What Is a Guarantee?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts: Guarantee

- Guarantees are legal promises that allow a third party to assume responsibility for payment or other obligations if the primary borrower defaults.

- The two main types of guarantees in real estate are payment guarantees and performance guarantees, each with different legal implications.

- Guarantors must meet specific financial qualifications, including credit score requirements, income verification, and asset disclosure.

- Commercial real estate loans often require guarantees, while residential mortgages might need guarantors for borrowers with limited credit history.

- Guarantee agreements must be in writing, contain specific terms, and comply with state-specific requirements to be legally enforceable.

Understanding Guarantees

Guarantees help reduce risk in real estate deals. When someone borrows money to buy property or start a development project, the lender wants to make sure they’ll get their money back. Guarantees give lenders extra protection.

A guarantee adds another person—called the guarantor—to the deal. This person agrees to pay the debt if the main borrower can’t pay. For instance, when a new company wants to build a shopping center, the bank might make the company owner personally guarantee the loan. If the company can’t pay, the bank can collect from the owner’s personal property.

Guarantees, at their most basic form, have existed for nearly as long as human civilization, with the earliest record in 2750 B.C. in Mesopotamia. Today’s guarantee agreements use standard legal forms and rules instead of informal promises.

Guarantees help several groups in real estate:

- Lenders can approve more loans since they have backup payment sources.

- Borrowers can get loans with lower interest rates and better terms.

- Property sellers can find more buyers who qualify for financing.

Note that the specific written document that contains the guarantee is called the “guaranty.”

Guarantor vs. Co-Signing

Many people confuse guaranteeing with co-signing, a related practice.

Simply put, a co-signer must pay from the start along with the borrower. A guarantor only pays if the main borrower stops making payments. This changes when a person must pay and what information they must receive.

Types of Real Estate Guarantees

Real estate guarantees come in several forms, each designed for specific situations and providing different levels of protection.

Payment Guarantees

Payment guarantees secure financial obligations in real estate contracts. When the main borrower fails to make payments, the guarantor must cover those costs. This is the most common form of guarantee, particularly in residential real estate.

These guarantees protect various financial requirements like mortgage payments, rent for commercial spaces, and construction loan payments. The guarantor has no payment duty until the main borrower defaults. Most agreements specify maximum amounts the guarantor must pay or set time limits on their responsibility.

Suppose a new tech company wants to rent office space but has a short business history. The landlord feels uncertain about approving them. The parent corporation that owns this tech company provides a payment guarantee, promising the landlord will receive rent payments regardless of the tech company’s financial situation.

Performance Guarantees

Performance guarantees cover tasks and responsibilities in real estate contracts instead of money payments. These guarantees make sure that construction projects finish properly, properties get maintained correctly, and development projects meet their deadlines.

These guarantees are common in development and construction projects. A developer might provide a performance guarantee that ensures a project will be completed even if construction costs exceed the budget.

Limited vs. Unlimited Guarantees

Guarantees also come in different sizes based on how much the guarantor must pay.

- Limited guarantees set a maximum amount the guarantor must pay. The guarantee might cover just a certain dollar amount or a percentage of what’s owed. For example, the guarantor might only need to pay 25% of whatever loan amount remains after the property gets sold in foreclosure.

- Unlimited guarantees make the guarantor pay everything that’s owed, no matter how large the amount. These are also called full recourse guarantees. They create a much bigger risk for the guarantor because there’s no maximum payment amount. Because of this high risk, unlimited guarantees aren’t used as often in today’s real estate deals.

Specific vs. Continuing Guarantees

Guarantees also differ in how long they last:

- Specific guarantees: A specific guarantee applies to a single transaction or debt and terminates once that specific obligation is fulfilled, such as a one-time payment of $10,000 for a property purchase or a single loan installment. Once the agreed-upon transaction is completed, the guarantor’s liability ends. This type of guarantee does not inherently apply to time-bound contracts involving multiple obligations.

- Continuing guarantees: A continuing guarantee covers a series of transactions or obligations over time and remains active until formally revoked or the contractual relationship ends. In the example above, instead of a one-time property purchase, the guarantor covers monthly rent payments under a one-year lease. Continuing guarantees are designed for ongoing relationships, such as leases or supply agreements, where obligations recur periodically.

