What Is Regulation Z?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- Regulation Z requires lenders to disclose all fees and costs to protect consumers from predatory lending.

- Lenders must provide standardized disclosures, including APR, finance charges, and payment schedules.

- Regulation Z doesn’t control interest rates or credit eligibility.

- It also doesn’t cover certain types of loans, such as business credit, some student loans, and loans exceeding a threshold amount.

- The CFPB enforces Regulation Z through audits, with violations resulting in penalties.

Understanding Regulation Z

Regulation Z, established under the Truth in Lending Act (TILA), is legislation designed to protect consumers in the credit marketplace from predatory lending.

The regulation requires lenders to disclose important details about loans, including interest rates, fees, and other costs associated with borrowing. This transparency helps consumers make informed choices when selecting credit products.

Regulation Z has three key objectives:

- Consumer protection: To safeguard consumers from deceptive lending practices.

- Transparency: To ensure that all terms and costs associated with credit are clearly disclosed.

- Informed decision-making: To enable consumers to compare different credit offers effectively.

Many publications use Regulation Z and TILA interchangeably, and in most cases, this is acceptable. However, strictly speaking, Regulation Z refers to the set of rules enacted by the TILA.

What Does Regulation Z Not Cover?

Though wide-ranging, Regulation Z does not mandate how much interest a financial institution may charge. Regulation Z also has no provision for who may be eligible for credit since laws like the Equal Credit Opportunity Act already cover this in greater detail.

In addition, Regulation Z doesn’t provide any guidance on how lenders evaluate the creditworthiness of potential borrowers. This means if you’re a land investor doing your due diligence for a seller financing deal, it’s up to you to find out if a borrower is a potential treasure or headache. Here’s one way to make it easy for you:

Finally, Regulation Z doesn’t cover certain types of loans. These include:

- Business, commercial, agricultural, or organizational credit.

- Credit extended to entities other than natural persons (e.g., corporations, partnerships).

- Loans exceeding the applicable threshold amount.

- Public utility credit.

- Securities or commodities accounts.

- Home fuel budget plans.

- Certain student loan programs.

- Employer-sponsored retirement plan loans.

Key Provisions of Regulation Z

Regulation Z encompasses several important provisions that lenders must adhere to when offering credit products. Below are some of the most significant components:

1. Uniformity

Regulation Z enforces a uniform system of disclosures and terminology regarding loans and credit products. This means lenders must define and present certain terms in a standard format, eliminating confusion about what terms describe various loan products and services.

2. Disclosures

Regulation Z outlines specific disclosures that lenders need to make about the loan or credit product. These include:

