What Are Soft Costs?

Why Are There Soft Costs?

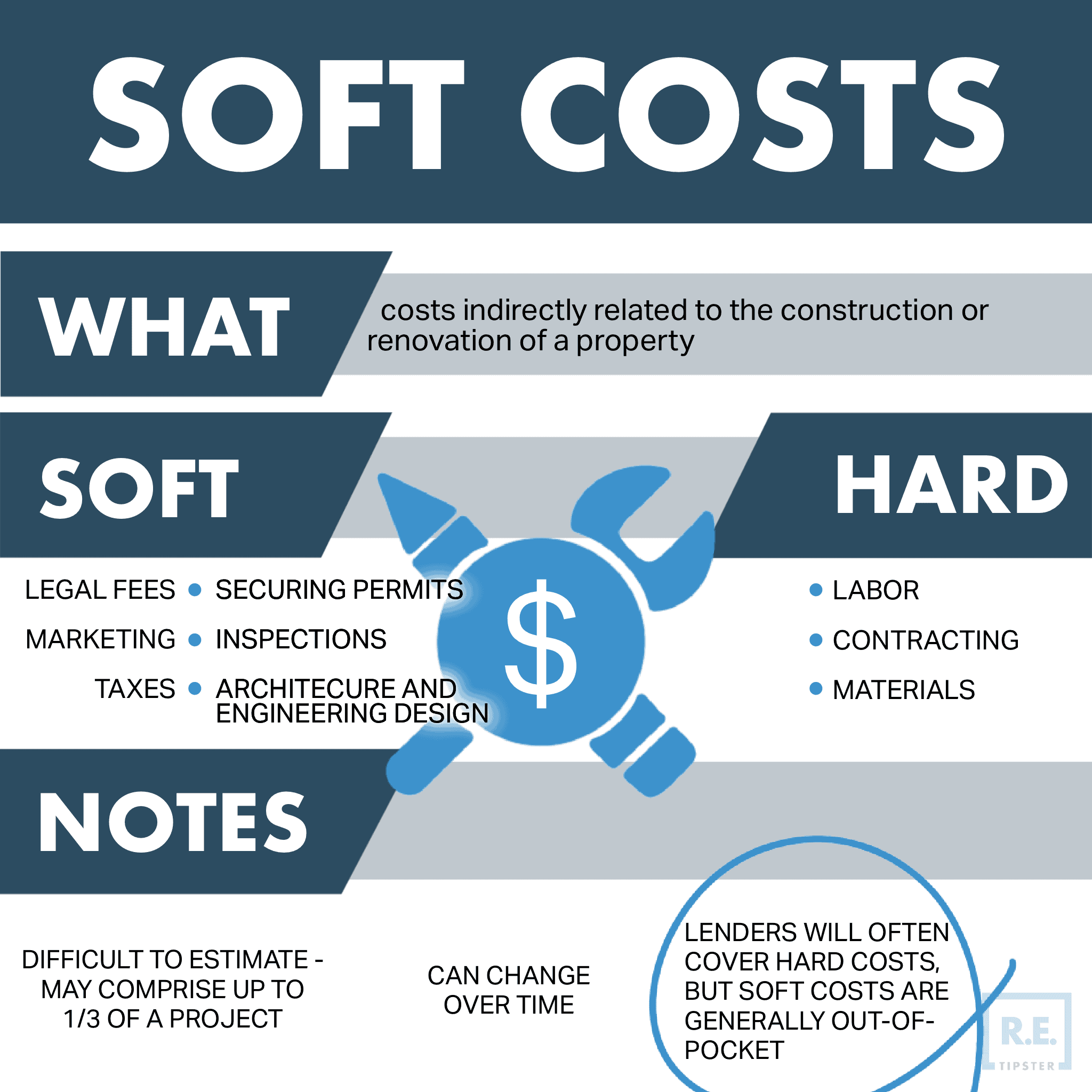

In real estate, the costs of building or renovating a property can be categorized into hard costs and soft costs. Hard costs cover things like labor, contracting, and the materials required in the building process. All other necessities fall under the category of soft costs.

Soft costs are often difficult to estimate as their value and percentage of the overall budget can differ depending on the construction project. In addition, maintenance fees and security measures also fall under soft costs, so it can be challenging to forecast these expenses when planning a construction or renovation project.

Calculating Soft Costs

Unlike hard costs, which are expenses directly involved in the project, soft costs are unpredictable and sometimes even unexpected. Real estate developers and investors may overlook or underestimate them, making them tricky to manage when they come up, especially when dealing with a limited budget.

Soft costs tend to change as the project progresses, which can bring total expenses up significantly. Moreover, owners may encounter soft costs even after construction, such as miscellaneous carrying costs like utilities and loan fees or sudden legal fees that can carry on for the entirety of the building’s lifetime.

Note that soft costs do not remain the same over time. Depending on local economic conditions, these expenses may gradually increase along with the overall market, which will also affect maintenance costs in the years to come.

Experienced project managers, contractors, or real estate agents can help real estate developers and investors estimate the overall costs of the project. This estimate is based on typical costs, including the purpose of the property purchase and other factors.

Depending on the nature of the project, some contractors may estimate that soft costs constitute as little as 8% of a project’s total cost[1] or as much as 33% of it.

Types of Soft Costs

The types of soft costs in any real estate project depend on the building type, location, stage of the building process, and the investor’s exit strategy.

Below are typical soft costs in any building or renovation project.

Architectural and Engineering (A&E)

Architectural and engineering costs involve technical design, planning, and development necessary for the property’s operation and safety. A&E fees include feasibility studies, building design, construction documentation, and electrical, mechanical, structural, and civil engineering. These aspects play the most prominent role in the planning and pre-construction stages.

