What Are Blue Sky Laws?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts: Blue Sky Laws

- Blue sky laws are state-level securities regulations that protect investors from fraud, with each state maintaining its own set of rules and enforcement powers.

- These laws require companies selling securities to register their offerings with state regulators unless they qualify for federal exemptions.

- States can review and reject securities offerings based on their merit, not just proper disclosure, giving them stronger investor protection powers than federal regulators.

- Real estate investments face particular scrutiny under blue sky laws, especially for non-traded REITs, crowdfunding, and syndications.

- While federal law exempts certain securities from state registration, states retain the power to investigate fraud, collect fees, and regulate securities professionals.

Understanding Blue Sky Laws

Blue sky laws are state-specific securities regulations that complement federal securities laws. They got their unusual name from a 1917 Supreme Court decision, Hall v. Geiger-Jones Co., where Justice Joseph McKenna described speculative schemes that had no more substance than “so many feet of blue sky.” This case upheld the constitutionality of state securities laws, establishing their importance in the American financial regulatory framework.

The laws emerged during a period of rampant securities fraud in the early 1900s. Before federal securities laws existed, states took the initiative to protect their citizens from fraudulent investments. Kansas led the way in 1911, with other states quickly following suit. By 1933, when the first federal securities laws were enacted, 47 states had already established their own blue sky laws.

Today, blue sky laws operate within a complex framework of state and federal regulations. For example, New York’s blue sky law, known as the Martin Act, is considered one of the strongest in the nation, giving the state’s Attorney General broad powers to investigate and prosecute securities fraud. Meanwhile, California’s Corporate Securities Law of 1968 takes a different approach, focusing heavily on merit review of securities offerings.

Merit Review of Blue Sky Laws

One of the most distinctive features of state blue sky laws is that many states conduct a “merit review” of securities offerings. Under merit review, state regulators can deny registration to securities they deem unfair or unjust to investors, even if all required disclosures are made.

This approach differs significantly from federal securities law, which focuses primarily on disclosure.

Most states conduct some form of merit review. For instance, the Texas State Securities Board provides a clear example of such merit standards. Under Texas law, an offering may be denied if:

- The promoter’s participation in the venture exceeds 10% of the total equity investment.

- Options or warrants exceed 10% of the public offering.

- The offering price significantly exceeds the price paid by insiders.

- The offering would result in unreasonable amounts of cheap stock.

