What Are Hard Assets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Are Hard Assets?

Hard assets are tangible assets, which means assets that can be seen and touched. These assets possess intrinsic value, meaning they have definitive worth regardless of outside financial forces. In other words, these assets retain value even if their market price falls or they are stored and not used to produce goods or services.

Business owners often use hard assets to produce other assets, such as goods and services. Meanwhile, analysts use the presence of hard assets to valuate a business and record them on the business’s balance sheet[1] and other relevant accounting books.

Most hard assets are fixed assets, meaning they are purchased for long-term use (i.e., for more than a year) and cannot be easily liquidated[2]. Real estate is an example. However, some hard assets can be used up within one year; in this case, they are categorized under current assets.

How are Hard Asset Purchases Financed?

Hard asset purchases are often costly, and a typical cash outlay does not always cover the entire cost. These assets usually involve large amounts of capital, and the decision to purchase them is part of a long-term financial plan.

Generally, big-ticket hard asset purchases are financed by banks and venture capital firms or through the issuance of corporate bonds[3]. Public companies may also issue new shares of stock to raise the money needed to finance hard assets.

Examples of Hard Assets

Investors can buy and sell many types of hard assets. Some of the most common include the following.

Real Estate

Investors and businesses looking to acquire hard assets often turn to real estate, particularly commercial real estate. Real estate allows its owner to generate income through a rent/lease agreement or by using the property to produce goods that can be sold for profit. An example of the latter is farmland.

Photo by Sveta Fedarava on Unsplash

Even during economic decline, real estate assets tend to hold their value[4]. Because real estate is finite, the value of a property goes up relative to other asset classes—a phenomenon known as appreciation.

Alternatively, investors can acquire real estate by purchasing shares in real estate investment trusts (REITs)[5] that own or control a diversified mix of properties with professional oversight.

Precious Metals

Gold, silver, platinum, palladium, and rhodium are among the most popular precious metals that can also be classified under hard assets. Most of these metals have some utility in the manufacturing of products. For example, gold is frequently used in creating jewelry, medals, electronics, and equipment used in space exploration, medicine, and dentistry[6].

As hard assets, precious metals are also great stores of value during economic uncertainties. Essentially, this means that they are in demand, easily convertible, and have virtually infinite shelf lives.

Equipment and Machinery

Also known as property, plant, and equipment (PP&E) in accounting[7], these hard assets comprise a company’s fixed assets—lands, buildings, computers, furniture, machinery, vehicles, and so on.

PP&E items are recorded on the balance sheet. For example, purchasing equipment and machinery with long-term expected service life is a signal that the company has faith in its long-term outlook. It can also determine if the company knows how to manage its resources efficiently and effectively.

Oil and Natural Gas

These resources hold much value because they fill a basic need. Individuals and organizations need energy generated by oil and gas resources every day, whether the economy is booming or declining.

Artwork

Original, high-value artwork (such as paintings and sculptures) are tangible assets traded in an industry worth billions of dollars.

While they can be a valuable investment, artworks generally require extensive care as many, particularly older ones, are prone to decay.

Collectibles

Collectibles are physical items considered valuable because they possess historical relevance or rarity. Stamps, rare coins, toys, and sneakers are the most common types of collectible assets that have offered bankable returns[8].

Collectibles are popular with niche communities. As such, they are usually harder to trade outside of those communities.

Classic Cars

Closely related to collectibles, classic cars’ value is generally relative to their rarity. Investors collect these classic cars and allow the investment to grow as the cars become rarer over time.

Pros and Cons of Owning Hard Assets

Owning or investing in hard assets comes with benefits and drawbacks. Knowing these can mean the difference between a good and bad investment.

Advantages

- High demand. Thanks to their unique economic fundamentals, hard assets tend to be in high demand.

- Inflation hedge. One reason hard assets are so popular is that they provide a hedge against inflation. Since they are typically long-term investments, they can ride out economic cycles without eroding value as quickly as other asset classes. Some hard assets also perform well during periods marked by high-interest rates[9].

- Valuable. Hard assets have intrinsic value, can be used to create more value, and can retain some value even when other asset classes go down with market fluctuation.

- Portfolio diversification. For many investors, allocating hard asset commodities can be a great way to earn diversification benefits.

- More stable investment. Hard assets generally enjoy greater stability than intangible assets. This makes them an attractive investment option for investors looking for long-term wealth appreciation.

- Can be used as collateral. Many hard assets can be used as collateral, especially for considerable loan amounts. For instance, real estate can be great collateral to fund new assets.

- Potential for regular income. This is particularly true for real estate properties where investors can earn a steady income from rent and lease payments. Certain types of machinery and equipment may also offer income opportunities[10]. Additionally, investing in some types of fixed assets may provide tax benefits.

Disadvantages

- Expensive. Investing in hard assets often requires substantial capital. After acquiring the assets, there will also be new costs associated with maintaining or replacing them.

