What Are Surface Rights?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

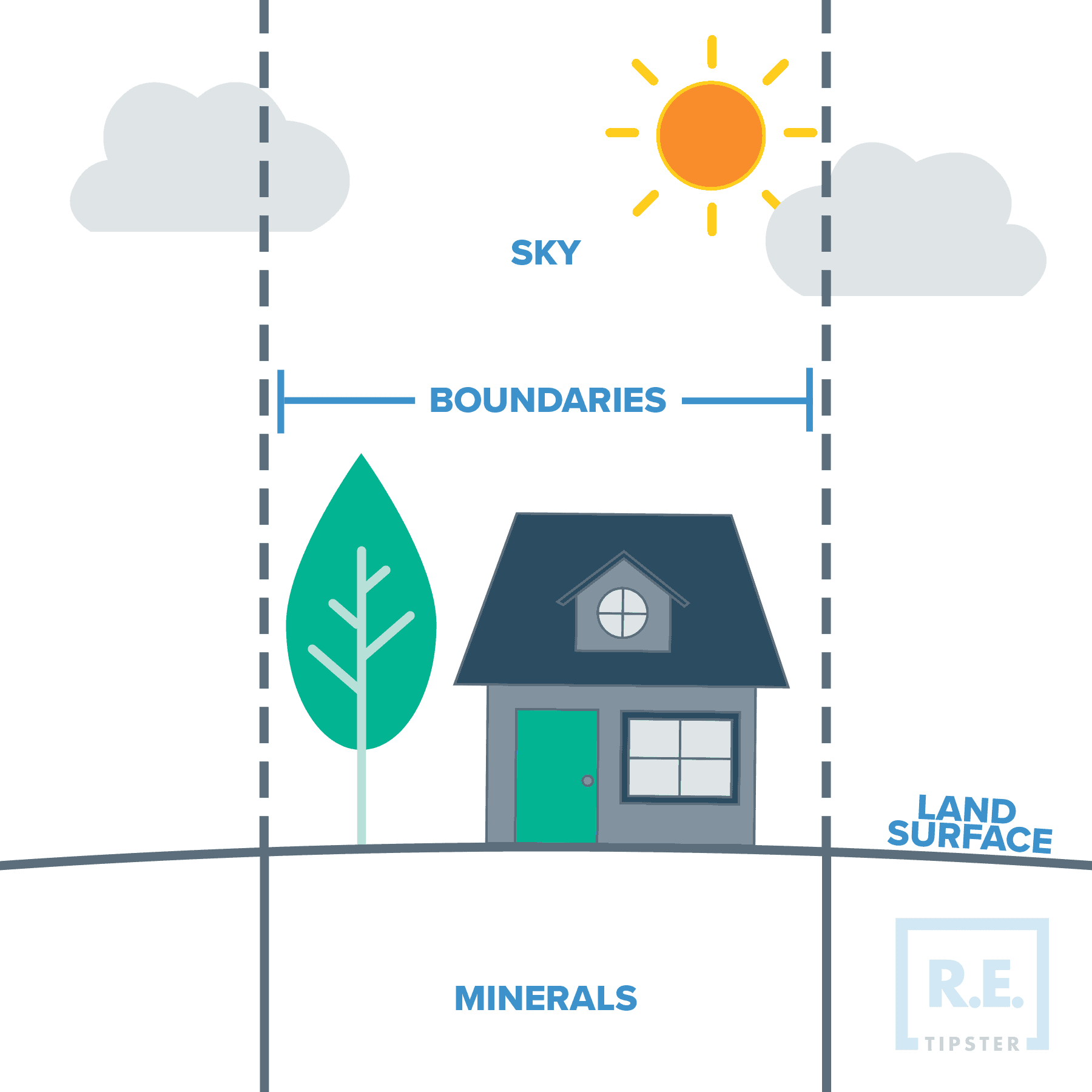

- Surface rights entitle an owner to control the use of the surface of their land, including benefiting from the resources they find above the ground.

- Surface rights often allow owners to tap the groundwater underneath a property and bury septic and heating oil tanks.

- Surface rights include building structures, farming, planting trees for timber, and accessing water on a property.

- By contrast, mineral or subsurface rights, unlike surface rights, grant control over underground resources.

- A person or entity can buy land without surface rights or vice versa, so checking the property deed for ownership rights is a good idea.

How Deep Are Surface Rights?

Surface rights typically extend aboveground and can also extend dozens of feet below the surface. Owners can often bury tanks, septic systems, or store heating oil underground without impacting ownership, within the limits of applicable state or municipal laws.

These rights often allow owners to dig, insert pipes, or drill holes up to a certain depth, depending on local regulations. Some owners use these rights to make private water wells[1], wine cellars, or emergency bunkers.

What Are Examples of Surface Rights?

Examples of surface rights include the rights to build a house, plant crops, raise livestock, grow timber, and access groundwater.

As long as you don’t break laws, you can do whatever you want with what you can generally find on your property. You can even control the airspace directly above it[2].

As the surface rights holder, you may sell and pass them to your heirs[3].

Which Ownership Rights Can Be Sold Separately From a Property’s Surface Rights?

Mineral rights are ownership rights that can be sold separately from a property’s surface rights.

Property owners typically own both surface and mineral rights, creating a unified estate. This means if you find gold or oil on your property, you own it and can profit from it.

You can also sell all or part of your mineral rights to someone else[4], turning your property into a split estate[5]. Meanwhile, if it’s divided among multiple parties, it becomes a fractional estate.