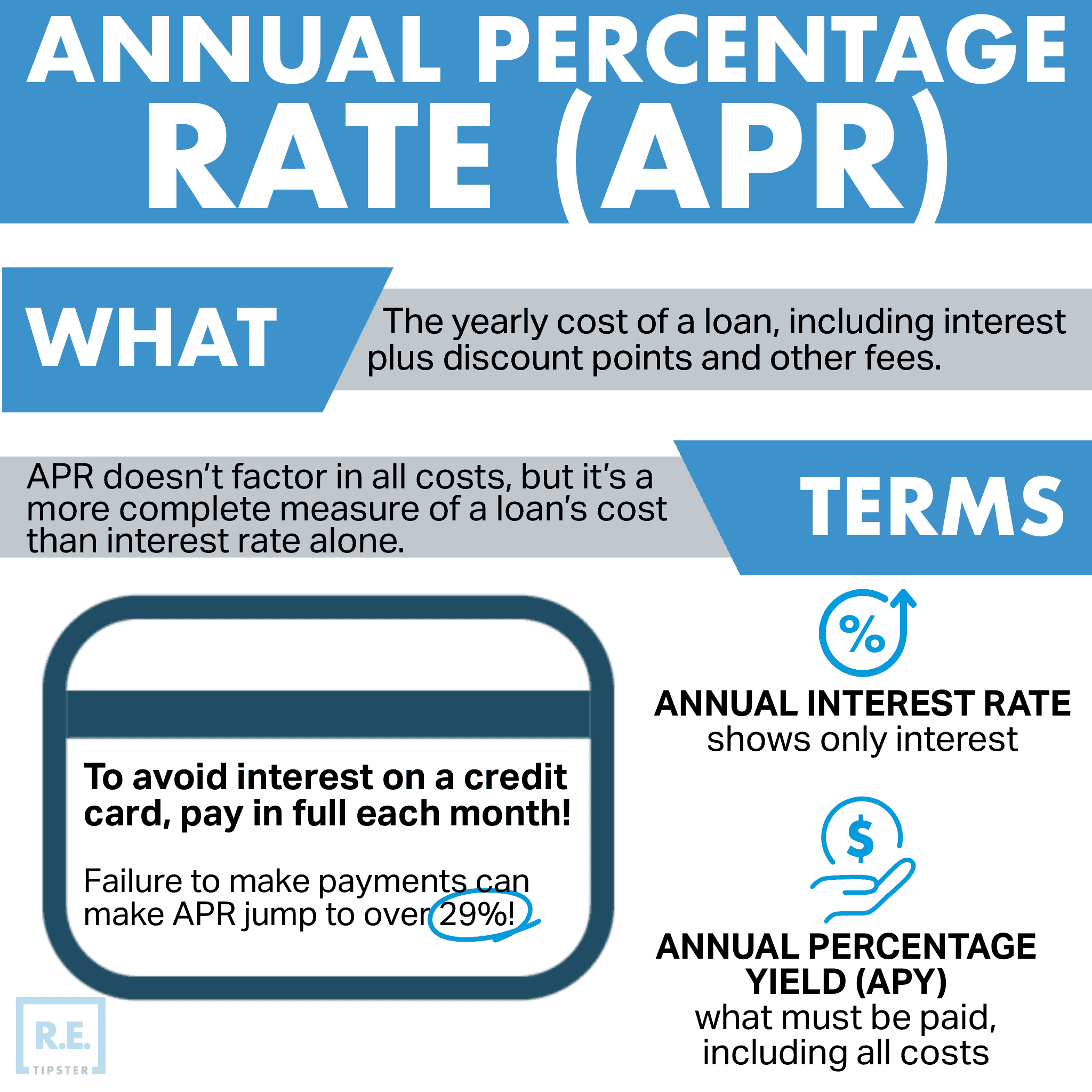

- Annual percentage rate (APR): The cost of borrowing expressed as a yearly interest rate.

- Finance charge: The total cost of credit expressed as a dollar amount.

- Total amount financed: The total dollar amount of the loan being obtained.

- Total payments: The total amount that will be paid over the life of the loan.

- Payment schedule: A detailed schedule outlining payment amounts and due dates.

- Late fees: Fees incurred if the borrower fails to repay the loan when due.

- Prepayment information: A disclosure of prepayment penalties (if any) and terms of the penalty.

3. Right of Rescission

The right of rescission allows the borrower to rescind (i.e., back out of) a loan agreement up to three days after accepting it.

This provision allows borrowers to reconsider their decision without penalty. It protects borrowers who may be having second thoughts about the loan or who were coerced into accepting the agreement through high-pressure sales tactics.

Exercising the right of rescission has no impact on the borrower’s credit or their chances of obtaining another loan in the future.

4. Advertising Guidelines

Regulation Z includes specific rules regarding advertising for credit products. Advertisements must not mislead consumers about loan terms or conditions. Any promotional materials must clearly state the APR and other relevant terms.

This provision also requires lenders to provide relevant educational materials created by the Federal Reserve Board (FRB) or Consumer Financial Protection Bureau (CFPB) about the financial product the borrower wishes to avail of.

5. Special Rules for High-Cost Mortgages

For high-cost mortgages—loans with interest rates or fees exceeding certain thresholds—additional disclosures and protections are mandated. These include:

- A written notice regarding the loan’s high-cost status.

- Limitations on prepayment penalties.

- Additional counseling requirements for borrowers.

The CFPB periodically adjusts certain thresholds related to high-cost mortgages based on inflation rates. These adjustments ensure that consumer protections remain relevant over time.

6. Mortgage Servicing Rules

Regulation Z also addresses mortgage servicing practices, requiring servicers to provide timely information about loan modifications, payment processing, and foreclosure prevention options.

How Does Regulation Z Define “Predatory Lending?”

Predatory lending refers to any practice that leads a borrower to enter a loan agreement with unfair or deceitful terms that exclusively benefit the lender.

In most cases, predatory lending tricks borrowers into taking on a loan designed to make it difficult for them to repay. As a result, the borrowers end up in more debt while the lender reaps the benefits in the form of exorbitant interest rates and late payment fees.

Most people targeted by such lenders are those in desperate need or unfortunate financial situations. It is much easier to entice someone into accepting a predatory loan agreement when they do not have anywhere else to get financial help.

Examples of Predatory Lending Practices

Some examples of predatory lending include the following:

- Equity stripping: A lender agrees to finance a property facing foreclosure and then rents it back to the homeowner in exchange for rent. This act “strips” away the equity on the property since the homeowner is now essentially a tenant in their own home.

- False or inadequate disclosure: The lender intentionally withholds vital information about the loan agreement that could have influenced decision-making. It also occurs when the lender provides false information about the loan before the agreement and then changes the terms after the initial offer.

- Inflated fees: The lender charges ridiculously high fees and costs compared to other lenders. These charges are often hidden in fine print so it’s not always easy to spot them.

- Bait-and-switch: The predatory lender entices borrowers with attractive terms or special offers but will provide a drastically different set of terms during closing. In most cases, the borrower would never have agreed to these new terms if they had known about them at the outset.

- Prepayment penalties: Or “prepay,” a clause in a loan agreement that charges the borrower excessive fees if they want to pay off the loan early or refinance it. Prepayment penalties are prohibited in federal home loan programs. Federal laws may also cap how much prepayment penalty a private lender can charge their borrowers.

- Packing: This is when the lender “packs” unnecessary or unrequested services into the loan agreement, all of which incur fees.

