REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

I met Adam Carroll at a conference earlier this year, where he was one of the keynote speakers. When I talked to him at lunch, he was telling me about this thing called The Shred Method that struck me as a fascinating way to destroy personal debt much faster than most of us realize is possible.

Adam has spent the past two decades teaching people how to eradicate debt and leverage equity in the most efficient way possible. He's a two-time TED talk speaker with one talk surpassing 6 million views on Youtube and TED.com. Adam developed a proprietary program that helps people leverage their equity to pay off their debt much faster.

Links and Resources

- The Shred Method Masterclass

- Adam Carroll TED Talk: When Money Isn't Real: The $10,000 Experiment

- Adam Carroll TED Talk: The Changing Economic Realities of College

- What Is Velocity Banking?

- What is Amortization?

- What is Compound Interest?

- What is Sweat Equity?

- Dave Ramsey

- What Is a HELOC?

- House Hacker University Review

- What Is Loan to Value (LTV)?

- What Is Equity?

- Build a Bigger Life Manifesto by Adam Carroll

- Gusto

- Figure Lending for HELOCs

- Debt Free and Prosperous Living by John M. Cummuta

- 025: What is the “Infinite Banking Concept” (and is it really legit)?

- MoneyInsights.net (Infinite Banking Concept Specialists)

Key Takeaways

In this episode, you will:

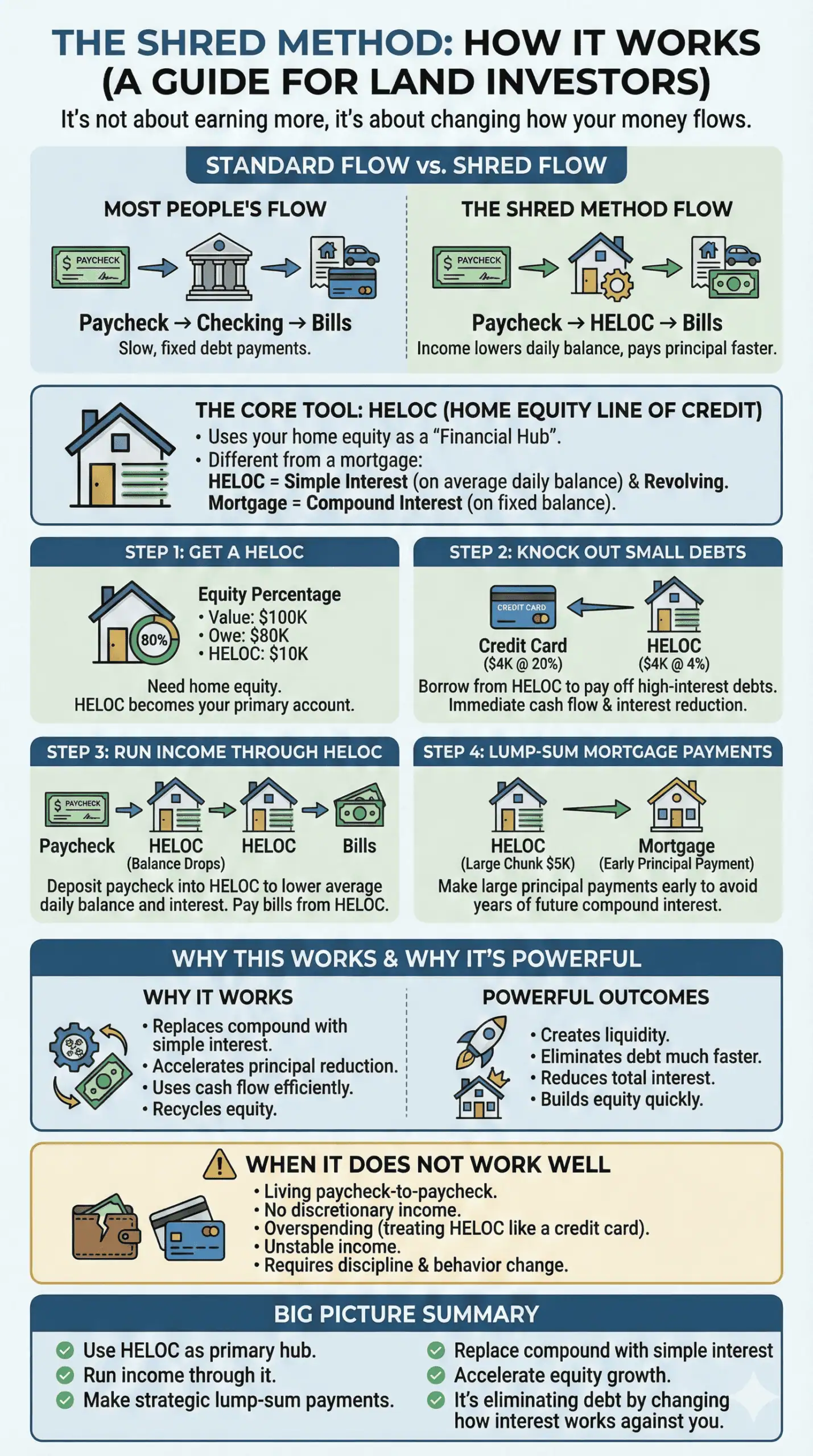

- Learn how the Shred Method works: using a HELOC to make large lump-sum payments.

- Find out about the other benefits of a HELOC, such as how it creates liquidity for emergencies or investments.

- Understand the impact of compound interest and how the Shred Method leverages simple interest calculations to minimize your overall interest payments.