Legal Requirements for Real Estate Guarantees

For a guarantee to be legally enforceable in real estate transactions, it must meet several requirements.

Statute of Frauds Compliance

Real estate guarantees must comply with the Statute of Frauds, which requires certain agreements to be in writing to be enforceable.

Key requirements include:

- The guarantee must be evidenced by a written document (which can be a formal contract, email, or PDF, provided it memorializes the guarantee).

- The document must identify all parties involved.

- The document must specify the obligations being guaranteed.

- The guarantor must sign the document; e-signatures are allowed in most jurisdictions.

Verbal guarantees for real estate obligations cannot be enforced in court, making proper documentation essential.

State-Specific Requirements

Guarantee rules change depending on which state the property is located in. Certain states have different rules about:

- What information must be shared with guarantors?

- How long can guarantors change their minds and back out?

- What kinds of guarantees does the state allow?

- When should guarantors talk to their own lawyer before signing?

States treat guarantees quite differently. California makes guarantors use exact wording to give up certain legal rights they would normally have. New York requires guarantee documents to be notarized, depending on the document type.

Before creating a guarantee, it’s important to check the specific rules in your state.

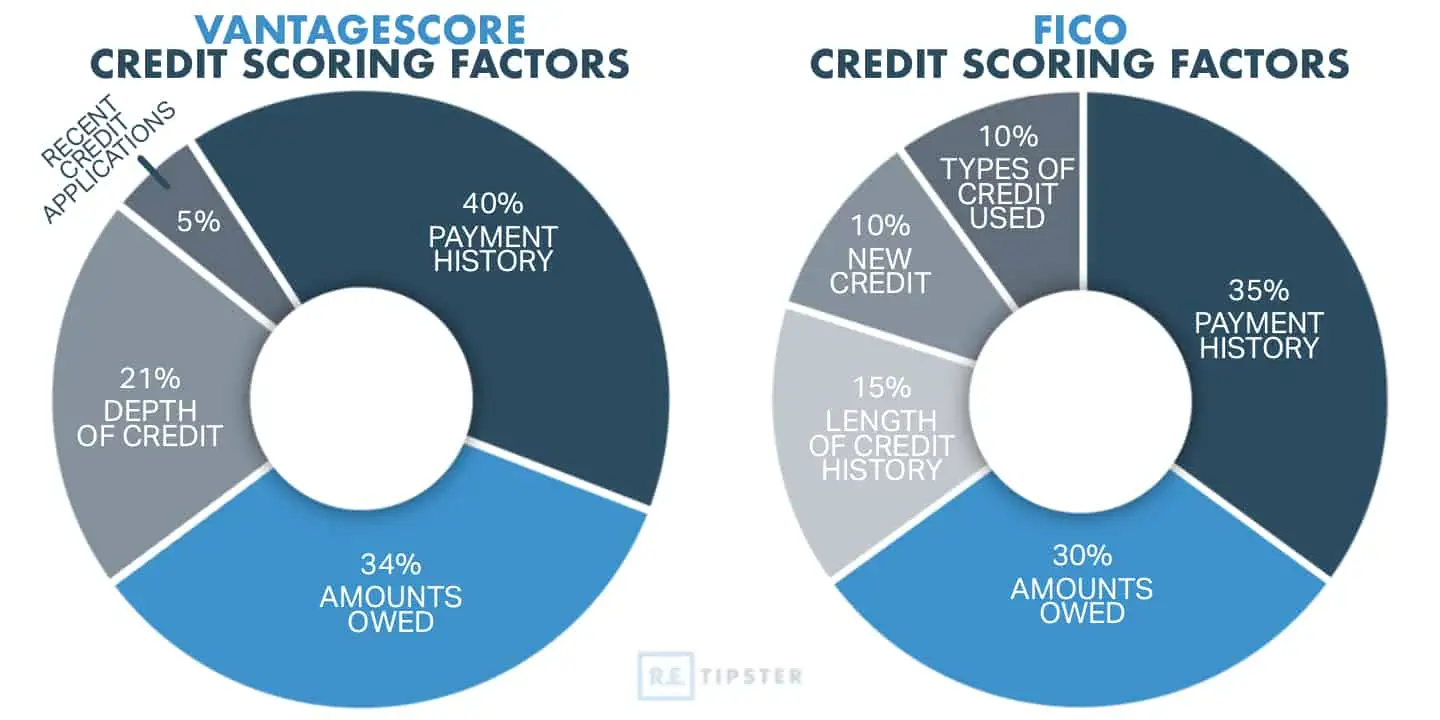

Qualification Requirements for Guarantors

Not everyone can serve as a guarantor for real estate transactions. Lenders and property owners require guarantors to meet specific financial qualifications.

Financial Stability

Guarantors must demonstrate financial stability through:

- Strong credit history with scores typically above 680 (higher than 700 preferred).

- Stable income that exceeds their personal obligations, usually 4-5 times the monthly rent or loan payment.

- Significant assets that could be liquidated if necessary.

- Low debt-to-income ratio, usually below 43%.

A guarantor without sufficient financial resources defeats the purpose of the guarantee, which is to provide additional security beyond what the primary borrower offers.

Relationship to the Primary Borrower

The connection between the guarantor and the main borrower isn’t required by law, but it matters in real-life situations.

For example, family members often become guarantors, with parents frequently guaranteeing loans for their adult children. Meanwhile, business partners commonly guarantee loans for each other when starting or expanding companies.

These close relationships help make guarantees work better. When guarantors have personal or professional connections to borrowers, they want to help the borrower succeed. They might provide advice, connections, or extra support to make sure loan payments happen on time. This personal interest reduces the chance that the lender will need to collect from the guarantor.

