What Are Liquid Assets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do Liquid Assets Work?

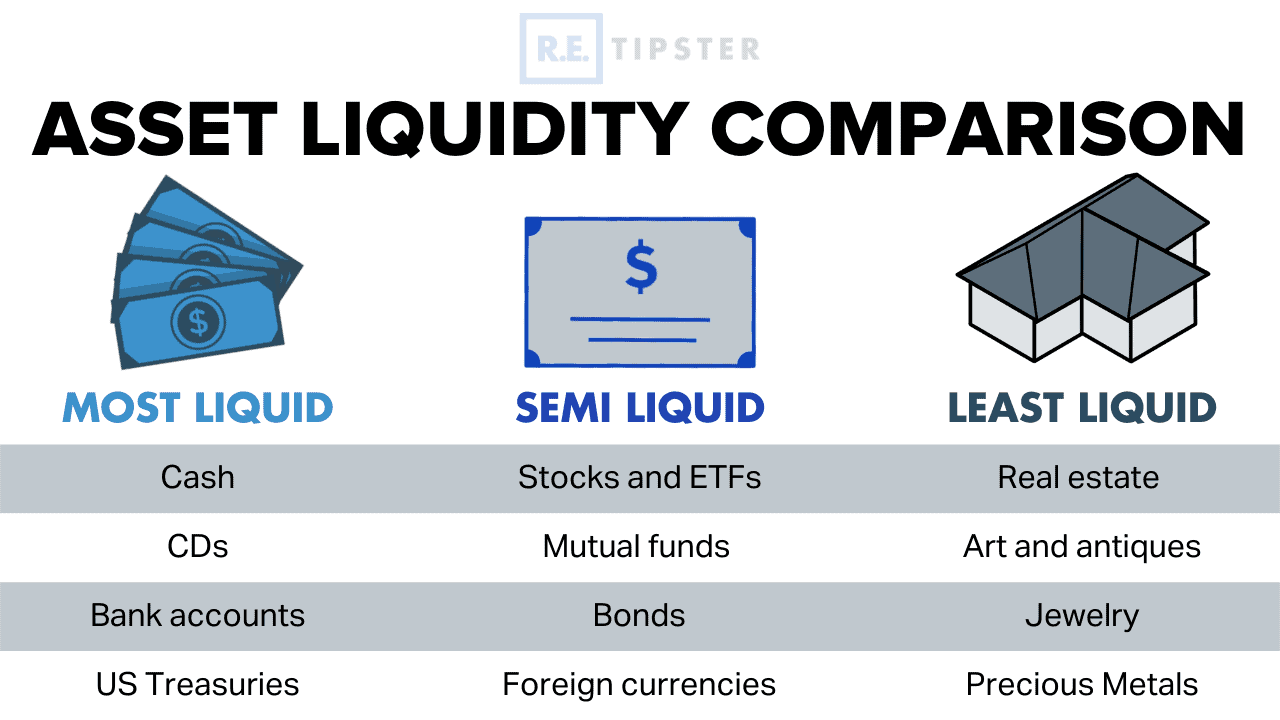

Liquidity refers to how quickly an asset can be converted into cash or how easy it is to sell an investment. It is a key factor for investors[1], as assets with high liquidity allow them to convert their assets into capital for other investments or settle liabilities[2]. Because of this, liquidity is a fundamental component of wealth generation.

Some investors also use liquid assets as a source of funds to deal with financial emergencies. For example, setting up an emergency fund is one way to build liquid assets that can be used to pay for unexpected medical bills, home repairs, and other expenses[3].

A portfolio with a substantial allocation of liquid assets may also help borrowers secure credit or qualify for a mortgage. Some lenders look at the assets people own and how liquid they are to determine if they can cover mortgage payments, especially in times of financial distress. The more liquid assets a borrower has, the less risk they pose to the lender. In turn, the borrower is in a stronger position and can negotiate for better terms[4].

