The BRRR strategy is technically the BRRRR strategy (but using so many “R’s” is kind of awkward to remember … not to mention a bit more cumbersome when typing into a search engine).

So let’s call it BRRR (pronounced like the sound you’d make when cold), but you and I know it’s really BRRRR. Let's talk about why…

What BRRRR Stands For

BRRRR is an acronym (first coined by Brandon Turner of BiggerPockets), that stands for the following 5 steps in strategically investing in a rental property.

- Buy

- Repair (or Rehab or Renovate)

- Rent

- Refinance

- Repeat

How BRRRR Works

- Buy: You buy a rental property for a below-market price. This typically involves a property that needs a little TLC.

- Repair: You then repair, rehab, or renovate that property so you can attract tenants who will pay the monthly rent to live in the property.

- Rent: Once the property is rented to good tenants, the property starts generating income, which thereby increases the home’s value.

- Refinance: Once you can show a lender that you are making money from this property and that you have equity in it, you should be able to do a cash-out refinance.

- Repeat: Go back to Step 1 (above), buy another property and do it all over again!

A note on the BRRRR strategy: it works best with properties you can get for below market value or in other words, homes that aren't move-in-ready.

Here’s an example that explains why:

Let’s say you’ve found a house listed for $120,000 in “as-is” condition.

Based on the comparable homes in the area, you determine that this home should be worth $150,000, assuming it's improved and in good shape.

Let’s also say this home has been on the market for a while and has had at least one price reduction. If you’re a good negotiator or you're working with a decent real estate agent, your offer should be less than asking price for this home.

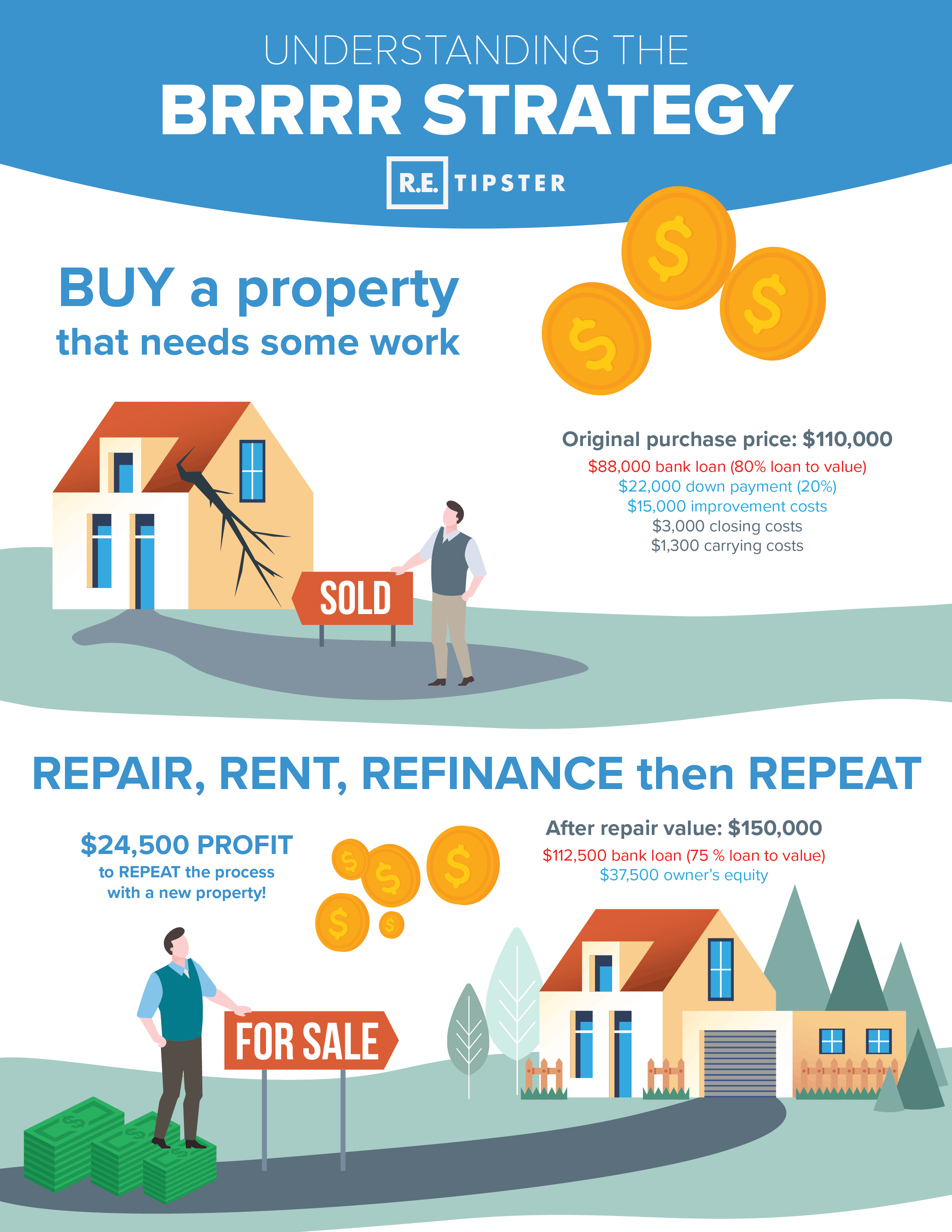

Suppose you get you the home under contract to purchase for $110,000 (or about 9% off the asking price). You put down 20%, which is $22,000 and get a loan for $88,000 to cover the full purchase price. You then put in another $15,000 of improvements to get it “rent ready”.

