What Are Mortgage Markets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Mortgage markets connect homebuyers seeking loans with lenders and investors providing financing to facilitate housing purchases.

- There are two mortgage markets: primary and secondary.

- The primary mortgage market is where loan origination takes place.

- The secondary market is where lenders sell the rights to these mortgages to investors, freeing up their capital so they can lend to other buyers.

- The healthier the secondary market, the more capital lenders can lend to homebuyers, making homeownership more affordable and achievable.

Why Are Mortgage Markets Important?

Mortgage markets are important because they make buying a home more doable for more people. They do this by making mortgages available and affordable through lending capital provided by banks and investors.

Here’s how it works:

Normally, you’d have to pay cash for a house. But with a mortgage, you can finance the purchase and pay it off over many years, where a real estate lender (such as a bank or a credit union) finances the purchase. However, because a mortgage is a 15- or 30-year contract, this effectively ties up their money with your loan, which limits their ability to originate new loans to other buyers.

One way they can free up their funds is by “selling” your mortgage to an investor. This frees up their money that was originally tied to you, making it available for other buyers to borrow and purchase their home[1].

Mortgage markets distinguish between “primary” and “secondary.” In the example above, taking out a mortgage to buy your home is the “primary market,” and the lender selling the mortgage to an investor is the “secondary market.” These markets connect homebuyers with lenders and investors and provide financing that allows more people to buy homes.

RELATED: House Hacking: The Official Guide On How to Live (Almost) Mortgage-Free

Key Players in Mortgage Markets

Several key players participate in mortgage markets[2]:

- Borrowers: mostly homebuyers taking out loans.

- Lenders: originate mortgages and collect payments.

- Investors: provide funding by buying mortgage products; examples include banks and asset managers.

- Government agencies: including government-sponsored enterprises (GSEs), which guarantee and securitize loans to support market liquidity.

- Service providers: facilitate processes like underwriting, titling, and foreclosures.

Primary and Secondary Mortgage Markets

The primary and secondary mortgage markets work together not only to make home buying practical, but as a way for all the key players to achieve their objectives (e.g., returns for investors, a house to live in for buyers, etc.).

Here’s a more in-depth look at what each market does.