Documentation Requirements

Prospective guarantors must provide comprehensive documentation, including:

- Tax returns for the past 2-3 years

- Bank and investment account statements

- Proof of ownership for major assets

- Employment verification

- Personal financial statements

Lenders scrutinize these documents to ensure the guarantor can fulfill the guarantee if necessary.

Guarantees in Residential Real Estate

While less common than in commercial transactions, guarantees play important roles in residential real estate markets.

First-Time Homebuyers

First-time homebuyers who have short credit histories or modest incomes often need guarantors to get mortgage loans. Parents or other relatives usually step in as guarantors for these new buyers.

The guarantee might back the whole mortgage amount or just part of it, depending on what the lender requires. Several government programs for first-time buyers allow partial guarantees to help more people qualify for homes.

RELATED: House Hacking: The Official Guide On How to Live (Almost) Mortgage-Free

Rental Guarantees

Residential landlords frequently ask tenants with a short rental history or lower income to provide guarantors. These rental guarantees protect the landlord throughout the lease period.

The guarantor promises to pay the full rent amount if the tenant can’t pay. They also agree to cover costs for any property damage beyond normal wear and tear. When a lease gets extended, the landlord might ask the guarantor to renew their commitment for the additional time period.

While guarantors may be released if tenants demonstrate financial reliability, this typically requires refinancing the lease or negotiating a new agreement.

Guarantees in Commercial Real Estate

Commercial real estate transactions rely on guarantees to mitigate risks that exceed those in residential transactions.

Common Guarantee Structures

Commercial real estate employs specialized guarantee structures, such as:

- Bad boy guarantees cover specific harmful actions by borrowers, such as fraud, intentional property damage, or bankruptcy filing.

- Burn-down guarantees gradually reduce the guarantor’s liability as specific milestones are met, such as achieving target occupancy rates or loan-to-value ratios.

Special Purpose Entity (SPE) Guarantees

In complex commercial projects, guarantees often come from Special Purpose Entities rather than individuals. These legal entities are created to acquire and finance specific investments while limiting risk for all parties involved.

Frequently Asked Questions: Guarantees

Can a guarantor be released from a real estate guarantee before the underlying obligation ends?

Yes, a guarantor can be released from a real estate guarantee before the underlying obligation ends, but this typically occurs under specific circumstances and requires formal agreement from all parties involved.

