What is a Capital Expenditure?

What Are Capital Expenditures in Real Estate?

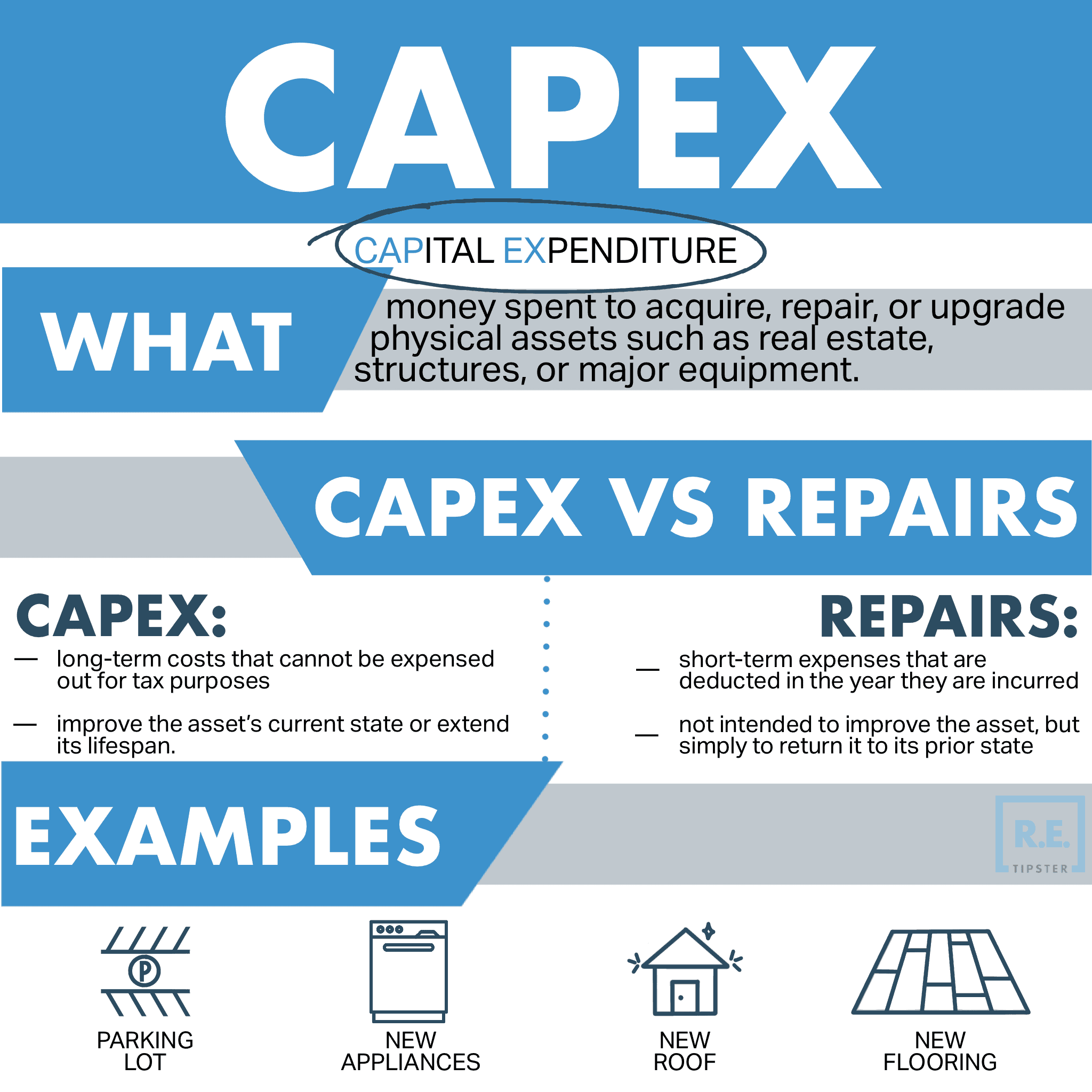

In real estate, capital expenditures are big-ticket items that are generally expected to improve the property for at least a year. For example, if a commercial property owner adds a new parking lot, it would be a capital expenditure.

In residential rentals, improvements such as a new roof, new appliances, or new flooring would be considered capital expenditures.