Building, Construction or Renovation Permits

A building permit is required before any construction is given the green light, whether building a unit from scratch or renovating an existing property. Investors or buyers can obtain a permit by visiting the state or municipal office with a project proposal, which often happens after preliminary A&E work is complete and approved.

Inspection Fees

Some state and municipal authorities mandate various reports—such as geotechnical, traffic, and site studies—to ensure that the building site is suitable for the intended construction project[2]. Inspectors study the property’s above-ground conditions and designate acceptable soil properties, with occasional input from the A&E team.

The cost and coverage of these reports vary widely depending on the building project. For instance, a high-rise residential building will require a more in-depth report than a two-story family home.

Lender Fees

If an institution finances a construction project, it may incur fees on top of the repayment value and interest rate, including closing, inspection, and administrative fees. Some financial services also require home or site appraisals and insurance as part of the borrowing contract, which the borrower must cover unless otherwise agreed upon with the lender.

Note that banks and traditional lenders are highly conservative and generally decline loan applications for house flipping[3]. Investors usually turn to hard money or private lenders, whose terms may form part of soft costs.

Project Management, Taxes, and Administrative Fees

The construction process can be overwhelming, even for experienced developers. For this reason, most developers or investors will hire a construction manager to coordinate with subcontractors and other teams to keep track of all the progress and changes that happen throughout the course of a construction or renovation project.

Construction managers are also responsible for securing permits and handling other administrative work. Occasionally, they can file all construction-related taxes, such as sales tax for all construction materials[4].

Legal Fees

An attorney is required during the home closing process, which involves ensuring the turnover of the property title from the buyer to seller is legitimate and done under state and federal requirements. Their services may also be necessary for drafting contractor and subcontractor agreements and purchase or lease agreements[5]. These are all soft costs under legal fees.

Marketing

If the investor intends to flip the property, or if the property will be sold or leased out, the investor or the developer needs to create advertising assets, brochures, photography, and possibly a website for larger-scale projects. These expenses fall under soft costs.

Interior Design

Interior design is purely optional, but some turnkey residential properties may appeal to some buyers who want a fully livable or furnished home when they move in. Interior design falls under soft costs in this scenario. The seller may hire an interior designer to create an interior based on the client’s requests.

Apart from interior design services, movable furniture (or those not built into the property) also fall under the category of soft costs. In these cases, it might be helpful to discuss the furniture budget with the designer before designing the interior.

Financing Soft Costs

Most lenders will cover hard costs, but soft costs are generally out-of-pocket for real estate developers and investors[6].

However, some loans are available to buyers and investors that cover some soft costs. These include construction-to-permanent loans (which convert the loan into a mortgage after the property has been constructed) to construction-only and renovation loans.

However, not all of them cover all types of soft costs[7]. Lenders often have specific clauses addressing soft costs that disclose the exact coverage and limitations of the loan.

Is There Insurance for Soft Costs?

Insurance for building construction or renovation is generally classified as a hard cost. An example is a builder’s risk insurance that insures construction materials and on-site equipment and any losses in sales, income, and additional taxes that may occur due to unforeseen circumstances. It mitigates the risk of natural calamities, such as fires and hurricanes and other unnatural occurrences, such as theft and vandalism[8].

Insurance for soft costs is mostly written under the terms of “delay in opening expenses” in commercial real estate. For instance, after a hurricane, developers would have to shell out additional funds for re-inspection fees, A&E services to revise initial plans, and possibly new studies to certify the feasibility of resuming construction[9]. The rationale is that soft costs are equally affected by natural calamities and other risks during production, although not all insurers cover all soft cost liabilities.

Takeaways

Soft costs are costs indirectly related to the construction or renovation of a property. These include securing permits, generating reports from inspections, design, architectural and engineering services, and legal fees. These miscellaneous fees may comprise up to a third of the budget and may change even after the project is completed.

Sources

- Big Cat Solutions. (2019.) SOFT COSTS: WHAT THEY ARE, & HOW THEY DIFFER FROM HARD COSTS. Retrieved from https://www.bigcatsolutions.net/blog/soft-costs-what-they-are-how-they-differ-from-hard-costs/

- Central Geotechnical Services. (n.d.) Do I Need A Geotechnical Report? Retrieved from https://www.centralgeotech.com/geotechnical-engineering-information/do-i-need-a-geotechnical-report/

- Frankel, M. (2020.) How to Get a Loan for Flipping Houses. Millionacres. Retrieved from https://www.millionacres.com/real-estate-investing/house-flipping/how-get-loan-flipping-houses/

- Nelson, N. (2021.) Understanding sales tax rules for the construction industry. Wolters Kluwer. Retrieved from https://www.wolterskluwer.com/en/expert-insights/understanding-sales-tax-rules-for-the-construction-industry

- Bremer, Whyte, Brown & O’Meara. (n.d.) Real Estate and Construction Law. Retrieved from https://bremerwhyte.com/real-estate-and-construction-law/

- Davis, G.B. (2021.) What are Soft Costs: Financing House Flipping. LendingHome. Retrieved from https://www.lendinghome.com/blog/how-to/soft-costs-real-estate-investing

- Marquit, M. (2021.) What are construction loans and how do they work? Bankrate. Retrieved from https://www.bankrate.com/mortgages/construction-loans-explained/

- The Hartford. (2021.) What Is Builder’s Risk Insurance? Retrieved from https://www.thehartford.com/insights/construction/builders-risk-insurance

- Tucker, H., Childes, G., Catalano, F. (2015.) 3 Exposures to Consider on a Builder’s Risk Insurance Policy. Amwins. Retrieved from https://www.amwins.com/resources-insights/article/3-exposures-to-consider-on-a-builders-risk-insurance-policy_8-15