What Are Porter's Five Forces?

The Origin of Porter’s Five Forces

Michael E. Porter[1], a Harvard Business School professor, coined the term Porter’s Five Forces in 1979. In his publication titled “How Competitive Forces Shape Strategy,” Porter described the five forces as integral in “helping a company stake out a position in its industry that is less vulnerable to attack[2].”

Porter’s Five Forces recognizes that maintaining a competitive edge is critical to improving profitability in business. This holds true regardless of the industry. According to the model, it is not enough to look only at the actions of their competitors but also to understand the forces shaping the market.

Since the article’s publication, Porter’s Five Forces has become a go-to resource in business strategy and market research[3]. The principles are relevant to this day and can be used to create a roadmap for businesses to compete effectively and maintain profitability in an ever-changing market landscape.

What Are Porter’s Five Forces?

Here is a description of each force as Michael Porter described them.

1. Intensity of Competition

The first of the five market forces refers to the level of competition in the industry. The organization needs to analyze the current landscape and answer the following questions:

- How many competitors do we have? — The larger the number of competitors, the more likely the company will struggle to create profit.

- Who are they? — Organizations must identify other players in the market and have a shortlist of current and potential competitors.

- What is their competitive edge? — This could be in the form of anything from packaging to product, service quality, or even pricing.

In an extremely competitive industry, customers and suppliers might seek out a company’s competition, especially those that may have lowered their price or embarked on a compelling marketing campaign. For them, it’s all about getting a better deal and they will willingly turn to a competitor who can best provide it.

On the other hand, if there is minimal competition in the industry, the company has more market power and can hike its prices to increase profits. Minimal competition also affords the company to focus on other aspects of business growth, including promoting brand identity for improved customer loyalty[4].

2. Supplier Power

This force looks at how much free rein suppliers have in the market. In other words, it addresses how easy it will be for suppliers to increase their prices. In turn, this impacts a company’s bottom line because it means they have to pay more to acquire the same number of supplies that they need to run their business.

After using this analysis, the company should be able to answer the following questions:

- How many current and potential suppliers do they have?

- How scarce and unique are the products or services these suppliers provide?

- How much will it cost to switch from one supplier to another?

Supplier power is determined by how many suppliers exist in that particular industry. The more suppliers there are, the less expensive it is to switch to another. This makes it harder for suppliers to increase prices because companies can easily another offering a better deal.

On the flip side, fewer suppliers in the industry mean a stronger position. In most cases, this is due to the uniqueness of the supplier’s product or service. Because they know their offering is harder to come by (therefore more expensive to switch), the suppliers can arbitrarily increase their prices or introduce more favorable terms for themselves.

3. Buyer Power

In any market structure, buyers want to buy at the lowest possible price[5]. On the other hand, businesses want to sell at the highest possible price. Buyer power examines the ability of consumers to push prices lower relative to seller power.

Analyzing the power of buyers allows companies to answer the following questions better:

- How many buyers do we have?

- How much worth of product or service do they typically order from us?

- How expensive will it be for them to switch to our competitor?

- Is our customer base strong enough to dictate to us their terms?

Fewer buyers and multiple sellers translate to stronger buyer bargaining power. Businesses have to do all they can to hold on to them, even if this means awarding buyers certain concessions, including lowering prices.

Conversely, industries with several buyers and fewer sellers mean weaker buyer power. Customers have little bargaining power because it is harder and generally more expensive to switch to the company’s competitor. In such an industry, the company tends to be more aggressive in its pricing strategy.

4. Threat of Substitutes

This force examines the likelihood and ability of a company’s customers to find substitutes for their products or services.

For example, a company operating software-as-a-service (SaaS) may face the threat of substitutes if their customers decide to outsource the process instead of using their software or choose to do it manually.

The threat of substitutes is measured by how many such substitutes exist in the market. The higher the number, the lower the threat, and vice versa.

In industries with a high threat of substitutes, companies or sellers do not have much power to influence pricing. If they attempt to, their customers will gladly ditch them for the substitute offering.

In the same vein, industries with a lower threat of substitutes mean companies have more power in the market and can review their prices because they know customers have no other choice but to buy from them.

5. Barriers to Entry

This force looks at the ease with which new players can enter the market, i.e., the barriers to entering the market or industry. These include imitators and businesses with new products that could potentially render the company’s products or services obsolete.

Several factors determine the threat of new market entrants. These include the size of the barriers to entry and the level of regulation in the industry.