How Blue Sky Laws Affect Real Estate

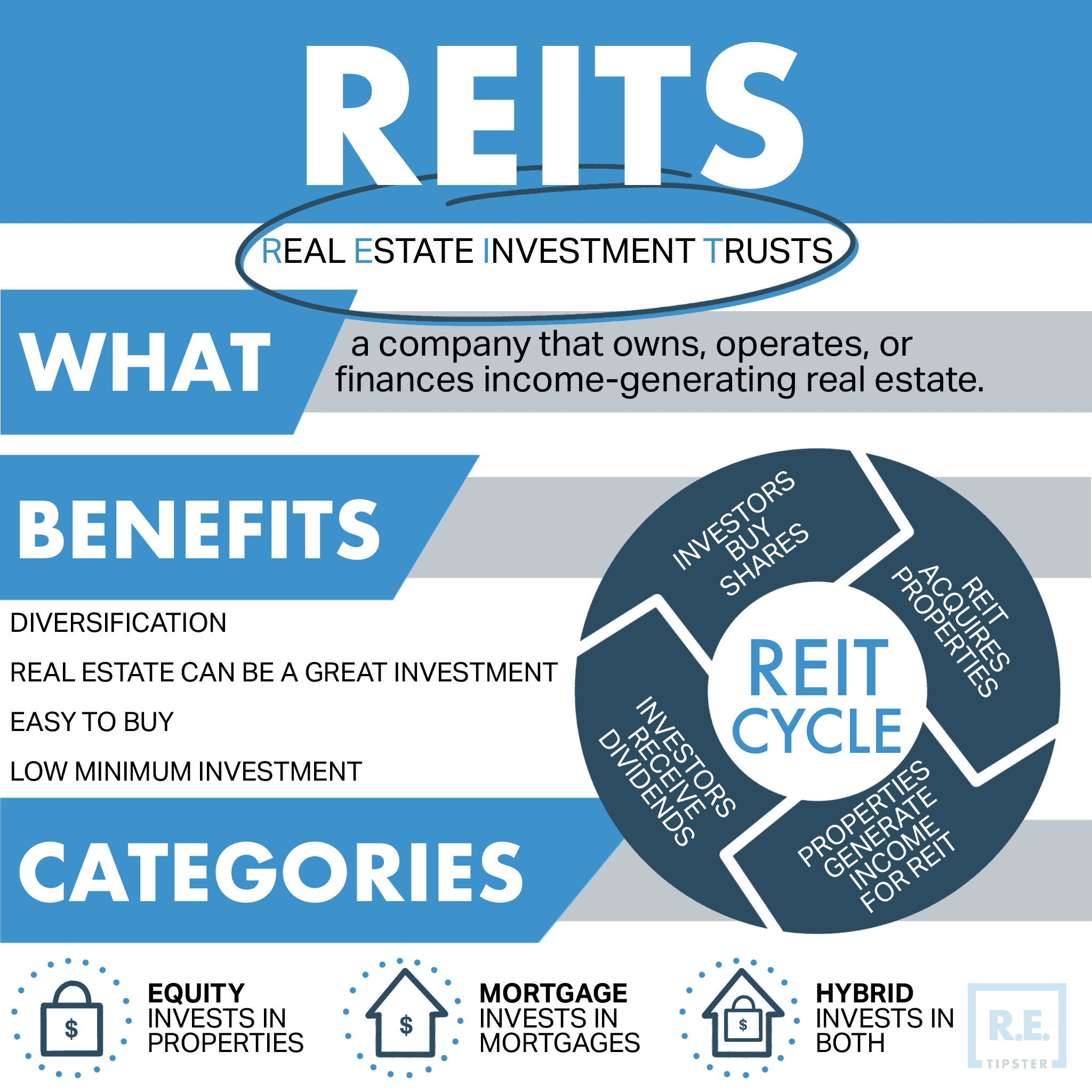

Real estate securities offerings must navigate both federal and state securities laws, particularly when structuring syndications, real estate investment trusts (REITs), and crowdfunding deals. Here’s how blue sky laws affect different types of real estate investments:

Syndications

Most real estate syndications use Rule 506 of Regulation D to avoid state registration requirements. While the offering itself is exempt from state registration, sponsors must still file notices in each state where they sell securities. These notice filings, typically due within 15 days of the first sale, vary by state.

Real Estate Crowdfunding

Crowdfunding platforms typically rely on Rule 506(c), which allows public advertising but requires all investors to be accredited. While the securities themselves are exempt from state registration, the platforms must:

- Register as broker-dealers or investment advisers in each state where they operate.

- File notice forms for each offering.

- Comply with state advertising and solicitation rules.

You can read more about how real estate crowdfunding works and how it differs from other types of real estate investments in our blog post, “Real Estate Crowdfunding: A Beginner’s Guide to Investing in Property Online.”

REITs

Non-traded REITs face stricter regulation under state laws. This is largely due to their nature of being illiquid and not listed on public exchanges, which raises concerns about investor protection.

Regarding REITs, most states follow the guidelines of the NASAA, or the North American Securities Administrators Association:

- Sponsor net worth of at least $25 million.

- Three years minimum real estate experience.

- Maximum 15% limit on organization and offering expenses.

- Independent director requirements.

Tenant-in-Common (TIC) Investments

State regulations also impact tenant-in-common (TIC) offerings. The SEC ruled in 2009 that investments involving more than one owner, such as TICs, typically qualify as securities under federal law. This means TICs require either registration or exemption at both federal and state levels.

California, for instance, requires specific disclosures about property management agreements and asset management fees in TIC offerings under California’s Code of Regulations Rule 260.140.111.9.

Blue Sky Registration Requirements and Process

Securities registration under blue sky laws typically follows one of three methods:

1. Registration by Qualification

This method requires issuers to provide detailed information about the offering and the company. It involves a thorough review by state regulators, who assess the fairness and adequacy of disclosures before granting approval.

2. Registration by Coordination

This method allows issuers to register simultaneously with both state and federal authorities. It is often used when a security is being registered at the federal level under Regulation D or other federal provisions. The state registration becomes effective upon federal effectiveness.

3. Registration by Notification

This is a simpler method that typically applies to offerings that have already been registered at the federal level. Issuers must file a notice with the state, along with any required fees, but do not undergo as extensive a review as in qualification or coordination.