- Explore how paying down high-interest debt first frees up monthly cash flow, which can be redirected to accelerate the payoff of other debts.

- Recognize the long-term benefits of the Shred Method in shaving years off your mortgage and other loans, saving thousands in interest payments.

Episode Transcript

Editor's note: This transcript has been lightly edited for clarity.

Seth: Hey, everybody. How's it going? This is Seth Williams and Jaren Barnes, and you're listening to the REtipster podcast.

Today we're talking with Adam Carroll. I met Adam recently at REWBCON in Phoenix, where he was one of the keynote speakers. And I got to sit at a table with him for lunch, talk to him for a little bit. And he was telling me about this thing called “The Shred Method.” That sounded like a fascinating way to destroy personal debt at a much faster rate than most of us realize is possible. And I'm not going to get too much into it because I don't want to steal the show from him.

But Adam has spent the past two decades teaching people how to eradicate debt and leverage equity in the most efficient way possible. He's a two-time TED Talk speaker with one talk surpassing 6 million views on YouTube and TED.com. Adam developed a proprietary system that helps people leverage their equity to pay off their debt much faster. And we're going to get into all that right here right now.

So, Adam, welcome to the show, how are you doing?

Adam Carroll: Seth and Jaren, thanks for having me, guys. I'm great. I'm excited to be here with your audience, with you guys. We have so much to share. And I feel like as real estate professionals and investors, this is all very, very timely.

Seth: Yeah. Just to kick it off, why don't you just—beyond what I just said—introduce you? Who is Adam Carroll? How did you get into this whole thing and how did you become a professional speaker, teaching about this whole topic of getting rid of debt?

Adam Carroll: My major in college, believe it or not, was broadcasting. The fact that I have a microphone at my desk and a podcasting machine in front of me is kind of cool. This is basically what I went to school for. But I got out of college and realized that I was a debt statistic. I had borrowed a lot of money. I was a rich college kid, living on borrowed funds. And then when I graduated, I realized I quickly became a broke professional.

And it occurred to me that no one had really taught me money growing up. My dad had made some hints about how to invest in mutual funds and that, but never really sat me down and created the right habits and taught me the ways, the rules of how to play the game of money that we all play at any given time.

It occurred to me after about two or three years of living very intentionally to get rid of debt. My wife and I lived on one income. We blasted away all of our debt with the other income that I could go teach this to people. And I started out by realizing I really wanted to teach college students how to do it because, in effect, college teaches us to be employable, but it doesn't teach us to be successful.

I started delivering messages on college campuses that led to doing a documentary on student loan debt. I have a couple of TED Talks under my belt. All the way along, just teaching myself money. I've read, I'm sure like you guys have, hundreds of books on personal finance and I just wanted to go share that with as many people as possible, trying to find the most efficient means that I could, both in sharing the information and in eradicating debt and building wealth.

And so, I've married those two about 10 years ago and I feel like I get to do a dream job now. I teach people about how to make the most of their money, and I get to speak at the same time. And typically, it paid pretty handsomely to do it. So, it's a good win-win.

Jaren: Adam, why do you think that there are so many institutions of education out there that don't address finances? Funny, the timing of this conversation, because I'm reading A Random Walk Down Wall Street and I'm starting to just educate myself on the managing side of money.

Because there are two sides to the coin. There's what you do to generate revenue, and then there's managing that revenue. And they're totally different skill sets.

Adam Carroll: Totally.

Jaren: But I've been in the pursuit of this, just learning about finance, I've run into so many financial podcasters. And so, they say that same thing. Education growing up doesn't teach us about money, but it's literally the most important thing for us to know. So, do you have any insight as to why it's just not addressed in most educational institutions?

Adam Carroll: Well, I think more and more states are beginning to make personal finance a graduation requirement. It's a one-credit class I'm sure, probably taught by someone who is passionate about it. Maybe I have gleaned some material off the internet. I still think we're woefully underprepared as far as high school kids go.

I was at a college not too long ago, in fact, and I don't get around to answering your question here, Jaren, I promise. But at this college, a young lady piped up and she said, "You said stocks. I have no idea what you're talking about. I don't even know how stocks work or what they are or how would I buy one. What do I put money in?" And she was a junior in college and this is part of the challenge.

So, I think to answer your question, Jaren, it's two things. Number one, I don't think we have enough people who are really skilled educators to be able to teach this in a way that kids get and appreciate. So that's number one, I think. And number two, particularly at the college level, I don't want to speak out of turn, I don't want to put any blame anywhere. But there was a period of time where folks said, “We don't want Adam's program on our campus because we don't want these kids to understand how much debt they're getting into.”

Seth: Interesting.

Jaren: Ouch.

Adam Carroll: It's certainly a reality and I appreciate the honesty of the comment, but it's also like, “Hey, hold on. There are a number of different ways we can afford college and make college affordable. It doesn't just mean we're going to take out private loans.”

I'm with you, though. I think that we have got to do a better job of layering this kind of education into society, which you guys are doing clearly. The REtipster community is growing and thriving and people are hungry for this stuff. So, if we don't learn it in school, kudos to the entrepreneurs who figure it out like you guys.

Jaren: Yeah, for sure.

Seth: Yeah. It is kind of crazy. I don't know what you call that kind of mentality, but I've seen it all over the place. Sometimes people feel like this about their competitors or whatever. It's not about the truth. It's just about self-preservation, whatever it takes to do that. Whether that means covering up the truth or lying about stuff. And everybody's susceptible to this. It's like a very human temptation that we all have to battle against. It's interesting to hear that going on at the college level, it's kind of sad.