The most common scenarios for early release include:

- Loan repayment completion: When the borrower has fulfilled all obligations, including full repayment of the loan.

- Debt transfer: If the loan is refinanced or transferred to another entity.

- Voluntary release by lender: Some lenders may agree to release a guarantor early if alternative security is provided or if the borrower’s financial situation has significantly improved.

- Negotiated release: All parties can agree to a release through a formal modification document.

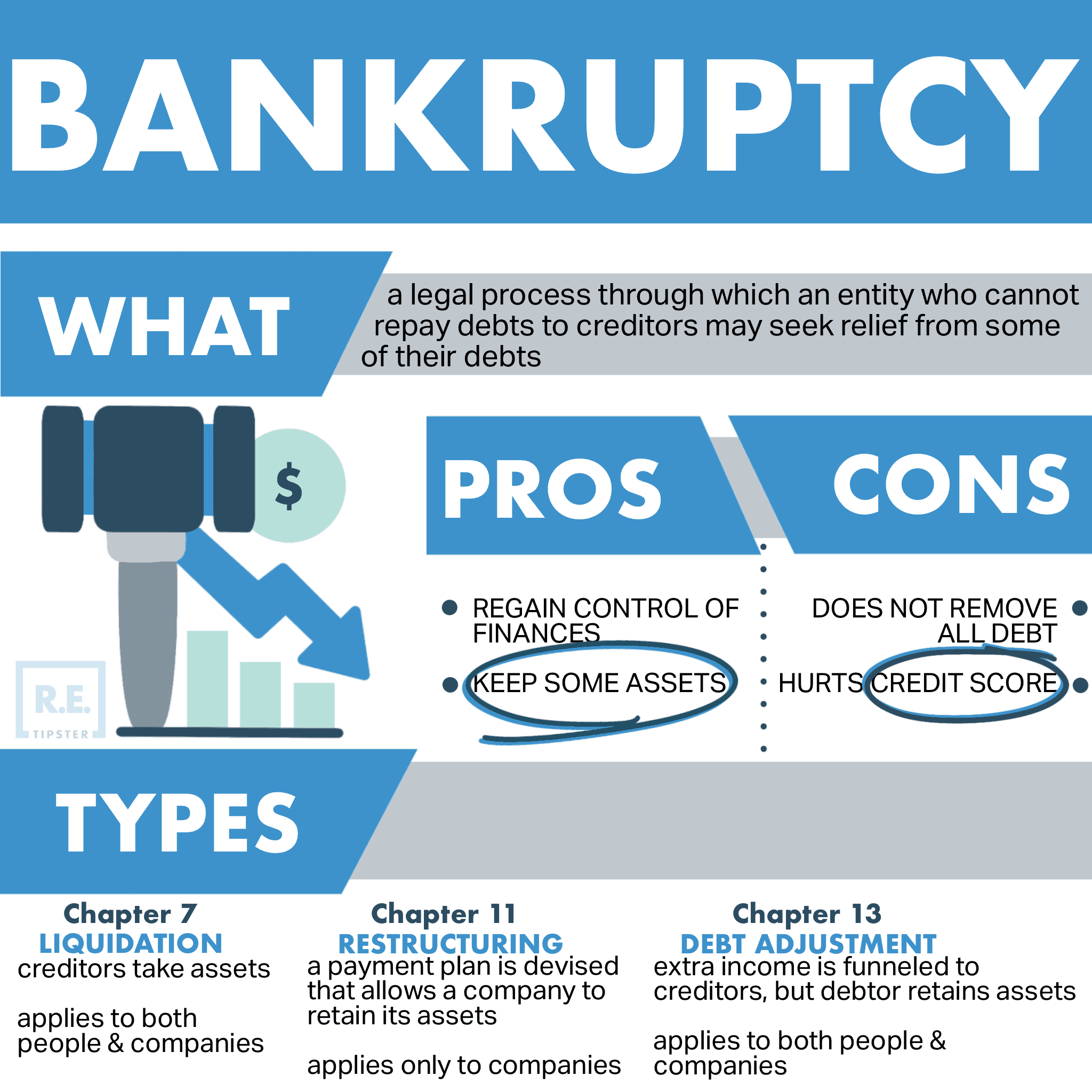

How does bankruptcy affect real estate guarantees?