Regulation Z: Enforcement and Compliance

The CFPB has been overseeing Regulation Z and the TILA since 2011, when it took over the role of the FRB after the enactment of the Dodd-Frank Act.

The CFPB monitors financial institutions to ensure adherence to Regulation Z. This includes conducting audits, investigating complaints, and enforcing compliance through corrective actions.

This oversight includes several key activities:

- Supervision and examination: The CFPB conducts regular examinations of financial institutions to assess their compliance with Regulation Z. This process involves reviewing lending practices, disclosure accuracy, and consumer complaint handling.

- Investigations: When consumer complaints arise, the CFPB can investigate potential violations of Regulation Z. This may involve gathering evidence, interviewing witnesses, and analyzing lending practices to determine if a lender has engaged in deceptive or unfair practices.

- Rulemaking authority: The CFPB can amend Regulation Z to address emerging issues within the lending industry. This rulemaking authority allows the Bureau to adapt to changes in market practices, technology, and consumer needs. There have been over 45 changes to Regulation Z since 2011.

RELATED: What Impact Does Dodd-Frank Have On Vacant Land Transactions?

Submitting a Report to the CFPB

If you think a financial product has misled you, you can submit a report to the CFPB. This can include issues related to inaccurate disclosures, unfair lending practices, or failure to provide required information.

You can contact the CFPB through phone, website, fax, or snail mail.

- Phone/fax (toll-free): (855) 411-2372

- Webpage: https://www.consumerfinance.gov/complaint/

- Mail: Consumer Financial Protection Bureau., PO Box 2900, Clinton, Iowa 52733

FAQs: Regulation Z

What types of loans are covered under Regulation Z?

Regulation Z applies to a variety of consumer credit transactions, including mortgages, home equity lines of credit (HELOCs), credit cards, and other types of consumer loans. It mandates that lenders provide clear disclosures regarding loan terms, including the APR, finance charges, and total payment amounts.

Loans made by certain small creditors or loans for commercial purposes, however, are exempt from Regulation Z.

How does Regulation Z impact the mortgage application process?

Regulation Z significantly affects the mortgage application process by requiring lenders to provide clear and comprehensive disclosures to borrowers. This includes the Loan Estimate form, which outlines key loan terms, estimated monthly payments, and closing costs. Lenders must deliver this document within three business days of receiving a loan application.

Additionally, borrowers receive a Closing Disclosure at least three days before closing, detailing final loan terms and costs. These requirements ensure that consumers have ample time to review and understand their mortgage options, fostering informed decision-making.

We’ve made a REtipster Mortgage Calculator here to help you plan out your mortgages. Here’s a detailed walkthrough:

What are the penalties for violating Regulation Z?

Lenders that violate Regulation Z can face significant penalties enforced by the CFPB. These penalties may include civil monetary fines reaching thousands of dollars per violation.

Additionally, consumers can sue lenders for damages resulting from misleading disclosures or unfair practices.

Non-compliance can also lead to corrective actions mandated by the CFPB, requiring lenders to revise their practices and provide refunds to affected consumers. There are different non-compliant procedures, such as the lender failing to calculate the APR or being intentionally ambiguous about due dates.

References

- National Credit Union Administration, “Truth in Lending Act (Regulation Z).” https://ncua.gov/regulation-supervision/manuals-guides/federal-consumer-financial-protection-guide/compliance-management/lending-regulations/truth-lending-act-regulation-z

- Federal Deposit Insurance Corporation, “Equal Credit Opportunity Act (ECOA).” https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/5/v-7-1.pdf

- Consumer Financial Protection Bureau, “12 CFR Part 1026 (Regulation Z) § 1026.3 Exempt transactions.” https://www.consumerfinance.gov/rules-policy/regulations/1026/3/

- Office of Financial Readiness, “Truth in Lending Act, Consumer Protection for Borrowing Money.” https://finred.usalearning.gov/assets/downloads/FINRED-TruthLendingAct-FS.pdf

- Experian, “What Is the Right of Rescission on Home Loans?” https://www.experian.com/blogs/ask-experian/right-of-rescission/

- Federal Register, “Truth in Lending (Regulation Z).” https://www.federalregister.gov/documents/2023/11/29/2023-25048/truth-in-lending-regulation-z

- Investopedia, “Equity Stripping: Meaning, Forms, Example.” https://www.investopedia.com/terms/e/equity-stripping.asp

- Forbes, “Prepayment Penalty: What It Is And How To Avoid One.” https://www.forbes.com/advisor/mortgages/prepayment-penalty-what-it-is-and-how-to-avoid-one/

- Consumer Financial Protection Bureau, “Final rules.” https://www.consumerfinance.gov/rules-policy/final-rules/?title=&categories=final-rule&topics=truth-in-lending-act&from_date=2010-07-01&to_date=2024-10-21

- Consumer Financial Protection Bureau, “Submit a complaint about a financial product or service.” https://www.consumerfinance.gov/complaint/

- Compliance Services Group, LLC, “TILA and Regulation Z: Top 10 Material Violations.” https://complianceservicesgroup.com/tila-and-regulation-z-top-10-material-violations/