What Is an Asset Class?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

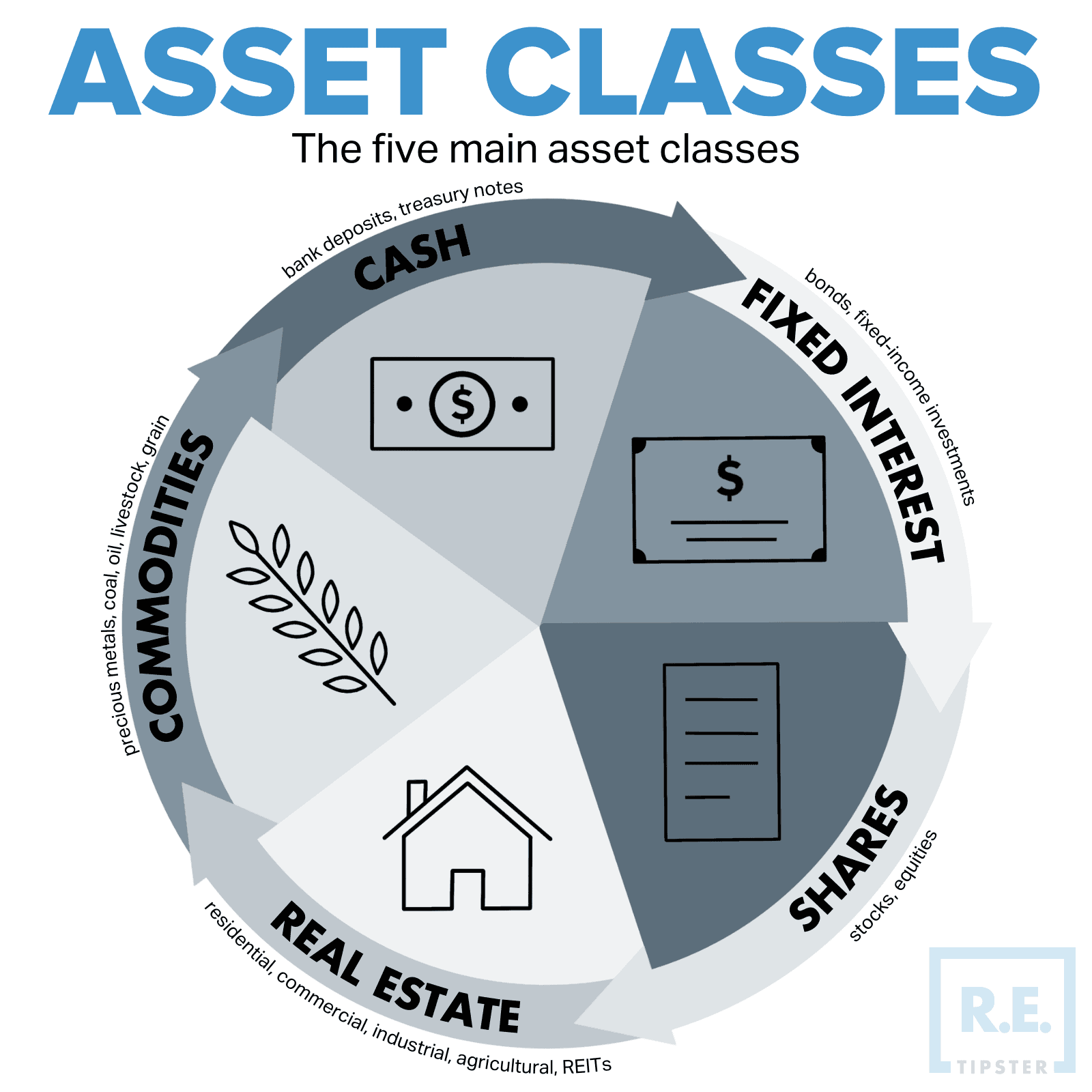

Types of Asset Classes

An asset class is distinguished from others by its liquidity, tenure, taxation, and market volatility. Investors use different asset classes to diversify their portfolios, reduce risks, and earn the highest possible returns. They choose a mix of these asset classes by looking at their personal investment goals, risk tolerance, and circumstances[1].

