuck

Alex hammered this point across multiple fireside chats: The only way to grow beyond your current level is to implement counterintuitive business growth strategies.

Think about it: the intuitive strategies are what you are ALREADY doing. Those are table stakes.

Recall, every business has three fundamental necessities: marketing, sales, and delivery. If you check the box for each one, you have a business.

Let's take staying financially solvent for granted… easier said than done, of course. For a typical land flipping business, marketing (mail, call, text, pay-per-click advertising, search engine optimization, or on-market listings), sales (closing acquisitions and dispositions), and delivery (transferring title from one entity to another, with potential value-add in between) is the baseline. Many viable businesses have been built from this framework, and several have become consistent profit engines.

Intuitively, when it comes to growing a land business, most folks will focus on marketing and/or sales constraints, because they are the easiest to understand and measure.

To note, marketing is a leads problem, sales is a conversion problem, and delivery is a lifetime value (LTV) problem. Bumping LTV is the most surefire way to increase a company's value.

In land, typically, the LTV is the profit earned from the sale of a property. Most land businesses barely, if ever, focus on LTV as a key performance indicator (KPI) because of the lack of continuity within the industry. Your LTV is generally relegated to a one-off sale, from a unique product that has its own particular price point.

No upsells. No downsells. No continuity.

I can hear the arguments forming, so let me head them off:

- Yes, an upsell could be considered value-add to land, like a septic or mobile home install, though that is generally still all handled as one purchase, which I would consider a core offer.

- Owner financing could qualify as continuity, though each parcel of land is still unique, with its own price and set of terms, and there is an eventual end to payments.

- Repeat buyers could bump average LTV, but most land businesses are not set up this way (for example, focusing on selling to builders or developers in a particular area).

- Accounting-wise, it makes more sense to calculate LTV at the point of disposition, but technically you could attribute the metric to acquisitions, so if you have a repeat seller or have wholesalers or realtors birddog for you, LTV could get bumped. This is not typical for most land businesses.

So, since most land businesses will focus on increasing leads and/or conversions, growth eventually plateaus. Of course, you can build a solid seven-figure, perhaps eight-figure, business this way. That's nothing to sneeze at.

But a nine-figure, or a billion-dollar land flipping business? I have never heard of one, though forgive my ignorance if there is. In order to reach those heights, dramatically increasing LTV is the only route.

Which inevitably, and counterintuitively, requires fewer customers.

(As an aside, only ~5% of United States private businesses reach $1 million or more of annual top line revenue. That is already rare air if you are at that mark. Then it is about 1 in 250 above the $10 million mark, and about 1 in 3,000 above the $100 million revenue mark. I love the symmetry that in order to grow 10X in size, it is about 10X more scarce in the stats. It is all a numbers game; how big you get is directly correlated with how good, and focused, you are.)