Adam Carroll: And I think to that point, Seth, part of the upbringing and the socialization of people today, particularly with targeted ads on Instagram and Facebook and elsewhere, because we're so easily targeted and there's so much information about each one of us, the psychology of selling, like you can flip that switch over and over and over again on people.

I'm guilty. I've been targeted so much on Instagram. I've spent tens of thousands of dollars on stuff that my wife's like, "Really? What is this?" I'm like clearly, they were going after the mid-40-year-old bald dude who has money.

My aunt says I'm like a middle schooler with money. I'm just easily swayed, but because it's so easy to be swayed to buy stuff and the ability to buy stuff is so easy today, given credit cards and the easy access to credit, we don't really question that aspect of society anymore.

And I think we'll get into the Shred Methods certainly, but that's what I started doing. I started questioning, “Hey, if you drive around and you see all these banks, clearly they have something figured out.” Because banks are building new branches all the time. And if you think about what a bank offers, anytime you exchange money for something else, like if I'm going to buy a pair of shoes, I give them money. They give me shoes. If I go to get an insurance policy, I give them money, they give me an insurance policy. But we go to the bank and we give them money and we don't expect anything from them other than “Can I have access to my money? Do you have a cool website?” And hopefully, it's guaranteed, which they all are by FDIC.

But beyond that, they'll pay us 0.2% if we're lucky, and we're excited about that. So, I started questioning that model and the fact that our society is based on debt and consumption and all of that. And just started to turn it on its head, going, “What if we challenge that whole notion? What would it look like?”

Jaren: And when you factor in inflation, like that 0.002% return, you're losing money. If you just park it in a savings account, it's insane when you realize, “Oh, snap.” Just in spending power, it all drops upwards. If I park $10,000, $20,000 in a savings account, if I don't do anything else with it, I'm going to lose money, in terms of spending power.

So, it's extremely important to understand how this stuff works and understand how the economy works. I'm 30 in this game and I've been doing real estate stuff for the last, on and off, for the last 10 years. It's a trip how much that second side of the coin that I highlighted of managing money is a huge part of success in the long game, because you can make all the money in the world, but if it comes in and goes out, it doesn't make a dent in your lifestyle.

Adam Carroll: No doubt.

Jaren: Well, do we want to dive into the Shred Method a little bit, kind of like lay the foundation there?

Seth: I just have a passing question before we do that. I've never even really asked this question. I just assume this is how it has to work, but is it possible to survive in society without a bank account? Because I hear what you're saying and I totally agree. What does a bank do for you other than just hold your money? I could hold my own money, but I guess the ability to have a checking account is kind of necessary, or a credit card, or a debit card, or something like that, just for payment. Is there such a thing, or do any people survive without this at all? Is there a way to self-bank without Chase or Bank of America getting involved with the situation?

Adam Carroll: It's a great question, Seth. And I think you would actually have to look at other countries to see this being done successfully. Because I know that in parts of South America where there’s a very high percentage, 60%, 70%, 80% of people are unbanked. The way that they're transacting is through their cell phone. They will store money or units’ credits on their cell phone and they'll transact that way. And essentially, it's digital currency and we will get to a point, I think it's probably a decade away. But I think we'll get to a point where banks in their current form will become less and less and less relevant.

Certainly, the Shred Method uses banking tools and resources and I'm hopeful even on this podcast, what I'd want to clearly articulate to your tribe is that the tools that we have access to through our banks, there are efficient tools and there are inefficient tools. And most of us have been programmed to believe that a mortgage, as an example, is a very efficient tool. “Well, I get such a low rate and this is great. I'm going to hold it for a long time. I'm going to finance every chance I get.” But in reality, when we do that, we play the bank's game.

Going back to your original question, I think there will come a time where we can get there, but even I rely fairly heavily on the bank as a holding mechanism. And I'll describe as we go along kind of how the money flows through and what's created. But at this point, yeah, I think we're sort of encumbered to banks, at least for the next decade until cryptocurrency and some other DeFi and things like that take over.

Seth: Yeah. I know my grandpa grew up in the Great Depression and he had a lot of distrust for banks. For a big portion of his life, he just didn't use them. He literally just stored cash in the walls of his house and that kind of stuff. And he'd buy his house and his cars with all cash. He'd just save like crazy and just said, "Nope, no banks, period."

Jaren: It feels risky from, “Okay, what happens if your house burns down?” Then literally your life's fortune is gone. That's where I feel like a bank as a holding mechanism is safer if it's less than $250,000.

The truth is if the world implodes and all of a sudden overnight all of their money is gone or whatever, I know that there's this guarantee. But I have my doubts. If we hit mass problems where there's no way the government can, unless they're just printing money, they can guarantee $250,000 for whatever the balance is underneath $250,000 for everyone that has a bank account. But I think, at that stage, you should just get some soup and a gun because the whole world isn't floated at that point.

Seth: Yeah. I think that was one of the issues back in the Great Depression, this FDIC and stuff didn't exist. A bank could just fold and you'd lose everything. So, it's like, “Well, I guess there's no benefit there if it's just as safe in my house versus a bank.” But I would agree. It seems like today there is that little safety measure in place.

Adam Carroll: This is a good call out and something I would mention too. Whenever I present there will inevitably be a banker in the audience. They'll come up and they'll say, “Well, I kind of felt vilified.” And that's not my goal. I don't want to vilify a bank. It's a valid business model. It's a great business model for the banker and it's useful and helpful for consumers. I just think there's a more efficient way and have proven it. We'll talk about it, I'm sure, here on the show.

