In some ways, fourplexes offer the best of both residential and commercial multifamily investing. You get the efficiencies of a multifamily property with the financing options of a residential home.

But there just aren’t that many of them out there, compared to single-family homes or apartment buildings, or even duplexes.

So how do you go about finding a four-unit investment property?

Finding Fourplexes the Old-Fashioned Way

Also known as quadplexes, these four-unit properties appear in residential searches on the MLS. The classic way to find one for sale is to hire a local real estate agent—specifically, an agent specializing in working with investors.

Beyond access to the MLS, the best Realtors also provide access to a wide network. That network includes not just service providers such as home inspectors, real estate photographers, insurance agents, and lenders, but also other local investors. They can ask around to see if any of them own a fourplex they’ve been considering selling or if they know someone who is.

No cutting-edge technology, no tricks or hacks, just good ol’ fashioned networking.

If you want to search local MLS listings, you can use tools like Zillow and Trulia to search for multifamily properties. To keep an eye on these, you can also set up automated alerts for when properties meeting your criteria hit the market.

Of course, buying on-market listings means paying market prices. You may still find a property that cash flows well, but the best deals aren’t publicly advertised.

How to Find Off-Market Fourplexes

You have plenty of options at your disposal for finding off-market properties. But many of them don’t make it easy to sift single-family homes from duplexes, triplexes, or fourplexes.

As you scour the web and the real world for properties, keep these tactics in mind.

Off-Market Listings

Nowadays, plenty of sellers use alternative platforms to list their properties for sale rather than hiring a Realtor.

The first example that comes to mind is Roofstock. It’s an online marketplace specifically built for landlords looking to buy or sell rental properties. If you’re unfamiliar with it, check out our full Roofstock review for more details. Right there in the search filters, you can select to search only for fourplexes. I found five listed for sale when I ran a test search.

You can also check out Mashvisor’s property marketplace, which includes listings from several sources. Read our full Mashvisor review here.

BiggerPockets offers several ways to find properties. You can search their real estate listings or check out their off-market deals. Their forums are also extremely active, and you can sometimes find tired landlords looking to unload deals there.

You can try Oodle’s real estate marketplace, which sources listings from several places. They have a subsection specifically for multifamily properties. While you’re at it, check out Asset Column’s marketplace of off-market deals.

And, of course, there’s oldie-but-goodie Craigslist. Still going strong after decades, the simple classifieds website features real estate for sale, not just furniture and electronics.

Premium Property Investing Tools

In today’s world, you can access plenty of online tools that real estate investors could only dream about a decade or two ago.

For a price, of course. The best platforms charge for their real estate investing tools.

Consider Propstream. The platform lets you search anywhere in the U.S. for pre-foreclosure filings, auctions, REO properties, divorce filings, tax sales, tax liens, judgments, and more. They also display off-market properties for sale, compiling data from many sources. You can also look up any property in the country to see its tax records, ownership history, owner details, mortgage history, comps, and more.

Alternatively, check out Foreclosure.com, which also helps you find distressed sellers. Read our full Foreclosure.com review for details.