The registration process varies significantly by state. For example, California requires all securities offerings to register using Form 260.110, unless they qualify for an exemption. Meanwhile, New York doesn’t require registration of securities offerings but does mandate dealer registration and maintains strong anti-fraud provisions.

Blue Sky Federal Preemption Under NSMIA

The National Securities Markets Improvement Act of 1996 (NSMIA) created a clearer divide between state and federal securities regulation. This law identifies certain “covered securities” that are exempt from state registration requirements, including:

- Stocks traded on major exchanges (NYSE, NASDAQ).

- Mutual funds and other registered investment company securities.

- Private placements under Rule 506 of Regulation D.

- Securities sold to qualified purchasers as defined by the SEC.

While NSMIA exempts these securities from state registration, states maintain important oversight powers. They can still require notice filings, collect fees, investigate fraud, and regulate securities professionals operating within their borders. States also retain full authority to regulate any securities not covered by NSMIA.

For example, a company conducting a Rule 506 offering can sell to investors across multiple states without registering in each state. However, they must still file notices and pay fees in each state where they sell securities, typically within 15 days of their first sale.

FAQs: Blue Sky Laws

Do blue sky laws apply to all securities offerings?

While blue sky laws potentially apply to all securities offerings within a state, certain offerings are exempt under NSMIA. According to SEC data, approximately 95% of all Regulation D offerings relied on Rule 506, making them “covered securities” exempt from state registration requirements.

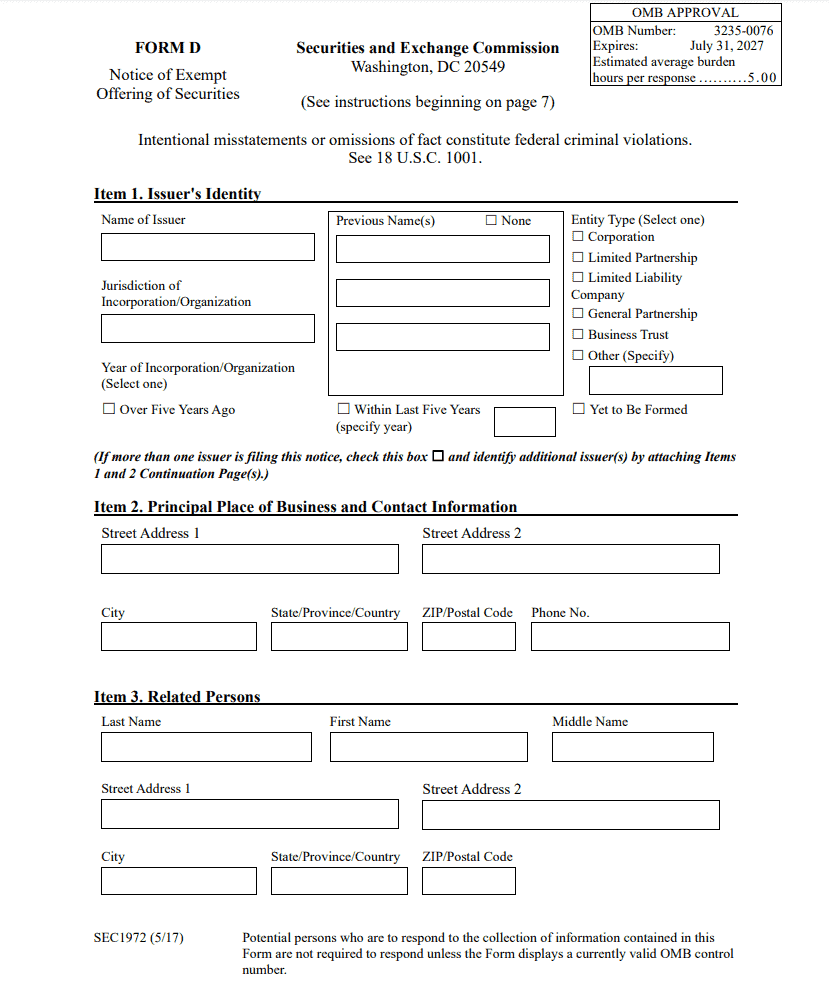

However, even exempt offerings must comply with certain state requirements. These typically include filing a notice with state regulators (usually Form D or state-specific forms), paying required filing fees, and complying with state anti-fraud provisions. Additionally, any broker-dealers involved in the offering must maintain appropriate state registrations.

Page 1 of Form D.

How do merit review standards vary by state?

