REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

As you learn more about selling properties with owner financing, you might start asking yourself,

“Is it really worth the extra effort to sell my properties this way?”

It's a good question because, in my opinion, seller financing is NOT the right answer for every property.

Even though it will sell properties faster and generate more revenue over the life of each loan, it takes a bit more work to set each one up.

It also requires that you get into a long-term relationship with each buyer, and it definitely slows down the velocity of your money as you wait to collect all of your sale proceeds.

Getting into a seller-financed deal with someone is a real commitment, and it's important to set clear boundaries so you know when to say “No.”

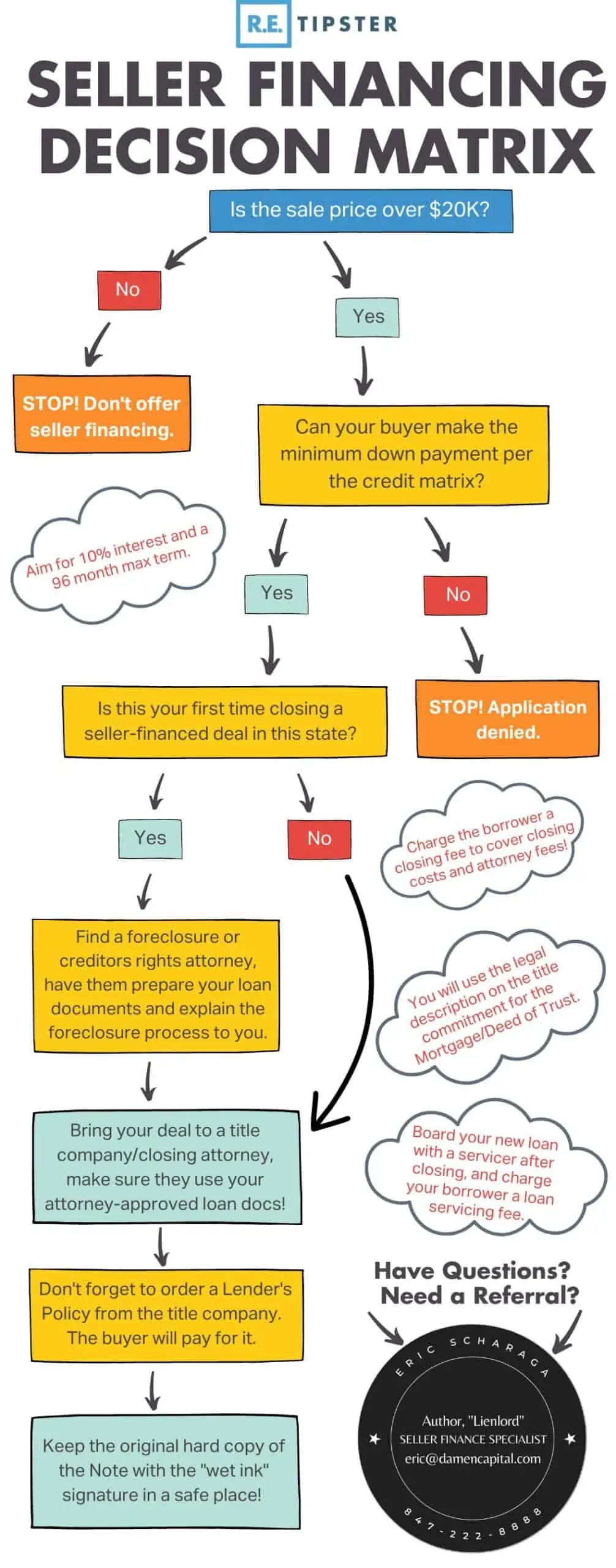

Here's the decision matrix I use to decide on the direction of each deal.

- If the sale price is less than $20K, I don't offer owner financing at all.

- If a property sells for $20K or more, and my buyer wants me to finance the sale, I'll outsource the closing to a title company or attorney.

- If it's my first seller-financed transaction in that state, I'll find a foreclosure/creditors rights attorney to compile the correct loan documentation and help me understand what the foreclosure process looks like in that state.

- If it's not my first seller-financed transaction in that state, my title company will use my attorney-approved templates to close the deal.

- Whatever closing costs are required to close the deal, I'll have the borrower pay a minimum $500 closing fee (maybe higher) to help offset these costs.

With these guidelines in place, I can only use seller financing on deals that are worth the trouble, and the borrower pays a good portion of the costs, so it doesn't come off my bottom line.

Here's a flowchart I put together with Eric Scharaga (note investor and seller financing aficionado) to help you visualize this decision-making logic.

Seller financing is a huge convenience we can provide for buyers, but we aren't obligated to do this, especially if it doesn't make good financial sense for us.

As a seller, you can choose when you do and don't want to make this available for each buyer. You don't have to follow the same logic explained above, but if you have no idea how to make this decision, this is a decent place to start.