What Is Microeconomics?

Understanding Microeconomics

Instead of taking a magnifying glass into the economy as a whole, microeconomics zooms in on the specific behaviors and decisions of people and organizations[1]. Customers, for one, make plenty of personal decisions every day. Economists call them economic agents, along with companies, households, schools, hospitals, churches, and other institutions.

Microeconomics believes that if the economy is the outcome of everyone’s daily actions, then an ideal place to start analyzing it is with individual decision-making.

Microeconomists attempt to answer questions like “How does a customer decide between having a cup of coffee or tea?” and “How does a homebuyer choose a property to purchase?” or “How does a restaurant decide the price of a meal?” Furthermore, it explores situations such as the way families reach decisions about what to invest in and how much to save. It affects how businesses determine the number of goods to produce and at what price to sell, as well as the level of competitiveness of certain niches and how that influences consumer behavior.

Microeconomists take the decisions of economic agents as their starting point and then use principles like supply and demand to examine how all these tiny parts combine together into a bigger picture of the economy.

Microeconomics vs. Macroeconomics: What Is the Difference?

Microeconomics is often confused with macroeconomics, and for a good reason. Both disciplines deal with the allocation of scarce resources based on demand. But how can one really tell them apart?

RELATED: What Is Macroeconomics?

By definition, microeconomics involves particular markets and segments of the economy. It concerns issues such as consumer behavior, individual labor markets, and the theory of firms. Macroeconomics, on the other hand, examines the entire economy. It studies combined variables, including aggregate demand and inflation[2].

Here is a handy table to differentiate between the two.

| Microeconomics | Macroeconomics |

| Bottom-up approach | Top-down approach |

| Examines decisions made by economic agents (e.g., customers, businesses, etc.) | Examines decisions made by national governments |

| Looks at the demand and supply of labor | Looks at total employment of the economy as a whole |

| Deals with individual and business decisions | Deals with performance and behavior of the general economy |

| Investors pay more attention to microeconomics factors | Investors pay little attention to macroeconomics factors |

Many economic events can be of great interest to both microeconomists and macroeconomists, although they may differ in the way they analyze such circumstances. For example, a change in tax policy can spark interest in both types of economists. A microeconomist may look at how the change can affect supply in a specific market or influence the decision-making of a particular business. Meanwhile, a macroeconomist will likely consider if the tax shift will impact the standard of living for the economy in general.

Key Concepts of Microeconomics

As a high-level branch of economics, microeconomics covers a wide range of topics. These include:

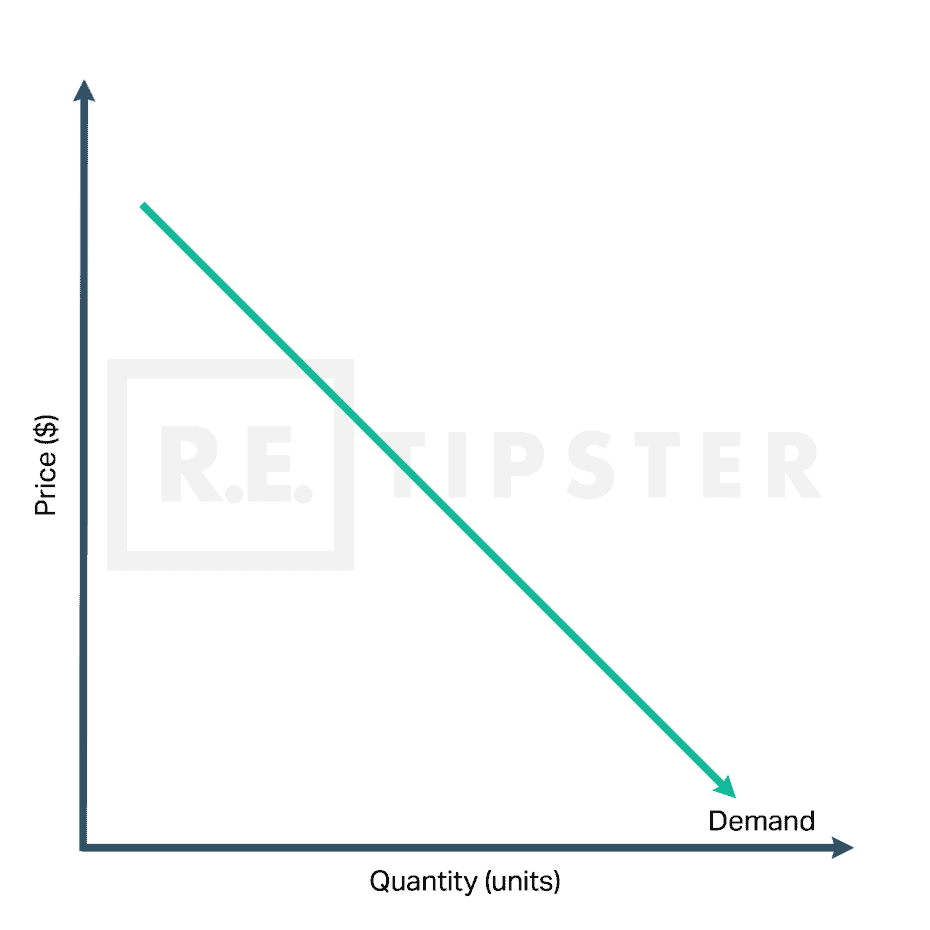

- Demand: It is a concept that determines the price a consumer is willing to pay when purchasing a specific product or service. Assuming that all economic variables remain constant, an increase in the price of products or services will eventually lead to a decrease in the demand and vice versa.

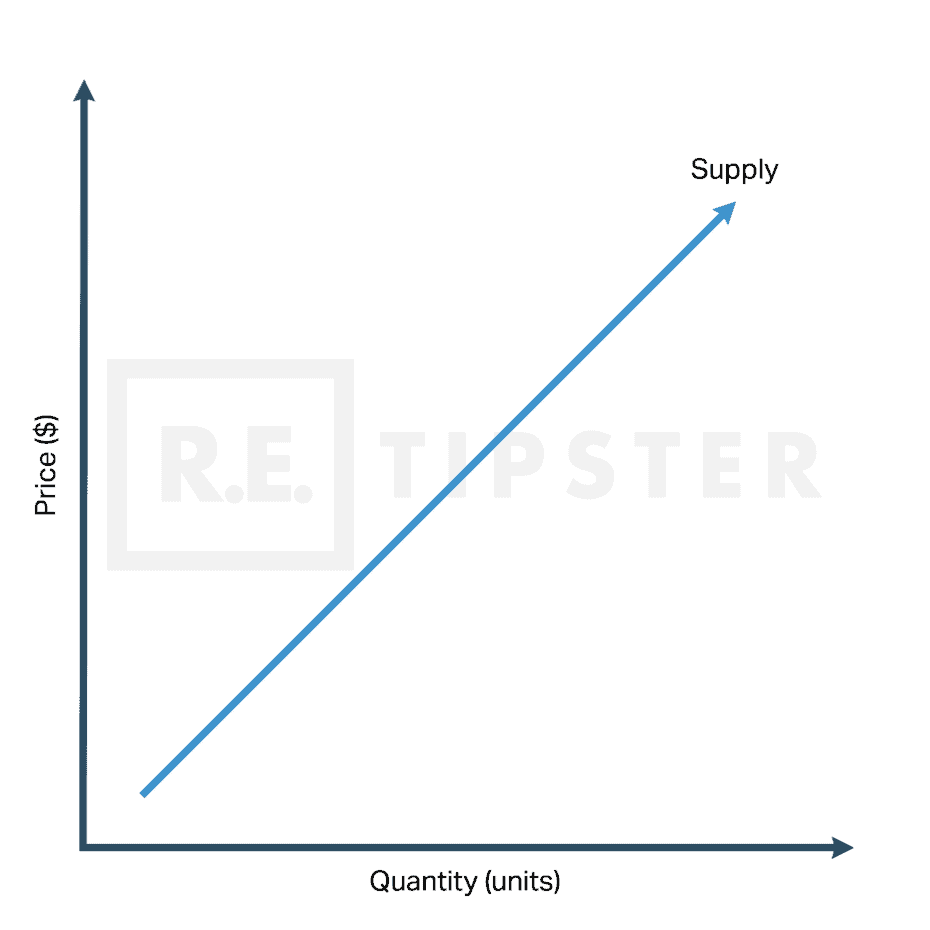

- Supply: Often considered the counterpart of demand, supply is the quantity of products and services available to the consumers. Most of the time, the rise in product prices will increase supply, as every producer will likely want to maximize their profit.

