What Is Year-to-Date (YTD)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Year-to-date or YTD is a timeframe that tallies the total of something from the start of the current calendar year until today.

- You can use year-to-date to assess investment returns, earnings, payroll expenses, and interest payments, to name a few.

- YTD data matters because it offers live updates about progress and trends, which simplifies evaluating if you’re trying to meet specific goals.

- The expansive scope of YTD can intersect with concepts like the fiscal year (FY) and period to date (PTD), depending on the context.

Why Is YTD Important?

YTD offers a peek into an individual or organization’s finances. Beyond record-keeping, it aids in goal tracking and future cost estimation. YTD is notably handy for gauging returns, earnings, and net pay.

This data enables investors and investment managers to demonstrate how asset values have risen or fallen since the year’s start. They can then predict potential asset price trends and adjust strategies accordingly.

While year-to-date, like many financial metrics, doesn’t provide a complete picture, it helps in tracking financial progress throughout the year. YTD figures allow for trend identification and improved decision-making rather than waiting to analyze numbers at year’s end.

There are also subcategories within YTD. Three of these are described below.

YTD Earnings

YTD earnings refer to the total money a person has earned since January 1st. This information, alongside withholdings, typically appears on an employee’s payslip.

For the self-employed and independent contractors, YTD earnings indicate their total net revenue. For businesses, YTD earnings can display the cumulative amount all employees have earned since the beginning of the year.

YTD Net Pay

YTD net pay, while similar to YTD earnings, only represents the employee’s total earnings after the deduction of benefits like Social Security and Medicare and any applicable taxes[1].

YTD Interest

YTD interest shows the amount of interest one has either paid or earned from the beginning of the year to today.

As interest rates are given in percentages, they don’t precisely show the actual cash amount spent or earned in the current year[2].

YTD interest makes it simple to keep tabs on all interest paid on debts or earned from investments and bank accounts since the start of the year.

BY THE NUMBERS: 4 out of 10 American credit cardholders do not know their credit card’s interest rate.

Source: CNBC

How to Calculate YTD Return

YTD return is a numerical figure that investors use to see how much an investment has gained or lost since the start of the current year. As YTD sums up data from the first day of the current year to today, this number changes daily or monthly.

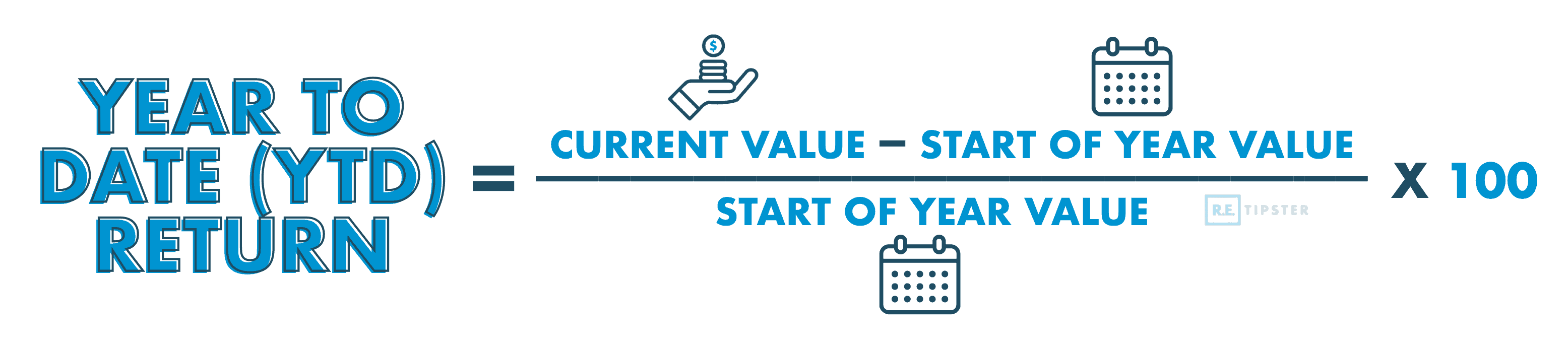

To figure out how the value has evolved, year-to-date return should be represented as a percentage, much like calculating stock performance.

For this, subtract the figure from the first day of the year from the current value after markets have closed[3]. Then, divide the difference by the figure from the start of the year. Multiply the resulting number by 100 to get it as a percentage.

