What Is Financial Ratio Analysis?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Financial ratio analysis assesses the company’s financial performance using data derived from its financial statements.

- Various financial ratios can offer a quick glimpse into a company’s financial health based on six broad categories: liquidity, solvency, profitability, efficiency, coverage, and market value.

- Financial ratio analysis can track a company’s performance over time and compare it with its industry or sector competitors.

- Financial ratios can be most helpful if combined with other metrics to gauge company or business performance.

A Background of Financial Ratio Analysis

Financial ratio analysis is a method used to examine how a business or a company is performing. With financial ratio analysis, businesses can be judged equally based on their performance instead of their size, market share, or sales volume[1].

These ratios are essential for investors and creditors to assess a company’s financial performance and make informed decisions[2]. Meanwhile, the company’s financial directors use these ratios to grow shareholder value, attract investors, and assess the competition[3].

Financial ratios are calculated by dividing one financial statement, such as income and cash flow statements, by another. Business leaders can then compare the resulting ratios to industry benchmarks, other companies in the same industry, or the company’s historical financial ratios to determine trends and identify potential areas of improvement[4].

Note that financial ratio analysis is just one tool in the overall financial analysis process. Whatever ratio the business leader looks at should be used with other methods and factors, such as market trends, macroeconomic factors, and comprehensive industry analysis, to make better, data-driven decisions.

Types of Financial Ratios

There are six major financial ratio groups, each serving a specific measurement purpose[5]. These six ratios, their elements, and specific formulas for analysis are as follows:

1. Liquidity Ratios

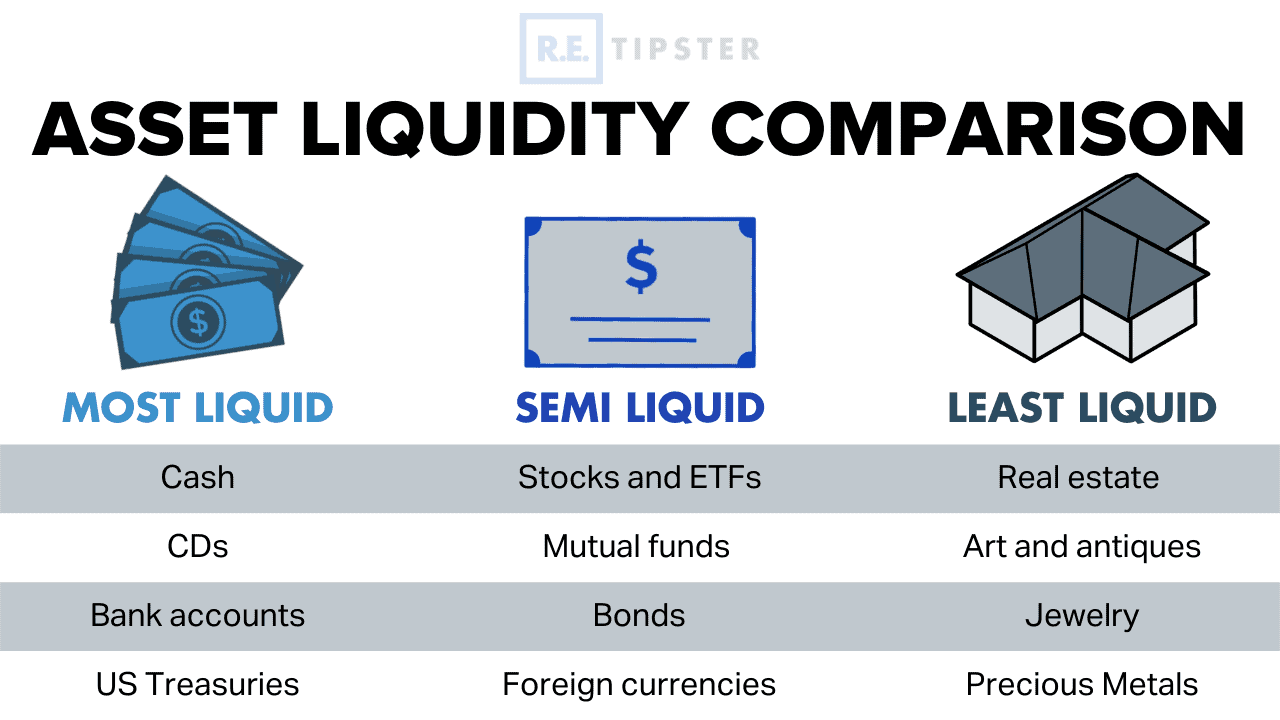

This ratio, with three subcategories, determines a company’s ability to pay its short-term debts[6].

