What Is Homeowner's Insurance?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Homeowner’s insurance covers financial losses related to owning or living in a home, including damage to the structure and personal property.

- It typically covers damage to the house and personal belongings and may offer liability protection as well.

- Standard exclusions include natural disasters like earthquakes and floods, which need specialized policies.

- While not legally mandatory, mortgage lenders and homeowners associations often require homeowner’s insurance.

- Premiums vary based on location and home features; generally, the riskier the home, the higher the premium.

Homeowner’s Insurance: The Basics

Homeowner’s insurance is a form of property insurance that protects the policyholder against financial losses associated with owning or residing in a home. It covers both the structure of the home itself as well as any personal property located inside or on the premises.

Homeowner’s insurance generally covers:

- Structural damage: Also known as “dwelling coverage” or “Coverage A,” this covers the actual structure of your home, including permanent fixtures like wiring, plumbing, and heating, ventilation, and air conditioning (HVAC) systems. Homeowner’s insurance will pay to repair or rebuild your home if it’s damaged by a covered event, such as a fire or a storm.

- Other structural coverage: This may cover other structures on your property, such as detached garages, sheds, and fences, usually at 10% to 20% of the dwelling coverage[1].

- Personal belongings: This protects most of your belongings inside your home and usually extends to outside items, such as yard fixtures or furniture. Some sub-limits apply for certain types of personal property and high-value items and do not cover automobiles and pets[2]. Insurance jargon for personal property coverage is “Coverage C.”

- Liability protection: Protects against legal costs if someone is injured on your property.

- Additional Living Expenses (ALE): Assists with the costs for temporary living arrangements while your home is under repair.

The roots of insurance trace back to ancient times, yet insuring homes became a focus after the Great Fire of London in 1666[3]. In the United States, the first standardized homeowner’s insurance policy emerged in the 1950s, reflecting the need for comprehensive protection following the substantial property losses from disasters like hurricanes and wildfires.

Types of Homeowner's Insurance Policies

Standardized forms known as HO-1 through HO-8 provide different protection levels. HO-1 is the narrowest and covers only 11 named perils, while HO-8 offers the most coverage.

For instance, HO-3, the most common[4], covers the structure on an open-peril basis and contents against named perils.

An open perils policy covers all losses except those expressly excluded in the policy, while a named perils policy covers only the losses explicitly listed as covered.

Perils Covered by a Homeowner’s Insurance

Many insurance policies name 11 basic perils, while more comprehensive policies cover up to 17[5].

In the list below, 1 to 11 are the basic named perils, and 12 to 17 are additional perils. Some insurance agencies also cover additional perils depending on the property to be insured.