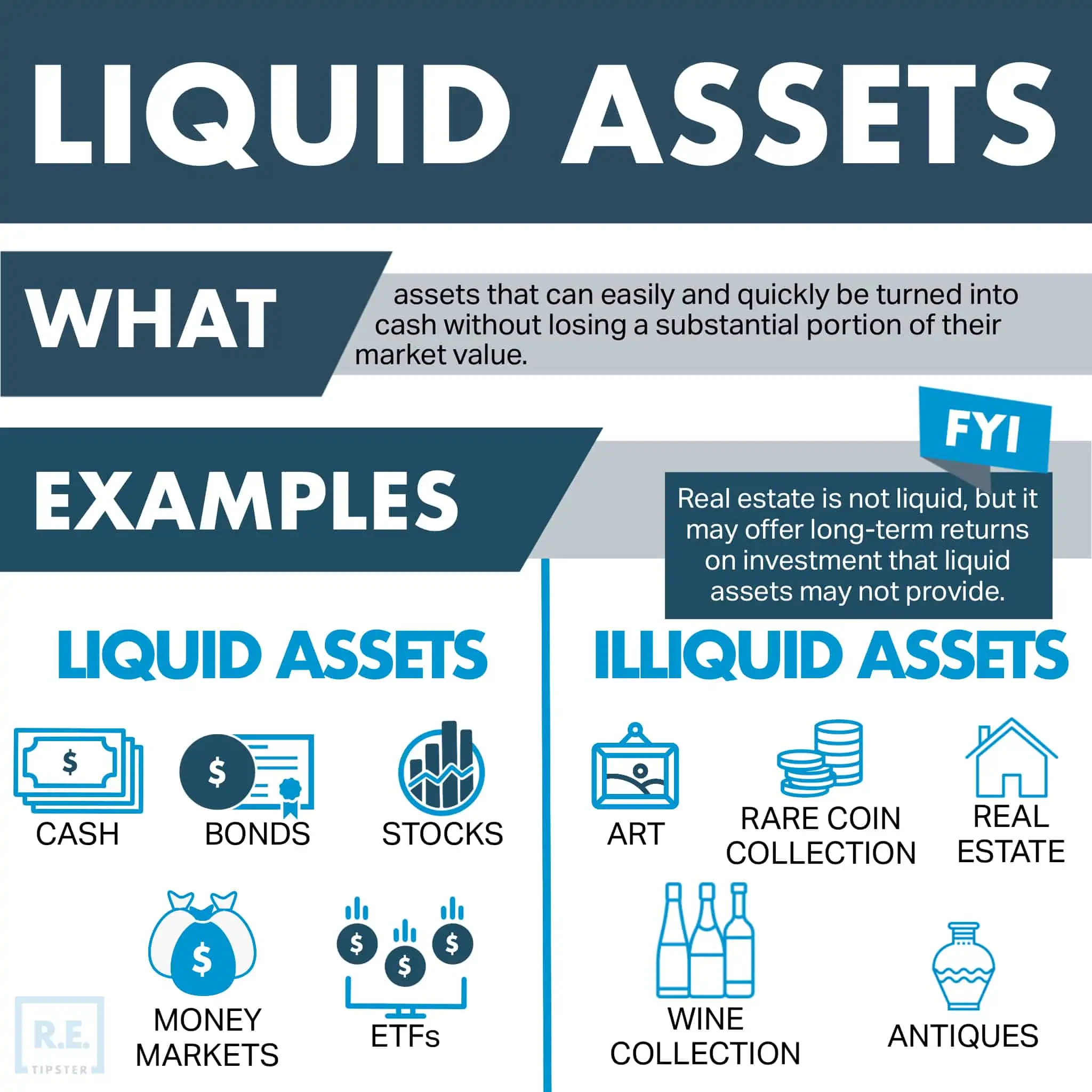

What Are Examples of Liquid Assets?

Here are some of the most common assets and investments considered liquid[5]:

- Cash or cash-like equivalents. Cash is the most liquid asset. It refers to money on hand or those held in checking or savings accounts. Cash-like equivalents refer to assets with short-term maturities that can be converted into cash quickly.

- Money market accounts. Also called money market deposit accounts or MMDAs, these are interest-bearing accounts with features not typically offered in a typical savings account, such as higher interest rates.

- Certificates of deposit. These certificates represent an account with a fixed amount of money with a short- to mid-term maturity, upon which the investor can get back the money plus interest. It typically comes with early withdrawal penalties.

- Stocks. Stocks are shares of public companies people own or are held in their name. Stocks can easily be bought, sold, or traded on public exchanges. One can buy and sell them at any time during market hours. That said, stocks bought on over-the-counter markets are less liquid because they often have fewer buyers[6].

- Bonds. Bonds are low-risk investments that represent a loan made by an investor to a borrower, such as the government or a company. Like stocks, bonds can be sold anytime for cash during market hours.

- Treasury bills and Treasury bonds. Also known as T-bills or T-bonds, respectively, these securities are short-term investments backed by the government with little risk of default. These assets can instantly be sold on the secondary market.

- Mutual funds. These funds consist of money pooled from different investors into a diverse portfolio. These funds can only be traded at market close. Investors can sell their shares and receive their money within days.

