Real estate comes with enormous advantages, from ongoing passive income and long-term growth to inflation protection and tax advantages, even the ability to leverage other people’s money.

Combine all those, and it’s no wonder so many investors use real estate to retire early.

Still, real estate is expensive. Investors with only $100 to their name have fewer options than those with $100,000. But if you do have six figures to invest in real estate, how should you invest it? What are the best options available to you?

Consider these ideas as you explore the best ways to invest $100,000 in real estate.

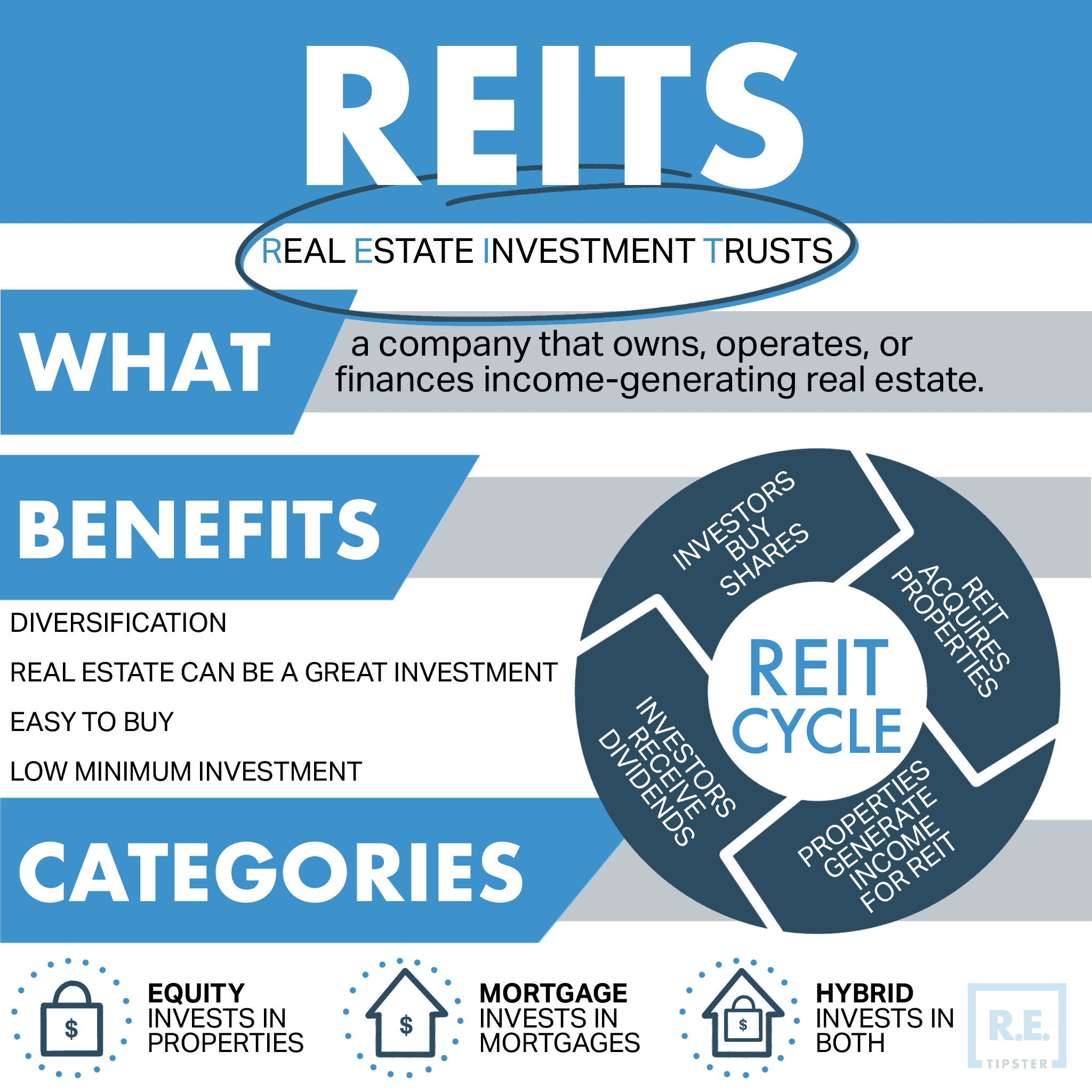

1. Real Estate Investment Trusts (REITs)

When most investors think of diversifying into real estate, their first thought is REITs.

