What Are Capital Gains?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Are Capital Gains?

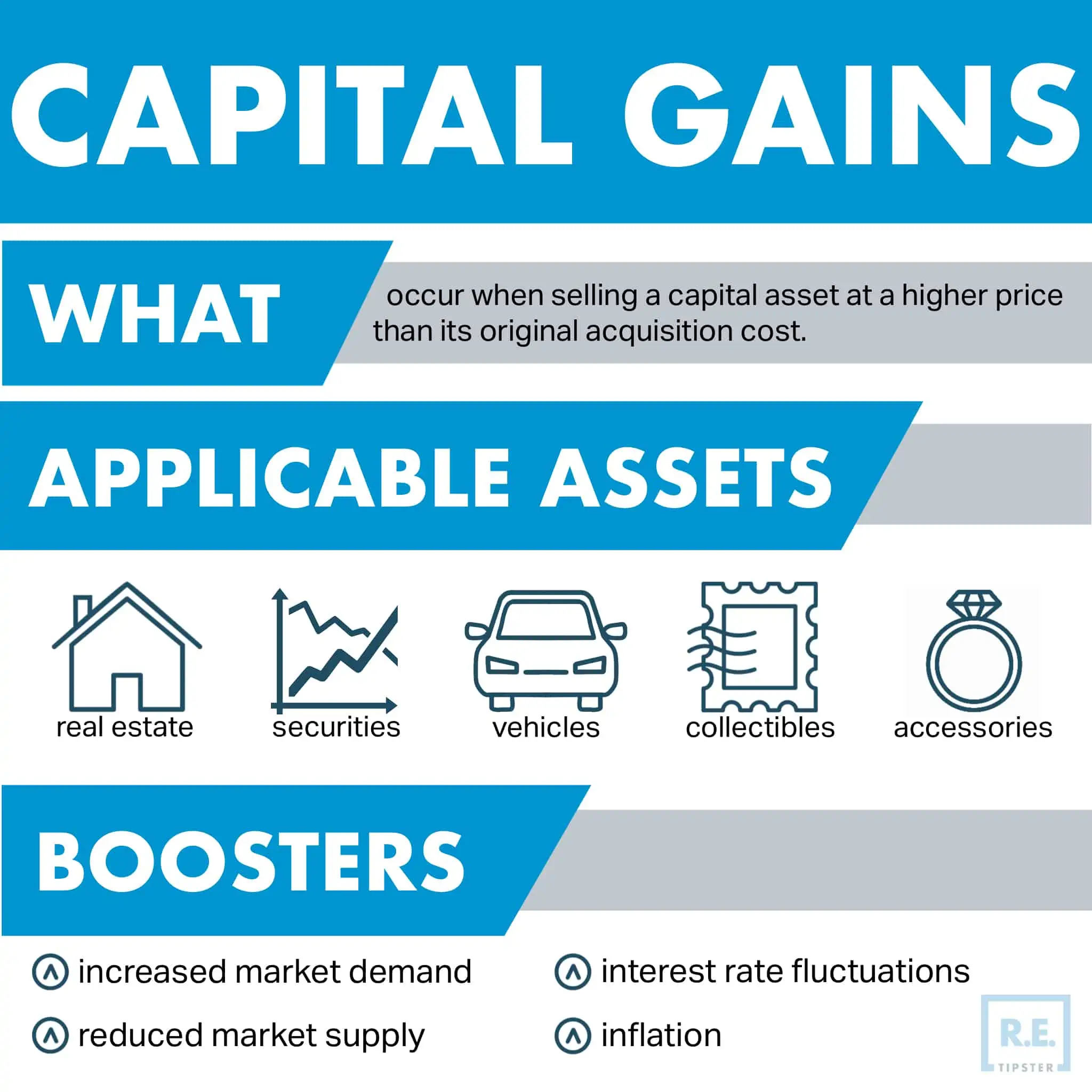

Capital gains materialize when the market value of an investment or asset rises above its original purchase price. In other words, capital gains are the profit the owner makes when they sell their asset.

Capital gains apply to all types of capital assets that are expected to grow in value over time[1], but specifically, these assets include:

- Real estate.

- Securities, e.g., stocks, bonds, or mutual funds.

- Cars, motorcycles, boats, and other vehicles.

- Collectibles, such as coins, stamps, antiques, and artwork.

- Jewelry and accessories like signature luxury handbags.

Capital gains are derived by subtracting an asset’s acquisition cost from its current sale price. The acquisition cost used as the basis for this computation should also include any amount spent toward improving the asset[2].

Realized vs. Unrealized Capital Gains

Capital gains can be categorized as unrealized or realized.

In an unrealized capital gain, a particular asset remains in possession of its owner who has not cashed in on its increased value. An unrealized capital gain, therefore, appears as capital gains only “on paper”[3].

In this sense, an unrealized capital gain can also be called capital appreciation or asset appreciation, which denotes an increase in the value or price of an asset. Because the increased value of an asset is yet to be tapped by its owner, an unrealized capital gain is not taxable[4].

On the other hand, a realized capital gain materializes when an entity (such as an investor, a corporation, or an individual) sells a capital asset at a price higher than its acquisition cost. Realized capital gains are often subject to tax[5] depending on factors like the duration the taxpayer has owned the asset.

Capital Gain Boosters

Several factors can drive an appreciation in the market value of investments and assets. These factors can include any or a combination of the following[6]:

- Increased market demand.

- Reduced market supply.

- Inflation.