- Exchange-traded funds (ETFs). Like mutual funds, an ETF is a portfolio of multiple securities. These funds trade like stocks on public exchanges.

- Accounts receivable. This is money owed to a business by their consumers.

- Money market funds. A money market fund (different from a money market deposit account, mentioned above) is a type of mutual fund that invests in short-term cash or cash equivalents. These types of investments are not suitable for long-term investments.

Note that most investments are liquid to some extent, but some are much more liquid than others.

What Assets Are Not Liquid?

Illiquid assets, also known as non-liquid or fixed assets, are the opposite of liquid assets—meaning they cannot be easily converted into cash or sold quickly at market value[7]. It may take months or years to sell illiquid assets at a reasonable market price.

Here are some of the most common examples of illiquid assets[8]:

- Real estate.

- Vehicles.

- Collectibles like artwork and rare coins.

- Antiques.

- Jewelry.

- Furniture.

- Equipment and machinery.

- Stock options.

- Estates.

- Private equity.

- Intangible assets.

How Liquid Is Real Estate?

Real estate is traditionally illiquid, even though most real estate holds substantial monetary value. Some factors contributing to its illiquidity are that it takes time to sell, transacting is costly and time-consuming[9], and houses especially experience wear and tear. Owners who sell their assets (i.e., properties) within a short period usually do so at lower prices than the market value.

However, real estate may offer long-term returns on investment that liquid assets do not always provide. For example, investors can generate a steady cash flow by owning a rental property[10]. Land also generally appreciates (even though its price may fluctuate because of market forces) because it has a finite supply and there is always a demand for it[11].

Many investors also diversify their portfolios by investing in real estate investment trusts (REITs). REITs are publicly traded companies that own income-producing properties. REITs provide a measure of liquidity for real estate investors because they are bought and sold like shares in the stock market[12].

Takeaways

- Liquid assets can easily and quickly be turned into cash without losing their market value.

- Common examples of liquid assets include cash, cash equivalents, stocks, bonds, and mutual funds.

- Real estate is illiquid, but it may offer long-term returns on investment that liquid assets may not provide, such as appreciation or regular cash flow from rental income. REITs also provide some liquidity on real estate, as they can be traded on a public exchange like stocks.

Sources

- Chen, J. (2022, August 18). What is a liquid asset? Investopedia. Retrieved from https://www.investopedia.com/terms/l/liquidasset.asp

- Becker, S. (2022, July 28). Liquid assets are an important part of a portfolio because they can be quickly converted into cash. Business Insider. Retrieved from https://www.businessinsider.com/personal-finance/liquid-assets

- Kennon, J. (2021, July 30). The Importance of Liquidity and Liquid Assets. The Balance. Retrieved from https://www.thebalance.com/the-importance-of-liquidity-and-liquid-assets-356055

- Crace, M. (2022, August 12). Types Of Assets To Include On Your Mortgage Application. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/types-of-assets

- Araj, V. (2021, October 25). What Are Liquid Assets, And Why Are They Important? QuickenLoans. Retrieved from https://www.quickenloans.com/learn/what-are-liquid-assets-and-why-are-they-important

- Majaski, C. (2022, January 1). Illiquid definition. Investopedia. Retrieved from https://www.investopedia.com/terms/i/illiquid.asp

- Non-liquid asset definition. Bankrate. (n.d.). Retrieved from https://www.bankrate.com/glossary/n/non-liquid-asset/

- Hoisager, C. (2022, July 18). Understanding illiquidity in real estate investing. Realized 1031 Exchange Marketplace. Retrieved from https://www.realized1031.com/blog/understanding-illiquidity-in-real-estate-investing

- Reed, E. (2020, November 4). What Types of Assets Are Illiquid? Smart Asset. Retrieved from https://smartasset.com/investing/illiquid-assets

- Why invest in real estate investment trusts (reits)? Why invest in REITs? | Benefits of REIT Investing | Nareit. (n.d.). Retrieved from https://www.reit.com/investing/why-invest-reits

- Andreevska, D. (2016, September 24). 6 things to know about real estate appreciation. Investment Property Tips | Mashvisor Real Estate Blog. Retrieved from https://www.mashvisor.com/blog/real-estate-appreciation/

- Roberts, C. (2021, February 17). Eight Reasons You Should Consider Real Estate Investing. Forbes. Retrieved from https://www.forbes.com/sites/forbesrealestatecouncil/2021/02/17/eight-reasons-you-should-consider-real-estate-investing/?sh=1c7d4dab5c51