Traditional asset classes include equities or stocks, bonds or fixed-income investments, and cash or cash equivalents[2]. Real estate and commodities, meanwhile, are the two most popular alternative asset classes[3].

Equities or Stocks

When an investor purchases stocks or equities, they are buying partial ownership of a publicly-traded company. Shareholders can hold an ownership stake in local and international companies across a wide range of sectors.

Investors earn money from equities through a rise in the company’s stock price or by dividends, payments of the company’s profits given to shareholders in cash or stock. The value of stocks can change rapidly, but they are considered growth asset classes that offer higher potential returns in the long run.

Bonds or Fixed-income Investments

Fixed-income securities are investments that pay a recurring amount of interest and return the principal when the security reaches its maturity date. The predetermined interest rate is also known as a coupon, usually paid out to investors semi-annually.

Bonds are the most common types of fixed-income investments. These debt instruments are essentially loans made to a company or government when it needs to raise money for specific projects or operations. Bonds are low-risk asset classes.

Cash or Cash Equivalents

Known as the lowest-risk assets, cash and cash equivalents are highly liquid investment instruments that are bought and sold easily and quickly. This asset is not limited to bank accounts. It also includes cash management trusts, treasury bills, commercial papers, and short-term government bonds.

These money market assets are safe options. In the long term, however, cash investments are likely to decrease in value due to inflation.

Real Estate

This tangible investment is a growth asset class that offers protection against inflation due to property appreciation. As a result, real estate offers the potential for more significant returns on income and capital growth. Investments in real estate can involve anything from buying and flipping a house to owning rental and vacation properties.

Real estate is one of the few asset classes that allows an investor to leverage other people’s money (OPM) to grow an investment portfolio.

Through a real estate investment trust (REIT), individuals can also have exposure to other property asset classes and own a percentage of residential, commercial, or industrial property.

Commodities

These refer to physical assets like precious metals, coal, oil, livestock, grain, and natural gas bought and sold in bulk. Most commodities are traded through futures contracts (or simply “futures”), or agreements to buy or sell a commodity for a set price at a set date in the future.

Real Estate as an Asset Class

Given enough time, real estate performs better and yields higher returns on average than other asset classes. Investors use real estate asset classes to build diversified and resilient portfolios and enjoy the benefits of ongoing cash flow.

As a hard asset, real estate is appealing to investors because it provides a sense of stability. Unlike other financial assets with values that can decline rapidly and even reach negative growth, real estate ownership will always hold value even in difficult market conditions[4].

Real estate assets are also valuable as a hedge against inflation. The demand for real estate tends to increase as the economy grows. This means that real estate prices remain steady even in rising inflation, and there is little to no risk that inflation will erode the value of future investments[5].

Plus, real estate values may appreciate over time, allowing investors to yield returns by just owning, maintaining, or making improvements to a property over a long period before making a sale.

Real estate as an asset class also exhibits a low correlation with most other principal assets, and this low correlation can improve an investor’s risk-return tradeoff. With real estate, investors benefit from stable, long-term returns from price appreciation and rental income[6].

Types of Real Estate Investments

Investors can invest in four main types of real estate: residential, commercial, industrial, and land[7].

Residential Real Estate

These properties refer to structures built as living spaces for family units, which can be sold to homeowners or rented out to tenants. Residential real estate assets include single-family homes, duplexes, condominiums, townhouses, apartments, and vacation homes.

Investors can generate returns from residential real estate by renting them out for passive income. Alternatively, they can wait until the property appreciates then sell it later at a profit.

Commercial Real Estate

This type of real estate property is primarily used for business or retail purposes. Investors purchase commercial real estate and lease them out to business owners to earn income from rent. They benefit from a steady cash flow from multi-year leases.

RELATED: 7 Crucial Questions to Ask Before Buying Commercial Real Estate

Industrial Real Estate

Driven by the consumption of goods, this type of real estate covers properties used by companies for the production, manufacturing, storage, and distribution of their products.

Industrial real estate attracts investors who look for lower turnover rates and higher returns from longer leases.

Land

This type covers any vacant land available for purchase, such as semi-developed land, working farms, and new construction. Investing in land provides unique opportunities for investors looking to profit from significant future property development or a long-term buy-and-hold.