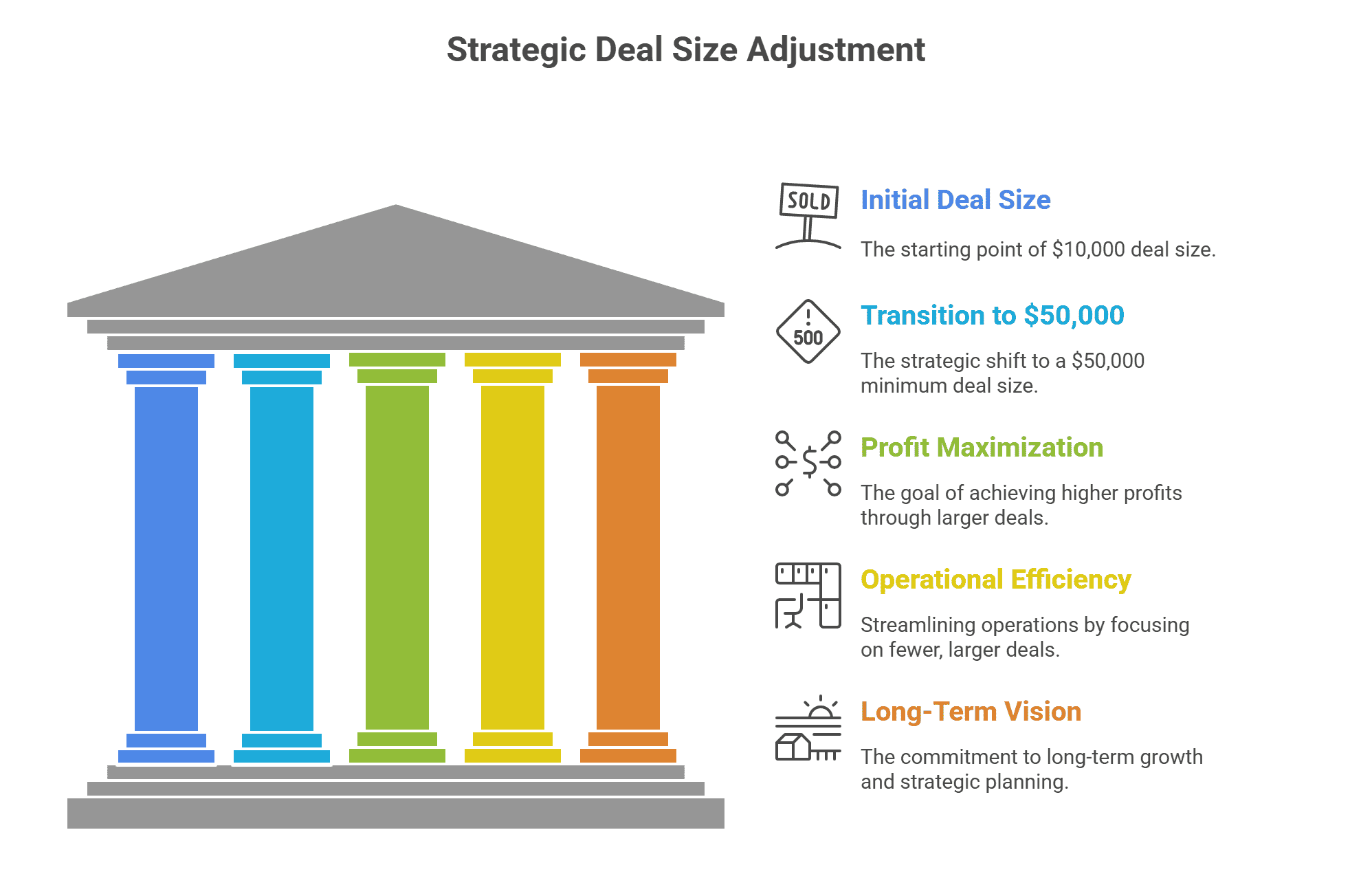

How Raising Our Minimum Deal Size From $10K to $50K Increased Profits

This is exactly what we have been doing at Serious Land Capital over time.

We steadily raised our land investing minimum deal size from $10,000 to $20,000, and now to a $50,000 minimum. Every time we raised it, we priced out a chunk of potential funding deals.

Psychologically, this was a hard pill to swallow. We could still fund those $20,000 and $30,000 properties. The 2X margins often exist at that level, and we had done very well with them.

But here is what changed: One ~$300,000 deal can deliver the same backend profit as six or seven $50,000 deals (or ~30-50 desert square deals), often requiring similar due diligence effort per transaction.

The unconventional business scaling tactic was intentionally reducing volume to increase deal size (and LTV), even though volume felt like proof we were “winning.” And yes, this hurt short-term as we adjusted operations. That is the trade-off. Long-term bets are required in business, and generally the person with the longest time horizon wins. The biggest operators in land — the ones doing hundreds of millions or billions — work on fewer projects with larger check sizes.

