Historically, precious metals have served as a hedge, a reserve, and a risk protection strategy. But you probably wouldn’t describe money held in gold as “put to work” on your behalf.

Take me, for example. I invest in real estate for cash flow, growth in value, diversification from stocks, and protection from inflation, among other reasons. And while precious metals offer three of those four, they’ve never offered cash flow.

That’s the beauty of Monetary Metals: it puts gold and silver to work to earn income.

If you like the idea of diversifying into alternative investments beyond real estate, read our full review below.

Monetary Metals Review

Summary

Monetary Metals holds your gold and silver with no vault or storage fees. Even better, they provide opportunities for you to invest your metals to earn interest on them through lease or bond offerings.

They put plenty of guardrails in place to protect your metals, and they've never had a single default or late payment. But they remain a relatively new and novel platform, and it's not necessarily easy to determine the risk of any given investment.

Pros

- No vault or management fees

- Interest net of fees

- Perfect track record

- Loss protections

- Some liquidity

- Free shipping available

- Interest paid in kind

- Completely passive

Cons

- Few investment options

- High minimum investment

- Metal transaction fees

- Risk difficult to determine

What Is Monetary Metals?

Monetary Metals is a market-maker that connects investors with companies that use precious metals in the course of their business. Examples include precious metals dealers, refiners, recyclers, jewelers, mints, and mining companies.

These businesses lease gold or silver from Monetary Metals—or more accurately, from you. You own the metals and simply lease them for use.

In exchange for leasing your investment metals, you collect interest. Think of it like a loan, except instead of lending dollars, you lend your gold and collect interest, also in gold. Monetary Metals finds the lessees and alerts you when new leases become available. You choose an amount to invest in any given lease or wait for the next one to come along.

Alternatively, Monetary Metals sometimes opens gold bonds for investment. The bond issuer borrows gold and repays you in gold. Gold bonds on Monetary Metals are only available to accredited investors, however.

How Monetary Metals Works

After creating an account and verifying your identity, you can then add gold or silver to your account in one of two ways:

- You can buy metals directly on the platform (after wiring funds to your account).

- Ship your physical gold or silver (free of charge under certain conditions).

The company earns money by charging a premium to lessees (usually 2% above the marketed interest rate) and not through vault fees. In other words, you don’t pay Monetary Metals—the company leasing the gold does.

On the other hand, you invest by browsing available leases and bonds. Each investment option displays the offered interest rate, the term, and the repayment frequency. Most leases pay monthly interest, but some pay quarterly.