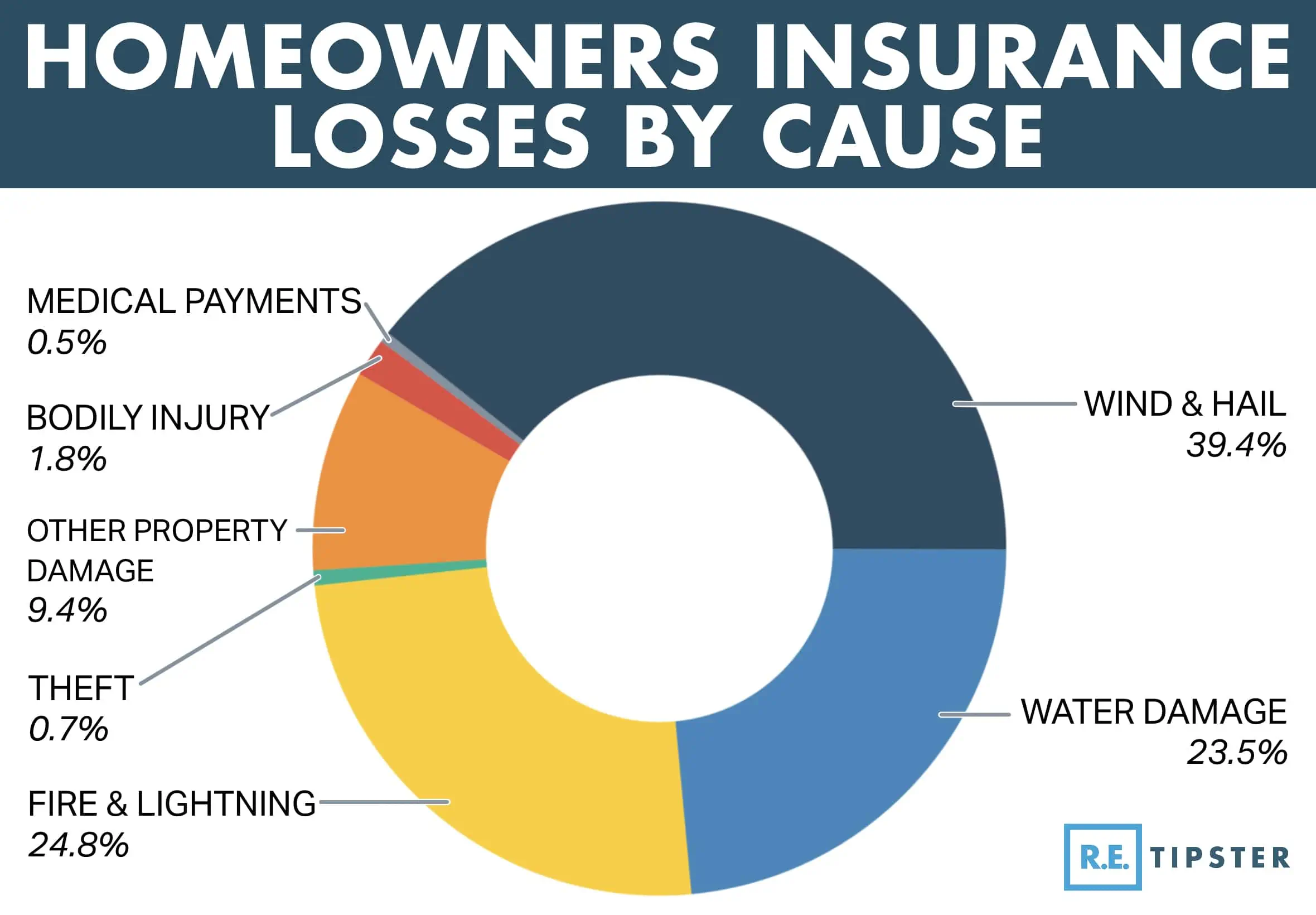

- Fire and lightning

- Hail and wind damage

- Volcanic eruption

- Explosion

- Civil disturbances

- Vandalism

- Theft

- Aircraft

- Vehicles

- Smoke

- Accidental tearing, cracking, burning, or bulging

- Falling objects

- Weight of ice, snow, and sleet

- Water-related damage, such as leakage

- Electrical surges

- Freezing

- Collapse (such as from sinkholes)

Exclusions of a Homeowner’s Insurance Policy

However, standard policies do not cover all risks, such as damages from earthquakes, floods, or general negligence, for which separate policies are required.

Other common exclusions include mold/fungus growth, wear and tear, and claims relating to illegal acts by the policyholder, such as theft or vandalism they take part in. Pre-existing property conditions may also not be covered.

Homeowner’s Insurance Requirements

Having a homeowner’s insurance policy is not legally required[6] in most areas of the United States. However, there are a few significant exceptions:

Mortgage Requirement

Virtually all mortgage lenders today will mandate homeowners insurance be maintained as a condition of the loan. Failure to keep coverage can result in foreclosure proceedings if the property is destroyed and not rebuilt.

HOA or Condo Requirements

If you live in a housing development or condominium with a homeowners association (HOA), their bylaws will likely stipulate homeowner’s insurance for all members. This is because damage to one unit can impact the structural integrity of the other homes nearby.

Flood Insurance

Separate flood insurance is strongly recommended for homes located in high-risk flood zones as designated by FEMA[7]. A homeowner must purchase this catastrophic risk coverage through the National Flood Insurance Program (NFIP).

How Much Are Homeowner's Insurance Premiums?

The cost, or premium, for homeowner’s insurance is determined by assessing the risk of insuring your home.

The premium for homeowner’s insurance varies based on:

- Location: Areas with severe weather or higher crime rates may see higher premiums.

- Home features and characteristics: The home’s age, construction type, and style can influence costs[8].

- Safety features: Installations like smoke detectors and burglar alarms may reduce premiums.

- Deductible: A higher deductible can lower premiums since you’ll pay more out-of-pocket on a claim.

- Creditworthiness: Insurers may also consider a homeowner’s credit history and previous claim history when setting premiums[9].

