What Is Property Tax?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do Property Taxes Work?

Tax laws require property owners to pay taxes on real property they own. In turn, the government uses these taxes to fund various public services and initiatives, such as infrastructure, security, and welfare[1]. Property tax is an essential source of revenue for state governments, as they get most of their funds from property taxes[2]. In states with no income tax, property related taxes become even more important.

Property tax is a type of tax called an ad valorem tax, which means the tax paid is based on the value of an asset.

Property tax rates vary based on location and depend on the assessed value of the land and any buildings on it[3]. In addition, property owners may pay variable amounts of property taxes year by year, subject to tax rate changes or as the value of the property shifts.

Most states bill property taxes annually, but the schedules and due dates may differ by state. Property taxes are sometimes included in mortgage payments or paid in installments. If in doubt, a taxpayer may check the local tax assessor’s office to determine property tax due dates[4] and other requirements.

Real Estate Tax vs. Property Tax

Many people confuse real estate taxes and property taxes. Both terms refer to taxes paid on real property, defined as land and anything built on it[5] (in other words, fixed and immovable property).

However, property taxes can also mean taxes owed on personal property. Personal property refers to tangible, movable assets[6], such as furniture, appliances, vehicles, clothing, jewelry, and anything that is not attached or fixed to the taxpayer’s home. Like real estate tax, state and local governments collect personal property taxes.

For the purposes of this article, “property tax” refers to real estate tax, unless otherwise noted.

BY THE NUMBERS: The average American pays $2,471 in property taxes each year.

Source: Business Insider

How Are Property Taxes Calculated?

Real property tax rates differ both across and within states. Local governments have different ways of assessing the values of properties and determining property tax bases.

