What is Negative Amortization?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Does Negative Amortization Work?

Amortization is the process of paying down debt by making regularly scheduled principal and interest payments.

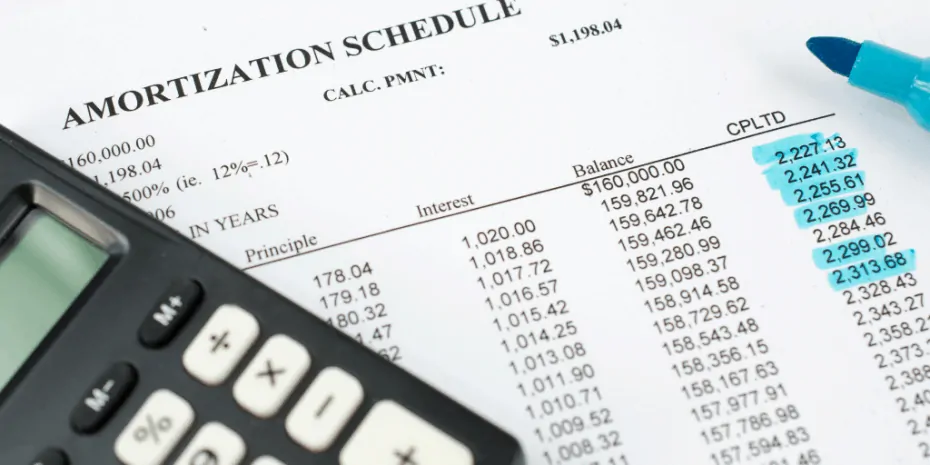

Most loans are amortized—car loans, student loans, personal loans, and mortgage loans. When a borrower signs the promissory note, it is usually accompanied by an amortization schedule showing every payment over the life of the loan and how much is applied to principal and interest[1].

The interest is calculated based on the outstanding principal balance; amortized payments cover the interest first with the remaining amount applied to the principal. If the borrower pays according to the amortization schedule, the amount of interest decreases each month, so the amount of the payment applied to principal increases.

With negative amortization, the lender accepts a smaller loan payment that does not cover the full amount of interest due that month. The unpaid interest is capitalized, i.e., added to the loan balance. In turn, this means the borrower will be charged interest on the unpaid interest the following month.

There are three ways to pay off a negative amortization loan:

- The lender recalculates amortizing payments, which will be higher than the original payment would have been.

- The borrower refinances the outstanding principal.

- The borrower makes a balloon payment at the end of the contract.

Example of Negative Amortization

Imagine a 30-year, fixed-rate $100,000 mortgage loan at 5%. Assume the monthly payment is $500 and the interest due the first month is $450. In an amortized payment, the borrower makes the full payment, paying the interest in full. As a result, the principal balance drops to $99,950.

On the other hand, assume the borrower makes an interest-only payment of $450. This payment does not reduce the principal balance at all, but the interest amount will remain the same the following month.

Finally, in a negative amortization scenario, assume the borrower has a graduated-payment mortgage and only pays $400. The payment goes entirely to interest, leaving a balance of $50. That $50 is added to the principal; the lender, in effect, loans the borrower another $50. The following month, interest is calculated on the new principal of $100,050, increasing it to $455 the second month.

When the borrower makes the second $400 payment, the unpaid interest is now $55, and the principal balance increases to $100,105. This is negative amortization in action, and it can add considerably to finance costs over time.

Potential Uses for Negative Amortization Loans

Negative amortization is an intended feature with some loan products. Payment-option adjustable-rate mortgages (ARMs)[2] and graduated payment mortgages (GPMs) are two examples. These products are attractive to borrowers who want lower monthly payments in the early years of the contract.

The Federal Housing Administration also offers graduated payment mortgages (GPM)[3] to help borrowers who, due to their income, would not otherwise qualify for a loan. By lowering the monthly payment to bring the debt-to-income ratio into underwriting guidelines, the borrower can afford a more expensive home. These are often used by younger first-time homebuyers whose incomes can increase as they progress in their career.

With the FHA’s GPM, the monthly payment is increased 7-10% a year until the full amortized payment is achieved. These loans are not the same as adjustable-rate mortgages; they are fixed rate, but the lender accepts a lower monthly payment for the first few years.

Sometimes, borrowers may buy a home in a rapidly increasing real estate market to sell it in the short term to capture a profit. In this case, a negative amortization ARM might make sense because the expected appreciation would cover the principal balance.

Takeaways

Negative amortization happens when a borrower makes payments that do not cover the interest due on the loan. The lender then capitalizes the interest, adding it to the principal balance. Instead of paying down the loan, negative amortization results in a growing loan balance.

Some mortgage products feature negative amortization to help borrowers lower their monthly payments in the early years of the contract. Eventually, however, the borrower will need to make larger payments, refinance the principal, or make a balloon payment to pay off the loan.

Sources

- Berry-Johnson, J. (2020.) Loan Principal and Interest (How To Pay It Off Quickly). Bench. Retrieved from https://bench.co/blog/operations/loan-principal/

- Kearns, D. (2018.) Adjustable-rate mortgages: Learn the basics of ARMs. Bankrate. Retrieved from https://www.bankrate.com/finance/mortgages/understanding-adjustable-rate-mortgages.aspx

- Siddon, S. (n.d.) How Graduated Payment Mortgages (GPMs) Work. HowStuffWorks. Retrieved from https://home.howstuffworks.com/real-estate/buying-home/graduated-payment-mortgages.htm