What Is Reserve Currency?

Shortcuts

- A reserve currency is currency held in significant quantities by governments as part of their reserves, which they use to trade with other countries.

- Having larger foreign reserves allows a country to better handle economic challenges and reduce the risk of fluctuating exchange rates.

- The world uses multiple reserve currencies, but the U.S. dollar has been the most dominant since the mid-1950s.

- When a country drains its reserves, it spells economic trouble for the country that can lead to more debt and lower living standards.

The Importance of a Reserve Currency

Reserve currencies (or “foreign reserves” or simply “reserves”) are important because they provide a common medium of exchange accepted by different countries[1]. This makes it easier to buy and sell goods and services in the global market without having to constantly convert currencies all the time.

Countries also use their reserves when they want to borrow or lend money to each other. If a country has its own currency as a reserve currency (such as the U.S.), it’s easier for them to get loans in their own currency. They also keep these reserve currencies as a way to show their creditworthiness to global lending institutions and other countries.

As a result, reserve currencies are a reliable store of value and a “safe haven” in times of economic trouble.

Having a larger reserve can also help protect against risks when the value of currencies changes. After the world abandoned the gold-U.S. dollar standard in 1973[2], national currencies became free-floating, which means their values can go up or down in value, affecting the cost of goods and services overnight.

When one currency gets weaker, it takes more of that currency to buy something priced in a stronger currency.