- Elasticity: Economists use this concept to learn how much consumers want a product or service (consumer demand) after an increase or decrease in its price. An elastic product means its demand relies heavily on price changes, while an inelastic product generally has the same demand whether its price goes up or down.

- Opportunity Cost: This concept looks into how individuals and businesses weigh various options[3]. For instance, an investor decides to invest $250,000 in real estate. The opportunity cost is what could have been done with that same amount if it was allocated instead to bonds or mutual funds.

- Production Theory: It dives into the economic process of converting raw materials to finished products. Producers examine the resources they use to produce goods and compare them alongside labor costs and capital to decide how they can augment their profits.

Market Equilibrium: The Law of Supply and Demand

The concept of supply and demand is one of the most essential principles in microeconomics. It tackles how market transactions take place and how prices are determined. To learn more about supply and demand, one should look at consumers and producers.

Consumers

As mentioned earlier, consumers are the economic agents willing to purchase a specific good or service. In most cases, the demand will increase as the price falls and vice versa[4]. This concept is pretty simple: Imagine how many people would buy a house in an upper-class community if they were not that expensive.

Producers

On the other hand, producers are agents that create and sell (or willing to create and sell) a specific good or service. Most of the time, the supply will fall as the price decreases and vice versa. Again, there is a simple reasoning behind this: If prices were to fall beyond the production cost of a shoemaker, for example, the shoe business will not be profitable, and production will be slower.

Supply, Demand and Reaching the Market Equilibrium

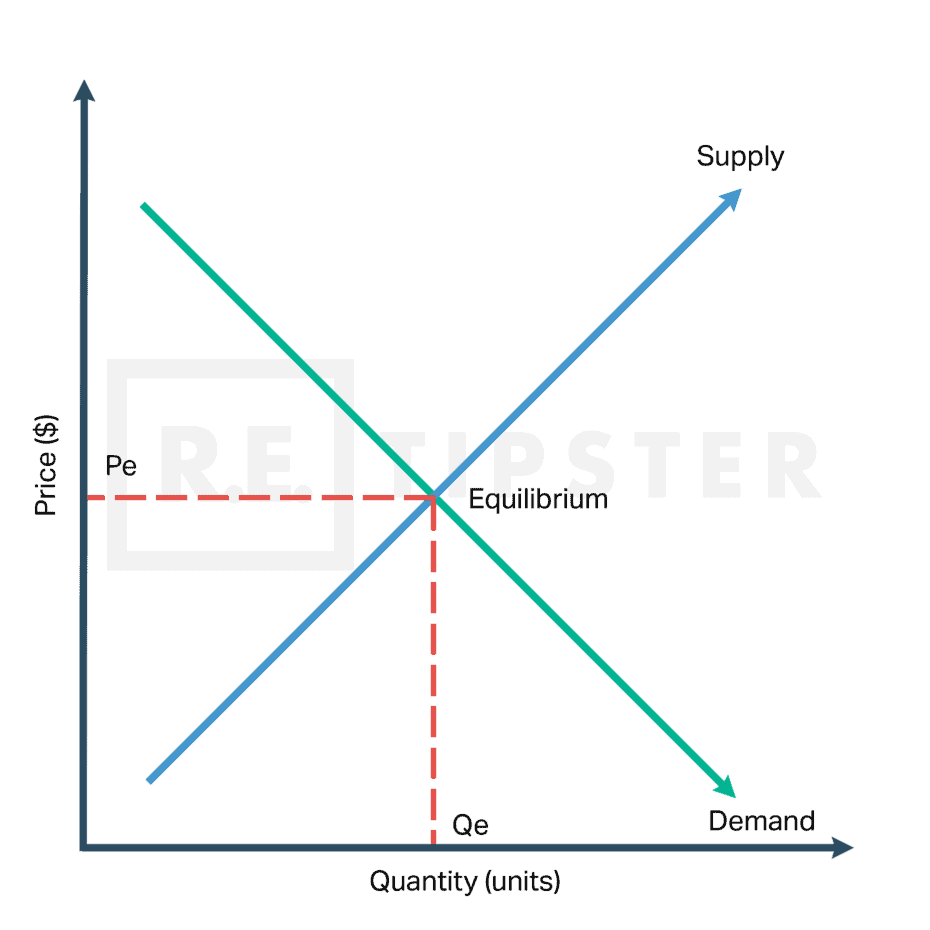

In the graphs below, the x-axis stands for quantity, and the y-axis represents price. Looking back at the behavior of consumers, they are more willing to purchase as the price goes down.