So, we would rather have the capacity to take on a greater number of larger projects, even if it means sitting on liquidity until a better opportunity arises.

This industry changes by the year, so we reserve the right to change our mind as new evidence arises, but I am laying my cards on the table right now.

There probably is a route for a land business to do disgusting amounts of volume to achieve the same size, but like Hormozi told us at the live event, while there are no rules in business, and plenty of folks have found success by following a route of lesser probability, why not play the odds and take the more likely route? Business is hard enough already.

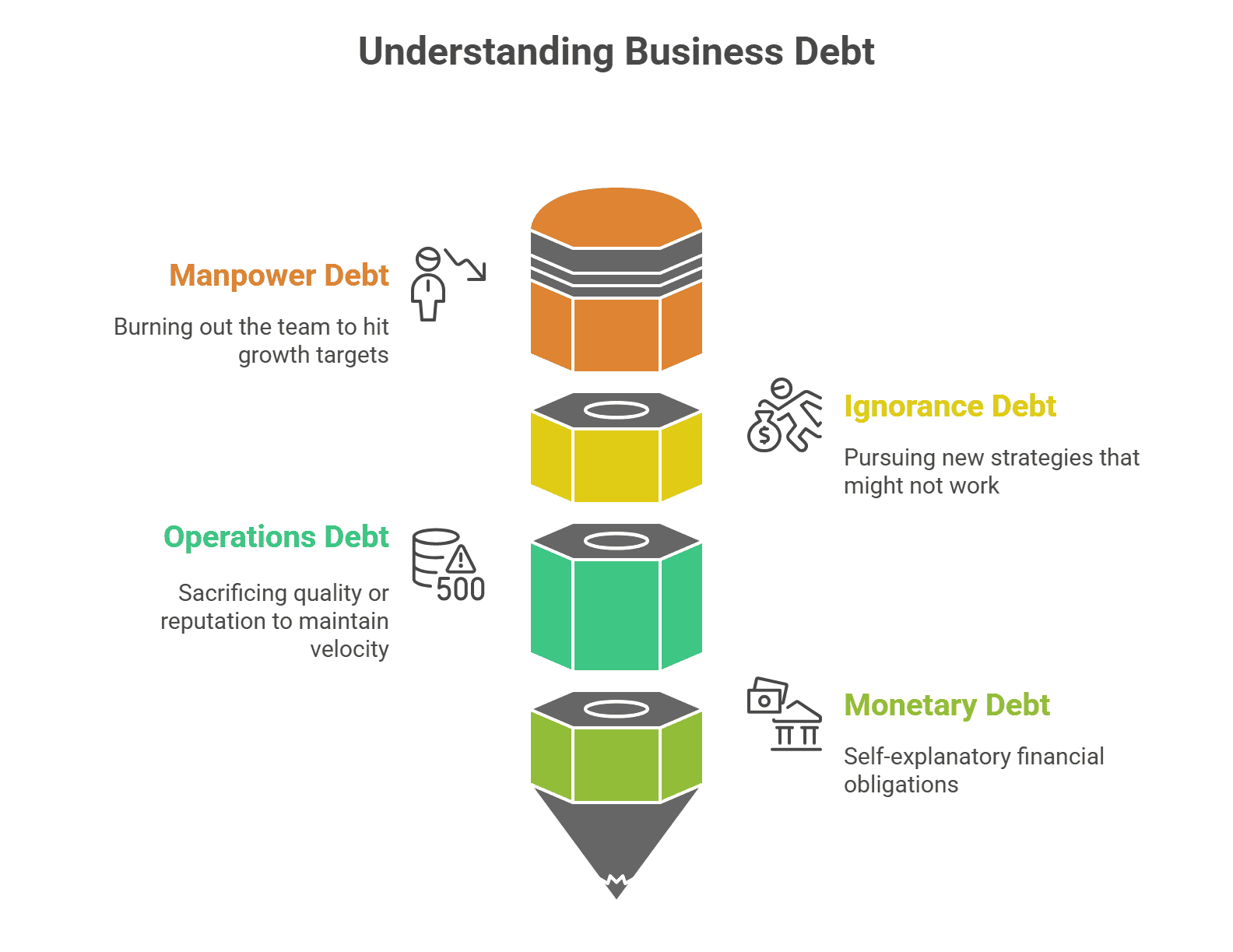

The 4 Types of Business Debt You're Incurring Daily (And Which One to Prioritize)

