What Is a Recession?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Happens During a Recession?

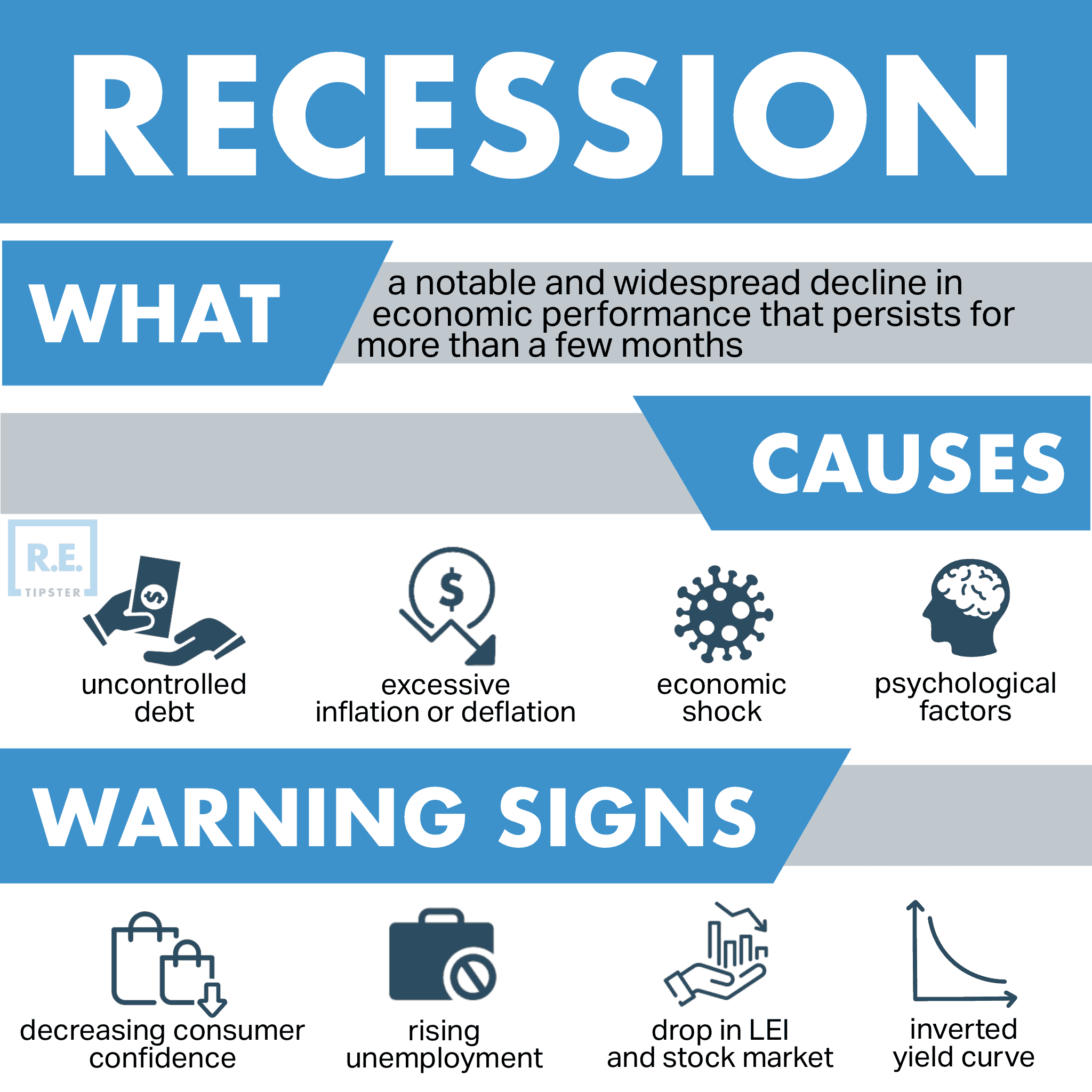

The National Bureau of Economic Research (NBER), a private, non-profit organization that determines the start and end dates of U.S. recessions, offers a more flexible way to define recession-—“a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales[1].”

During a recession, business owners often face a decline in their sales, which could lead to layoffs and even a declaration of bankruptcy. As businesses struggle and fail, employers are forced to cut costs and lay off their employees, which leads to a rise in unemployment. Although some employees may be able to keep their jobs, they may have to deal with wage and benefit cuts, and negotiating salary increases may be a struggle. These circumstances may affect an individual’s ability to pay bills and settle debt, such as mortgage loans.

Recession and the Real Estate Market

The real estate industry typically suffers from a drop in property values during a recession, because when houses are listed for sale, they tend to stay on the market for a longer period of time before they sell.

