What Is Return on Equity (ROE)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Why Is Return on Equity Important?

Because return on equity (ROE) is a financial ratio that measures a company’s net income divided by the total equity of its shareholders, it is an important metric to gauge the company’s general profitability.

Since the income of a public company is sent to its shareholders in the form of dividends, a positive ROE means that the business is not only able to generate profit but it can also pay its shareholders.

This is why ROE is a key performance indicator of profitability and whether a company’s net income is appropriate for its size. As such, ROE is also an indirect measure of the company’s operational and financial efficiency[1].

How to Calculate ROE

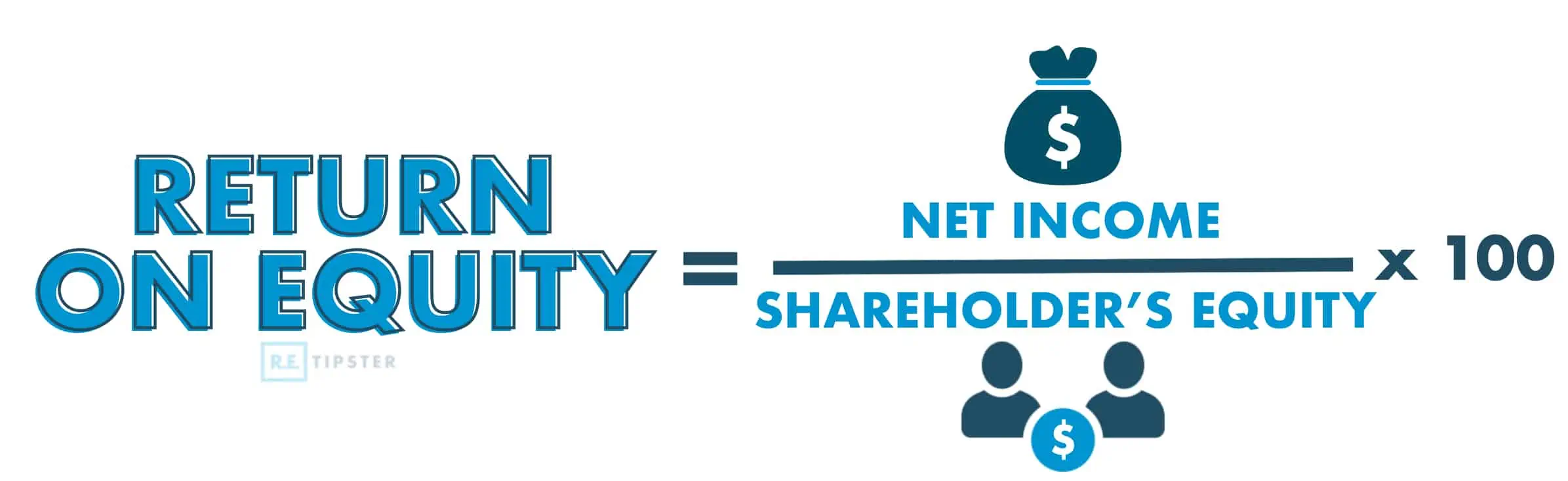

Financial analysts and business leaders calculate a company’s ROE using the return-on-equity formula:

These two elements are described as:

- Net income: The annual earnings after expenses of a company as reported on its income statement.

- Shareholders’ equity: Also called the company’s net worth, shareholders’ equity represents the shareholders’ claim on a company’s assets after deducting liabilities as reported in its balance sheet.

ROE is expressed as a percentage value, so the raw result after dividing net income by shareholders’ equity is multiplied by 100[2].

Suppose Company A has a net income of $1,000,000 and a total shareholders’ equity of $5,000,000. To get Company A’s ROE, the calculation is as follows:

ROE = 1,000,000 / 5,000,000

ROE = 0.20 x 100

ROE = 20%

Company A’s return on equity is 20%, which means that the company has grown 20% relative to the shares held by its investors. This ROE figure simply means that every dollar of equity capital invested in Company A has generated an extra 20 cents in the past year[3].

Net Income Alternative in ROE Formula

Some businesses use free cash flow (FCF) instead of net income to calculate ROE[4]. FCF is the cash that a company generates after cash outflows to support operations and maintain capital assets.

Unlike net income, FCF excludes non-cash expenses and includes assets and equipment spending as well as working capital changes[5].

The DuPont ROE Model

Another alternative to computing a firm’s ROE is the DuPont formula, named after the science and chemicals company.

DuPont Chestnut Run, Delaware (photo on public domain)

The DuPont formula uses three factors in its computation, each derived from a separate calculation. The formula is as follows:

The elements of this return-on-equity calculation are further defined as:

- Net profit margin: The company’s after-tax profit generated for each dollar of revenue, derived by dividing net income by revenue. Alternatively, one can also obtain a net profit margin by adding net income, minority interest, and tax-adjusted interest then dividing the sum by the company’s revenue.

- Asset turnover: This figure measures how effectively a company utilizes its assets to generate income. It is calculated by dividing revenue by the company’s asset price.