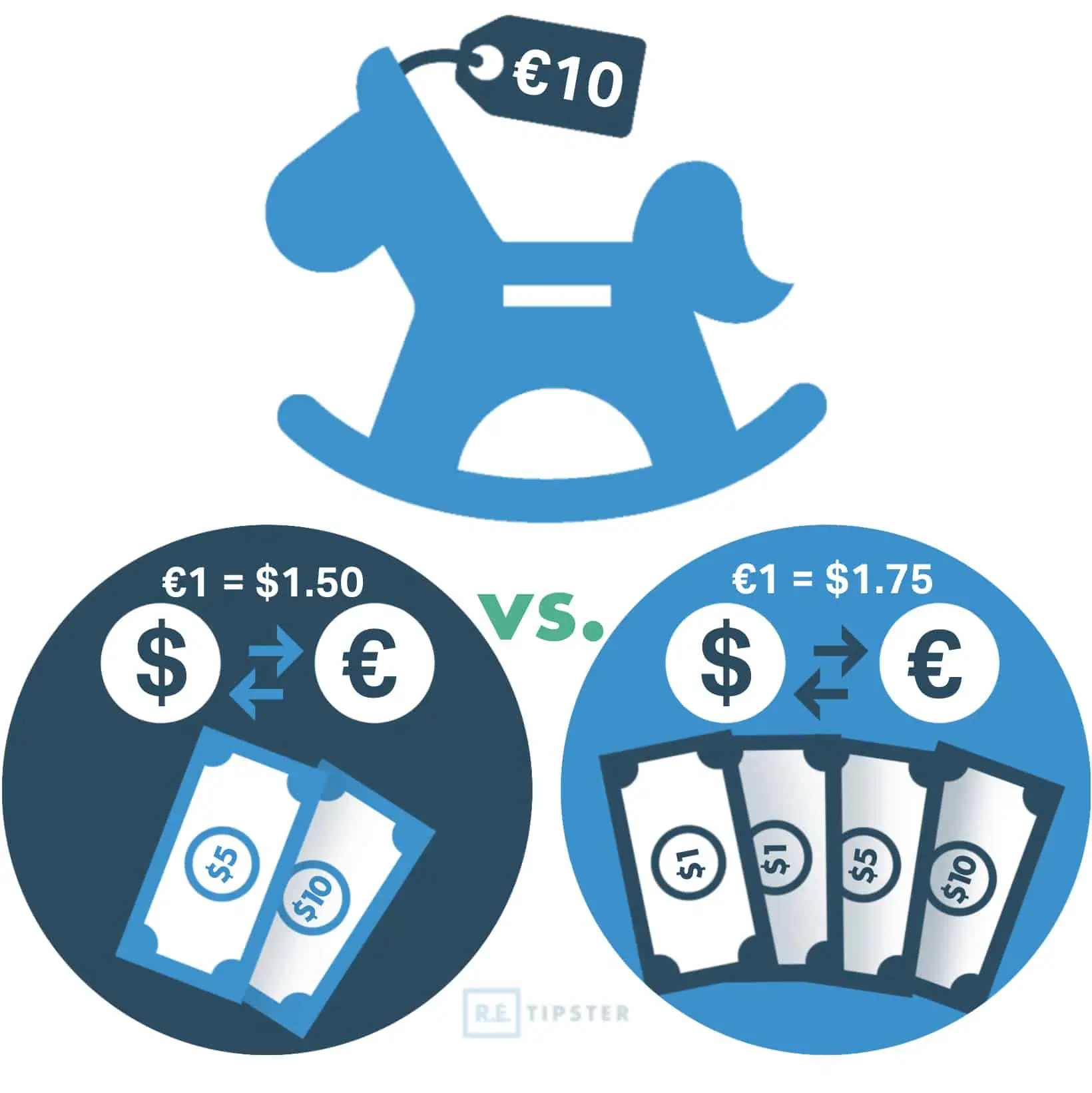

Let’s say Country A wants to buy a toy (priced at 10 euros) from Country B. In Country A, 1 euro is equivalent to 1.50 USD. So, initially, the toy would cost Country A around 15 U.S. dollars (10 euros multiplied by 1.50).

However, the currency of Country A weakens relative to the euro and the exchange rate becomes 1 euro to 1.70 USD. Now, to buy the same toy priced at 10 euros, Country B would need to pay around 17 USD (10 euros multiplied by 1.70). The weaker currency means that Country A needs to spend more U.S. dollars to buy the toy.

Why Is the U.S. Dollar the Reserve Currency?

The U.S. dollar became the main reserve currency after World War II[4] because the United States became a powerful nation both in military and economic terms. It produced a lot of goods that were exported all over the world, and it held a significant amount of gold in its vaults[5].

The United States Bullion Depository, aka “Fort Knox” (Work permitOriginal author=Cliff, CC BY-SA 4.0, via Wikimedia Commons)

These factors made the U.S. economy strong and stable, which is important for a country to be chosen as the issuer of the global currency.

As an issuer of the world’s primary reserve currency, the United States exerts great influence over global monetary policies. They can make decisions that affect international financial situations, like changing interest rates or taking actions to keep their own economy stable while also keeping the global economy in good shape.

Even though the U.S. dollar is the primary reserve currency, different countries also hold other reserve currencies. The British pound sterling remains an internationally recognized reserve currency before the U.S. dollar overtook it in the mid-1950s[6]. Additionally, the euro, Japanese yen, Chinese renminbi, Swiss franc, Canadian dollar, and Australian dollar are also recognized as reserve currencies.

RELATED: How to Invest in U.S. Real Estate from Another Country: What You Need to Know

Reserve Currencies by Country

China holds the largest reserves among countries, while São Tomé and Príncipe has the smallest reserves. Although China doesn’t disclose the specific currencies it holds, it is believed that the U.S. dollar makes up the majority[7].

One reason for China’s substantial reserves is its aging population[8]. It is preparing for retirement while ensuring its economy continues to grow and generate income[9].

On the other hand, São Tomé and Príncipe and the Federated States of Micronesia have much smaller reserves, worth only tens of thousands of dollars[10].

São Tomé and Príncipe’s bronze cannons front the Atlantic Ocean, a reminder of its colonial past.

What Happens When a Country Runs Out of Foreign Reserves?

When a country runs out of foreign reserves, it may seek credit from other sources, reduce the amount of goods it imports, or in severe cases, even default on its debts.

Running out of foreign reserves means that the country is spending more of its reserve currency than it earns from its domestic economy.