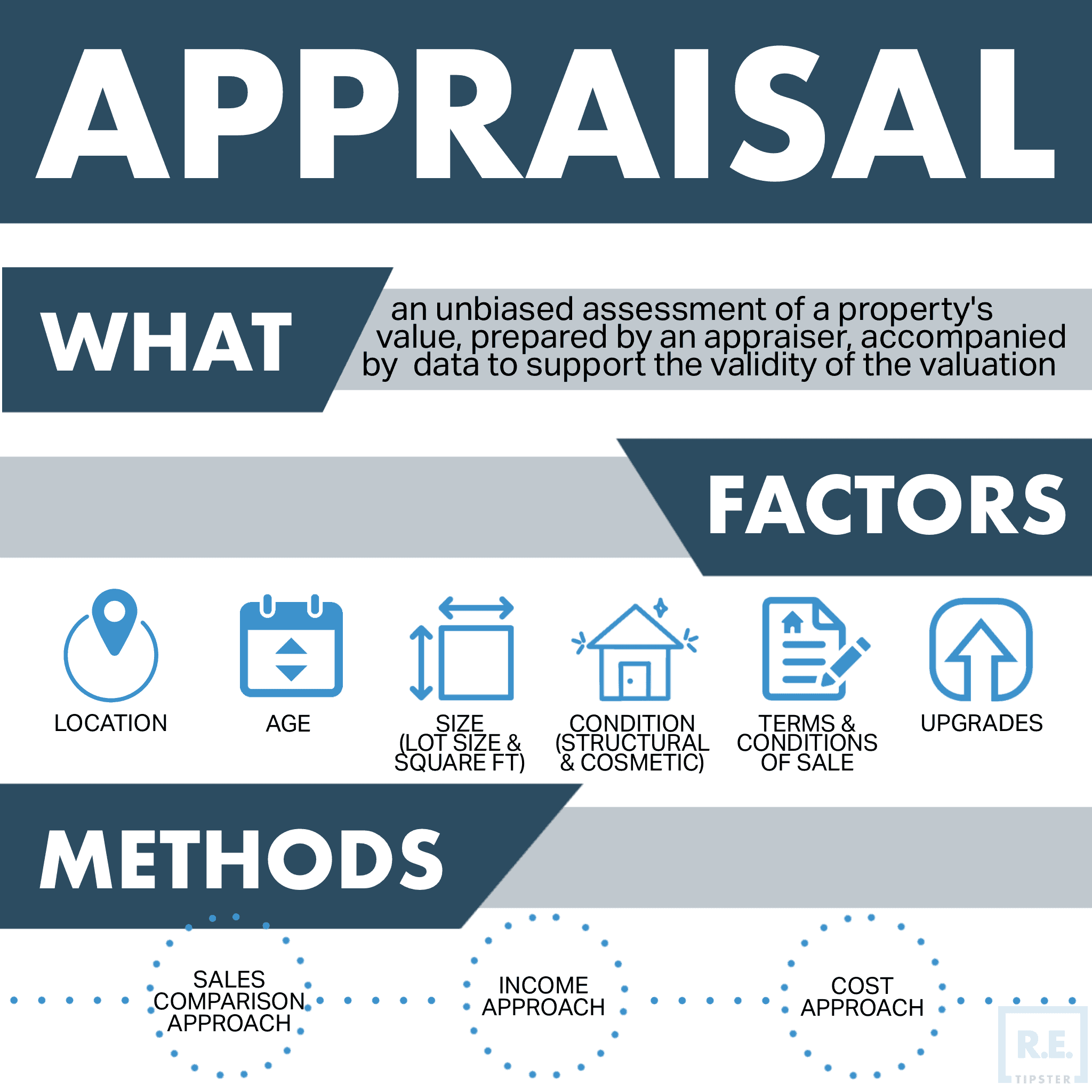

Since property tax is ad valorem, to estimate property taxes, one must first get the assessed value of the asset (real property, in this case). Generally, property appraisals take place once a year, but some areas conduct annual appraisals every three years, while others do them every five[7]. Whatever the frequency of the appraisal, property owners still pay annual property taxes unless a different payment schedule is arranged.

Local governments assess property value by its fair market value or use a percentage of the appraised value.

Finally, determining the local real estate tax rate or mill levy is necessary. This tax rate depends on the property’s location; most of the time, the wealthier the neighborhood, the higher the tax rate. The local tax assessor’s website lists local real estate tax rates[8].

To calculate the property tax rate, one can multiply the assessed value by the mill levy or local real estate tax rate[9].

Property Tax = (assessed value) x (local real estate tax rate)

For example, a property assessed in Los Angeles County, CA, is $450,000, while the average tax rate for that area is 0.72%[10]. Therefore, following the formula above, the property tax for that property is $450,000 x 0.72%, which is 3,340.

The property owner thus pays $3,340 in property taxes every year.

What Are Property Tax Exemptions?

Taxpayers may lower property tax bills if they qualify for property tax exemptions or deductions. These exemptions usually reduce the value of the real property subject to tax. Total property tax exemptions may vary based on the location, current market value, and circumstances the owner qualifies for.

Here are some of the most common property tax exemptions[11]:

- Homestead exemption. This is a discount given to a person who owns a single-family residence and has been using it as a primary residence for a long time. It reduces the total amount of property value subject to tax. How homestead exemptions are offered differs from state to state.

- Senior citizen exemption. This tax exemption helps older adults lower their annual property tax bill through discounted real estate taxes. Generally, the minimum age requirement for this exemption is 61 to 65.

- Exemptions for veterans and their surviving spouses. In some states, this property tax exemption is only available to disabled veterans, while in others, it is available to all qualified veterans. In some cases, disabled veterans can write off all of their local real estate taxes with this exemption.

- Exemptions for people with disabilities. Each local government has different rules and exemptions based on the extent of the homeowner’s disability. Some areas exempt people with disabilities from paying taxes on parcels up to 160 acres in size.

- Religious exemptions. Some religious organizations and charitable institutions may be exempt from paying real estate taxes.

Takeaways

- Property tax is tax levied on property, paid to the municipal government or state authority that has jurisdiction over the property.

- It is an ad valorem tax, which is based on an asset’s assessed value (in this case, real property).

- Property tax can refer to both real property and personal property.

- In cases where some confusion is liable, tax experts use “real estate tax” instead.

- Property tax rates vary from location to location, and not just by state; some locations, even in the same county, may vary in terms of property tax rates.

Sources

- Ziraldo, K. (2022.) Property Taxes: What They Are And How To Calculate Them. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/property-tax

- State & Local Revenue. (n.d.) National Association of State Retirement Administrators. Retrieved from https://www.nasra.org/revenue

- Cammenga, J. (2021.) How High Are Property Taxes in Your State? Tax Foundation. Retrieved from https://taxfoundation.org/high-state-property-taxes-2021/

- Folger, J. (2021.) How to Pay Your Property Tax Bill. Investopedia. Retrieved from https://www.investopedia.com/how-to-pay-your-property-tax-bill-4783420

- SmartAsset. (n.d.) California Property Tax Calculator. Retrieved from https://smartasset.com/taxes/california-property-tax-calculator

- Araj, V. (2022.) Real Estate Taxes Vs. Property Taxes. Quicken Loans. Retrieved from https://www.quickenloans.com/learn/real-estate-taxes-vs-property-taxes

- Williams, T. (2021.) How To Find the Assessed Value of Real Estate. The Balance. Retrieved from https://www.thebalance.com/how-to-find-the-assessed-value-of-real-estate-5208497

- McCamy, L. (2021.) Knowing how to calculate property tax is crucial when owning or buying a home. Here’s how you do it. Insider Inc. Retrieved from https://www.businessinsider.com/personal-finance/calculate-property-tax

- Wiebe, J. (2022.) How To Calculate Property Tax: What Homeowners Should Know About How to Estimate Property Taxes. Realtor.com. Retrieved from https://www.realtor.com/advice/finance/how-to-calculate-property-taxes/

- Bankrate. (n.d.) Personal Property Taxes. Retrieved from https://www.bankrate.com/glossary/p/personal-property-taxes/

- HouseLogic.com. (n.d.) Property Tax Exemptions: Do You Qualify? Retrieved from https://www.houselogic.com/finances-taxes/taxes/property-tax-exemptions/