- Equity multiplier: Finally, this metric equates to financial leverage, highlighting the ROE portion resulting from debt. It is calculated by dividing total assets by shareholders’ equity[6].

As in the simple ROE formula, the result in the above calculation is multiplied by 100 to get the metric’s percentage value.

DuPont Analysis vs. Simple ROE Formula

The DuPont formula offers a more comprehensive analysis than the simple ROE formula because it affords a deeper look into the individual performance factors, including financial leverage and debt capital, that drive the ROE of a company.

The simple ROE formula only indicates a simple ratio of a company’s net income versus its shareholder’s equity. The DuPont formula, on the other hand, expands the analysis and measures the impact of each individual ROE component on the equity ratio.

What Insight Can an ROE Analysis Provide?

Tracking the ROE of a company provides important insight into a company’s financial health, especially in three realms of business management.

Company Management

The ROE is a window for the company’s decision-makers to identify its strengths and find areas for improvement. Using this financial metric allows them to focus on opportunities to improve the company’s financial performance. Business owners can also compare their average ROE to similar companies over the same period to analyze their performance.

ROE is also a measure to determine the compensation of a company’s management team.

Company Shareholders

A company’s shareholders can appraise its management team’s performance through the ROE. Through this metric, they not only can assess the rewards that their invested capital delivers to them; having an ROE reading also allows them to advocate for policy changes to improve company profitability.

Prospective Investors

Investors, particularly those who deal in stock market-listed companies, can rely on ROE for better-informed stock picks. Stock investors will find the DuPont ROE analysis more insightful than the simple ROE calculation.

Investors may use ROE analyses to scrutinize a company’s capital structure, business quality, and growth drivers[7] and see whether it makes sense to invest money in it or not.

BY THE NUMBERS: An ROE of anything over 15% is generally considered a good profitability indicator for a company.

Source: Business Intelligence

Comparing ROEs

Stock investors compare the ROE of different companies to determine those that offer the better yield.

This comparison will be even more useful if it covers similar-sized companies in the same industry. This happens because averages in the ROE components vary in each industry. Therefore, investors want to target companies with a higher ROE than the industry average[8].

Twists to Watch in an ROE Analysis

Investors have to watch certain flukes in ROE when using this financial ratio in decision-making. In some instances, they may have to track a company’s ROE performance on a longer time horizon, especially when analyzing the ROE of new companies (which tend to have a negative ROE).

Granted, a negative ROE is not necessarily bad, as the new capital can take time to deliver profits for newer entrants in the space. In older businesses, for example, a negative ROE might result from restructuring costs to streamline the business.

Share buybacks are another factor to consider when analyzing an ROE. Share buybacks reduce the number of outstanding shares, temporarily increasing return on equity[9]. This is a means for businesses to artificially boost ROE in the short term, which is why assessing average shareholders’ equity over a fixed period can provide useful insight.

Takeaways

- Return on equity is a financial metric that measures a company’s ability to generate profits for its shareholders relative to their equity.

- Typically used year-over-year, the higher the ROE, the better it is for its shareholders.

- There are three ways to calculate ROE: using the simple formula, an alternative formula using free cash flow, and a more painstaking DuPont expanded analysis.

- Investors often compare ROE between companies, which is especially useful for evaluating investment returns between companies in the same industry due to industry-wide similarities.

Sources

- Gerber, B. (n.d.) 12 Key Financial Performance Indicators You Should Be Tracking. Accounting Department. Retrieved from https://www.accountingdepartment.com/blog/12-key-performance-indicators-you-should-be-tracking

- Lewis, R. (2021.) What is return on equity? How to calculate ROE to evaluate a company’s profitability. Insider. Retrieved from https://www.businessinsider.com/return-on-equity

- Reed, E. (2018.) What Is Return on Equity and Why Does It Matter? The Street. Retrieved from https://www.thestreet.com/investing/what-is-return-on-equity-14813508

- Furhmann, R. (2021.) How to Calculate Return on Equity (ROE). Investopedia. Retrieved from https://www.investopedia.com/ask/answers/070914/how-do-you-calculate-return-equity-roe.asp

- Fernando, J. (2021.) Free Cash Flow (FCF). Investopedia. Retrieved from https://www.investopedia.com/terms/f/freecashflow.asp

- Kennon, J. (2020.) What Is the DuPont Return on Equity Model, or ROE, Formula? The Balance. Retrieved from https://www.thebalance.com/the-dupont-model-return-on-equity-formula-for-beginners-357494

- Indeed Editorial Team. (2021.) DuPont Analysis, Components, Formula, and Example. Indeed Career Guide. Retrieved from https://www.indeed.com/career-advice/career-development/du-pont-analysis

- Merril, T. (n.d.) What Is Return on Equity, How to Calculate It, & What Is a Good ROE? Fortune Builders. Retrieved from https://www.fortunebuilders.com/what-is-return-on-equity/

- Corporate Finance Institute. (n.d.) Return on Equity. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-return-on-equity-roe/