Seth: Yeah. I used to work in banking and it's actually interesting. A lot of bankers who are very technically smart on paper, they should know it all in terms of how to manage money. They couldn't do it. They all had personal debt up to the eyeballs. Not all of them, but just because you know it doesn't mean you're actually applying it and smart with it. And a lot of them too were very anti-debt. They believed in Dave Ramsey, even though they work for banks. It's almost like it's their job. It's not their philosophy necessarily.

All right. So, let's move on. What is the Shred Method?

Adam Carroll: The Shred Method, some people may recognize my description of this, and they call it by different names, Velocity Banking, some people call it an Australian Mortgage. There's a variety of different folks that have sort of promoted this method out there in the past.

The Shred Method itself has been a lifelong journey for me. I started early, early on in my career in the mortgage business and I realized that I was making money when I wrote a mortgage for people who were either purchasing a home or those who are refinancing a home. And it always struck me as odd that I was going to get paid 2% or 3% or whatever the number was just to shuffle paper from one place to another when I closed on a mortgage.

And I started digging into things like the amortization table. And this is going to sound super nerdy but for those of you who love finance and numbers, you'll get it. When you look at an amortization table, visually, it looks like a waterfall. It's a slight, gigantic waterfall.

And so, most people, on average, will stay in their home about 5.5 years and then they move on. They buy bigger, they turn it into a rental, whatever the case may be, most of the time they're going to refinance their home if they're in it beyond five years to sort of recast, maybe to take money out, maybe get a lower rate, whatever the case may be. But they recast the mortgage at 30 years, which basically restarts the clock every time you do it.

And the way that compound interest works on an amortization table of a mortgage is that the majority of the interest you pay is front-loaded. So, you're paying more interest in the first five years than you are pretty much any time else throughout the mortgage.

In fact, a little quiz for you guys. Do you know what year in a 30-year fixed mortgage, you will have half of your mortgage paid off?

Seth: I should know this. I used to nerd out on this stuff all the time. 10 years ago. I remember hearing, I think it was Dave Ramsey who said, "If on the first month of your 30-year mortgage, you make an extra principal payment that is the same amount as your normal payment, it'll take nine months off the schedule at the very end," or something like that. And I remember playing around with it and I was just amazed. Like if I bent over backwards to pay as much as I could toward the principal at the beginning, it had a huge impact on the back end.

But to answer your question, I don't have an answer. I don't recall what that is. It's probably pretty far down, right?

Adam Carroll: It is. Jaren, what do you think?

Jaren: I don't know.

Adam Carroll: The answer is 21 years.

Seth: Oh, man. That's crazy.

Adam Carroll: In year 21 of a 30-year fixed mortgage, you would've half of your mortgage paid off. Meaning the last nine years are when all of the principal paydown happens. If we are just paying our mortgage payment and going, “Hey, yay me. I got a 3% interest rate”, which is great. Let's not take anything away from that. The reality is on $300,000 or 500,000 or $1,000,000, it's still a significant amount of money that you're paying in every single month and/or year.

And so, I started questioning, is there a way that we can game that system? And I dug in, I found the Shred Method. I really found a piece of software that guides people in their decision-making on how much to send and when. And effectively, what we're doing with the Shred Method guys is the HELOC, a Home Equity Line Of Credit, is central to the method working.

And the reason for that is we are going to borrow against the HELOC from time to time in order to make giant lump-sum payments to the mortgage, which does exactly what Seth was talking about doing. It takes huge notches off the back end of the mortgage in terms of interest and principal paydown.

In effect, we're borrowing money from that HELOC, but HELOCs are generally set up as a simple interest vehicle. The interest that you pay on it is based on the average daily balance of the HELOC over 30 days’ time, which is contrary to a mortgage, in which you pay interest on whatever the amount that was owed on the last day of the previous month.

If you owe $300,000 on day 31, then you're going to pay 3% interest on that $300,000 divided by 12. That becomes your interest payment.

With a HELOC, because it's average daily balance, when we deposit our income into the HELOC, which is central to this working as well, the balance fluctuates up and down throughout the month, but we're only paying on the average daily.

So, what I ask folks is this. Would you pay $100 in simple interest to borrow $5,000 from your HELOC if you knew it would save you $20,000 in payments?

Jaren: Yes, I would do that every day.

Adam Carroll: All day every day?

Jaren: All day every day. Yeah.

Adam Carroll: This one question for some people sometimes it's like showing the caveman fire. They're like, "What? How does this work?" But when people get it and they realize the power of it, they're like, “Oh my gosh, why have I not been doing this all along?”

It does a couple of things for us, you guys. Number one, and this is a broad-brush statement and it's going to be somewhat dependent on people's income and expenses and things like that. But the majority of people out there could be completely debt-free, mortgage included, in three to five years. And when you do it, you're saving hundreds of thousands of dollars in interest.

Jaren: Well, I think I'm about to share this podcast with everybody I know. That sounds very amazing. I'm very much the caveman with fire at the moment.

Seth: I knew before we did this that Jaren was going to get really excited.

Jaren: I'm like freaking out.

Seth: And become just totally fanatic over this. So, I'm not at all surprised to hear Jaren say this.

