REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

If you invest in real estate—multifamily apartments, Airbnbs, commercial properties, or even self-storage—you already know that taxes can eat away at your profits fast.

But there's a simple, legal way to lower your taxable income right now, and keep more of your hard-earned money in your pocket.

It's called cost segregation, and if you’re not using it yet, you could be missing out on thousands (maybe even tens of thousands) of dollars in savings.

In this article, I’ll explain exactly how cost segregation works, why it’s such a powerful strategy, and how you can leverage it for maximum real estate tax savings, no matter what size investor you are.

What Is Depreciation (and Why Does It Matter)?

Before we dive into cost segregation, we need to talk about depreciation—because it's the foundation of the whole strategy.

Depreciation is a phantom expense. It’s not actual money spent out of your bank account, but the IRS allows you to write it off because they understand your property is legitimately wearing out over time.

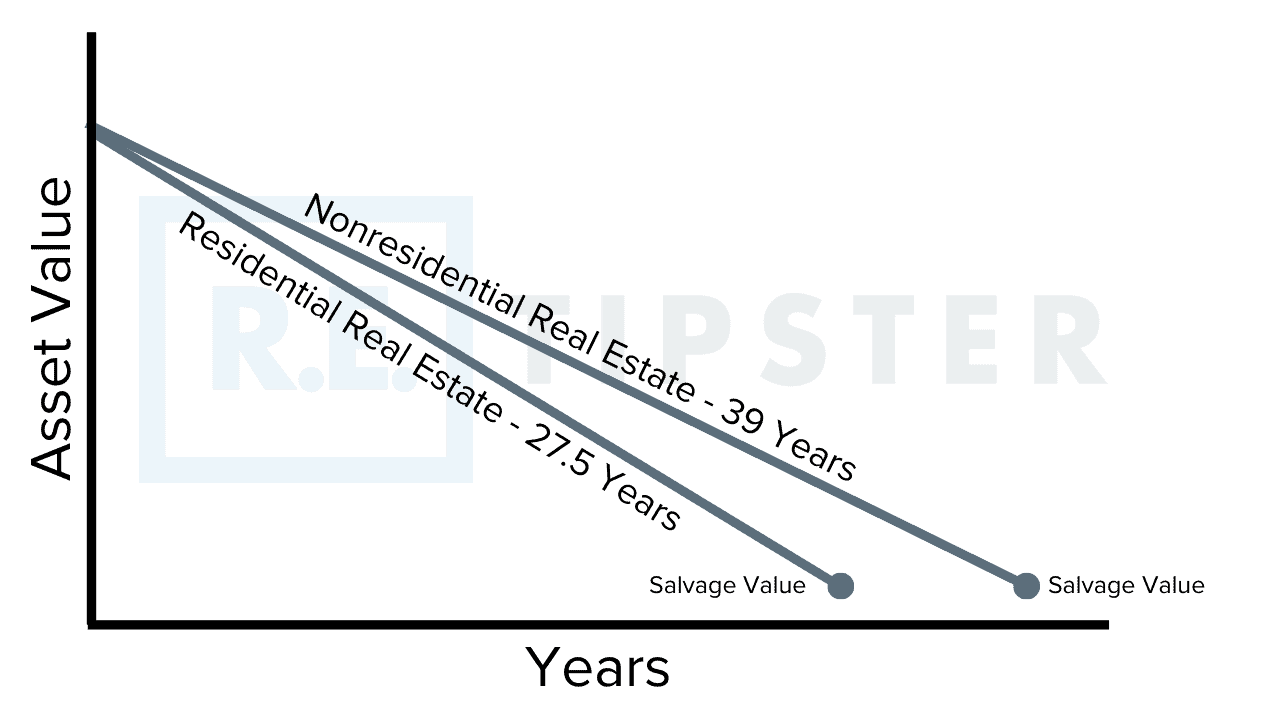

Even if your building gains value, the IRS lets you deduct part of its cost annually. The standard depreciation period for residential properties is 27.5 years; for commercial properties, it's 39 years.

This write-off lowers your taxable income each year, which effectively saves you money, without touching your actual cash flow.

How Cost Segregation Works

Normally, you depreciate a property as one big chunk over 27.5 or 39 years.

Cost segregation takes a smarter approach. Instead of treating the entire building as one unit and depreciating everything over that set timeline, a cost segregation study breaks the property into smaller components—like electrical systems, flooring, cabinetry, parking lots, landscaping, and more.

Here’s the key: some items can be depreciated much faster—over 5, 7, or 15 years—instead of waiting decades.

Accelerating depreciation for certain components as they wear out faster allows for much larger upfront tax deductions, which means more cash flow, more reinvestment opportunities, and faster wealth-building.

RELATED: How to Calculate Land Value for Taxes and Depreciation

Why Use Maven Cost Segregation?

There are many companies that can provide cost segregation studies, but they aren't all created equal.

Take Maven Cost Segregation, for example.

They have an in-house team of certified civil engineers and accountants (no outsourcing to random vendors).

Their lead CPA, Sean Graham, personally reviews and signs every cost segregation report to ensure aggressiveness and full IRS compliance.

They offer a Condensed Engineering Study for smaller properties, making cost segregation affordable even for everyday investors.

When you work with Maven, you’re not just getting a basic analysis—you’re getting a thorough, rock-solid study you and your CPA can trust.

The Simple Process with Maven

Here’s how it works if you use Maven Cost Segregation:

- Free Consultation – A quick call to see if cost segregation makes sense for your property.

- Property Review – Either an on-site inspection or an easy, streamlined photo process for smaller properties.

- Asset Breakdown – They classify eligible property components into faster depreciation categories.

- Final Report – You get a detailed, IRS-compliant report ready to file with your taxes.

Most investors who go through the process see real financial benefits almost immediately.

Real-World Example: How Much Can You Save?

Suppose you buy a property for $1 million. If you depreciate it normally, you’re taking about $36,000 per year in write-offs.

But with a cost segregation study, Maven might identify $250,000 in components eligible for faster depreciation.

Under current IRS bonus depreciation rules, you could deduct most or all of that amount in the first year—giving you a massive tax savings boost.

Is There a Catch?

There’s a small caveat called depreciation recapture.

If you sell your property soon after doing a cost segregation study, the IRS might require you to “recapture” some of those deductions at a higher tax rate.

But good news: you can avoid or defer this tax hit with strategies like:

- A 1031 Exchange (rolling profits into a new property)

- A Delaware Statutory Trust (DST)

- An installment sale

- Holding the property longer

The bottom line? Depreciation recapture isn’t a deal breaker if you have a solid plan.

Is Cost Segregation Only for Big Investors?

Absolutely not! This is one of the biggest myths about cost segregation.

Thanks to companies like Maven, even owners of $150,000 rental properties, Airbnbs, or small self-storage facilities can benefit from a cost segregation study.

It’s not just a tool for the big institutional players—it’s a tax strategy any savvy investor can use.

How to Get Started

If you’re curious about how much cost segregation could save you, Maven has a free online calculator that allows you to run quick estimates.

Or better yet, schedule a free consultation with Sean Graham to determine what a personalized cost segregation study could mean for your property.

There’s zero pressure; at worst, you’ll walk away with a better understanding of your tax options. At best, you could be saving thousands this year alone.

Final Thoughts

Cost segregation is one of the smartest ways to maximize real estate tax savings—and it's completely legal, completely IRS-approved, and underutilized by the average investor.

If you’re looking for a way to boost your cash flow, pay fewer taxes, and grow your portfolio faster, this strategy is worth serious consideration.

Don't leave money on the table! Take advantage of cost segregation and see how much you could save.