What Is Yield?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Is Yield in Real Estate?

Real estate investors pursue yield by purchasing income-generating property and renting it out. Yield is often used in the discussion of income or cash flow projections since yield is forward-looking. Contrast this with return on investment, which refers to an investment gain or loss expressed in dollar value[1].

When calculating yield, it is essential to distinguish between “gross yield” and “net yield.” Gross yield is the yield before expenses are accounted for[2], while net yield is the yield that remains after deducting all running costs.

Yield can technically be used for any real estate investment, such as a fix-and-flip. However, yield is measurable by its income over a certain time frame, which flipping does not typically have.

For simplicity’s sake, “yield” in this article means “rental yield.”

Gross Yield

Gross yield is essential when comparing two kinds of investments (such as real estate or bonds).

For example, investors can filter a prospective rental property using a specific yield to compete with other investments’ yields. They can also use the yield estimate from a particular property to set a reasonable monthly rent for their tenants.

Investors can calculate gross yield by dividing annual rent collected by the property’s purchase price, then multiplying the result by 100 to get a percentage:

GRY = (AR / PP) x 100

Where:

- GRY is the gross rental yield;

- AR is the annual rent; and

- PP is the property’s purchase price.

Note that some investors instead use an estimate of the property’s appraisal value, while others use a comp analysis. However, many investors (especially those who have just bought the property) tend to use its purchase price[3].

Net Rental Yield

Investors can also rely on an estimate of net rental yield to plot their real estate investment strategy. This yield estimate is useful, particularly when evaluating a property purchase.

In a net rental yield, all expenses related to operating and maintaining the property are deducted from the equation. These “running costs” include taxes, insurance, repairs, property management, and vacancy. Mortgage payments and other debt service costs, if any, are excluded in computing net rental yield.

To compute the net rental yield[4], an investor should subtract annual operating expenses from the annual rent collection. The result is then divided by the property’s purchase price, after which the resulting figure is multiplied by 100 to get the percentage:

NRY = ([AR – OC] / PP) x 100

Where:

- NRY is the net rental yield;

- AR is the annual rent;

- OC is the annual operating costs; and

- PP is the property’s purchase price.

In many cases, net rental yield is the same as the cap rate.

What Factors Determine Yield?

The yield of a rental investment can vary depending on the conditions of the market. Other factors include the type of property, its location, and its management.

There are two categories of rental properties: residential and commercial. Residential properties comprise either single-family or multifamily homes. The latter can include condo units, duplexes, apartments, and townhouses. Properties with more than three bedrooms and two bathrooms generally attract more tenants.

Commercial rentals, on the other hand, include retail spaces, office spaces, self-storage, warehouses, and the like[5].

Both rental types can be rented out for short or long periods. Short rentals include vacation rentals, while long-term rentals include those leased for a year or more.

BY THE NUMBERS: Commercial real estate trumps residential in terms of yield, which ranges from 6% to 14%. Residential real estate yields only 1% to 4%.

Source: Nolo.com

What Is the Ideal Yield for Rental Investors?

All things being equal, experienced real estate investors consider 7–8% yield as ideal. Risk-averse investors, however, settle for a lower rental yield, given that higher yields usually carry higher risks[6]. These investors instead seek capital growth through a long-term, buy-and-hold strategy.

Investors who want the highest yields possible manage costs, such as tenant vacancy, among other measures[7].

What Locations Have the Best Yields?

Generally, areas with relatively lower home prices often reach the highest residential rental yields, ranging from 10% to 15%. The low purchase price for these properties skews the calculation in favor of higher percentages[8].

The nearer the location to an investor’s residence, the more favorable it is for them. This proximity makes it easier for them to manage the property, even allowing them to forgo hiring a property manager. Moreover, they already know the area, so they can easily check or validate research on local rental demand[9].

However, if investing in an unfamiliar, remote, or isolated area, investors need to perform research to pick properties with the best potential rental yield. An undersupplied area is ideal. In any case, investors must examine the current rentable square footage and any commercial construction, either planned or underway[10].

BY THE NUMBERS: A real estate rental yield in New York City is rated “poor,” at only 2.91%.