Jaren: I do have a question for you though, Adam. About a year ago, we came out with a course at REtipster about house hacking. And a lot of the time it's presented as though you have pretty much two options. You can either rent or you can have a mortgage. And there's a lot of people, the Grant Cardone’s ones out there, I actually did this whole montage of all these influencers being like “Renting is smart, owning a mortgage is stupid.” And there's some validity there for sure.

But I'm just curious, because I know you've mentioned a couple of times getting the 3% interest rate and all of that, in the grand scheme of things if you're a single-family house and you're paying it, it's kind of smoking mirrors because you're really front-loading the interest in everything you just said.

But in the context of a house hack where you have tenants who are paying the mortgage, does the Shred Method come into play there at all? Or do you think it's like, hey, if you're house hacking, you're smart and savvy and you're in a different category and you should get as cheap as debt as possible?

Adam Carroll: It's such a good question. What's interesting about what I'm doing with the Shred Method and teaching people about it, I hear every situation imaginable. House hacking, people are doing short term rentals, long term rentals. Land is a little bit different animal, certainly commercial properties. I'm helping a ton of business owners free up their commercial loans.

The answer to your question Jaren, in terms of house hacking, is actually, if you're house hacking and you've got multiple bedrooms that you're getting rent on and you are superseding from an income perspective what your expenses are on the property. Let's say the mortgage is $1,000 and you're bringing in $3,000. This will be like putting nitrous oxide in your gas tank because you've got that extra cash flow that you could be running through a HELOC and immediately creating equity in that property.

Someone who's house hacking, I could show them that in a year's time, if we're talking about those kinds of numbers, $1,000 extra on that property, so long as you're not living on that $2,000, but if you're using it to build wealth, we could set it up where within the first year you would have a ton of equity, like probably somewhere between $40,000 and $50,000 of equity in the property. And you will have saved $100,000 in interest on that mortgage already.

And at that point in time, you could easily go into another property because you've got a ton of equity in the first property that you can now leverage with that HELOC if you wanted to. So, this thing becomes almost like a stacking mechanism for people who want to invest in real estate and make sure their money is as efficient as humanly possible.

Jaren: What if you're closer to breaking even, or you are house hacking where you are coming out of pocket every month, but just a little bit like $100, $300? In that situation for the Shred Method to work, you still would suggest doing a HELOC and bringing more to the table to pay down the balance?

Adam Carroll: Yes, is the short answer. The HELOC, regardless, is the tool that you're going to use for this. So, if you have equity in the property or can tap equity, HELOC is the way to do it. Secondary would be a PLOC, a Personal Line of Credit if you don't have enough equity to do a HELOC. And the third would be a BLOC if you're investing in the property as an LLC, and you've had your company long enough that you could go to the bank and say, “Can I just get a business line of credit for $10,000 or $15,000?” which is way easier than most people think.

So, if you are just breaking even, maybe you're contributing a little bit to the house hack, the goal should be that you have some discretionary income every month anyway. This does not work flat out. People always say, “What's the con situation here? When does this break down?” And it breaks down when you have more months at the end of your money. You have to have more money at the end of your month. And whether that's a couple of hundred or a couple of thousand or $5,000 or $10,000, it depends on how big of a Shredder you have.

Somebody who has a couple of hundred bucks, it's like having a little tabletop Shredder that you can feed two sheets at a time into. If somebody's got $2,000 or $10,000 a month, that is like an industrial-size grinder you could put trees through. It is staggering to see how fast you can blast away debt.

And I will mention, and this is something we can definitely touch on, but sometimes it's less about being debt-free and it's more about just having access to the liquidity. This goes to Seth, one of the questions you had pre-interview was if folks want to buy more, but they're tied up in deals, where do you go for the money? Shred allows you to create liquidity pools that are super accessible and they don't require a bank's approval, because you've already decided what you have available. If you've been at this for a year or two, you might have $150,000, $200,000 on your home equity line of credit that's available. So, you could go do cash deals like that and turn cash flow.

Seth: Yeah, it sounds like the HELOC is an essential part of making this work. What if a person can't get a HELOC or if they don't own their home? Say if they want to pay down other kinds of consumer debt that they have, that's not just a mortgage. Even when I think of somebody who just bought a new house and maybe they have an 80% loan of value or something like that, or 90%. At what point can you even get a HELOC? What happens if the HELOC isn't available? Are you just out of luck at that point?

Adam Carroll: Not necessarily. Most lenders today are doing HELOCs up to about 90% LTV. If you're on the coast, it's a little bit different because with appreciation comes more risk for the lenders so they're looking at those going, "I don't know. That value may not be there in a year. We're not going to give that much."

But certainly, if you're in the Midwest, you're down in Texas anywhere kind of in the Panhandle area, you're going to be able to walk into any bank or credit union and ask for a 90% LTV HELOC and they'll give it to you.

For those who don't own a property and are just looking to get rid of debt, we can technically do the Shred Method with just, I say massive, but it could be a moderate savings account. If you had $5,000 or $10,000 sitting in a side fund, and let's say it's an emergency fund, we could use some of that to help shred the debt faster.

It's obviously way more efficient to be able to use that HELOC. The way that the method has been orchestrated for most of our clients is it does create that liquidity. So, for people who say, I got to have 6 to 12 months' worth of living expenses in the bank, think about for the average American, average consumer, how long it would take them to save 12 months of living expenses if they have an extra $500 a month to put away. It could be four years, five years before they get their 12 months put away.