Merit review standards vary significantly between states, with each jurisdiction taking a unique approach to investor protection. Massachusetts, for instance, focuses primarily on the offering price and underwriting terms, examining whether the price is fair to investors based on current market conditions.

California takes a different approach, closely examining promotional shares and selling expenses, with strict limits on promotional shares at 50% of the offering. Meanwhile, Minnesota emphasizes the company’s operating history and financial condition, requiring companies to meet minimum net earnings standards.

Texas conducts perhaps the most comprehensive merit review, examining everything from promoter participation to cheap stock restrictions.

By contrast, some states, like New York, don’t conduct merit review at all, focusing instead on ensuring adequate disclosure to investors.

What happens when a company violates blue sky laws?

Violations of blue sky laws can trigger both civil and criminal penalties, varying significantly by state.

For example, California can impose fines of up to $1 million per violation and jail terms of up to five years under Corporations Code Section 25540. The most common violations occur through missed notice filings or improper investor verification, which typically result in fines of $5,000 to $25,000 per incident.

More serious violations, such as fraud or selling unregistered securities, often trigger investor rescission rights, meaning the company must refund all investor money plus interest, which, in New York, accrues at 6% annually under the Martin Act. Additionally, state regulators can bar violators from future securities offerings and require public disclosure of violations, significantly impacting a company’s ability to raise future capital.

References

- Justia, “Hall v. Geiger Jones Co., 242 U.S. 539 (1917).” https://supreme.justia.com/cases/federal/us/242/539/

- Securities and Exchange Commission Historical Society, “Chasing the Devil Around the Stump: Securities Regulation, the SEC and the Courts.” https://www.sechistorical.org/museum/galleries/ctd/ctd02d_limits_blue.php

- University of Maryland Baltimore, “The Martin Act: an Overview.” https://digitalcommons.law.umaryland.edu/cgi/viewcontent.cgi?article=1010&context=jbtl

- Hofstra University, “Merit Regulation via the Suitability Rules.“ https://scholarlycommons.law.hofstra.edu/cgi/viewcontent.cgi?article=1214&context=jibl

- Texas State Securities Board, “RULES AND REGULATIONS OF THE TEXAS STATE SECURITIES BOARD.” https://www.ssb.texas.gov/sites/default/files/2021-11/2021-11-21_TSSB%20Electronic%20Rulebook.pdf

- Growth Turbine, “Is Reg D-506(C) still the Gold Standard in Equity Crowdfunding in 2024?” https://www.growthturbine.com/blogs/is-reg-d-506-c-still-the-gold-standard-in-equity-crowdfunding-in-2024

- Mayer Brown, “REITs and REIT Offerings.” https://www.mayerbrown.com/-/media/files/perspectives-events/events/2021/02/reit-offerings-mayer-brownpli-february-2021.pdf%3Frev=a65991aa2dda4ceeba3319961d2553e0

- SirkinLaw, “1031 Exchange and TICs.” https://andysirkin.com/investment-tics-crowdfunding-securities/an-introduction-to-1031-exchange-tics/

- University of Baltimore, “Blue Sky Law and Practice: An Overview.” https://scholarworks.law.ubalt.edu/cgi/viewcontent.cgi?article=1085&context=ublr

- Cornell Law School – Legal Information Institute, “Cal. Code Regs. Tit. 10, § 260.140 – Application of Standards.” https://www.law.cornell.edu/regulations/california/10-CCR-260.140

- Loyola Marymount University, “Regulation of Securities Offerings In California: Is It Time For a Change After a Century of Merit Regulation?” https://digitalcommons.lmu.edu/cgi/viewcontent.cgi?article=3091&context=llr

- Texas State Securities Board, “Federal Covered Securities.” https://ssb.texas.gov/securities-professionals/regulation-securities/federal-covered-securities

- Carofin, “Regulation D, Rule 506(b) Private Placements.” https://carofin.com/knowledge-base/evaluating-issuers/regulation-d-rule-506b-private-placements/

- North American Securities Administrators Association, “New York.” https://www.nasaa.org/industry-resources/securities-issuers/coordinated-review/regulation-a-offerings/state-filing-requirements/new-york/

- Casetext, “Cal. Corp. Code § 25541.” https://casetext.com/statute/california-codes/california-corporations-code/title-4-securities/division-1-corporate-securities-law-of-1968/part-6-enforcement/chapter-3-crimes/section-25541-fraud-or-deceit-in-connection-with-offer-purchase-or-sale-of-security