For instance, if your real estate investment trust (REIT) stocks were worth $200,000 on January 1st, and they’ve grown to $275,000 today. Using the formula mentioned, the difference is $75,000, making the YTD return 37.5%.

Comparing YTD With Similar Concepts

Year-to-date’s wide scope means it intersects with related concepts.

YTD vs. Gross

YTD can also encompass gross data, such as YTD payroll. Here, it refers to the money paid[4] to full-time employees, freelancers, or independent contractors, which can include salaries or wages, as well as commissions.

You don’t need to calculate each worker’s net pay in this case. For the business leaders who need this information, the primary concern is the money leaving the organization, not where it eventually goes.

Establishing what proportion of total business expenses constitutes payroll can reveal if a company is overpaying or underpaying for labor relative to output[5]. If a company lacks enough staff to meet targets, YTD payroll data helps determine if there’s budget room to recruit more people.

Conversely, if the company is overstaffed[6], this number can justify layoffs, helping to decide which and how many roles to cut without impacting productivity.

Also, YTD payroll figures play a key role in projecting potential tax liabilities on a quarterly and annual basis, helping to keep cash flow under control.

BY THE NUMBERS: Employee benefits make up up to 30% of all labor costs.

Source: The Business Journals

YTD vs. Fiscal Year

The standard definition of year-to-date refers to the period from the start of the calendar year to the current date. However, in some contexts, it can refer to the period from the start of the fiscal year.

Both calendar and fiscal years span 12 consecutive months. However, a fiscal year may start on the first day of any month, not just January. Therefore, YTD doesn’t always begin on January 1.

For example, many universities mark June as the end of their fiscal year because they tend to base their fiscal year around the academic year[7] ending in June. Meanwhile, the fiscal year for the U.S. federal government runs from October 1 to September 30 of the following year[8].

Companies can choose their fiscal years based on their business requirements or revenue cycles. For instance, Apple’s fiscal year runs from October to September of the following year; Microsoft’s from July to June of the following year; and Adobe’s from December to November of the next year[9].

However, most publicly traded companies stick to the calendar year for their fiscal year to keep things straightforward.

Note, for tax purposes, the IRS allows businesses to designate a fiscal year that ends on the last day of any month, including December, as their tax year[10].

YTD vs. Period-to-Date

Period-to-date, or PTD, is a date range that starts from a specified date and ends on another specific date, making it similar to, yet distinct from, YTD. Unlike YTD, PTD isn’t constrained to the start of the calendar and doesn’t need to span a set 12-month period.

PTD can provide more flexibility when one needs to go beyond the rigid parameters of YTD or account for partial data.

Sources

- Understanding paycheck deductions. (n.d.) Consumer Financial Protection Bureau. Retrieved from https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_understanding-paycheck-deductions_handout.pdf

- Burnette, M. (2022, October 14.) How to Calculate Interest in a Savings Account. NerdWallet. Retrieved from https://www.nerdwallet.com/article/banking/how-to-calculate-interest-in-a-savings-account

- Kennan, M. (2013, June 9.) YTD Stock Performance. The Nest. Retrieved from https://budgeting.thenest.com/ytd-stock-performance-31026.html

- What is a payroll expense? A guide to payroll expenses. (2020, October 19.) QuickBooks. Retrieved from https://quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/

- Ingram, D. (2011, June 10.) What Is Included in Labor Cost? Chron.com. Retrieved from https://smallbusiness.chron.com/cost-plus-incentive-fee-vs-fixed-priced-contract-11291.html

- Stace, C. (2022, June 14.) Understaffing and Overstaffing – A Delicate Balance. Factorial. Retrieved from https://factorialhr.com/blog/understaffing-overstaffing-guide/

- U.S. colleges and universities raised $52.9 billion in FY21. (2022, February 19.) Philanthropy News Digest. Retrieved from https://philanthropynewsdigest.org/news/u.s.-colleges-and-universities-raised-52.9-billion-in-fy21

- Budget of the U.S. Government. (2022, June 7.) USAGov. Retrieved from https://www.usa.gov/budget

- Raman, M. (2016, October 29.) Why Do Different Companies Have Different Fiscal Years? Yahoo News. Retrieved from https://www.yahoo.com/news/why-different-companies-different-fiscal-161925029.html

- Tax Years. (2022, September 14.) Internal Revenue Service. Retrieve from https://www.irs.gov/businesses/small-businesses-self-employed/tax-years