But if they have access to the equity in their home as a HELOC that could serve as an emergency fund, if they absolutely needed it. And so, for a lot of our clients that say, “Hey, I've got $100,000 available. How much of it should I use?” We might say, “Hey, let's keep $40,000 or $50,000 of it in reserve. And let's just shred $50,000 of it, with half of it.” So, you always know you've got this reserve tank should you need it if things went completely south. And I've got tons of thoughts on that.

Jaren: Can we take a step back here for a minute, because I want to dive into the brass tax, details on the practicals of how this works. So, walk us through Adam, like, okay, I have a 30-year mortgage. I'm in a conventional situation. W-2. I'm like the textbook example of an average consumer. From there, walk me through the process of getting the HELOC and then how the numbers break down. Because you still actually have to pay a monthly payment on your HELOC. So, where it's breaking down in my head is like, “Okay, I go get a HELOC and then now having to pay two different payments.” How does it actually work on paying down my mortgage in three to five?

Adam Carroll: Yeah. Great question. Is this a personal question, Jaren? You're trying to figure out how to make this work?

Jaren: I work for myself now, so I'm not a W-2, but outside of that caveat, yeah, I'm excited. I'm freaking out over here, to be honest.

Seth: Actually, I was thinking a similar thing, but maybe even get more specific. Like let's say Jaren bought a $100,000 house and he has $20,000 in equity into it. So, does that mean he can get a $10,000 HELOC?

Adam Carroll: That's correct.

Seth: And then if so, if he takes all of that money and puts it towards principal, didn't he just lose all his liquidity because now it's tied up in his mortgage?

Adam Carroll: This is a good question. And you guys are on the right path, but it's a little more nuanced than that. Let me share with you how this would work. Let's use this example. Jaren buys a $100,000 house. He puts $20,000 down. So, he's got 20% equity in the home. We go and get a HELOC from a local bank or credit union. And by the way, it doesn't really matter where you get it. The main thing is that you're getting a HELOC from, ideally, the lending institution where you have your bank account.

Because the goal of this is the simplicity of moving money back and forth. That's sort of paramount for this to work and be palatable or successful for most people if they just need to be able to move money quickly. Like I can go on my phone and I can move money from HELOC to checking and go write a check for $30,000 for a new ride tomorrow if I wanted to. That's the power of it.

So, Jaren gets a $100,000 home. He's got $20,000 equity. He gets a $10,000 home equity line of credit from a local lender. It's going to be somewhat based on credit score. Obviously, they're going to underwrite it for your income. They're going to ask you, Jaren, “What are you using it for?” And what you're going to say is, “I have this super complex system where I use the HELOC against the…” No, you're not going to say any of that. You're going to say, “I'm just doing some home reno. We've got some home projects.” That's it.

And the reason I say that is most bankers, their eyes will roll back in their head out of a lack of understanding when we start talking about what we're doing, and this kind of goes to what you said, Seth. It's amazing that bankers don't understand the finances of simple versus compound and how this is working.

So, the first thing that happens is, Jaren is going to plug all his information in the software that we have that basically will tell you exactly how much to move and when, and it's all based on how much is coming in, how much is going out and how much is left over at the end of the month or the end of every two weeks.

Seth: About that person's income?

Adam Carroll: Income. Yep. So, let's say that Jaren makes $2,500 every two weeks. So, he is taking home $5,000 a month. He's got a $1,000 mortgage payment. He's got a car payment of $500. He got a credit card minimum payment of $200, which has a balance of about $4,000 that he's actively trying to pay off. The credit card payments are somewhere between 15% and 20%, the car loans at 4%. Then he's got household expenses. So, we're up to $1,700 so far between the mortgage, the car, and the credit card. And he's got another, call it $1,500 in household expenses. So, I think if my memory serves me right, we are up to $3,200. He'd have $1,800 left over at the end of the month, which is pretty good.

And so far, his advisors have been telling Jaren, "Hey, put $1,000 of that away into a savings account. Because you got to save up 6 to 12 months’ worth of living expenses.” And in the meantime, he's trying to put that away to save up his 6 to 12 months, he's still making a car payment. He's still making a credit card payment, still getting charged 20% interest on $4,000. Still paying 4% on the $20,000 he owes on his ride. And he's paying 3% on $100,000 on the house, which he just bought.

So, in the grand scheme of things, and I'm riffing on this, I don't know the exact numbers, but I'm going to guess Jaren's probably spending at least $18,000 to $20,000 a year in interest between those three different things. And that is money that goes right out of Jaren's pocket to the bankers. And that's how they make their money. Again, I’m not vilifying, that's just the banker's business model.

Instead, what we're going to do is we're going to take that HELOC and the very first thing we do is knock out the credit card debt of $4,000 because our HELOC is probably going to be around 4%. The credit card was at 20%. But what's most important in this is we are freeing up $200 in cash flow a month that Jaren didn't have before because he kept sending it to the credit card.

Jaren: Because of the difference in interest. So, when I'm paying the monthly payment on the HELOC, it is less than the credit card payment because the interest is higher.

Adam Carroll: That is right.

Seth: You're actually getting rid of the credit card payment. Like it's totally gone.

Adam Carroll: You're totally getting rid of the credit card.

Jaren: But you're still having to pay back the monthly HELOC?

Adam Carroll: You are.

Jaren: You have to pay back the HELOC on a monthly basis?

Adam Carroll: Yep.

Seth: But it's a lot cheaper than that credit card, right?

Adam Carroll: Yes. And what happens is, remember when I said the simple interest is calculated on the average daily balance? So, Jaren just put $4,000 on the HELOC, which would suggest 4%. And let's do the math here really quick. If you take $4,000 times 4%, that's $160 a year in interest. If you divide that by 12, Jaren's going to pay $13 a month in interest on that amount of money.