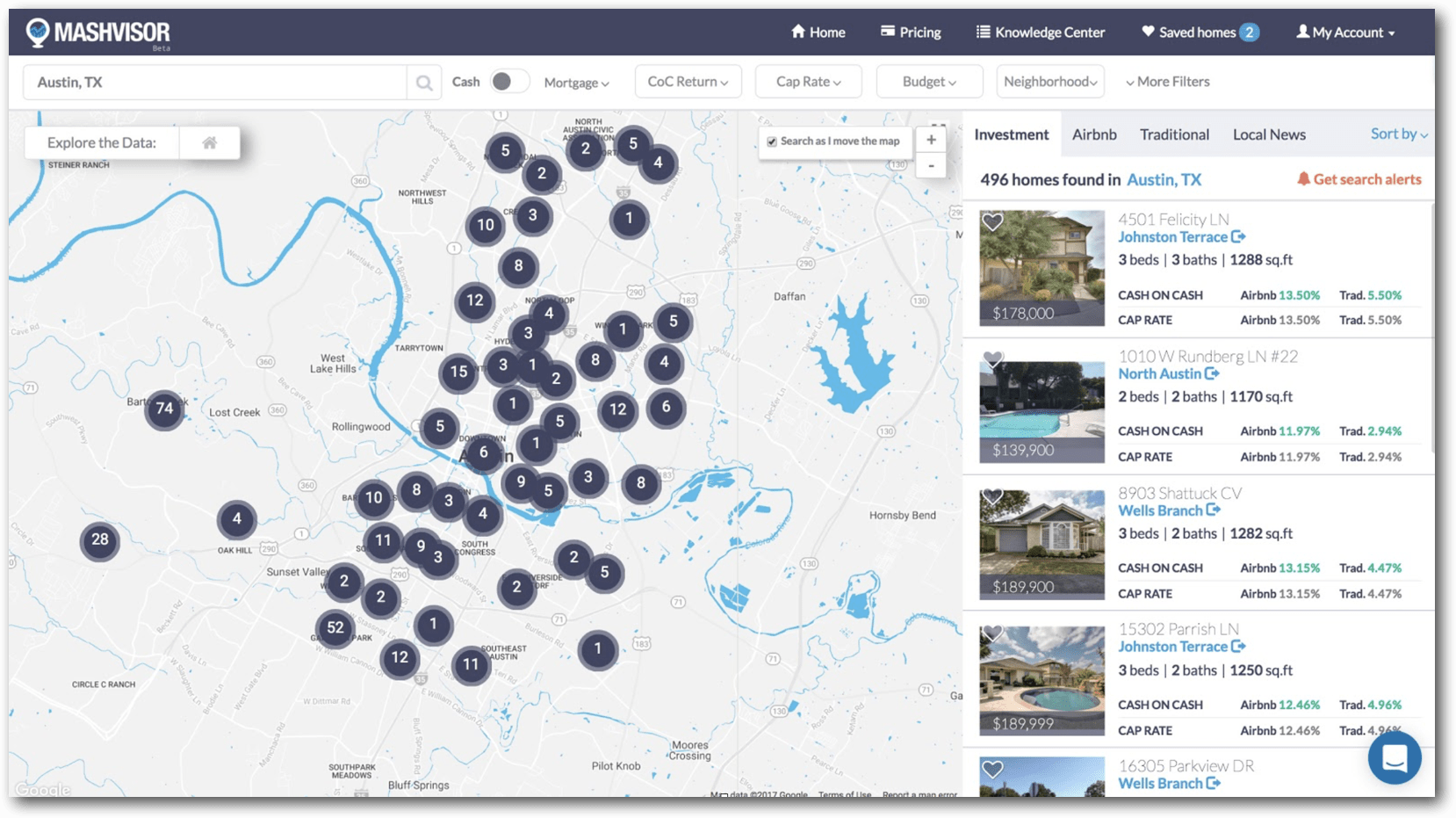

Mashvisor's search page

Mashvisor also offers a Property Finder tool to help you find and compare investment properties.

Contact Your County Appraiser

While you can’t expect anywhere near the polish or user-friendliness of commercial tools like Propstream and Foreclosure.com, your local government has a wealth of information about every property in the county.

The trick is just accessing it.

Every county does things a little differently (or a lot differently), so you need to reach out to your county to ask how you can get ahold of property records. Some counties offer spreadsheets available for download directly from their website, but more likely you need to contact them and ask. These spreadsheets often offer an incredible depth of detail, but it’s not always intelligible at first glance. And each county lays these out in its own way.

But once you get ahold of this data, you can theoretically isolate fourplexes and then drill down further to identify property owners in tax sale or with judgments or liens against them. You can then reach out to these distressed property owners to make them an offer, whether through direct mail campaigns, phone calls, text messaging, or social media outreach.

Network with Wholesalers

Wholesalers are always looking to add investors to their mailing lists. And occasionally, they may just have duplexes, triplexes, and fourplexes available to buy.

Do some research to find reputable real estate wholesalers in your market. Reach out to them and explain exactly what you’re looking for, and follow up with them every few months. You'll be their first phone call when they come across a fourplex deal.

Driving for Dollars

Another oldie-but-goodie, driving for dollars is another way to find fourplex properties.

In this classic tactic, you drive around your target market looking for, well, whatever type of property you’re looking for. Most investors look for neglected, abandoned, or dilapidated properties that the owner clearly has little interest in maintaining. These owners often don’t mind parting with their properties for a discounted price.

But you can also look for fourplexes and other multifamily properties, neglected or not. Reach out to the owner—you never know who might have been looking for an excuse to sell.

For a modern twist on this old-school strategy, try the DealMachine app. You simply snap a photo of the property with your phone, and DealMachine pulls up the owner and property details. With the click of a button, you can send a postcard to the owner. Read our full DealMachine review here.

Why Invest in Fourplexes?

To begin with, fourplexes offer more efficiencies than other residential properties. You get four units, but you only have to maintain one roof, one foundation, one of each set of mechanical systems, and so on.

It’s also easier to manage four units in a single location rather than four separate properties spread out geographically.

Fourplexes also tend to cash flow better than single-family rentals. There’s often less competition for them, given the higher price tag. And you compete with fewer homebuyers willing to pay retail pricing.

Four units in a single property also diversify the income streams from that property, reducing risk. Sure, one tenant might move out and leave you a vacancy, but you still have three other tenants paying rent for the next month or two while you market and fill the vacant unit. With a single-family rental, a vacancy means $0 in income—worse than $0 actually, since you’ll need to spend money cleaning up the unit to market for rent.

Finally, fourplexes allow for flexible financing (say that five times fast). You can borrow a conforming loan for properties with up to four units. If you plan to move into the property to house hack for at least a year, you can even borrow an FHA loan or a VA loan, and possibly put down 3.5% or even 0%. Or you can borrow from hard money lenders and portfolio lenders, which also allow up to four units.

Challenges with Fourplex Investing

As you can imagine, fourplexes tend to be expensive, at least compared to single-family rental properties or duplexes. Unless you plan to house hack, you’re probably looking at coming up with a 20% to 30% down payment on a pricey property.

If you can find one at all in your target market. There just aren’t that many fourplexes in the U.S., and with the boom in the popularity of house hacking, they’ve come under huge demand over the last decade.

In some markets, you won’t find any at all. Some counties imposed zoning restrictions making it nearly impossible for developers to build fourplexes, so they simply don’t exist in some areas.

And while most residential loan programs allow fourplexes, many underwriters aren’t familiar with them and ask for endless documentation when reviewing your loan. Expect delays ahead, unless you work with a specialist lender who often works with investors and multifamily properties.

Final Thoughts

Fourplexes offer plenty of perks for real estate investors, assuming you can find decent deals on them. But that’s not always easy to do.

Try the strategies above to find fourplexes, but if you struggle to find good deals, consider casting a wider net. Add triplexes and duplexes to your search, as you never know how a good deal might come along.

Finally, consider graduating to apartment buildings with five or more units. Yes, these are zoned as commercial, which means you need commercial financing. But that’s not the end of the world, as many of the same portfolio lenders also offer loans on these properties. And just by crossing that line from residential zoning to commercial zoning, you immediately ditch a huge chunk of your competition.