When a recession causes rising unemployment and stagnant household incomes, banks and lending institutions become more cautious and restrictive in the amounts of financing and loan approval standards. They may tighten their lending rules and criteria by requiring higher minimum credit scores or a larger down payment. Additionally, paying off mortgages during a recession becomes even more challenging, which is why short sales and foreclosures usually increase during this time.

Although these scenarios are generally bad news for real estate professionals and the industry, they can also create opportunities for buyers. Recessions tend to make the market less competitive since there are fewer investors and homebuyers who have the means to purchase real estate during an economic downturn. This means potential buyers will have time to look at other properties and will not be pressured to immediately pounce on their desired property for fear it will be off the market before they can submit an offer.

With fewer buyers in the market, a seller may be willing to accept offers below their asking price or take the initiative to lower their selling price to make their properties more appealing. Along with falling house prices[2], buyers can also take advantage of lower interest rates. During a recession, the Federal Reserve will often lower the benchmark interest rates to encourage investments. Banks will, in turn, charge reduced interests on loans, including mortgages.

Recession vs. Depression

Many economists agree that an economic depression and an economic recession have similar causes. However, a depression results in a much more devastating economic impact than a recession[3]. Depressions cause far greater job losses and sharper GDP declines. It also lasts much longer than a recession; for example, the Great Depression of the 1930s lasted 10 years. More often than not, the amount of time it takes for an economy to recover is a major differentiator between a recession from a depression.

Common Causes of Economic Recessions

Identifying the specific circumstances leading up to a period of recession is rarely black-and-white. Many factors may contribute to a cascade of business failures that will inevitably result in an economic downturn.

Some common causes are as follows:

- Uncontrolled debt. When businesses or individuals, in the public or private sector, take on excessive loans, the cost of servicing the debt can balloon to the point where the borrowers are unable to pay back their lenders. A big enough debt default can lead to a business declaring bankruptcy. Enough defaulting borrowers can lead to a bank failure. Unhealthy lending institutions can lead to a tight money market, which can lead to sluggish economic growth, which can eventually snowball into a recession. And when a recession happens, borrowing money and paying off debt becomes even much more difficult[4], which leads to a downward spiral.

- Excessive inflation or deflation. Inflation is when the prices of goods and services rise for a period, while deflation happens when there is a sustained fall of those prices. Although these conditions are not bad by themselves, excessive inflation or deflation is dangerous and can potentially force an economy into recession. This is why central banks, such as the Federal Reserve, constantly monitor price changes. When inflation gets out of hand, central banks may raise interest rates. As interest rates rise, economic activities fall. On the other hand, central banks fight off excessive deflation by lowering bank reserve limits or target interest rates on short-term funds.

- Economic shock. Another potential driver that can cause an economy to fall into a period of recession is when an economic shock occurs. An economic shock is any significant change to economic variables or relationships that impacts a country’s economic performance. A recent example of this phenomenon is the COVID-19 pandemic—which stalled economies of most, if not all, countries around the world. Many countries had to declare lockdown protocols that harmed labor productivity and growth rate, disrupting supply and demand chains in the world’s interconnected economy, leading to a 4.3% contraction of the global GDP in 2020[5].

- Psychological factors. Economists also often cite psychological factors as contributory to an economy’s downfall. Investors can be too optimistic when the economy is strong. Their irrational and unrestrained exuberance can cause stock or real estate markets to inflate up to the extent it has to “pop” and many engage in panic selling, which can cause the markets to crash and lead to a recession.

How to Predict an Economic Recession

It is difficult to know when and how a recession will happen. Apart from the two uninterrupted quarters of GDP decline, economists have to account for other factors to forecast if there is an impending recession or there is already one in place.

That said, the following are some usual indicators of potential trouble brewing in the economy:

- Inverted yield curve. Yield refers to the interest rates on bonds or treasuries. These treasuries have varying duration or maturity—some may last a few months, while others last for years. The yield curve is a graphical representation of the interest rates on similar bonds across different maturities. A normal yield curve has an upward slope, indicating that short-term interest rates are lower than long-term rates. However, when the yield curve becomes inverted (showing a downward slope), this reflects that short-term interest rates are higher than long-term ones. This is a rare scenario that is considered a predictor of impending economic recession in one to two years[6].

- Waning consumer confidence index. Consumer spending is a main driver of the economy. A person’s spending activities are directly related to how confident they feel about their income’s stability and the overall state of the economy. When surveys show declining consumer confidence, this may result in less spending that will slow down the economy.

- Significant and sudden drops in the stock market. A large and unexpected decline in stock markets can signify a looming recession. Investors may sell some or all of their holdings in anticipation of an economic downturn.

- Increasing unemployment rates. People losing their jobs is another red flag that a recession is possible, even if the NBER has not officially declared one yet.

- A decline in the Leading Economic Index® (LEI). The LEI, which is published monthly, measures leading economic indicators in a bid to forecast future economic trends. It looks at various factors, such as durable goods orders reports, manufacturing orders and jobs, unemployment claims, building permits, and new housing units, among others.