Here's another quick lesson from the live Alex Hormozi event: Every business incurs debt daily.

You are incurring debt on:

- Manpower – burning out your team to hit growth targets

- Ignorance – pursuing new strategies that might not work

- Operations – sacrificing quality or reputation to maintain velocity

- Monetary – self-explanatory

Alex's framework: Always take out the debt in your business that you can pay back the fastest. For example, burning the team hard for six weeks to complete a major AI buildout that creates leverage for years.

The mistake is not acknowledging which debt you are taking on, and whether you can actually pay back before it compounds into a crisis.

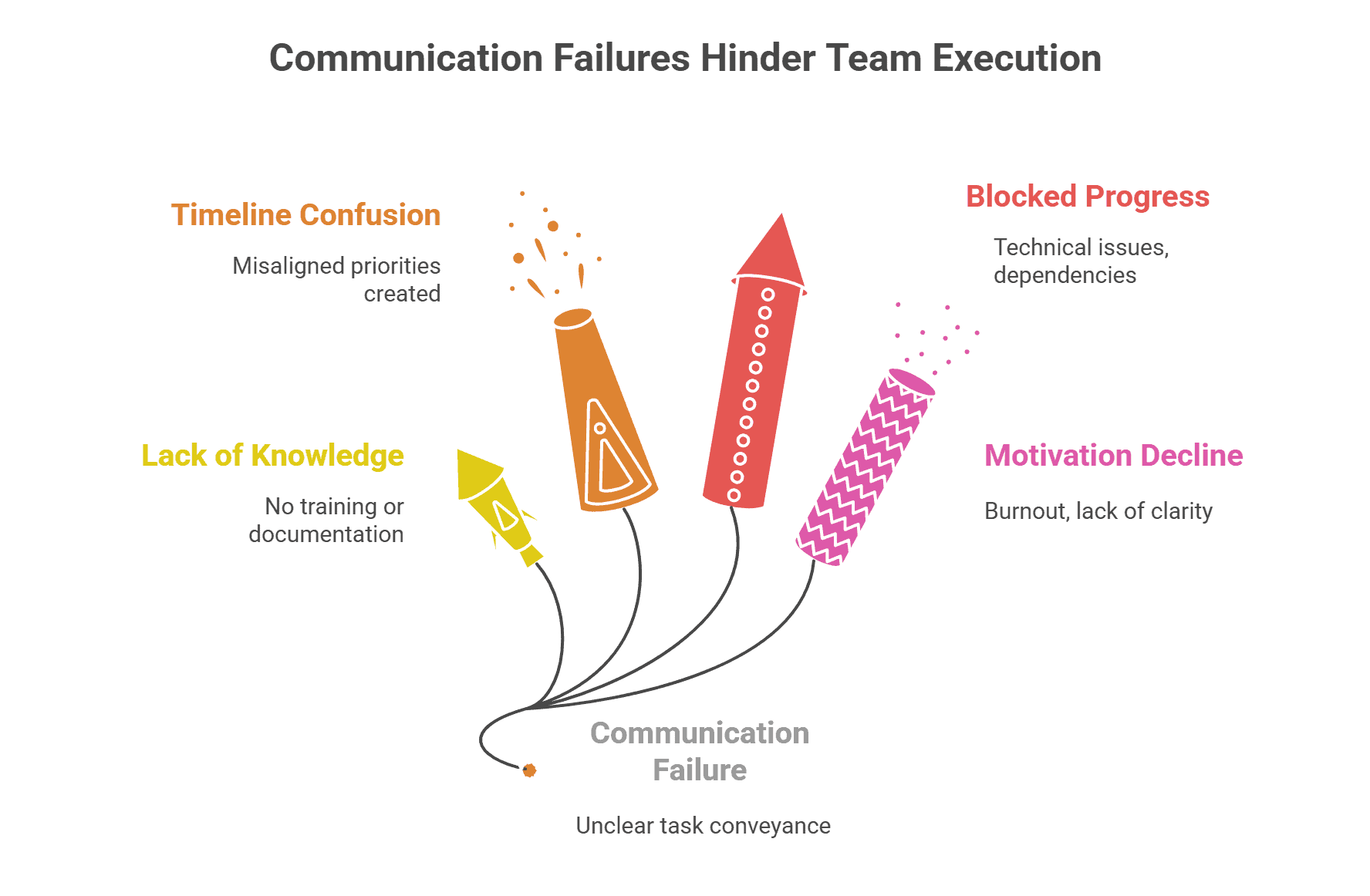

Why Your Team Isn't Executing: The 5 Real Constraints (And How to Fix Them)

Another key lesson from Alex is to break down the five real reasons employees do not complete work:

- They did not know you wanted THAT done. Communication failure; the task was not clearly conveyed or got lost in translation.

- They did not know HOW to do it. No training, no documentation, or no access to the process.

- They did not know WHEN it was due. Timeline confusion creates misaligned priorities.

- They are BLOCKED. Technical issues, or dependencies on others.

- They do not WANT to do it. Burnout, lack of clarity on why it matters, or being overwhelmed by competing priorities.

Most execution problems live in constraints 1-4. Fix those first before assuming it is a motivation issue. Most employees want to be of value and contribute.

This is also how you prompt AI effectively. The best AI prompting requires solving all five of these constraints (including motivating LLM models), which means the best way to communicate with AI is also the best way to communicate with humans.

The Other Lessons From Alex Hormozi Worth Noting