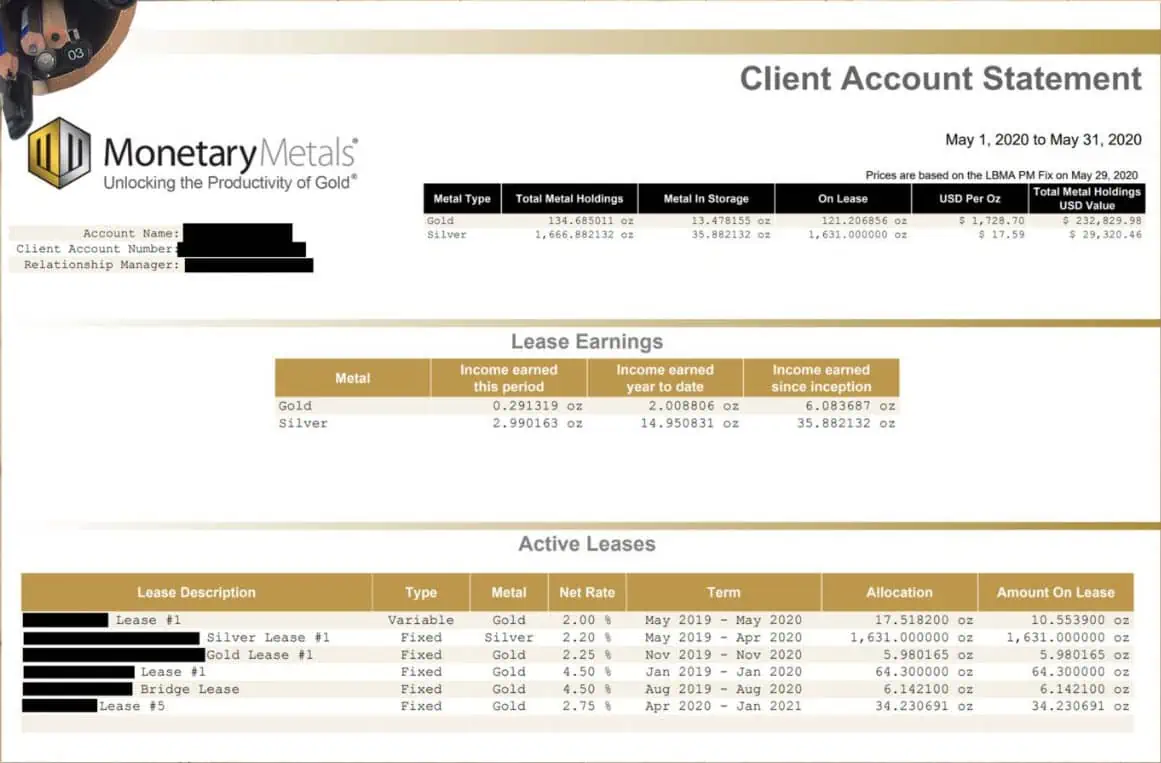

Here’s what an actual account statement looks like:

When the lease ends, you can typically renew to reinvest with the same lessee (or not, if you’d rather withdraw your metals). In fact, you can usually withdraw your metals even mid-lease, because most leases oversubscribe. If you want to pull your gold out early, most often there’s a waiting list of other investors happy to step in.

Of course, that cuts both ways. When nearly every lease oversubscribes, that indicates a scarcity of investment options—more on that later.

Pros of Monetary Metals

Monetary Metals has a lot going for it.

Consider the following highlights that Monetary Markets makes for its platform:

No Vault or Management Fees

One of the downsides of owning physical metals is that you have to store them somewhere safe (read: totally not under your mattress).

Not a safe space to store anything in, guys.

The trouble is, plenty of banks and online vault services offer to store your gold or silver for you—at a cost. That cost eats into your returns. Many investors skirt the storage issue by investing in exchange-traded funds (ETFs) that own metals. But they simply swap one set of fees for another with annual fund fees.

Monetary Markets doesn’t charge any vault, storage, or management fees to hold your gold.

Interest Net of Fees

When you browse available investments on Monetary Metals, they advertise a specific interest rate. That’s what you earn, with no fees diluting it.

Monetary Metals charges a separate fee to lessees to create revenue, usually 2%. For example, at the time of this writing, Monetary Metals offers a silver lease paying 5% to investors. Presumably, the lessee is paying 7% total to lease that silver: 5% to the owners and 2% to Monetary Metals.

Perfect Track Record

Monetary Metals has batted a thousand on their leases and bonds—no investment has ever lost money.

For that matter, no investment has ever failed to pay interest. Of the 55 metals leases they've executed, every single one has repaid in full, with interest. The same goes for their gold bonds.

That doesn’t happen by accident. Monetary Metals has put strong protections in place to prevent losses.

Loss Protections

To begin with, Monetary Metals requires that lessees buy insurance policies protecting all leased metals. And that these policies list Monetary Metals as the beneficiary in the event of a claim. Monetary Metals also buys supplemental insurance as an additional layer of protection.

They further require lessees to sign both corporate and personal guarantees on the leases. If they were to default, all company assets and the principals’ personal assets would be subject to collection.

Finally, Monetary Metals also keeps a close eye on lessee financials with direct portal access and regular third-party audits.

All investments come with risk, but Monetary Metals has systematically worked to shield against risk from multiple directions.

(Some) Liquidity

If you need to pull your metals out of an investment mid-lease, Monetary Metals can usually accommodate you.

Most investments oversubscribe between 2 to 4 times their capacity, leaving a long waiting list of investors ready to step in if another pulls out mid-lease. So while liquidity isn’t guaranteed, investors can typically recall their gold or silver in an emergency.

Free Shipping From Residential U.S. Addresses

Have gold in a vault behind a painting in your home office?

Gold is heavy and expensive to ship, but Monetary Metals foots that bill for you. They provide a prepaid shipping label from any residential address in the U.S. if you opt to fund your account by shipping physical gold or silver. And they insure the shipment so it doesn’t get “lost in the mail.”

Interest Paid in Kind

You earn interest on the metal you invest, but not in U.S. dollars. Rather, on the metal that you've invested in.

For example, if you invest 100 ounces of gold in a lease that pays 5% interest, you’d close out the year with 105 ounces of gold. It doesn’t matter if the value of gold went up, down, or in squiggly lines that year—you collect interest in gold.

Completely Passive Investment

Once you click the “Invest” button, you don’t have to lift a finger again.

Which is something I’ve come to value more and more as I get older. When I was in my 20s, I had no problem with running around looking at properties, negotiating with contractors, screening tenants, or hassling with lenders, inspectors, and property managers.

Actually, that’s not entirely true; it was a pain even then.

But today, I only invest passively. That goes for real estate investments such as crowdfunding platforms and syndications, and it goes for stock index funds. And that’s why Monetary Metals is right up my alley.

Cons of Monetary Metals

All investments come with drawbacks and risks. So what are Monetary Metals’?