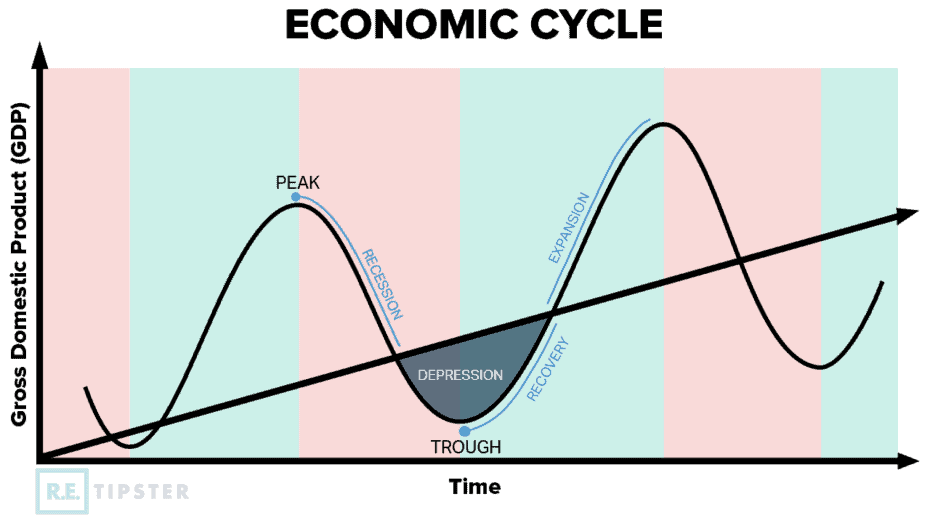

Recession and the Business Cycle

A business cycle traces an economy’s upward and downward movements. The typical business cycle has four phases: expansion, peak, contraction, and trough.

The expansion phase refers to a period of economic growth, usually characterized by a rise in consumer demand and spending and an increase in employment rates. As these factors go up, the cost and production of goods and services will likewise manifest an upward movement.

The peak phase represents the highest point of economic expansion. The last month before key economic indicators begin to drop often signifies the peak of a business cycle.

The contraction phase is a period that shows a significant decline in economic performance, such as higher unemployment rates and GDP downturn.

Finally, the trough phase is the lowest point in a business cycle where economic performance is at the bottom. The trough, however, is also considered a turning point as it marks the end of declining economic activities and is succeeded by a new period of expansion.

Recessions occur between the peak and trough phases. They are a regular occurrence in the ebb and flow of business cycles[7].

Takeaways

A recession is a time when the economy’s growth is stunted for a time due to various reasons, such as uncontrolled debt, excessive inflation and deflation, psychological factors, and economic shocks like the COVID-19 pandemic. Although it is difficult to determine when the economy will fall into a recession, there are usual indicators of an imminent economic downturn. An inverted yield curve, a drop in LEI, rising unemployment, and decreasing consumer confidence are red flags for a possible economic recession.

As recessions bring job losses and unstable cash inflow, banks and lending institutions tighten lending criteria and become wary of approving loans, including mortgages. As a result, the real estate market will see reduced property values, houses for sale stay longer in the market, and difficulty settling mortgages, which are generally bad news for real estate professionals. That said, these scenarios can create opportunities for potential property buyers as they can take advantage of the lower overall housing prices and less competitive buying market.

Sources

- National Bureau of Economic Research. (2008.) Business Cycle Dating Committee Announcement January 7, 2008. Retrieved from https://www.nber.org/news/business-cycle-dating-committee-announcement-january-7-2008

- Yale, A. (2021.) How Recessions Affect Housing Prices in the US. The Balance. Retrieved from https://www.thebalance.com/when-will-housing-prices-drop-again-4773140

- Ashe, S. (2020.) Depressions and recessions differ in their severity, duration, and overall impact. Here’s what you need to know. Business Insider. Retrieved from https://www.businessinsider.com/recession-vs-depression

- Rossman, T. (2019.) The next recession could crush many with credit card debt. CNBC. Retrieved from https://www.cnbc.com/2019/09/18/the-next-recession-could-crush-many-with-credit-card-debt.html

- UN News. (2021.) World Bank expects global economy to expand by 4% in 2021. Retrieved from https://news.un.org/en/story/2021/01/1081392

- Brettell, K. (2020.) Countdown to recession: What an inverted yield curve means. Reuters. Retrieved from https://www.reuters.com/article/us-usa-economy-yieldcurve-explainer/countdown-to-recession-what-an-inverted-yield-curve-means-idUSKBN1ZR2EX

- Lachuthan, A. (2020.) Business Cycle. Investopedia. Retrieved from https://www.investopedia.com/terms/b/businesscycle.asp