Source: GlobalPropertyGuide.com

Takeaways

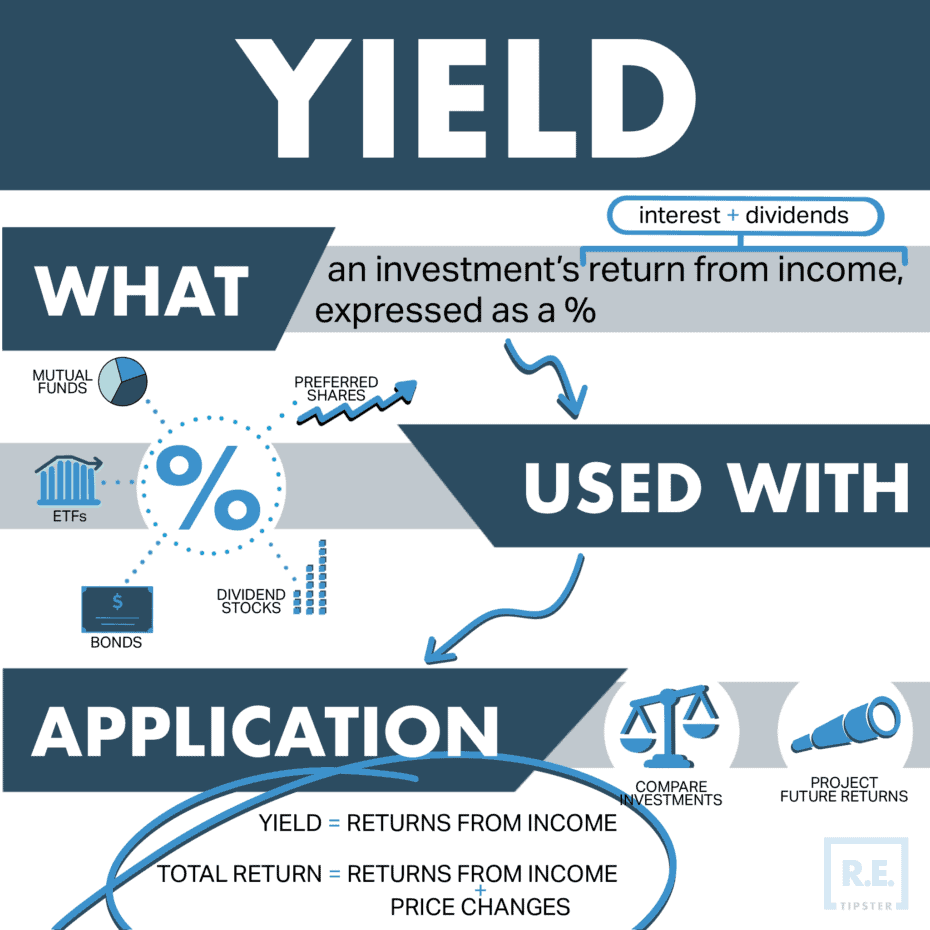

Yield refers to the potential income of an investment, usually expressed as a percentage.

In real estate, yield is often used in the context of income over time, which makes it a metric to determine rental rates and potential revenue.

Determining yield is different for gross rental and net rental yields. Gross yield is useful to analyze comps or set rates, while net yield can help investors fine-tune their investment strategies and diversify their portfolios.

Sources

- Banton, C. (2021.) Yield vs. Return: What’s the Difference? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/difference-between-yield-and-return/

- Rhode, J. (2021.) What is Gross Yield in Real Estate Investing? Roofstock. Retrieved from https://learn.roofstock.com/blog/gross-yield-real-estate

- Frankell, M. (2020.) What Is Gross Rental Yield? Millionacres. Retrieved from https://www.millionacres.com/real-estate-basics/real-estate-terms/what-is-gross-rental-yield/

- Kimmons, J. (2019.) Net Rental Yield for Property Investors. The Balance Small Business. Retrieved from https://www.thebalancesmb.com/net-rental-yield-calculation-for-real-estate-investors-2866812

- Brumer, L. (2019.) Rental Property Investing Basics. Millionacres. Retrieved from https://www.millionacres.com/real-estate-investing/rental-properties/rental-properties-guide/

- Baker, H. (2019.) What Is a Good Rental Rate for Your First Property? Mashvisor. Retrieved from https://www.mashvisor.com/blog/what-is-a-good-rental-yield-first-rental-property/

- Eberlin, E. (2019.) Learn How to Successfully Manage a Rental Property. The Balance Small Business. Retrieved from https://www.thebalancesmb.com/how-to-successfully-manage-investment-property-4059905

- Friedman, R. (2017.) How (and Where) to Get the Best Return on Rental Property. The Wall Street Journal. Retrieved from https://www.wsj.com/articles/rental-returns-lure-real-estate-investors-1496847312

- Elliot, C. (n.d.) Key Factors to Finding the Perfect Rental Property Neighborhood. Listen Money Matters. Retrieved from https://www.listenmoneymatters.com/rental-property-neighborhood/

- Brumer, L. (2021.) 6 Things You Need to Know Before Investing in Commercial Real Estate. Millionacres. Retrieved from https://www.millionacres.com/real-estate-investing/commercial-real-estate/6-things-you-need-know-investing-commercial-real-estate/