These equities trade on public stock exchanges, so you can buy and sell at a moment’s notice. And there’s no minimum investment other than the price of a single share. That could cost you as little as $10.

You don’t need to open a new account to trade them, either–you can access them through your regular brokerage account or IRA.

For all those advantages, REITs are volatile, and too closely correlated to stock markets for many investors’ comfort. After all, what’s the point of diversifying away from stocks if they correlate closely?

If you want more diversification benefits, keep researching other ways to invest in real estate.

RELATED: REIT: Can It Build Your Portfolio and Generate Wealth?

2. Short-Term Real Estate Crowdfunding Investments

Most real estate investments require a long-term commitment. Real estate is inherently illiquid after all, costing thousands of dollars and several months to buy or sell.

But in today’s world, technology makes it easier to buy and sell fractional ownership of properties or loans secured by real property. Many investors new to real estate prefer to start with short-term investments to dip their toe in and test the waters.

For example, Groundfloor lends purchase-rehab loans to real estate investors, with loan terms ranging from 6-18 months. You can invest as little as $10 toward any particular loan and earn the full interest (typically 8% to 14%). You get repaid in full, plus interest, when the borrower repays the loan. (For more details, read our full Groundfloor review.)

Alternatively, you can invest in a pooled fund that owns short-term secured loans for more liquidity. Groundfloor offers such a fund through their Stairs app, paying 4% to 6% interest. You can withdraw your money at any time, penalty-free. Concreit offers a similar competing fund, paying 5.5% (read our full Concreit review here).

Other short-term real estate crowdfunding investments include Ark7 and Lofty, which both offer fractional ownership in rental properties. You can buy shares of rental properties for $20 to $50, and sell them at your leisure on their secondary markets.

3. Long-Term Real Estate Crowdfunding Investments

Despite the rise in short-term real estate investments in recent years, real estate remains a long-term investment. It’s true for buying properties directly, and it’s true for most real estate crowdfunding platforms.

Many options hit you with a penalty if you sell within the first few years. For instance, Fundrise charges you 1% on some holdings if you sell within the first five years of buying. When you invest with them, your money spreads among many different pooled funds and “eREITs” owning both properties and secured loans. Only some of those hit you with the 1% penalty for early withdrawal. (Read our full Fundrise review for more information.)

To invest in commercial office buildings, Streitwise owns several across the Midwest and pays a hefty dividend yield. They charge an early redemption fee on a sliding scale if you sell your shares within five years.

Arrived offers fractional ownership in rental properties, similar to Ark7 and Lofty. While they don’t offer an early redemption option (yet), some of their properties operate as short-term vacation rentals to diversify even further.

If you’re an accredited investor, you can buy fractional ownership in commercial properties through Crowdstreet or EquityMultiple. These platforms simply make it convenient to invest in real estate syndications, but you can also invest in them directly.

4. Real Estate Syndications

Real estate syndications come with many enormous advantages and a few downsides as well.

In a syndication, a commercial investor (the sponsor) finds a deal they love and typically borrows 50% to 75% of the purchase price. They come up with part of the down payment themselves, but can’t come up with all of it. So they raise the rest from passive investors like you and me.

In exchange, we get fractional ownership of the property. That entitles us to a share of the cash flow while the property is owned and a cut of the profits when it sells. Often syndications pay returns in the 15% to 50% range (or even higher) without any of the responsibilities, labor, or skill required to find and manage deals yourself.

Passive investors (called limited partners) get nearly all the same tax benefits as landlords get on rental properties. In fact, they usually get accelerated depreciation, getting to write off paper losses on their tax return even as they collect distributions.

But syndications come with disadvantages too. First, they’re not liquid; once you buy in, you lock up your money until the sponsor sells or refinances the property. Second, most sponsors require a minimum investment of $25,000 to $100,000. Finally, it takes some effort on your part to find and vet sponsors.

Real estate syndications remain one of my favorite ways to invest, however, with nearly all the advantages of direct real estate investing with few of the disadvantages.