Bankruptcy creates complex scenarios for real estate guarantees. If the primary borrower files for bankruptcy, the guarantor becomes immediately liable for the guaranteed obligations, as the automatic stay under U.S. Bankruptcy Code (11 U.S.C. § 362) that protects the borrower doesn’t extend to the guarantor. If the guarantor files for bankruptcy, the guarantee obligation becomes part of their bankruptcy estate.

In Chapter 7 bankruptcies, personal guarantees may be discharged unless the creditor successfully objects. In Chapter 11 and 13 reorganizations, the guarantee might be modified or partially discharged. However, bad boy guarantees specifically designed to survive bankruptcy often remain enforceable.

What happens to a guarantee if the guaranteed property is sold or transferred?

When a guaranteed property is sold or transferred, the effect on the guarantee depends on the specific terms of the guarantee agreement and the type of transfer involved.

Most commercial loan guarantees remain in effect regardless of property transfers, binding the original guarantor until the loan is paid or refinanced. For residential properties, some guarantees automatically terminate upon property sale if the underlying loan is paid off.

If the loan transfers with the property (assumption), lenders typically require either that the original guarantee continues or that the new owner provides a replacement guarantor.

The safest approach for guarantors is to obtain a formal written release whenever guaranteed property transfers ownership.

References

- Cornell Law Review, “History and Economics of Suretyship.” https://scholarship.law.cornell.edu/cgi/viewcontent.cgi?article=1251&context=clr

- Writing Explained, “Guarantee vs. Guaranty – What’s the Difference?” https://writingexplained.org/guarantee-vs-guaranty-difference

- Federal Trade Commission, “Cosigning a Loan FAQs.” https://consumer.ftc.gov/articles/cosigning-loan-faqs

- Geraci, “5 Types of Guarantees: A Detailed Guide.” https://geracilawfirm.com/5-types-of-guarantees/

- Cliffe Dekker Hofmeyr, “Performance guarantees in construction contracts.” https://www.cliffedekkerhofmeyr.com/news/podcasts/2024/Construction/performance-guarantees-in-construction-contracts

- Chesser & Barr Attorneys, “E-Signatures and the Statute of Frauds.” https://www.chesserbarr.com/blog/2019/march/e-signatures-and-the-statute-of-frauds/

- California Mortgage Association, “Is Your Personal Guaranty Up to Snuff?” https://www.californiamortgageassociation.org/news-articles/article/personal-guaranty-snuff/

- New York State Bar Association, “The Future Is Here: New York Approves Remote Online Notarization.” https://nysba.org/the-future-is-here-new-york-approves-remote-online-notarization/

- FasterCapital, “What Are The Requirements To Be A Guarantor.” https://fastercapital.com/topics/what-are-the-requirements-to-be-a-guarantor.html

- Checkmyfile, “How much does a guarantor need to earn?” https://www.checkmyfile.com/help-centre/articles/how-much-does-a-guarantor-need-to-earn

- Upstart, “680 Credit Score: What You Need to Know.” https://www.upstart.com/credit-score/680-credit-score

- JD Supra, “A Guaranty for Every Need: An Overview of the Variety of Loan Guaranties-and How to Select the Right One.” https://www.jdsupra.com/legalnews/a-guaranty-for-every-need-an-overview-95939/

- Janover, “Special Purpose Entities in Commercial Real Estate.” https://www.commercialrealestate.loans/commercial-real-estate-glossary/special-purpose-entities/

- Cornell Law School, “11 U.S. Code § 362 – Automatic stay.” https://www.law.cornell.edu/uscode/text/11/362

- The Fealy Law Firm, “Can You Discharge Personal Guarantees in Bankruptcy?” https://www.houston-bankruptcy-attorney.com/blog/can-you-discharge-personal-guarantees-in-bankruptcy

- Reuters, “Guaranties in Commercial Mortgage Loans.” https://www.reuters.com/practical-law-the-journal/transactional/guaranties-commercial-mortgage-loans-2023-01-04/