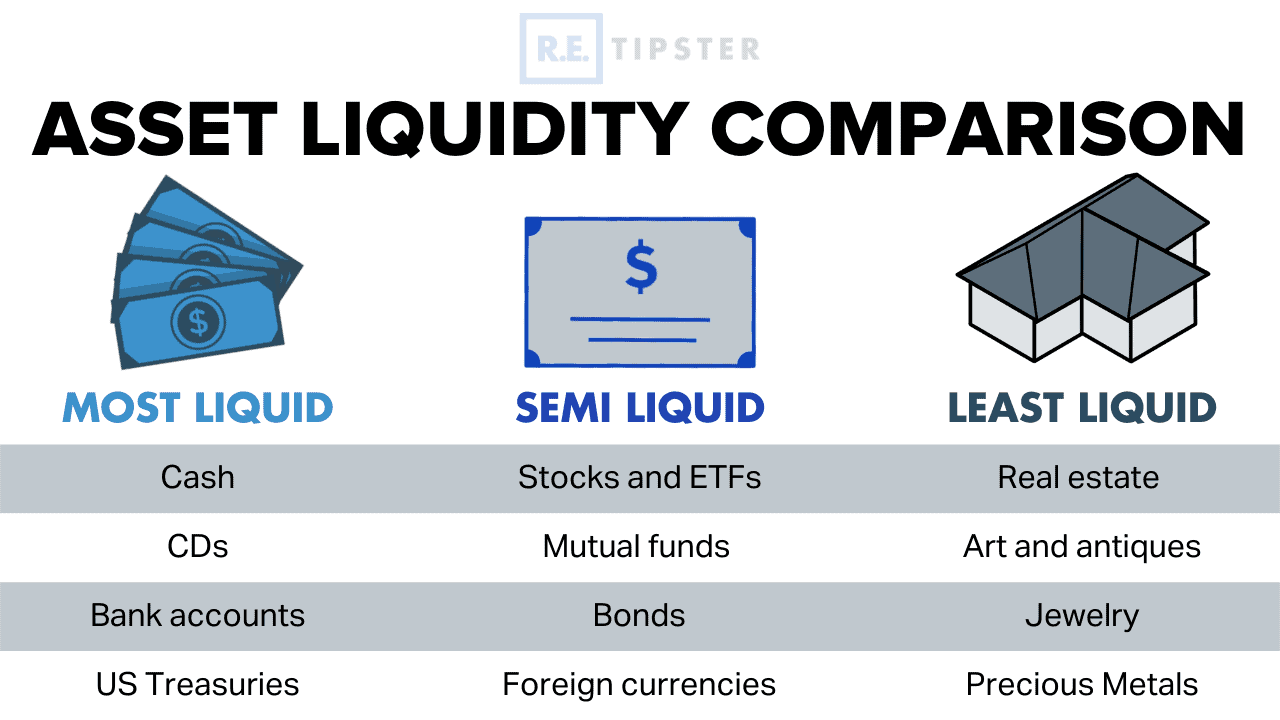

- Not always easy to liquidate. Hard assets may be more difficult to sell in comparison to intangible assets. This makes convertibility to cash and cash equivalents more complex, which can be a huge issue if the owner needs money immediately.

- Relatively slower value appreciation. The markets for hard assets may not experience high volatility since they are relatively stable. However, this also means they are less likely to experience significant value appreciation compared to other assets like stocks. Even if some hard assets appreciate (like real estate), they tend to do so slowly and linearly.

- No global exposure advantage. Hard assets such as real estate and some types of heavy machinery/equipment are siloed in a fixed location.

- Depreciation. PP&E items generally lose their resale value the longer they are used. Selling a depreciated asset means selling it at a loss.

Takeaways

- Hard assets are tangible assets that hold intrinsic value. Business owners typically use hard assets to produce more assets, such as consumer goods and services.

- Hard assets are typically held for the long term.

- Examples of hard assets include real estate, commodities, property, plant, and equipment (PP&E), precious metals, artwork, and collectibles.

- Hard assets typically require large financial outlays and are usually funded by loans, corporate bond issuance, or new stock shares.

Sources

- What Is a Balance Sheet? (2022, October 14). FreshBooks. Retrieved from https://www.freshbooks.com/hub/accounting/balance-sheet

- Fixed asset definition. (2022, May 14). Accounting Tools. Retrieved from https://www.accountingtools.com/articles/fixed-asset

- Investing in collectibles: 5 types of collectibles that have historically offered bankable returns. (2022, October 7). Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/commercial-lending/asset-financing/

- Catmull, J. (2022, August 18). 6 Assets That Will Hold Their Value. GO Banking Rates. Retrieved from https://www.gobankingrates.com/money/financial-planning/assets-that-will-hold-their-value/

- Real Estate Investment Trusts (REITs). (n.d.) U.S. Security and Exchange Commission. Retrieved from https://www.investor.gov/introduction-investing/investing-basics/investment-products/real-estate-investment-trusts-reits

- King, H. (n.d.) The Many Uses of Gold. Geology.com. Retrieved from https://geology.com/minerals/gold/uses-of-gold.shtml

- Murphy, C. (2022, July 10). Property, Plant, and Equipment (PP&E). Investopedia. Retrieved from https://www.investopedia.com/terms/p/ppe.asp

- Rhiannon, A. (2022, July 28). Investing in collectibles: 5 types of collectibles that have historically offered bankable returns. Business Insider. Retrieved from https://www.businessinsider.com/personal-finance/collectible-investments-valuable-types

- Raskulinecz, J, (2022, August 15). How Hard Assets Can Benefit Investors During Inflationary Periods. Retrieved from https://www.forbes.com/sites/forbesfinancecouncil/2022/08/15/how-hard-assets-can-benefit-investors-during-inflationary-periods/?sh=6278be9a144c

- Bushnell, M. (2022, October 21). Equipment Leasing: A Guide for Business Owners. Business News Daily. Retrieved from https://www.businessnewsdaily.com/8083-equipment-leasing-guide.html