5. House Hacking

If a genie offers you a wish, everyone knows you should wish for more wishes.

The same logic applies to house hacking. If you have a little money, you can use it to ditch your monthly housing payment forever, freeing up thousands of dollars you can reinvest every month.

The classic house hacking strategy involves buying a multifamily property such as a duplex or quadplex, moving into one unit, and renting out the others. The rents from your neighboring units ideally cover your monthly mortgage payment plus repairs and maintenance, leaving you with no housing costs whatsoever. You could take that money and blow it on a fancier car and dinners out, or you could do the smart thing and reinvest those savings every month for compounding returns.

Hate the idea of living in a multifamily property? Try these other house hacking ideas out instead.

As a final note, house hacking lets you buy a multifamily property with owner-occupied financing. Read: lower down payment, lower interest rate, and lower fees than investment property loans. You must live in the property for at least a year, then you can move out and keep it as a rental property—and rinse and repeat to keep growing your portfolio.

6. Buy Rental Properties

While house hacking offers an easy way to start rental investing, it’s far from the only way.

Rental properties generate ongoing income from the day you buy them. You lock in a monthly mortgage payment, which stays fixed even as you raise the rent each year. That means that the gap between your mortgage payment and your rent grows disproportionately over time.

Imagine you buy a property that rents for $1,000, and the mortgage payment costs you $500. After the first year, you raise the rent to $1,050 (a 5% increase). The gap between your mortgage payment and the rent jumps from $500 to $550—a 10% increase.

Those same mechanics make rental properties (and syndications, for that matter) a great hedge against inflation. Inflation drives up rents but reduces the value of your monthly mortgage payment. In fact, rents usually drive inflation higher!

Eventually, your tenants pay off your mortgage entirely, and your cash flow explodes even further.

If you don’t like the idea of becoming a landlord, you can always rent your property short-term on Airbnb. It requires more labor on your part (or higher property management fees) but offers higher returns in some markets.

7. Flipping Houses

While you may not be familiar with how real estate syndications or crowdfunding work, you probably know how flipping houses works.

You can earn high returns in a short time frame by flipping houses. Oftentimes, house flippers double or triple their down payment. But that financial return doesn’t account for all the labor involved in finding deals, financing them, hiring and managing contractors, pulling permits, hassling with city inspectors, working with real estate agents, and selling properties.

In other words, house flipping is one of the most labor-intensive ways to invest in real estate. But for many investors, it’s also a ton of fun. If you suspect you’d enjoy it, start with properties that need cosmetic repairs before diving into renovation projects that require structural or mechanical repairs.

8. Flipping Land

No one says that properties need a building on them to flip them for profit.

You can buy land for as little as a few hundred dollars and often sell it for 100% or higher returns. Some investors earn millions of dollars each year on land investing. But you need to know what you’re doing, or you’ll just end up with a few acres of desert that no one wants.

Check out our Land Investing Masterclass if you want to build a business around flipping land. Emphasis on the word “business,” because you need to set up automated ways to generate leads from sellers and market land parcels to potential buyers. It feels more like creating an online business than physical real estate investing.

9. Lend Private Notes

If you know successful real estate investors, you can piggyback on their labor and returns by simply lending them money.

They do the work of finding deals, screening tenants, fixing toilets, and wrangling contractors. You just write them a check and let them pay you interest.

Years ago, I lent money to a real estate investing couple in Ohio at 10% interest. They still pay me 10% interest on it like clockwork.

But don’t just lend private notes to anyone. Make sure you know, like, and trust a real estate investor before offering them a loan. Review their track record, and only lend money to experienced real estate investors with endless integrity.

Final Thoughts

I love stocks, and I believe they make up a crucial part of every investor’s portfolio.

But you just don’t get the same tax advantages or cash flow from stocks as you do from real estate.

Consider the concept of infinite returns. With the BRRR strategy (buy, renovate, rent, refinance), you can pull your entire down payment back out of a rental property, leaving you with $0 invested in it. You still own it, you still collect cash flow from it, but you don’t have a single dollar tied up in it. That leaves you free to recycle the same down payment over and over again to build a portfolio of cashflowing income properties.

You just can’t pull those kinds of maneuvers with stocks.