Primary Mortgage Markets

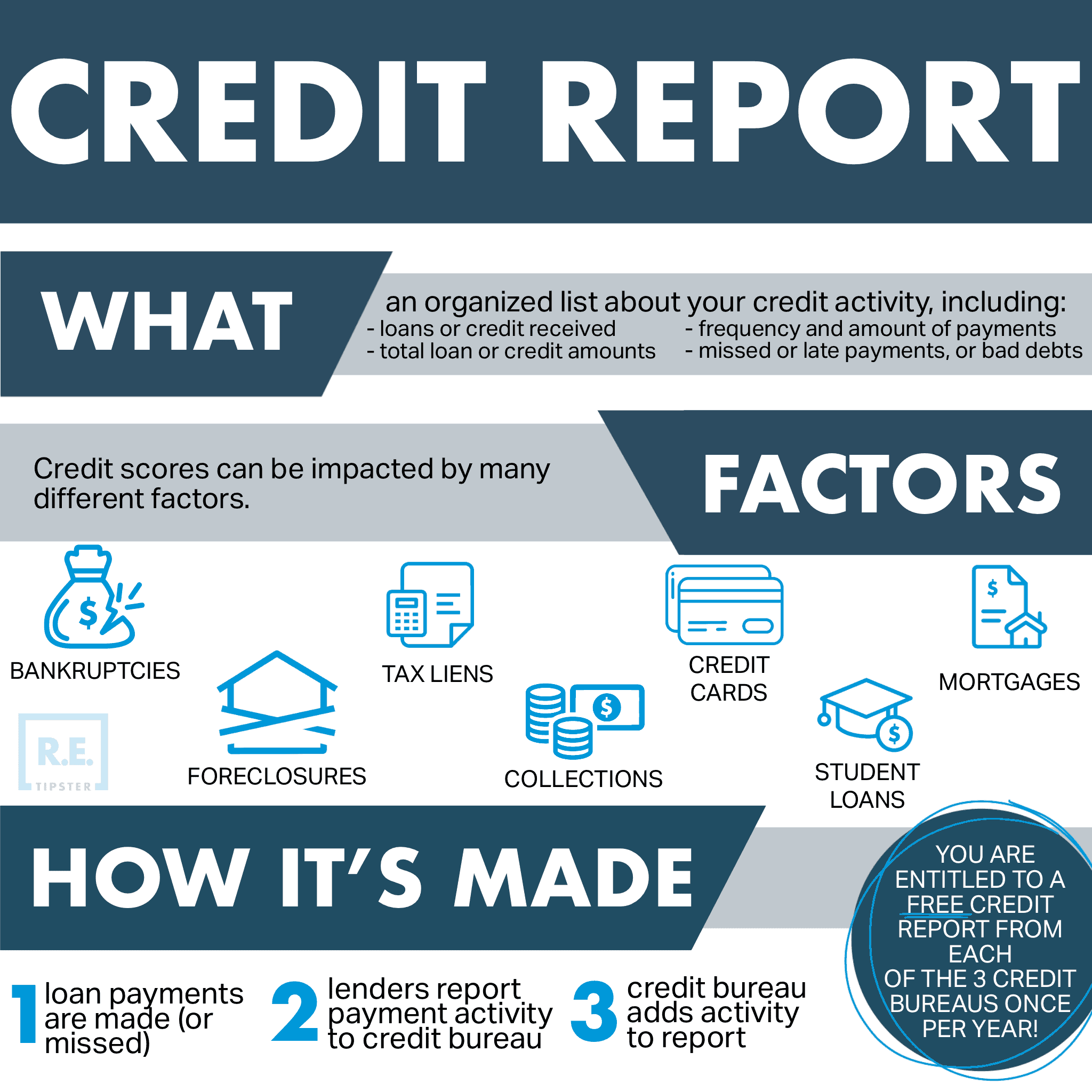

This is where lenders give loans directly to home buyers[3]. Lenders look at the borrower’s creditworthiness, which comprises income, credit score, and overall debt, to decide if someone qualifies for a mortgage. If approved, the lender gives the money to the buyer and collects the mortgage payments over time.

In the primary mortgage market, the main benefit is that buyers can get a mortgage tailored to their situation. Most mortgages come directly from banks, mortgage brokers, or smaller lenders selling loans to bigger banks. Lenders can look at each person’s finances and find the best mortgage option for them[4]. Federal rules and regulations provide oversight to make sure lenders lend responsibly, including the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA)[5].

Secondary Mortgage Markets

This is where existing mortgages get traded between big investors, banks, and institutions after the loan closes. It provides a way for lenders to sell mortgages off their books and get new money to lend again while reducing their overall risk. Borrowers still make payments to whoever ends up owning the mortgage.

The secondary market brings in new money from investors, which increases available lending beyond what lenders alone could provide. This makes mortgages more affordable and accessible.

Key players in the secondary market include government-sponsored enterprises like Fannie Mae and Freddie Mac. They bundle mortgages into investments called mortgage-backed securities (MBSs) and sell them to investors[6]. However, private entities like banks can also sell mortgages in bulk to other banks and investors.

Factors Influencing Conditions of Mortgage Markets

Several economic and regulatory factors influence mortgage market conditions like rates, pricing, and availability of financing. Key drivers are federal monetary policies, lender capital levels, investor appetite, foreclosure volumes, housing market trends (such as the House Price Index), and government housing policies or reforms. Imbalances can restrict or loosen access to mortgages.

Market Size

The overall size of the mortgage market significantly influences conditions and availability of financing. In general, a larger mortgage market means there is more lending capital available to fund mortgages[7] for homebuyers by allowing lenders to originate new loans.

Conversely, declining market size indicates tightening conditions, reduced liquidity, and constrained access to financing. Any of these result in increasing the average prices of homes.

Note that the mortgage market may also overheat (i.e., grow too fast). In this scenario, it can lead to loose lending standards and too much risk that lenders take on, destabilizing markets.

Oversight and Reforms

Government and quasi-government entities like the Department of Housing and Urban Development (HUD), Federal Housing Finance Agency (FHFA), Ginnie Mae, Fannie Mae, and Freddie Mac provide oversight, standardization, and support for mortgage markets. Major reforms like the Dodd-Frank Act have also reshaped operations after the subprime crisis by improving consumer protections and risk controls[8].

The Impact of Technology

Technology is increasingly influencing mortgage markets by improving efficiency and expanding access, thus lowering overall costs.

For example, web-based lending enables quicker and easier transactions featuring APIs that enhance integration with existing tools, while automated valuation models provide faster home appraisals. Some lenders use alternative data sources[9] in addition to traditional credit scoring to evaluate borrower risk, potentially expanding the pool of qualifying borrowers.

Frequently Asked Questions: Mortgage Markets

How do mortgage lenders make money in the secondary market?

Mortgage lenders make money in the secondary market by selling the loans they originate to investors. This gives lenders cash they can then use to fund new mortgage loans and generate more revenue. They earn money by continuing to service these loans[10], earning servicing fees from the new owners.

There are several ways lenders can sell mortgages to investors.

First, they can sell mortgages to government-sponsored enterprises like Fannie Mae and Freddie Mac, which package the loans into mortgage-backed securities that are sold to investors.

Additionally, lenders also sell mortgages in bulk portfolio sales to larger banks and institutional investors. Another way is to use their own mortgage-backed security programs to bundle and sell loans to the capital markets.

What are the advantages and disadvantages of the primary mortgage market for borrowers?

The primary mortgage market offers several advantages for borrowers, such as a variety of mortgage loan options, potentially low down payment requirements, and reasonable rates due to high demand for conforming loans.

However, there are also downsides, including stringent credit vetting processes and potential higher costs for nonconforming loans. Understanding these pros and cons can help borrowers navigate their mortgage options more effectively.

What’s the difference between the secondary mortgage market and a second mortgage?

The difference between the secondary mortgage market and a second mortgage is primarily their purpose and function in home financing.

The secondary mortgage market is where existing mortgages are traded between lenders and investors. It provides liquidity to the housing finance system, allowing lenders to free up capital for new loans.

On the other hand, a second mortgage is an additional loan taken against a homeowner’s equity, beyond the primary mortgage[11]. Homeowners use a second mortgage for various purposes like home improvements or debt consolidation. Types of second mortgages include home equity loans and home equity lines of credit (HELOCs). Second mortgages generally have higher interest rates than primary mortgages due to the higher risk to lenders.