What is Chapter 11 Bankruptcy?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Chapter 11 Bankruptcy Explained

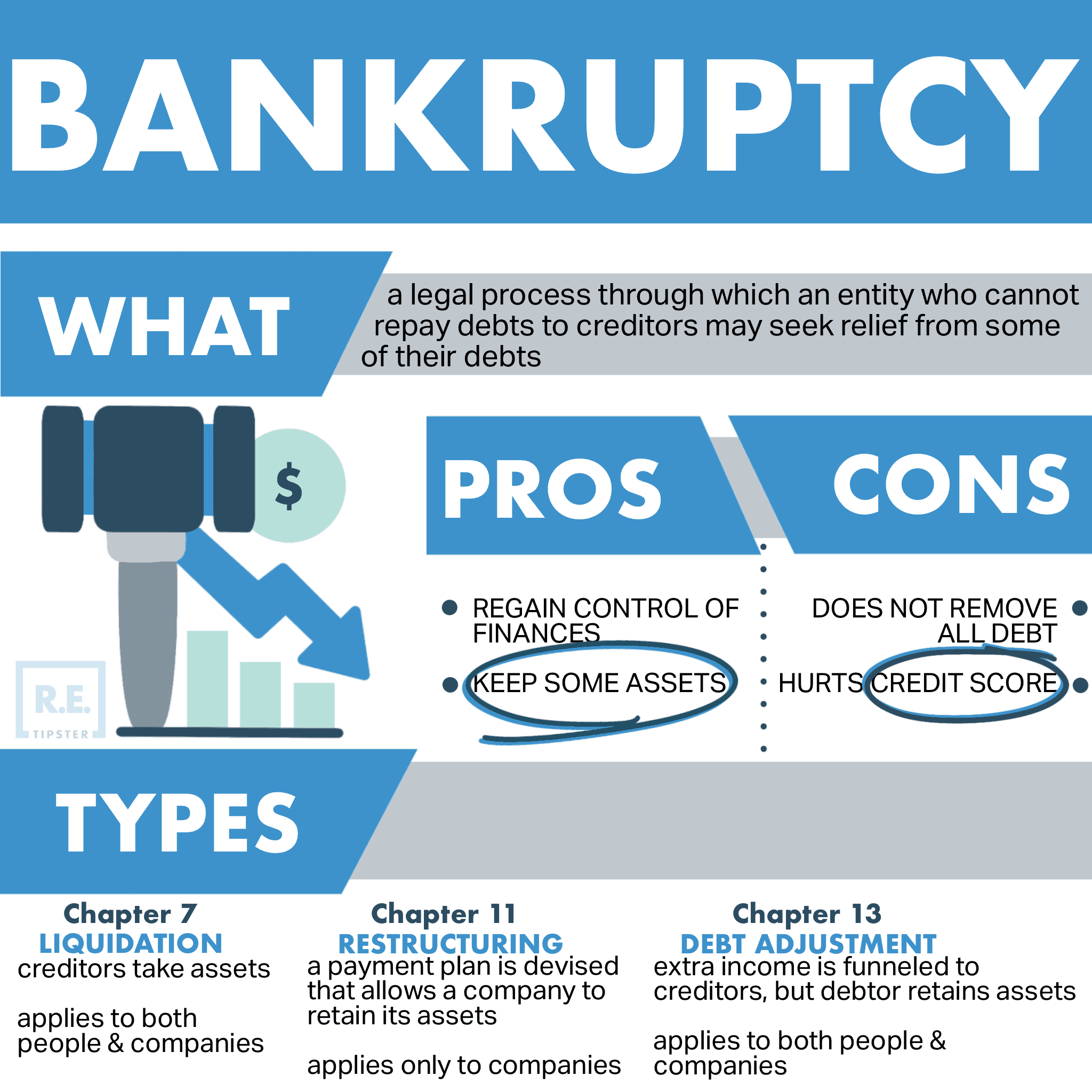

Chapter 11 is a bankruptcy proceeding where the court may appoint a trustee and committee of creditors to work with the defaulting borrower to rehabilitate the business. During the process of a Chapter 11 bankruptcy, the debtor maintains possession of the business and its assets.

A Chapter 11 bankruptcy is known as a reorganization, usually involving a corporation or partnership, but can also be beneficial to certain small businesses.

In many cases, a Chapter 11 bankruptcy may be the most sensible option for both the debtor and the creditors, because it allows the business to continue operating and paying its workers while also giving ample time for the debtor to pay back their creditors in full.

A Chapter 7 bankruptcy, by contrast, is where a court-appointed trustee liquidates the debtor’s nonexempt property and other assets, and the liquidated assets (which may or may not be sufficient to pay back the creditors in full) are used to cover the outstanding debts. There is no additional repayment after the liquidated assets are disbursed among the creditors.

What Happens In A Chapter 11 Bankruptcy?

While Chapter 7 and Chapter 13 bankruptcies are designed for consumers, Chapter 11 bankruptcies are designed for businesses.

Known as a “reorganization bankruptcy,” Chapter 11 works similarly to Chapter 13 for businesses. The goal is to restructure debts — and possibly business operations — so the business can continue paying its obligations without going under. Businesses may even borrow additional money, with court approval.

Affected creditors meet with the trustee and vote on the proposed plan. If the borrower doesn’t propose their own plan, or their proposed plan is voted down, the creditors may propose their own plan to restructure the company’s debts while allowing them to stay in business.

Note that either the borrowing company or the lenders can initiate a Chapter 11 bankruptcy, unlike with consumer bankruptcies.

Sometimes real estate investors opt for a Chapter 11 over a Chapter 13 bankruptcy. As many real estate investors operate under business entities such as LLCs, some choose a Chapter 11 bankruptcy when their debt levels exceed the limits on Chapter 13 bankruptcies.

Chapter 11 bankruptcies appear on your personal credit report for ten years, and on your business credit report for up to 20 years.

Reviewed by Mark H. Zietlow, Innovative Law Group

References

- ^ “Chapter 11 – Bankruptcy Basics.” uscourts.gov, www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-11-bankruptcy-basics. Accessed 25 Mar. 2020.

- ^ Petts, Jonathan. “Chapter 7 vs. Chapter 11 Bankruptcy.” Upsolve, 19 Dec. 2019, upsolve.org/learn/chapter-7-vs-chapter-11-explained/. Accessed 25 Mar. 2020.

- ^ Ruth, George E. Commercial Lending. 5th ed., Washington, D.C., American Bankers Association, 2004, pp. 306.