What Is Cost Segregation?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts: Cost Segregation

- Cost segregation is a strategy to frontload tax deductions from depreciable assets in real property, such as building components and improvements.

- Cost segregation enables owners to compartmentalize the personal property components of a building for accelerated depreciation, allowing the investor to reap the benefits of tax deductions in the first year of the building.

- The key to achieving the tax benefits of cost segregation is which parts of the building can be depreciated under IRS rules on depreciation.

- A cost segregation study is pricey and time-consuming, and the IRS may find the valuation of personal property by the cost segregation provider too aggressive and decide to impose penalties on the investor.

How Depreciation Is Worked Into Cost Segregation

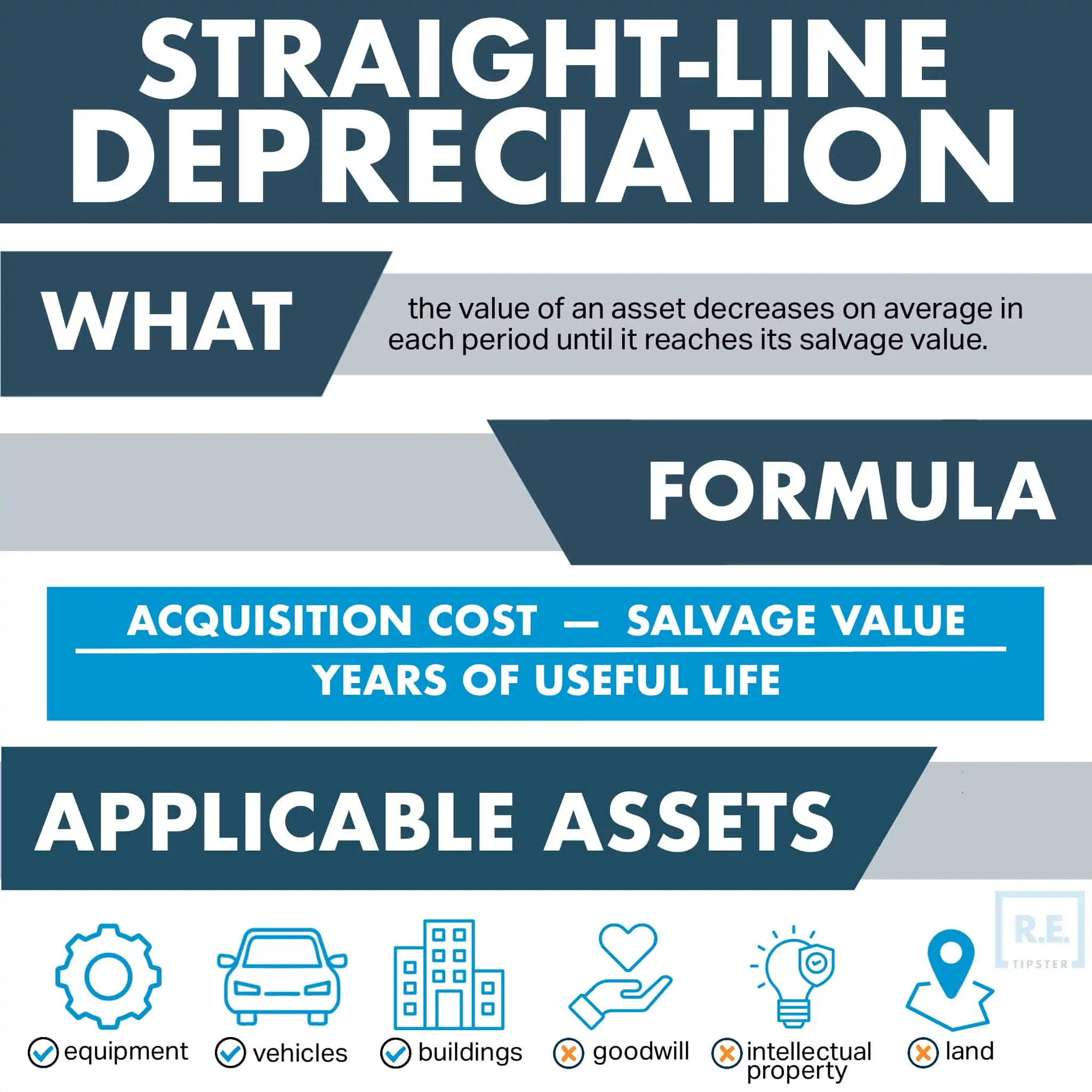

Before diving into cost segregation, it is important to understand how depreciation (particularly straight-line depreciation, referred to as simply “depreciation” in this article) happens.