- Current ratio = Current assets / Current liabilities

- Quick ratio = (Cash + Accounts receivables + Marketable securities) / Current liabilities

- Cash ratio = (Cash + Marketable securities) / Current liabilities

2. Profitability Ratios

This metric indicates the ability of a company to generate profit in relation to its operating costs, sales revenue, assets, and shareholder’s equity[7]. Common profitability ratios include:

- Operating margin ratio = Operating income / Net sales

- Gross margin ratio = Gross profit / Net sales

- Return on assets ratio = Net income / Total assets

- Return on equity ratio = Net income / Shareholder’s equity

Generally, a net profit margin (net profit / revenue × 100) of 10% is considered average, 20% is considered good, and 5% is low.

3. Efficiency Ratios

Also called activity or asset management ratios, this ratio measures how well a business uses its assets to maximize sales, profit, and shareholder wealth. These ratios include:

- Asset turnover ratio = Net sales / Average total assets

- Inventory turnover ratio = Cost of goods sold / Average inventory

- Receivables turnover ratio = Net credit sales / Average accounts receivable

- Days sales in inventory ratio = 365 days / Inventory turnover ratio

4. Solvency Ratios

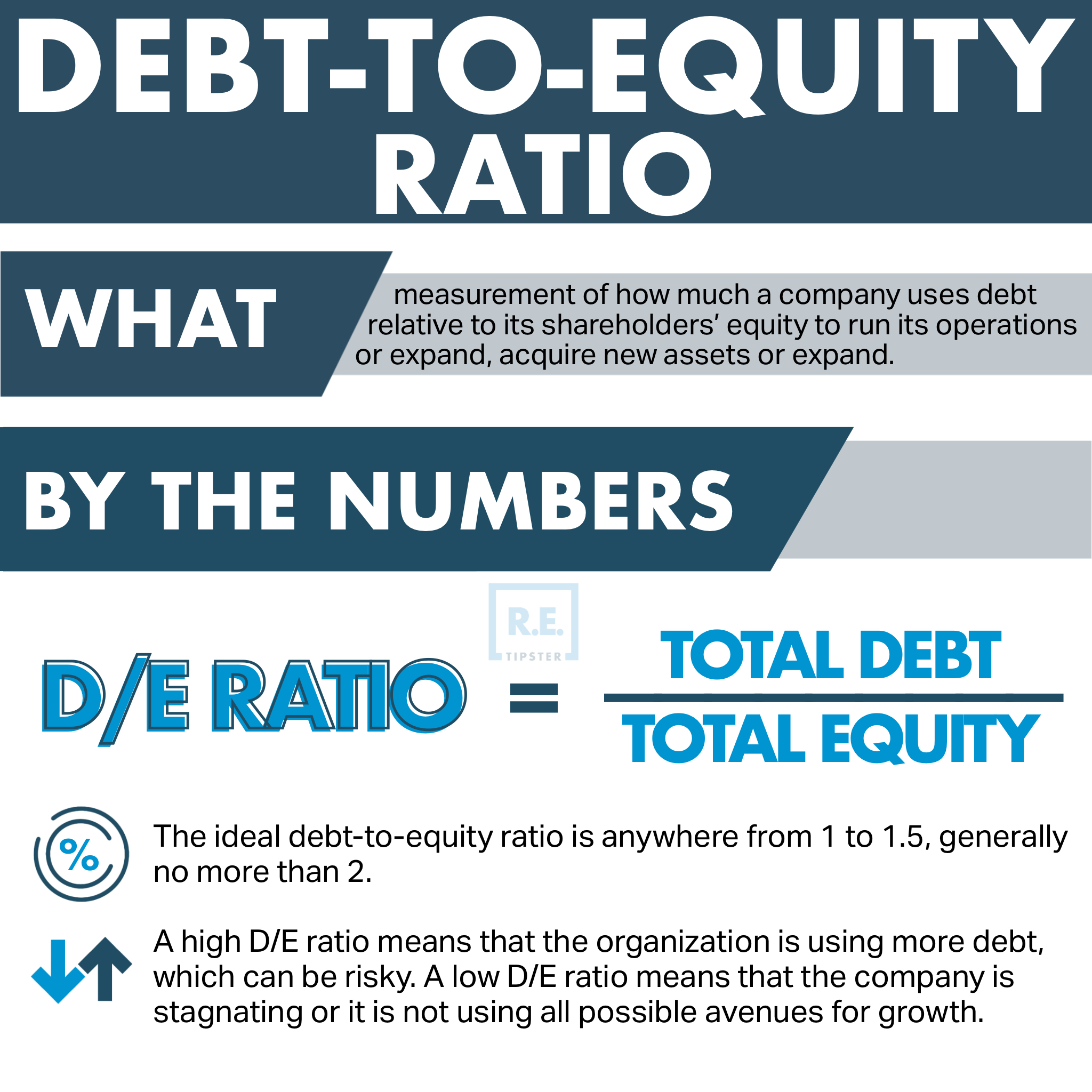

This group of financial benchmarks is also called the financial leverage ratio. It evaluates the long-term viability of a business by comparing its debts with its earnings, assets, and equity. Examples of solvency ratios include:

- Debt ratio = Total liabilities / Total assets

- Debt to equity ratio = Total liabilities / Shareholder’s equity

5. Coverage Ratios

These ratios measure a company’s capacity to pay interest and meet other debt obligations. Coverage ratio examples include:

- Interest coverage ratio = Operating income / Interest expenses

- Debt service coverage ratio = Operating income / Total debt service

6. Market Value Ratios

This metric is popular among stock investors and traders[8]. It calculates the value of a company’s share of stocks, and its examples include:

- Book value per share ratio = (Shareholder’s equity – Preferred equity) / Total common shares outstanding

- Dividend yield ratio = Dividend per share / Share price

- Earnings per share ratio = Net earnings / Total shares outstanding

- Price-earnings ratio = Share price / Earnings per share

Pros and Cons of a Financial Ratio Analysis

As noted before, a financial ratio analysis is only one tool in an investor’s kit. One must combine it with other data to accurately assess a business.