From an accounting perspective, capital expenditures are added to the property’s basis. While they are depreciated over time, the schedule may be different from the depreciation schedule for the property itself. For example, if an investor replaces the kitchen appliances in a rental property, the appliances would be depreciated over five years while the house itself is on a 27.5-year depreciation schedule.

The Difference Between Capital Expenditures and Repairs

In real estate, capital expenditures are typically the long-term costs that improve the asset’s current state or extend its lifespan.

By contrast, repairs are short-term expenses that are deducted in the year they are incurred. Repairs are not intended to improve the asset, but simply to return it to its prior state.

Example: Tammy Tenant is complaining of a leaky roof. Larry Landlord calls a roofing contractor who inspects the property and gives him two options. He can either repair the damaged shingles at a cost of $1,000, or since the roof is nearing the end of its natural lifespan, he could replace the entire roof at a cost of $10,000.

If Larry Landlord repairs the damaged shingles, he could write off the $1,000 in the current tax year as an expense. If he opts to replace the roof, it would be a capital expenditure subject to a 27.5-year depreciation schedule.

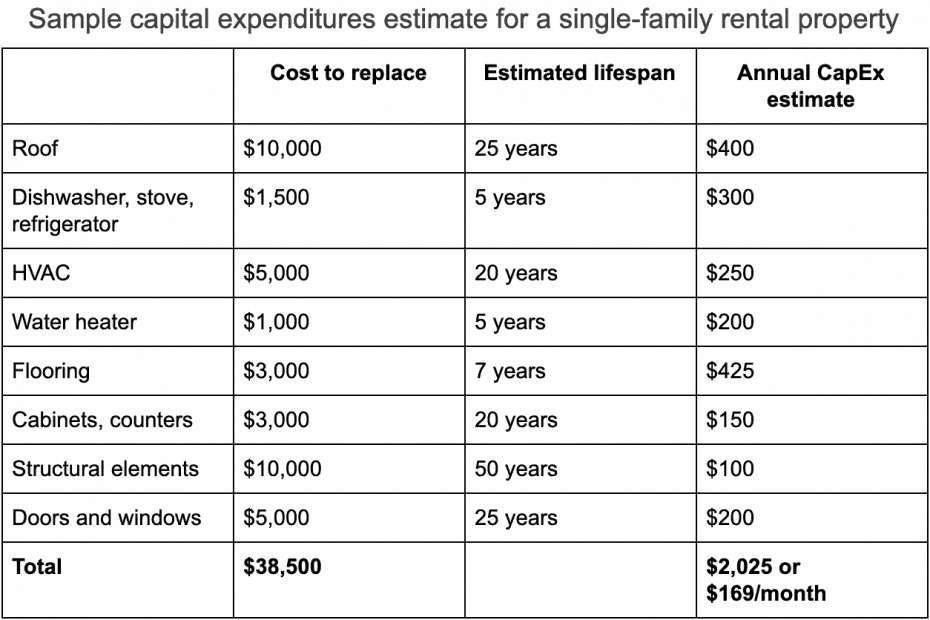

How to Estimate CapEx for Real Estate Investors?

There’s no universal formula that can be applied to a real estate portfolio because there are too many variables to consider. Estimating CapEx is more of a forecasting operation than a formulaic one.

It’s helpful to make a spreadsheet listing each asset and the big-ticket items associated with each one, along with the estimated lifespan and cost to replace. With this method, it’s possible to forecast a CapEx budget for each property in your portfolio.

The only problem with the above system is that it assumes the elements are all in new condition and will break down according to schedule.

Since that’s rarely the case (especially for older homes with appliances and flooring near the end of their natural lifespan), the spreadsheet should also have a column listing the estimated remaining lifespan for the existing elements.

Why CapEx Matters for Real Estate Investors

Capital expenditures for residential property don’t change much, regardless of the property.

A $400,000 property will have roughly the same CapEx budget as a $100,000 property, give or take a couple thousand. A water heater, kitchen appliances, laundry appliances, furnace, for example, won’t cost four times more to replace in a $400,000 house than it will in a $100,000 one.

If an investor can rent out a $400,000 property for $2,500 a month, a monthly CapEx budget of $170 is less than 7% of the rental income. If the $100,000 property only generates $700 a month in rent, the same CapEx budget of $170 is about 25% of rental income.

That’s an important point to keep in mind when you’re evaluating potential “bargain” properties for your portfolio.