The IRS defines depreciation as an annual tax write-off of property over time to account for its gradual deterioration or wear and tear[1]. Depreciation deductions help the property owner recover some of the cost of the property while it loses value.

In real estate, in terms of defining tax liabilities, depreciation happens over 27.5 years for residential properties and 39 years for commercial buildings[2].

However, most real estate is not an entirely independent structure but rather is composed of several components that get worn down or damaged far earlier than the foundational building. These components, such as plumbing, lighting, wiring, and more, typically depreciate over five, seven, or 15 years. Unfortunately, they are purchased or developed as part of the building, so they are typically written off as part of the overall structure (at either the 27.5- or 39-year rate of depreciation, depending on the property type).

A property owner may ask experts to analyze their property’s components to segregate them from the structure. This study, called the cost segregation study, allows real estate owners to reap the benefits of accelerated depreciation on the building’s short-life assets instead of writing it all off after 27.5 or 39 years.

In effect, cost segregation frontloads the tax deductions for building components in the first year. Doing so can immediately write off up to 30% (even up to 40%) of the building’s purchase price [3].

Cost Segregation: Is It Legal?

Taxpayers have utilized cost segregation analysis since a Tax Court ruling in 1997[4]. Under this decision, cost segregation is acceptable despite the prior elimination of component depreciation in computing taxes.

For background, the tax deductibility of component depreciation was replaced by the accelerated cost recovery system (ACRS) and the modified accelerated cost recovery system (MACRS) under IRS regulations.

The IRS recognized cost segregation as permissible in a decision in 1999 but warned taxpayers that a cost segregation study must be based on timely, pertinent records, with some penalties imposed on erring investors.

BY THE NUMBERS: A cost segregation study and a written report can cost $10,000 to $25,000.

Source: Journal of Accountancy

How a Cost Segregation Study Works

A cost segregation study involves supporting depreciation records. A team of qualified CPAs and/or engineers is often needed for a taxpayer to receive a quality cost segregation study[5].

The key to cost segregation is which properties are categorized under IRS Sections 1250 and 1245.

The IRS classifies real property (those that depreciate over 27.5 to 39 years) and tangible personal property (those that depreciate over five, seven, or 15 years) into Sections 1250 and 1245, respectively[6]. In other words, Section 1245 properties are non-structural items that depreciate more quickly.

Applying the criteria in a cost segregation study can accelerate the depreciation of the following items (though not limited to this list) in a building[7]:

- Facade (building skin)

- Foundations

- Electrical wiring

- Communication and data

- Computer systems (such as servers, personal terminals, and electronic devices)

- HVAC (heating, ventilation, and air conditioning)

- Window treatments

- Lighting

- Storage tanks

- Specialized kitchen equipment

- Special plumbing demands

- Carpeting

- Wall coverings

- Partitions

- Concrete slab floor

- Millwork

Site improvements (such as the following) may also be included:

- Parking areas

- Signages

- Sidewalks

- Landscaping

- Enclosures (e.g., walls and fences), gates, and entryways

- Security equipment

Bonus Depreciation

Some personal property items in real estate may also qualify for additional first-year depreciation. This “bonus” depreciation comes as 30%, 50%, or 100% tax deductions for the year the qualifying property was put in service.

A personal property qualifies for bonus depreciation if the taxpayer first owned it and put it into service[8]. Other than this primary qualification, the property must also be:

- A MACRS property with a 20-year recovery period or less

- Depreciable computer software

- Water utility property

- Qualified leasehold improvement property

Originally introduced in 2002, bonus depreciation has undergone various changes, with the most notable being the Tax Cuts and Jobs Act (TCJA) of 2017, which allowed businesses to deduct 100% of the cost of eligible property in the first year. This provision significantly enhanced cash flow for businesses by reducing their taxable income immediately.