To address this, the government can try to raise funds by issuing bonds to foreign investors. However, if the country is seen as a risky borrower, they may not want to buy those bonds, even if the terms are attractive.

In addition to reducing spending and cutting back on imports, the government can increase exports. However, these measures can lead to shortages of certain goods, and when the supply of goods is low but the demand is high, it can drive up inflation and lower people’s living standards.

The World Bank Building at Washington, D.C. (Shiny Things, CC BY 2.0, via Wikimedia Commons)

While other countries or organizations like the World Bank may eventually provide aid to a struggling nation, there is no guarantee of such assistance. Often, any aid received involves additional loans, debt restructuring, and other measures. As a result, people may experience a decline in quality of life before help arrives.

How Long Do Reserve Currencies Last?

Reserve currencies last around 94 years on average.

Since the mid-15th century, there have been six primary reserve currencies, with five of them originating from Europe. These include the Spanish dollar, Dutch guilder, French franc, British pound sterling, and German mark.

Among these, Spain’s currency served as a global reserve for the longest time, lasting 110 years, while Portugal and the Netherlands had shorter periods of dominance, each controlling the world’s currency for 80 years.

The U.S. dollar became the main reserve currency after World War II, and it has exceeded the average lifespan of previous reserve currencies[11]. However, experts believe that the dollar’s status as the world’s primary currency may eventually come to an end. This can open the door for other forms of money to take its place, such as gold, a Central Bank Digital Currency (CBDC), or even cryptocurrencies like Bitcoin.

Sources

- dummies. (2021.) How the Fiat System Works. Retrieved from https://www.dummies.com/article/business-careers-money/personal-finance/investing/general-investing/how-the-fiat-system-works-198367/

- U.S. Office of the Historian. (n.d.) Nixon and the End of the Bretton Woods System, 1971–1973. Retrieved from https://history.state.gov/milestones/1969-1976/nixon-shock

- Grannan, C. (2016.) How Are Currency Exchange Rates Determined? Britannica. Retrieved from https://www.britannica.com/story/how-are-currency-exchange-rates-determined

- Rosalsky, G. (2019.) 75 Years Ago The U.S. Dollar Became The World’s Currency. Will That Last? NPR. Retrieved from https://www.npr.org/sections/money/2019/07/30/746337868/75-years-ago-the-u-s-dollar-became-the-worlds-currency-will-that-last

- Burton, K. (2020.) Great Responsibilities and New Global Power. The National WWII Museum. Retrieved from https://www.nationalww2museum.org/war/articles/new-global-power-after-world-war-ii-1945

- Jones, C. (2022.) Does sterling’s slide into obscurity foreshadow the US dollar’s fate? The Financial Times. Retrieved from https://www.ft.com/content/9ce54a9e-be11-4b61-bf49-f2cfe5b22628

- Tran, H. (2022.) Wargaming a Western Freeze of China’s Foreign Reserves. Atlantic Council. Retrieved from https://www.atlanticcouncil.org/blogs/econographics/wargaming-a-western-freeze-of-chinas-foreign-reserves/

- PRB. (n.d.) China’s Rapidly Aging Population. Retrieved from https://www.prb.org/resources/chinas-rapidly-aging-population/

- Neely, C. (2016.) Why Does China Have Large Foreign Exchange Reserves? Federal Reserve Bank of St. Louis. Retrieved from https://www.stlouisfed.org/on-the-economy/2016/may/why-china-large-foreign-exchange-reserves

- Burton, J. (2017.) Lowest Foreign-Exchange Reserves In The World. WorldAtlas. Retrieved from https://www.worldatlas.com/articles/the-lowest-foreign-reserves-worldwide.html

- Sharma, R. (2021.) The dollar has had a 100-year run as the world’s reserve currency. But a new class of contenders is emerging. Financial Post. Retrieved from https://financialpost.com/financial-times/the-dollar-has-had-a-100-year-run-as-the-worlds-reserve-currency-but-a-new-class-of-contenders-is-emerging