In industries where the entry barrier for new entrants is low, overall competition will eventually increase, which will affect the profitability of the existing players. More players in the market mean higher cost of raw materials, higher spending on marketing and related overheads, and increased risk of prices going down.

On the other hand, heavily regulated industries and those requiring large capital investments to enter mean that existing companies have a better chance of securing their foothold. There is also more market share to compete for, which gives the companies more wiggle room for expansion.

How Porter’s Five Forces Affect Business Decisions

Porter’s Five Forces help businesses formulate data-driven strategies to thrive in a competitive marketplace. This model allows business leaders to focus on three main areas:

Cost Leadership

Businesses must find ways to make their products or services as affordable as possible without sacrificing quality. Such practices can help make the company profitable by attracting buyers who may be in the market for a better deal.

Product Differentiation

By differentiating their products or services, businesses can carve out their share of the market without competing on price. Apple and Starbucks are examples of companies that have made product differentiation work to their advantage[6].

Buyer-Centric Approach

Companies need to be able to cater directly to buyer needs. But the focus should also be on making the product or service extremely difficult to replicate or substitute.

Takeaways

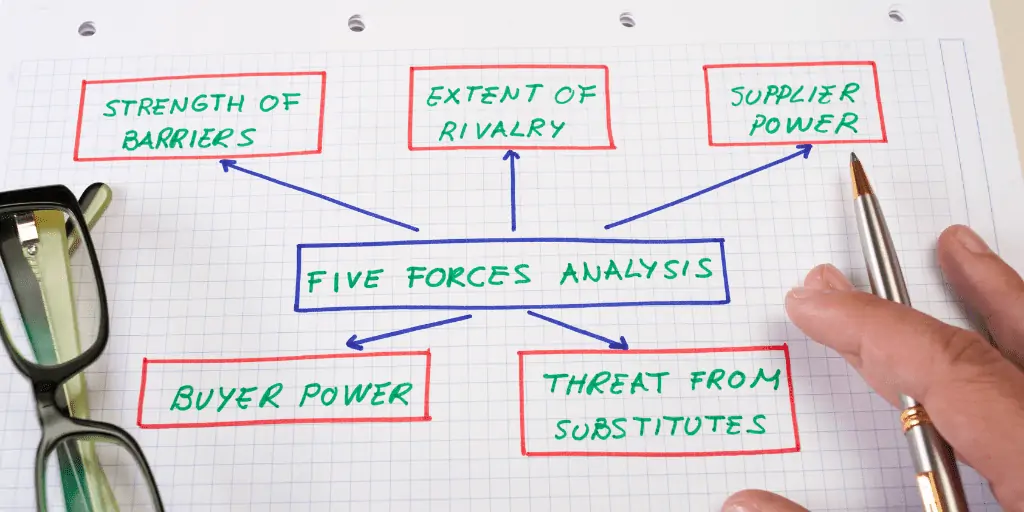

- Porter’s Five Forces is a business analysis model that companies can utilize to compete more effectively and improve profitability. It is a framework for competitive research that uses five fundamental forces to help businesses determine the weaknesses and strengths in their market.

- These forces are competitive rivalry, supplier power, buyer power, the threat of substitutes, and the threat of new market entrants.

- Together, Porter’s Five Forces allow businesses a data-driven way to formulate and rationalize a strategy in a saturated market or industry.

Sources

- Harvard Business School. (n.d.) About Michael Porter. Institute For Strategy & Competitiveness. Retrieved from https://www.isc.hbs.edu/about-michael-porter/Pages/default.aspx

- Porter, M. (1979.) How Competitive Forces Shape Strategy. Harvard Business Review. Retrieved from https://hbr.org/1979/03/how-competitive-forces-shape-strategy

- The Strategy Institute. (2021). Top 5 Strategy Frameworks Every Business Strategist Must Know. Retrieved from https://www.thestrategyinstitute.org/insights/top-5-strategy-frameworks-every-business-strategist-must-know

- Tartaglione, A., Cavacece, Y., et al. (2019) A Systematic Mapping Study on Customer Loyalty and Brand Management. MDPI. Retrieved from https://www.mdpi.com/2076-3387/9/1/8/pdf

- StuDocu. (2020). Markets – Basic Rules of Supply & Demand. Retrieved from https://www.studocu.com/en-us/document/university-of-auckland/understanding-the-global-economy/1-markets-basic-rules-of-supply-demand/6860744

- Predictable Profits. (n.d.) 3 Businesses That Don’t Compete On Price, And You Shouldn’t Either. Retrieved from https://predictableprofits.com/3-businesses-dont-compete-price-shouldnt-either/