However, the 100% bonus depreciation expired at the end of 2022, and a phased reduction is now in effect[9]. This sees the maximum rate that can be depreciated phasing out in increments of 20% per year starting 2022 and until 2027, when the rate becomes 0%.

Qualified Properties for Cost Segregation

In general, the real estate properties that qualify for cost segregation are[10]:

- Properties acquired, built, or significantly remodeled after 1986

- Income-producing commercial properties, e.g., apartments, office buildings, hotels/motels, medical offices, etc

- Depreciable cost basis of at least $500,000, the threshold value from a cost-to-benefit point of view.

Note that land cannot depreciate since it does not get used up, become obsolete, or wear out. However, some land improvements related to preparing for business use, like landscaping, can be depreciated[1].

BY THE NUMBERS: Most residential rental properties in the U.S. depreciate annually at a rate of 3.636%.

Source: Investopedia

Pros and Cons of Cost Segregation

Cost segregation is not always the best course of action in every circumstance. Nevertheless, here are some of its advantages and disadvantages.

Pros

Both residential and commercial property owners can enjoy a year of decreased tax with a cost segregation study performed on their assets. In addition, property owners can derive convenient write-offs and tax credits from a cost segregation report if an asset is destroyed or damaged.

In addition to helping property owners maximize depreciation deductions, the updated property-related costs on the annual tax report can further reduce one’s future tax liability.

Cost segregation is also particularly beneficial in new property developments and building renovations. If donated to charitable institutions, unused construction materials for these projects can be classified as tax-deductible in a cost segregation study [10].

Cons

Besides its cost, a cost segregation study poses some potential drawbacks. One is time; a cost segregation specialist may take a month or more to complete the study.

The IRS could also find the cost segregation too aggressive or containing incorrect information. The agency can rule on a “substantial valuation overstatement” and impose penalties on the additional tax due[11].

Another disadvantage is when an investor later sells personal property included in cost segregation. The IRS can then treat this property as depreciation recapture income, which is taxable up to 35% plus applicable state taxes.

RELATED: How to Calculate Land Value for Taxes and Depreciation

References

- Publication 946 (2021), how to Depreciate Property: Internal Revenue Service. (n.d.). Retrieved from https://www.irs.gov/publications/p946

- Billings, L. (2022, May 6). What is a cost segregation study? [how it works and why it matters]. Warren Averett CPAs & Advisors. Retrieved from https://warrenaverett.com/insights/what-is-cost-segregation/

- Cost segregation study explained. Engineered Tax Services. (2022, August 29). Retrieved from https://engineeredtaxservices.com/services/cost-segregation/

- Hospital Corp. of America v. Commissioner, 109 T.C. 21 (1997). Retrieved from https://cite.case.law/tc/109/21/

- Castelli, T. (2021.) Cost Segregation: The Strategy Real Estate Investors Use to Pay Little to No Taxes on Their Investments. Real Estate CPA. Retrieved from https://www.therealestatecpa.com/blog/costsegregation

- Cost Segregation Audit Techniques Guide – Chapter 1 – Introduction: Internal Revenue Service. (n.d.). Retrieved from https://www.irs.gov/businesses/cost-segregation-audit-techniques-guide-chapter-1-introduction

- Simple example of cost segregation. Specializing in cost segregation services cost segregation studies. Perkins Financial LLC. (n.d.). Retrieved from http://www.costsegregationconsulting.com/simple-example-of-cost-segregation/

- Cost Segregation Audit Techniques Guide – Chapter 6.8 – Bonus Depreciation Considerations: Internal Revenue Service. (n.d.). Retrieved from https://www.irs.gov/businesses/cost-segregation-audit-techniques-guide-chapter-6-8-bonus-depreciation-considerations

- Paquin, R. (2023, July 17). Bonus Depreciation Is Sunsetting – How Will This Affect Cost Segregation? Anchin. Retrieved from https://www.anchin.com/articles/bonus-depreciation-is-sunsetting-how-will-this-affect-cost-segregation/

- Does Your Property Qualify For Cost Segregation? O’Connor Tax Reduction Experts. (n.d.). Retrieved from https://www.expertcostseg.com/cost-segregation-qualify

- Disadvantages of Cost Segregation Study? Exeter 1031 Exchange Services. (n.d.). Retrieved from http://www.exeter1031.com/article_disadvantage_cost_segregation_study