Benefits of Commercial Real Estate Investment

The stability of commercial real estate makes it a desirable investment even when market cycles fluctuate. Investors get the advantage of an asset that can offset the long-term impacts of rising inflation, allowing it to generate predictable, high returns over time.

There are two ways to invest in commercial real estate: direct investment (through the acquisition of a portfolio of properties) and indirect investment (via publicly traded REITs or private funds[8]).

Commercial real estate assets are great tools for portfolio diversification because they are non-correlated investments, which means their performance is not tied to market fluctuations like bonds and stocks. With the security provided by a physical asset, commercial real estate investors enjoy steady cash flow and income that may be distributed monthly, quarterly, or annually[9].

Types of Commercial Real Estate

There are five common types of commercial real estate[10].

Office

An office can be single or multi-tenanted and range from small office buildings to high-rise office buildings. Office spaces provide owners with steady cash flows from long-term leases and annual rent increases.

Retail

Retail is any building used for the sale and marketing of consumer goods and services. Examples of retail properties include pharmacies, small, local shopping stores, salons, fast-food restaurants, grocery stores, and major shopping centers.

A variety of lease terms characterize retail assets. Meanwhile, demographics, location, and consumer trends and spending habits affect the value of retail assets.

Industrial

Often occupied by a single tenant or several large tenants, industrial real estate provides efficient spaces for the manufacturing and distribution of products. These include warehouses, storage, and research and development buildings.

The value of industrial real estate is affected by export and import activities. These properties generally have longer-term leases.

RELATED: Single, Double, and Triple Net Leases – What’s the Difference?

Multifamily

Multifamily residences are residential buildings that can house five or more families. Multifamily properties include apartments and student housing (such as dormitories). These properties provide investors with a diversified and steady passive income stream through predictable rents and high occupancies.

Hospitality

These commercial real estate assets are defined primarily by the services they offer. Hospitality properties include hotels, motels, event centers, inns, and luxury resorts. These properties accommodate transient rentals.

Travel and tourism are the main drivers of the demand for hospitality assets. Investors may benefit from these assets by improving amenities, changing offerings, and adjusting prices during periods of high demand.

Takeaways

An asset class is a group of similar investment vehicles that perform comparatively in the marketplace and are bound by the same laws and regulations.

Real estate is one such asset class that suits investors looking to diversify their portfolios and enjoy all the benefits of stable income, high returns, and protection against inflation.

Sources

- U.S. Securities and Exchange Commission. (n.d.) Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing. Retrieved from https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- Little, K. (2021.) Use All Four Asset Classes to Build your Portfolio. The Balance. Retrieved from https://www.thebalance.com/use-all-four-asset-classes-to-build-your-portfolio-3141071

- Carlson, D. (2021.) A Beginner’s Guide to Alternative Investments. U.S. News. Retrieved from https://money.usnews.com/investing/investing-101/articles/a-beginners-guide-to-alternative-investments

- Palmer, B. (2021.) Key Reasons to Invest in Real Estate. Investopedia. Retrieved from https://www.investopedia.com/articles/mortgages-real-estate/11/key-reasons-invest-real-estate.asp

- Lewis, R. (2021.) How to hedge against inflation with investments that keep pace with rising prices. Business Insider. Retrieved from https://www.businessinsider.com/how-to-invest-for-inflation

- Rohlfs, C. (2020.) Why Real Estate is Less Volatile than the Stock Market. Fundrise. Retrieved from https://fundrise.com/education/why-real-estate-is-less-volatile-than-the-stock-market

- Corporate Finance Institute. (n.d.) Real Estate. Retrieved from https://corporatefinanceinstitute.com/resources/careers/jobs/real-estate/

- Likos, P. (2021.) How to Invest in Commercial Real Estate. U.S. News. Retrieved from https://money.usnews.com/investing/real-estate-investments/articles/how-to-invest-in-commercial-real-estate

- Chen, J. (2020.) Commercial Real Estate (CRE). Investopedia. Retrieved from https://www.investopedia.com/terms/c/commercialrealestate.asp

- Becker, M. (2021.) The Beginner’s Guide To Commercial Real Estate Investing. WealthFit. Retrieved from https://wealthfit.com/articles/commercial-real-estate/