What is the Quick Ratio?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

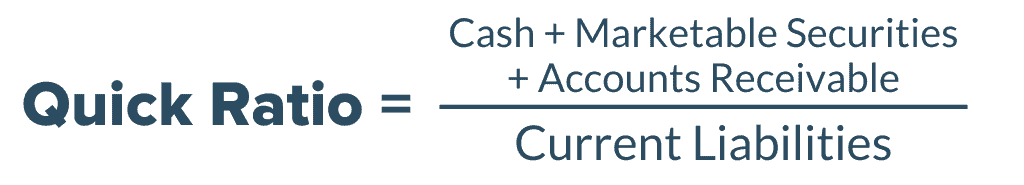

How to Calculate the Quick Ratio

The quick ratio formula looks like this:

The quick ratio examines liquidity in the very short term, typically 90 days. For this reason, financial experts occasionally disagree about the role of inventory and accounts receivable in the quick ratio calculation.

Inventory is an issue because many businesses would have a hard time liquidating their inventory within 90 days without heavily discounting it. In other words, experts argue that inventory cannot be converted to cash in the short term, at least not at full value.

The argument surrounding accounts receivable revolves around payment terms. In businesses where payment is due in advance, due on receipt, or due within 30-days, accounts receivable is often included in quick ratio calculations. On the other hand, in businesses that extend payment terms of 90 days or more, including accounts receivable in the quick ratio is more controversial.

Technically, to keep the quick ratio calculation precise, only amounts that would be received within 90 days at full value should be included. For this reason, it’s important to look at cash equivalents and interest-bearing securities to make sure there are no penalties for early liquidation.

What's a "Good" Quick Ratio?

A quick ratio of 1 is considered healthy. It means that the business has just enough liquidity to instantly pay off its current liabilities. A quick ratio below 1 suggests that the business doesn’t have enough cash to cover both operations and short-term liabilities. A quick ratio above 1 indicates the business could instantly pay off current liabilities and have cash left over for operations.

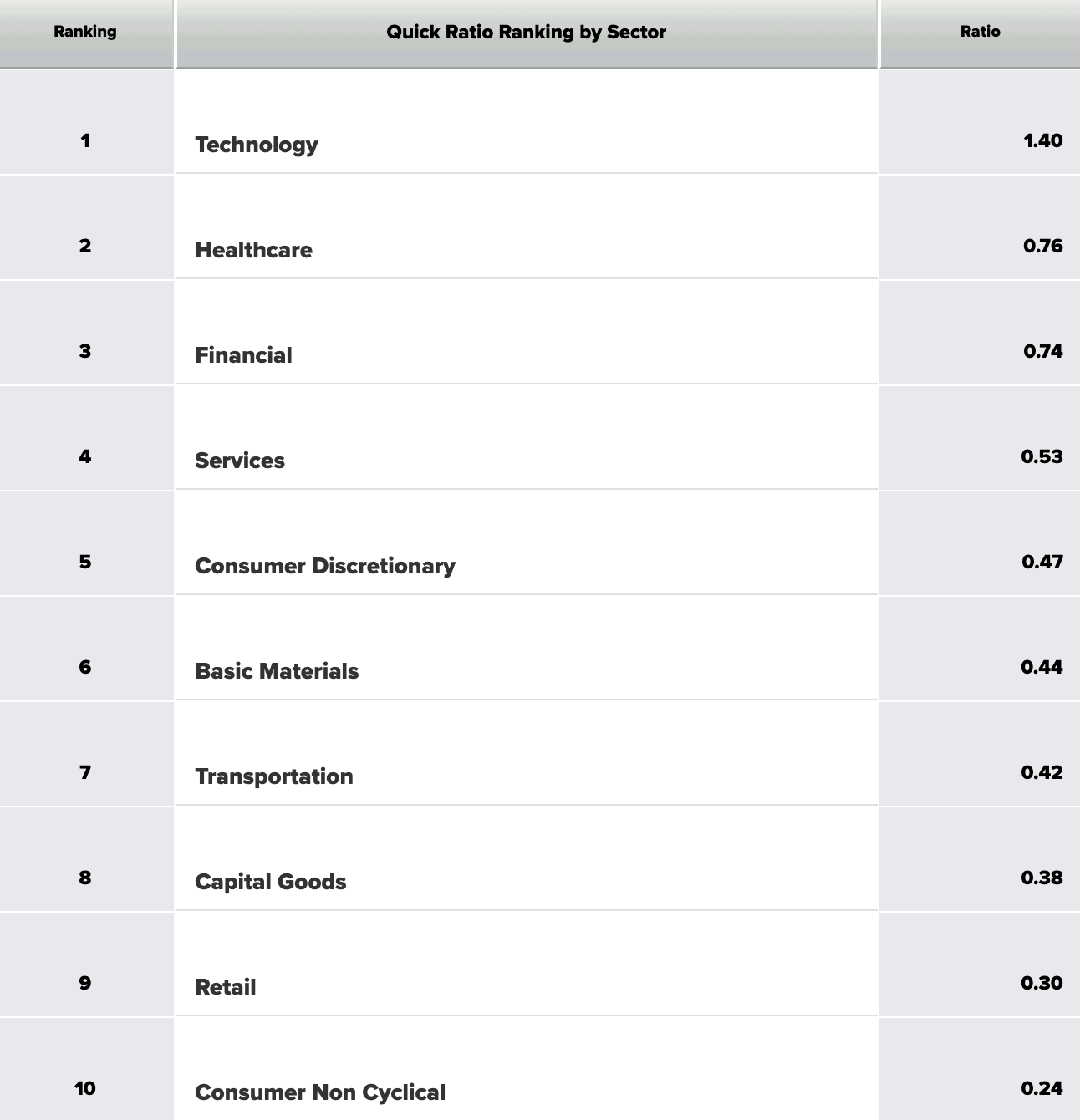

Quick Ratio Benchmarks

It’s important to recognize that some industries by nature are less liquid; and a low quick ratio isn’t necessarily a sign of poor financial health.

Many online resources maintain industry quick ratio benchmarks. The following list of industry benchmarks was taken from CSIMarket.com:

According to CSIMarket, the real estate operations industry had a quick ratio average of 0.96 in 2020, although it hovered around 0.20 for most of 2019.

Quick Ratio vs. Current Ratio

The current ratio is simply the ratio of current assets to current liabilities, with “current” defined as within one year from the date of calculation. In other words, assets that will be realized or converted to cash within one year are included in the current ratio calculations as opposed to the 90-day limit for current assets in the quick ratio.

Most analysts consider the quick ratio to be a more conservative metric because, unlike the current ratio, it removes assets such as inventory and other non-liquid assets. It focuses on short-term liquidity. When the current ratio is much higher than the quick ratio, it may suggest that inventory makes up a high share of the company’s current assets.

A quick ratio of 1 is considered “healthy,” but as the benchmarks above demonstrate, that’s not always the case for all industries. Walmart, generally considered to be a blue-chip stock, had a quick ratio of 0.18 in the 4th quarter of 2019. The retail sector as a whole has a low quick ratio, so other metrics such as inventory turnover may be more meaningful.

On the other hand, some sectors typically have higher quick ratios. Many financial services and technology businesses operate with a quick ratio of 7 or higher because of their massive cash flow. While this may be normal in some sectors, a quick ratio above 2 isn’t always a positive sign because it indicates the business is hoarding cash that could be put to productive use or returned to shareholders.