Note that homeowner’s insurance policies typically have limits. These are the maximum amounts that can be paid off for a covered loss.

How to Choose the Right Homeowner's Insurance

Choosing the appropriate insurance involves:

- Assessment of needs: Evaluate the value of your home and possessions to determine coverage.

- Coverage comparison: Examine different policies to understand what’s covered under each.

- Endorsements: Consider additional coverage for valuables, such as jewelry or antiques.

Understanding policy terms and shopping around for quotes is crucial in selecting the best insurance for your needs.

Risks and Challenges of Choosing a Homeowner’s Insurance Policy

Homeowner’s insurance is integral to a homeowner’s peace of mind, but it also faces evolving challenges.

One significant concern is the impact of climate change[10], which is believed to be leading to more frequent and severe weather events. These changing conditions are not only a risk to homeowners and insurers, who must adjust their risk models and pricing to account for these trends.

Additionally, technological advancements like smart home devices offer new opportunities for risk mitigation, which may be reflected in policy pricing and offerings in the future.

Also, note that filing a claim for a homeowner’s insurance will stay on your record for five years, even up to seven years[11]. If you apply for a new insurance policy, your next insurer may charge you higher premiums if they see multiple insurance claims on your history.

Frequently Asked Questions: Homeowner’s Insurance

How long is a homeowner’s policy good for?

Most homeowner’s insurance policies are written for one year [12], with coverage usually renewed annually. Some insurers may offer longer terms. You can generally cancel coverage any time by sending written notice to your insurer, but they also reserve the right not to renew your policy at annual renewal dates.

What’s the difference between replacement cost and actual cash value in homeowner’s insurance?

Replacement cost is the amount it would take to replace or rebuild your home or repair damages with materials of similar kind and quality without deducting for depreciation. Actual cash value, on the other hand, is the value of the item minus depreciation.

How can I lower my homeowner’s insurance premiums?

You can lower your premiums by increasing your deductible, updating home safety and security systems, maintaining a good credit score, and asking about discounts for bundling policies or being a new homeowner.

Sources

- Pope, C. (2023, August 4.) Homeowners insurance for other structures. Bankrate. Retrieved from https://www.bankrate.com/insurance/homeowners-insurance/other-structures-coverage/

- Sleight, M. (2023, October 9.) What Is Personal Property Insurance? U.S. News. Retrieved from https://www.usnews.com/insurance/homeowners-insurance/what-is-personal-property-insurance

- The History of Home Insurance: What You Might Not Know. (2022.) Schumacher Insurance Agency. Retrieved from https://schins.net/the-history-of-home-insurance-what-you-might-not-know/

- Moon, C. (2023, October 16.) Types of Homeowners Insurance (Policy Forms). ValuePenguin. Retrieved from https://www.valuepenguin.com/types-homeowners-insurance

- Broad causes of loss form. (n.d.) International Risk Management Institute. Retrieved from https://www.irmi.com/term/insurance-definitions/broad-causes-of-loss-form

- Can I own a home without homeowners insurance? (n.d.) Insurance Information Institute. Retrieved from https://www.iii.org/article/can-i-own-home-without-homeowners-insurance

- What is a flood map? (n.d.) FEMA | National Flood Insurance Program. Retrieved from https://www.floodsmart.gov/all-about-flood-maps

- Factors That Affect Homeowners Insurance Premiums. (2020, September 1.) First-Citizens Bank & Trust Company. Retrieved from https://www.firstcitizens.com/personal/insights/home/homeowners-insurance-premiums-factors

- Hayes, M. (2023, January 13.) 10 Factors That Impact the Cost of Homeowners Insurance. Experian. Retrieved from https://www.experian.com/blogs/ask-experian/factors-that-impact-homeowners-insurance-costs/

- Hill, A. (2023, August 17.) Climate Change and U.S. Property Insurance: A Stormy Mix. Council on Foreign Relations. Retrieved from https://www.cfr.org/article/climate-change-and-us-property-insurance-stormy-mix

- Brennan, R. (2023, September 14.) How long do homeowners insurance claims stay on your record? PolicyGenius. Retrieved from https://www.policygenius.com/homeowners-insurance/how-long-does-a-home-insurance-claim-stay-on-your-record/

- Brock, M. (2023, September 29.) What Is Homeowners Insurance And What Does It Cover? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/homeowners-insurance