Jaren: Oh, my goodness, man. This is one of those things where it's like, nobody should graduate high school without having this. This is like compound interest. I just saw the magic of compound interest recently, because the stock market compared to real estate, it's like, why would I ever do the stock market? But the magic isn't in this 8% to 10%, it's in the compound interest. But it took me 10 years of being an adult for me to see it. This is one of those things.

Adam Carroll: What we're doing is we are reversing compound interest effect against us and turning it on for us.

Jaren: For us, yeah. This is huge.

Adam Carroll: This is a much faster version. So, what happens logistically is we pay the $4,000, but keep in mind, Jaren still got to pay a mortgage payment. He's still got to pay his living expenses. He still got to pay the car payment. That's still there. Where do those payments come from, you guys?

Jaren: Well, from our salary, our income.

Adam Carroll: Okay. Logistically, in the Shred Method, where do you think they come from?

Jaren: The HELOC.

Adam Carroll: The HELOC. So, we make our normal house payment out of the HELOC, that's $1,000. Let's say that the HELOC or the house payment falls during that period, that two-week period when you're about to get paid between when you pay off the credit card and you make your house payment. Technically now you owe $5,000 on the HELOC, but you're going to get a $2,500 deposit dropped into your account on Friday, which brings the balance down to $2,500. And you've only had a balance of $5,000 for maybe a total 7 days, 10 days at the most.

So, when we said $13 was the amount of interest you pay, it's actually going to be more like $4 or $5 in interest that you pay on that amount of money. And then you make your household budget payments, the $1,700, you make your car payment. So, the balance goes up again and then you get paid again, $2,500 goes in and it drops back down again.

Now, we have $10,000 available to us on the HELOC. So, the software that powers the Shred Method is going to say, “Hey, based on your upcoming expenses and your upcoming income, why don't we send $2,242 to either the mortgage or to your car payment, whichever one we want to knock out first?” And in some cases, it makes sense to do the house. In some cases, it makes sense to do the car. Some of that is dependent on how much HELOC you have available.

Let's just say we dropped $5,000 on the mortgage right away. On a $100,000 loan, you dropped $5,000 in before payment two. So, let's say we make payment one and we drop it in before payment two, you'll literally shave somewhere between 12 and 15 payments off of your mortgage, just like that.

Jaren: Wow.

Seth: The new thing I'm hearing that I'm just starting to understand. Basically, every dollar of income that you get from your W-2 or otherwise, goes to the HELOC, not to your bank account. That makes sense. And it also makes sense if you have a smaller debt amount that you want to knock out, do that ASAP, just get rid of that payment altogether. So, thumbs up on that.

But when it comes to something like a mortgage debt, I totally get that you're shaving off 12 payments at the end or however many it ends up being, but at some point, you're going to tap out your HELOC and it's great that your balance is way lower and there's less interest over time and all that, but still your liquidity is gone from that. Or does that somehow become available to you? Can you get a higher HELOC because the balance has been paid down?

Adam Carroll: Yeah. You've nailed it, Seth. What you're doing is going back to the bank, to the lender potentially every 6 months, every 12 months and literally calling and saying, “Hey, when you look at my mortgage balance now, I'm at 70% LTV. And so instead of $10,000, I'd like $20,000 on my line of credit.”

Seth: Okay. Got you.

Adam Carroll: Again, depending on how much discretionary income there is or how many side hustles you have or how much income is cycling through that thing, that's going to dictate how fast you can blast away the principal to create equity, to then tap using that HELOC.

I have friends and we all know people who are investing in real estate and they will save and build up the down payment funds and then go deploy them, getting a loan and do it. We're effectively doing kind of the same thing. It's just that down payment funds are going to come from the equity of your property. And all the while you're leveraging the Shred Method, more and more and more of your payment is going to principal and less and less it's going to interest. So, what we call this, this is a really effective way to own more of your income month after month after month.

Because if most people today looked at (and I would challenge your listeners to do this) go look at all of your monthly bills, all of the debts that you're paying back, student loans, credit cards, car loans, mortgages. Look at how much of your payment goes to principal and how much of it goes to interest. All of it that goes to interest is money you don't own. That's money someone else owns. All the money that's going to principal, you own.

We want to own more of our income month after month after month. That is a byproduct. It's a sneaky byproduct of the Shred Method, but it is unbelievably powerful when you've used it for a while. Because guys, to throw this into the arena, we live in a 5,000-square-foot home in West Des Moines, Iowa. This house plunked down in a different city, I'm sure it would be millions of dollars. It's not in Des Moines.

But on an annual basis, we pay somewhere in the neighborhood of $3,000 to $5,000 in interest total across all debts. And for me, that means I get to own the majority of my income and I'm okay keeping that debt level, the amount of interest that's paid out relatively low. I keep it at a certain percentage of whatever our income or net worth is. And for me that is my own risk tolerance and I can throttle up or throttle back based on the opportunities that are in front of us. But we're constantly using Shred no matter what kind of investment we're in.

Seth: Say in this situation, where we've got a $100,00 house with $10,000 HELOC, $80,000 mortgage. Let's say if there was no other debt, couldn't you just take that $10,000, pay off $10,000 of your mortgage, get $10,000 more of HELOC money and then do it all over again. Just chunk, chunk, chunk, chunk, pay it all down however many months it would take to do that. Is that what people should be doing?