After selling your property’s mineral rights, future owners will only have surface rights unless the mineral rights are subsequently purchased or otherwise transferred back.

Buying Land Without Surface Rights

Buying land without surface rights means purchasing only the mineral rights to it.

The deed for the land should say which rights the seller legally owns. When in doubt, a title company can help you determine which level of ownership is transferred.

Owning only mineral rights often makes you the dominant estate, allowing you to use underground resources, usually without explicit permission from the surface rights holder, as long as local authorities approve your activity[6].

Additionally, you may have the right to use the land’s surface to establish necessary equipment for your project or operation, but this may also be subject to negotiation and the approval of the local government.

Naturally, you can’t extract the resources underneath a piece of land without affecting its quality and appearance[7] and negatively impacting the surface rights owner’s interests. Therefore, the surface rights holder may request compensation for potential long-term losses from your activity or negotiate a contract outlining your surface operations’ boundaries.

Some owners may want the agreement to include clauses protecting local water resources and requiring land restoration after mineral extraction[8].

In split estates, mineral rights owners and surface rights holders often negotiate drill site locations and features like easements and access roads. However, while these negotiations are crucial, certain requests may not be feasible if they compromise the viability of the mineral extraction project.

What Are Subsurface Rights in Real Estate?

In real estate, the term “subsurface rights” is another word for mineral rights.

Keep in mind that owning these rights doesn’t mean all underground resources belong to you. Typically, mineral rights only apply to the following:

- Precious metals (e.g., gold and silver).

- Fossil fuels (e.g., oil, natural gas, and coal).

- Heavy metals (e.g., copper and uranium).

- Precious stones (e.g., diamonds, amethysts, emeralds).

Meanwhile, the property’s surface rights holder owns common materials like limestone, sand, and gravel[9]. The same goes for subsurface water sources. Which materials and resources belong to the owner may vary based on the area, so if in doubt, check your state and local laws.

In the same vein, subsurface rights aren’t always limited to the resources below the land, as holding these rights can entitle you to minerals present on the property’s surface.

If you own subsurface or mineral rights to a property but don’t wish to extract its resources, you can sell these rights to interested parties and retain the sale profits. Alternatively, you can lease your rights to others, let those with expertise and capital manage an oil, gas, or mining operation, and receive a cut from the profits.

A third option is a combination of the first two. You can sell a portion of your rights and lease the rest. This way, you can earn a large sum upfront and passively build generational wealth with royalties as a lessor[10].

RELATED: What Every Land Investor Should Know About Mineral Rights

Surface Rights vs. Mineral Rights

Comparing surface and mineral rights can help clarify who owns a property’s different resources.

Ideally, an owner would possess both rights. However, in cases where you can only acquire one, mineral rights can be more valuable due to the potential economic benefits. These rights often take precedence over surface rights in law, though exercising them can require navigating local zoning laws and potential conflicts with surface rights owners.

However, mineral rights can impose limitations through depth rights. These limits the end point of your rights to the resources beneath the land’s surface.

The Kola Superdeep Borehole, the deepest borehole in the world (shown in this photo welded shut). The numbers “12262” refer to its vertical depth of 12,262 meters (40,230 ft or over 7.6 miles). (by Alexander Novikov, CC BY-SA 4.0, via Wikimedia Commons)

For example, if zoning regulations say that you can’t drill deeper than 15,000 feet below the ground, you can’t legally extract and sell the potential or proven mineral reserves deeper than or beyond that point.

Depth restrictions can have economic implications. If you lease your mineral rights, your agreement should account for any depth restrictions, as they can affect the potential profitability of mining or drilling operations.

Sources

- Learn About Private Water Wells. (2023, March 1.) United States Environmental Protection Agency. Retrieved from https://www.epa.gov/privatewells/learn-about-private-water-wells

- Ownership of Airspace Over Property. (n.d.) US Legal. Retrieved from https://aviation.uslegal.com/ownership-of-airspace-over-property/

- Shuriah, N. (2022, April 7.) 5 Ways to Transfer a Home to Your Child. First Citizens Bank. Retrieved from https://www.firstcitizens.com/wealth/insights/planning/transfer-home-to-children

- Ross, B. (2015, July 21.) Who Owns the Minerals Under Your Property. Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/who-owns-the-minerals-under-your-property.html

- Mall, A. (2014, May 9.) It’s time to eliminate hurdles for split estate landowners to buy federal oil and gas rights. NRDC. Retrieved from https://www.nrdc.org/bio/amy-mall/its-time-eliminate-hurdles-split-estate-landowners-buy-federal-oil-and-gas-rights

- Application for Permits to Drill. (n.d.) Bureau of Land Management. Retrieved from https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/operations-and-production/permitting/applications-permits-drill

- Can we mitigate environmental impacts from mining? (2019, July 12.) American Geosciences Institute. Retrieved from https://www.americangeosciences.org/critical-issues/faq/can-we-mitigate-environmental-impacts-mining

- Land Rehabilitation After Mining. (2020, August 31.) American Mine Services. Retrieved from https://americanmineservices.com/land-rehabilitation-after-mining/

- Chapter 6 Drilling Technology and Costs. (n.d.) U.S. Department of Energy. Retrieved from https://www1.eere.energy.gov/geothermal/pdfs/egs_chapter_6.pdf

- Autry, M. (2022, November 1.) Paying It Forward: Ensuring Your Beneficiaries Get Full Rights to Your Mineral Assets. Wealth Management. Retrieved from https://www.wealthmanagement.com/estate-planning/paying-it-forward-ensuring-your-beneficiaries-get-full-rights-your-mineral-assets