There is a certain quantity demanded for every price, and these quantity-price combinations make up the demand curve. On the side of producers, they are willing to produce less as the price decreases. This results in a mirror image of the demand curve called the “supply curve.”

The point where both demand and supply curves intersect is called the market equilibrium[5]. At this point, consumers are willing to purchase as much of a good or service as the producers are willing to (or able to) sell, resulting in balanced market status.

Forms of Market Competition

To aid microeconomists in understanding the status and needs of a market, they analyze elements based on different types of competition, such as:

- Perfect competition: In this market type, many small companies compete against each other. Because of this, a single business may not gain any significant market power. As such, the industry produces the socially optimal level of output, primarily because no specific business can affect market prices. The best example of an industry with almost perfect competition is the stock market.

- Monopolistic competition: While it also consists of many businesses competing against each other, it differs from perfect competition in such a way that the companies offer similar but slightly differentiated products. As a result, each business has a modest degree of market power, enabling them to charge higher prices within a certain range. An example of this is the market for roofs. There are several different brands that buyers can choose from. Most of them probably offer varying longevity and energy efficiency, but at the end of the day, they are all roofs.

- Oligopoly: It describes a market dominated by only a handful of companies, resulting in a state of limited competition. These big names use their collective power to control market prices and earn more profit. To give an example of an oligopoly, look at the market for smartphones. In the U.S., this specific market is dominated by three big brands: Apple, Samsung, and LG[6]. That leaves all of them with a remarkable amount of market power.

- Monopoly: This refers to a market structure where a single company controls the entire market, mainly because consumers do not have any alternatives. One real-life example of a monopoly is Google. While it has competitors like Microsoft and Yahoo, Google owns the majority of the search engine market, retaining more than 90% of its market share over the years[7]. A monopoly is considered a predatory business practice, and antitrust laws are meant partly to protect consumers against it[8].

Takeaways

Microeconomics deals with specific markets. It dives into the economic interactions of a particular person, a single entity, or an entire company, which are called “economic agents.” Unlike macroeconomics that looks at the structure, behavior, performance, and decision-making of the economy as a whole, microeconomics is concerned with how individuals and firms make decisions based on factors such as supply and demand, elasticity, opportunity cost, and market equilibrium.

Microeconomists look at various forms of market competition to understand the status of the market and the needs of consumers better, which includes oligopolies and monopolies, among others. Each type has its own supply and demand patterns, as dictated by certain elements that influence cost-benefit relationships.

Sources

- Nelson, C. (2006.) Review of the Principles of Microeconomics. Macroeconomics: an Introduction, Internet Edition. Retrieved from http://faculty.washington.edu/cnelson/Chap01Sup.pdf

- Rodrigo, G. (2020.) Micro and Macro: The Economic Divide. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/fandd/basics/bigsmall.htm

- Kennon, J. (2020.) What Is Opportunity Cost? The Balance. Retrieved from https://www.thebalance.com/what-is-opportunity-cost-357200

- Sheth, N. (2021.) Everything You Need to Know About Supply and Demand. iGrad. Retrieved from https://www.igrad.com/start/start-here-supply-and-demand

- Lumen Learning. (n.d.) Reading: Demand, Supply, and Equilibrium in Markets for Goods and Services. Retrieved from https://courses.lumenlearning.com/baycollege-introbusiness/chapter/reading-demand-supply-and-equilibrium-in-markets-for-goods-and-services/

- Counterpoint Research. (2021.) US Smartphone Market Share: By Quarter. Retrieved from https://www.counterpointresearch.com/us-market-smartphone-share/

- Desjardins, J. (2018.) How Google retains more than 90% of market share. Insider Inc. Retrieved from https://www.businessinsider.com/how-google-retains-more-than-90-of-market-share-2018-4

- Federal Trade Commission. (n.d.) The Antitrust Laws. Retrieved from https://www.ftc.gov/tips-advice/competition-guidance/guide-antitrust-laws/antitrust-laws