Here are some of the strengths and weaknesses of financial ratios, regardless of the ratio used.

Pros

The strengths[9] of financial ratio analysis stem mainly from its simplicity. Using simple formulas, a business leader can quickly derive financial metrics from readily available balance sheet data.

Comparability is another merit of this method. Analysts can easily compare specific financial ratios with industry benchmarks. A close inspection of the ratios market can also uncover industry trends.

Cons

Financial ratio benefits can only be derived when the ratios are combined with other metrics and when comparing companies in the same industries[10]. Such a comparison can be a drawback when analyzing companies with multiple lines of business.

A particular financial measurement, such as a working capital ratio, can also be pointless when comparing across an industry with different frameworks in financial reporting. These companies’ transactions, though identical, may have other accounting methods.

Sources

- Ingram, D. (2019.) The Advantages of Financial Ratios. Chron. Retrieved from https://smallbusiness.chron.com/tools-financial-measurement

- Carlson, R. (2020.) What Is Financial Ratio Analysis? The Balance. Retrieved from https://www.thebalancesmb.com/what-is-financial-ratio-analysis

- Cadence Bank. (2022.) What Are Financial Ratios and Why Are They Important? Retrieved from https://cadencebank.com/fresh-insights/commercial/what-are-financial-ratios-and-why-are-they-important

- Elmerraji, J. (2022.) Guide to Financial Ratios. Investopedia. Retrieved from https://www.investopedia.com/articles/stocks/06/ratios

- Bloomenthal, A. (2021.) Ratio Analysis. Investopedia. Retrieved from https://www.investopedia.com/terms/r/ratioanalysis

- CFI Team. (2022.) Liquidity Ratio. Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/liquidity-ratio/

- Black, M. (2022.) Profitability Ratios: Types of Profitability Ratios and Why they Matter. Nav. Retrieved from https://www.nav.com/blog/profitability-ratios-types-of-profitability-ratios/

- Caudle, T. (2008.) Evaluating a Stock. Wall Street Journal. Retrieved from https://www.wsj.com/articles/evaluating-a-stock

- Obaidullah, J. (2019.) Advantages and Limitations of Ratio Analysis. Xplaind. Retrieved from https://xplaind.com/425487/advantages-limitations

- Wilkins, G. (2022.) 6 Basic Financial Ratios and What They Reveal. Investopedia. Retrieved from https://www.investopedia.com/financial-edge/0910/6-basic-financial-ratios-and-what-they-tell-you