You’ll also have a couple more expenses to factor in: closing and carrying costs. Closing costs are typically 2% to 5% of the home’s purchase price. So in this case, they could be around $3,000. Carrying costs are the mortgage payments and utilities you need to pay while you are rehabbing the home that is sitting vacant (we could assume a vacancy period of two months in this example).

Let's recap those numbers so far…

- List Price: $120,000

- Sales Price: $110,000

- Down Payment: $22,000

- Loan Amount: $88,000

- Closing Costs: $3,000

- Carrying Costs: $1,300

- Rehab Cost: $15,000

- Potential After Repair Value (ARV): $150,000

Before we move on, here are two tips:

Tip No. 1: Unless you’re a professional contractor, you’ll want to hire professionals to rehab the place. It’s more cost-effective to hire the right people for the job than to cut corners and pay a more costly price at a later date. Remember, you want the job done quickly and with expertise, so you can start collecting rent as soon as possible.

Tip No. 2: Don't forget that this is a rental property, not a flip or a primary residence. You just need to get the house in as good a condition as other rentals in the area. It doesn't need to be the nicest home on the block with designer upgrades (True Story: When I won yard of the month with my first rental, it was then that I first suspected I might be overdoing the landscaping a bit). You want the home to be nice, a place people will want to live, but you don’t need to go overboard.

The Refinance Part of BRRRR

Okay, so you bought the home, made the repairs, and now you're collecting rent. Since you’ve made some big improvements, the home is now appraised at a whopping $150,000. Congrats!

Now that the overall value has jumped from $110,000 to $150,000 (with verifiable income from the tenants who are now paying rent), you can essentially hit the ‘reset' button by refinancing the loan, because the bank will now look at your property with a new set of eyes, with an appraised value of $150,000.

Most conventional banks will typically refinance up to 75% of an investment property's appraised value – so in this case, you'd be able to squeeze $112,500 out of the property's $150,000 value.

With this new $112,500 loan amount – you'll be able to pay off your original $88,000 bank loan and have an extra $24,500 leftover… and guess what?

That's enough for you to buy another rental property and start the process all over again!

Once you've been through your first BRRRR project, there's virtually no limit to how many more properties you can repeat the process with, because after your first deal is done, you'll be using the bank's money for every future project.

Of course – realistically – you'll probably encounter obstacles that make this process difficult to continue forever (changing interest rates, fluctuating markets, risk-averse banks, etc), but even so, there is beauty in the concept… however long you can run with it.

The fact that your original property (which grew substantially in value) will continue to generate enough income to pay for itself AND put money in your pocket each month. And you can use the refinanced value from that first property to continue buying and improving more cash flowing investment properties, all without tying up much (or any) of your own money. It's pretty cool!

The Origin of BRRRR

The strategy of buying, rehabbing, renting and refinancing rental properties is hardly a new idea.

Real estate investors have been following this model for years – long before the name “BRRRR” ever existed – but these catchy acronyms have a funny way of sticking, and because it's easy to remember, many real estate investors have grown familiar with the term.

BRRRR Alternatives

When it comes to the refinancing process, another option to wringing the equity out of your property is to take out a home equity line of credit (HELOC) on the home.

The benefit of a HELOC is that it won’t change the terms of your existing mortgage (say, if you originally got locked in at a longer-term or lower interest rate) so depending on the numbers and situation, a HELOC may be a better choice.

With a HELOC, you would be borrowing money against the equity in one rental property to buy another. Also, with a HELOC, you get a line of credit, similar to a credit card. You can borrow the money as needed until you max out the line or until the draw period ends, usually in 10 years, and you can get up to 20 years to repay it.

Not all lenders will let investors take out a HELOC on investment property, though. If that’s the case, you might consider taking out a HELOC on your primary residence, but of course, you would be putting your main home at risk if you cannot make the payments.

Using a Home Equity Loan (HEL) with the BRRRR Strategy

Similar to the HELOC is a home equity loan (HEL). A HEL is the same idea as a HELOC in that a HEL won’t change your mortgage terms, but the product is somewhat different.

With a HEL, you typically get a set amount instead of a line of credit. HELs also generally have a structured payment plan with a fixed monthly payment whereas HELOC repayment is determined by the amount you borrow and the shift in interest rates. A HEL term can range from 5 – 30 years, but 5 – 15 years is more typical.

As you can see, the trick with making a BRRRR deal work is in financing the properties. Try approaching a local bank about doing a cash-out refi or perhaps see about getting a HELOC or a HEL. Your best bet would be to contact your preferred lender to discuss all these options to see which (if any) would be the best choice.

Your End Plan

One important caveat to keep in mind with the BRRR method is that there are some tradeoffs. In a very real way, you are robbing Peter to pay Paul – taking money from one source and giving it to another. If you're a Dave Ramsey disciple with a goal of being debt-free, this strategy is diametrically opposed to that. The whole reason the BRRRR strategy works is because you're maximizing every possible dollar of bank debt you can get access to.

RELATED: Are You a Victim of These Money Myths?

Be careful not to get overly aggressive by getting yourself into a situation where you can’t make a payment, which could potentially cause you to lose your property and destroy your credit score. Something like that could happen if the economy takes a downturn in your area, for example, and people can no longer afford to pay rent.

Part of your strategy with BRRR might be to pay off your homes within a certain timeframe, say 10 to 15 years. Once you have the number of properties you feel comfortable with, you might want to stop buying more and to start aggressively paying them off.

A good method that works for many people is the debt snowball method. If you’re unfamiliar, the snowball method is paying more than the minimum on one property and the minimum on the others. When the first property is paid off, you take the money you were spending on that house and add it to the minimum payment you were making on the next property. You do that until that loan is paid off and so on until you own all your properties free and clear. And what an accomplishment that will be.