- Interest rate fluctuations.

Over time, these factors can provide a significant boost in capital gain. For this reason, many investors adopt a buy-and-hold strategy to maximize capital gains[7]. Investors in securities, such as stocks and mutual funds, typically employ this tactic.

How Are Capital Gains Taxed?

The IRS taxes realized capital gains and further classifies them into two[8]:

- Short-term capital gain — capital gains from selling an asset owned for a year or less.

- Long-term capital gain — capital gains from selling an asset owned for more than one year.

Short-term capital gains are taxed as ordinary income, like salary and wages or income from business or self-employment. Taxpayers with capital gains must declare these in their annual income tax returns filed with the IRS.

How much a taxpayer pays for short-term capital gains tax depends on their federal income tax bracket. This ordinary income tax bracket ranges from 10% to 37%.

On the other hand, long-term capital gains tax is more complicated, with some qualifying for special tax rates. Generally, the tax in this case is lower than the tax on short-term capital gains declared ordinary income[9].

Long-term capital gains tax is broken down into three brackets: 0%, 15%, and 20%. Which bracket applies depends on the taxpayers’ filing status and total taxable income, not on the amount of capital gain.

For example, a single individual taxpayer with a total taxable income of less than $40,400 pays 0% tax. Another taxpayer with the same status but with a taxable income of $40,401 to $445,850 will pay a 15% tax. Meanwhile, a 20% tax assessment will apply to a single individual taxpayer with a total taxable income of $445,851 or more[10].

Capital Gains Tax on Home Sales

Capital gains tax on home sales scale based on the total taxable income of taxpayers and their status.

However, some rules apply to long-term capital gains on selling owner-occupied residences, particularly the 2-in-5 years rule. This rule applies to homeowners selling the homes they have occupied for a total of two years in the five years before the sale. These two years do not have to be consecutive or continuous; for example, the owner needs only to tally a total of 730 days in the span of five years preceding the sale.

Home sellers who qualify for this rule enjoy an exemption on the first $250,000 capital gains they realized from a sale. This exemption doubles to $500,000 for married couples jointly filing their income tax return.

BY THE NUMBERS: The average length of homeownership in the United States is 16 years, with 42.3% of homeowners occupying their current residence for less than 10 years and 8.6% living in their present home for 40 years or more.

Source: Property Management

The selling expenses of a residence, such as advertising, real estate agent fees, and attorney’s fees, can be included in the cost basis to compute the amount of capital gain. These expenses, plus any amount spent to improve the residence and help attract buyers, can reduce capital gains and hence, its tax[11].

Capital Gains Tax on Collectibles

The tax rate on long-term capital gains from collectibles is 28%. The capital gain from selling these assets less than a year after their purchase is taxed as ordinary income.

Under IRS guidelines, “collectible assets” include the following:

- Works of art and antiques, including rugs.

- Musical instruments and historical objects.

- Coins and stamps.

- Alcoholic beverages (such as valuable vintage wine).

- Precious metals or gems.

The 28% tax also applies to long-term capital gains from investment vehicles, like mutual funds or exchange-traded funds, that invest in precious metals.

Takeaways

- Capital gains occur when the owner of a capital asset sells it for a higher price than its original purchase price. In other words, capital gains are the profit its owner makes from selling their asset.

- The amount of capital gains is computed by deducting the original purchase cost of an investment or asset from its selling price.

- Capital gains are categorized as either realized or unrealized capital gains. Only realized capital gains are taxable by the IRS.

- Capital gains tax is further subdivided into short- and long-term capital gains tax. The former is taxed as ordinary income, while the latter may qualify for special tax rates.

Sources

- What Is Capital Gain? (n.d.) Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/capital-gain/

- Berry-Johnson, J. (2022, May 4). Capital gains are the profits you make from selling your investments, and they can be taxed at lower rates. Business Insider. Retrieved from https://www.businessinsider.com/what-are-capital-gains

- Segal, T. (2022, March 28). What Are Unrealized Capital Gains and Losses? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/04/021204.asp

- Adams, R. (2022, August 15). Appreciating Assets: 10 Best Things that Appreciate in Value. Young and The Invested. Retrieved from https://youngandtheinvested.com/assets-that-appreciate-in-value/

- Kenton, W. (2022, April 26). Realized Gain. Investopedia. Retrieved from https://www.investopedia.com/terms/r/realizedprofit.asp

- What Is Appreciation? (n.d.) Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/other/appreciation-definition/

- Thune, K. (2022, May 22). What Is Buy and Hold Strategy? The Balance. Retrieved from https://www.thebalance.com/what-is-buy-and-hold-2466543

- Royal, J. (2022, February 23). Schedule D: How to report your capital gains (or losses) to the IRS. Bankrate. Retrieved from https://www.bankrate.com/investing/schedule-d-reporting-your-capital-gains-or-losses/

- Orem, T., Parys, S. (2022, August 10). 2021-2022 Capital Gains Tax Rates — and How to Calculate Your Bill. Nerd Wallet. Retrieved from https://www.nerdwallet.com/article/taxes/capital-gains-tax-rate

- Ashford, K., Curry, B. (2021, November 10). 2021 and 2022 Capital Gains Tax Rates. Forbes. Retrieved from https://www.forbes.com/advisor/taxes/capital-gains-tax/

- Fishman, S. (n.d.) When Home Sellers Can Reduce Capital Gains Tax Using Expenses of Sale. Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/when-home-sellers-can-reduce-capital-gains-tax-using-expenses-sale.html