- The ~$1-3 million revenue swamp. Most businesses get stuck here because they have proven they can operate and owners have plateaued psychologically, but they have not solved for the next constraint and cannot afford star talent without sacrificing most of the business's profits. You need to focus 80% or more of your time on your main constraint and let other fires burn (and potentially give up major short-term profits). What got you to $1 million will not get you to $10 million.

- The SPCL content framework. Content either primarily entertains or educates. The best performing educational content needs to demonstrate Status, Power, Credibility, and Likeness. Power (giving directions that produce positive results for your audience) matters most, which is why my content focuses relentlessly on tactical value you can implement in your life and business. Seth wouldn't graciously allow me to guest post on REtipster if it were otherwise, right?

- Focus on internal deliveries over external metrics. Stop obsessing over hitting $2 million or $5 million (or $10 million or $1 billion) revenue targets. Instead: “Can I make 100 cold calls every day this month?” or “Can I review 10 on-market deals today?” The inputs you control lead to outputs you cannot force.

=====

Most of the above items come back to one uncomfortable truth: Growth requires doing things that feel wrong in the short-term.

Every time I pick up a weight at the gym, my brain immediately demands that I put it down. Every time. And I have been training for 20+ years. Growth never comes easy. Get uncomfortable, and maximize intent.

The operators who break through are the ones willing to implement counterintuitive growth strategies while their competitors stay comfortable with what is working “well enough” — until it doesn't.

=====

Looking for funding from operators who have implemented these frameworks at scale? Serious Land Capital's 41% operating margins did not come from remaining complacent in today's challenging market, they came from counterintuitive strategic decisions like raising our minimum purchase price to $50,000. Land investing experience preferred, but not required. 100% close rate on committed deals.

Get Your Property Analyzed Today

Originally published at seriousland.capital on November 10, 2025.