Lack of Investment Options

At the time of this writing, Monetary Metals only has one open investment: a silver lease. There are no gold leases or bonds available.

And when investments do become available, they typically oversubscribe quickly. That means you have to pay attention to email alerts from Monetary Metals and jump on investments ASAP.

It also means you just don’t have many options to choose from, limiting your opportunities to diversify.

High Minimum Investment

Monetary Metals requires a minimum investment of at least 10 ounces of gold or 1,000 ounces of silver.

In today’s prices, that comes to over $20,000 for gold or over $24,000 for silver. That’s not chump change, especially when most investors only put a relatively small percentage of their portfolio in precious metals as a defensive play. You can see how the price of gold per ounce has changed over the last decade below:

Gold prices over the last 10 years (adjusted for inflation). The gray bar in the middle represents the COVID-19 pandemic.

Metal Transaction Fees

If you opt to buy or sell precious metals directly on Monetary Metals’ platform, they charge a transaction fee.

Specifically, they charge a spread over and above the London Fix Price (or the spot price, depending on when the trade takes place). The spread surcharge depends on how much you buy or sell. Monetary Metals charges an extra 0.75% for transactions under $250,000, 0.55% for transactions between $250k to $1 million, and 0.40% for transactions over $1 million.

Risk Is Difficult to Determine

When you invest in a metal lease or bond, how do you know how risky the investment is?

Take the current silver lease offering. The lessee is AGA Bullion, described as “one of the largest precious metals companies in Turkey. AGA offers integrated precious metals solutions including assaying, refining, bullion trading, sourcing, logistics, and vaulting services. This lease will provide and finance their inventory.”

I don’t know anything about AGA Bullion—do you? For that matter, I don’t know anything about how difficult it is to recover money from a company in Turkey if something happens the insurance policy doesn’t cover.

As a layperson with little knowledge of the precious metals industry, I have little to go on besides Monetary Metals’ track record and the steps they take to limit risk. That makes it hard to assess just how much default risk comes with any given offering on their platform.

And that says nothing of the market risk of metal valuations dropping. But that’s a separate topic entirely.

How Monetary Metals Compares to Other Investment Platforms

I don’t know of any direct competitors to Monetary Metals or any other investment platforms offering precious metals leases and bonds. Still, we can still compare them to other alternative precious metals platforms or other real estate investment platforms.

Glint offers a debit card tied to your gold holdings. Every time you make a purchase, it deducts the value from your gold balance. It charges no transaction fees for debit card purchases in the U.S., and charges 0.5% for foreign transactions. That’s lower than the typical 1% to 3% foreign transaction fee for debit cards. However, Glint does charge a 0.02% monthly storage fee to hold your gold, which adds up in the long term.

For a more traditional gold storage option, Vaulted holds your metals for a 0.4% annual fee. You can buy and sell metals on the platform for a 1.8% transaction fee. And if you prefer, you can have Vaulted deliver your physical gold to you rather than store it for you.

Alternatively, you can invest in real estate crowdfunding platforms for fractional ownership of properties. Platforms like Arrived (full Arrived review) and Ark7 (full Ark7 review) let you buy shares in rental properties for as little as $20 to $100, and you get full cash flow, appreciation, and tax benefits. Arrived doesn’t offer liquidity, but Ark7 does offer a secondary market.

If you’d rather invest fractionally in larger properties, EquityMultiple (review) and Crowdstreet (review) let you do so. Expect higher minimum investments, but still potentially lower than Monetary Metals. That said, both restrict access to accredited investors and typically require long-term investments for equity.

Or you can invest in a fund that owns many properties, such as what Fundrise offers. You can check out our review in the YouTube video below.

Nor do the options end there. You can also invest small amounts in secured debts to earn fixed interest. My personal favorite option is Groundfloor (review), which has delivered remarkably consistent returns year-after-year averaging 9.5% to 10%.

Final Thoughts on Monetary Metals

To be candid, I’ve always been skeptical about precious metals as an investment. I don’t like the lack of income, and I don’t like how speculative it feels. The prices rise or fall based on fear of financial collapse or inflation, not based on the measurable value created by a company or property.

Monetary Metals makes a strong case for itself, however, by adding passive income to the returns on metals. It points to historical gold returns of 8.35% over the last 20 years, on top of which you can add 2% to 5% interest from gold leases or 5% to 19% on gold bonds.

Those combined returns sound spectacular for a “defensive” or “hedge” investment. But again, it’s hard to know for certain just how safe the gold leases or gold bonds are.

By all accounts, Monetary Metals has delivered on its promises of security. If you like precious metals as an investment class, check out their current offerings. Just be aware that you take on both default and market risks on the value of precious metals dropping.