Adam Carroll: Yes and no. For people who are really comfortable and confident in their own financial system in terms of, I meet people who say “I use YNAB or I use Mint or I'm so dialled in to Quicken. I don't think I could ever get away from the system that I'm using.” And I fully understand that.

The Shred Method, it will force you to rewire your brain just a little bit. The banks have taught us to walk heel-toe, heel-toe. And this is like walking toe-heel, toe-heel. It's a little backwards. However, what I will say is that if someone leveraged the method that you mentioned, Seth, they will probably not experience the level of calm or patience, peace I would even call it, that most people have when they're using Shred. Because what happens if a storm rolls in and there's massive damage to your home that isn't covered by insurance? Or heaven forbid, there's a medical emergency. And somebody is like, “Well, now I don't have the money that I need to pay off this debt or this expense.”

With Shred, because the equity continually increases, my wife used to have sleepless nights about “Well, how would we pay for this if it happened?” We got to a point where I said, “It's there. It's in the equity of our home. It's sitting there. We have access to it at any time. And our income because it's funnelling through that HELOC is constantly paying it down.” So, there is no more fear. There are no more money concerns.

I wrote a book called The Build a Bigger Life Manifesto. And in the book, chapter seven is all about how do you make money irrelevant? And money irrelevancy is when you can live a life where you're not really concerning yourself with, “Oh my gosh, this is how much is coming in and how much is going out. Can I survive this?” It's really about, once you get to a point where you know you're living below your means, you're living below what your income is, turn this thing on autopilot. It's just a wealth-generation machine.

Jaren: How different is the Shred Method for people who are not W-2s? Because I know getting a conventional mortgage, typically you have to have like two or three years of really clean books. And a lot of people who are in the process of building their legacy wealth don't necessarily have the cleanest books or have the best practices in place. So, for a lot of our entrepreneurs out there who are listening, what are the caveats or differences between somebody who's W-2 versus working for themselves?

Adam Carroll: Yeah, it's a great question, Jaren. I think that the number one thing that I would recommend, obviously you mentioned they may not have the cleanest books. Having clean books actually is a really great first step in building wealth. But that being said, if somebody has an LLC and they've had it for 12 to 24 months, this is again, kind of a broad-brush statement, but I would guess you could go into virtually any lender or certainly the business bank where you have your business account, and you could go in and ask for a BLOC, a Business Line of Credit.

They're going to underwrite you based on how much income is flowing through your account on an annual basis. So, if you're doing one or two real estate deals, and maybe you are wholesaling as an example, and you make $20,000 each time, they might give you $10,000, 25% of whatever your cash flow is. If it's significantly more, they might give you significantly more.

I walked in years and years ago, and I think my business was doing $200,000 to $250,000 a year top-line revenue. And this was when I was doing speaking and consulting and really getting started. I walked into a US bank office, and I just said, “Out of curiosity, how much can I get on a business line of credit?” And the woman started typing away on her computer. “Oh, that's interesting. Oh, okay. Well, I could give you $42,000.” And I was like, “Are you out of your mind?”

Jaren: That's awesome.

Adam Carroll: And for me, what that did, and this goes back to your question for someone who's in a business that maybe the income is up and down, what having a business line of credit allowed me to do was smooth out my monthly cash flow. Because at the time my wife was working, I was building this business and she said, "Dude, are you going to pay us or not? Do we get a pay check this month?" It was a feast or famine. I said, “How much do you need on a monthly basis from me to make sure everything's even at home?” And she goes, "We need a minimum $3,000. You got $3,000 a month to make sure everything's good and we sleep well at night and all that.” So, I just said, “Okay, no matter what, high or low-income month, $3,000 is what I was paying.” And then it just notched higher and higher from there every single year.

But for those who are just getting started, yes, you are an entrepreneur. Yes, you're doing it on your own. But there is a benefit to thinking like an employee in terms of how you pay yourself, because that's how the banks think. So, if you can prove, hey, every month I'm paying myself this amount and when money comes in, it brings the business line of credit down. Eventually, you're going to be in a position where a HELOC becomes very, very easy.

Seth: Just to again, make sure I'm fully understanding this. The goal is to use this HELOC to pay down the conventional mortgage. You're basically just shifting what kind of debt it is. You're not getting rid of it. And the difference is that you'd need an organized plan on how to pay down your HELOC then instead of your mortgage. Because a mortgage is very planned out for you with an amortization schedule whereas a HELOC is just interest-only payments. Unless you make a principal payment, it's not going down, if I understand that right. Is that what your software does or am I missing anything?

Adam Carroll: Yeah, and true to an extent, Seth. The plan to pay down the HELOC is really baked in the cake in terms of your income cycling through every two weeks. And if you've got, in the example we gave for Jaren, if it's $1,800 a month difference, we're actually eliminating $1,800 of simple interest debt every month when that money funnels in. And this is the analogy or the metaphor I use with people. Because again, we're programmed, conditioned to believe by the banks, put money in the bank, it's safe, secure 6 to 12 months’ worth of living expenses, so on and so forth. But if you guys were to leave your homes in the morning to go to the post office and came back home knowing that you had to go out to the grocery store at 4:00 PM later that afternoon, would you leave your cars, your vehicles running in the driveway all day long?

Seth: No.

Jaren: Well, if you were in Kazakhstan in the middle of the winter.

Seth: If it was a diesel, maybe.

Adam Carroll: Maybe you would. Yeah, then maybe you would.

Jaren: My wife's from Kazakhstan, by the way, that's the reference.

Adam Carroll: And I have people who will say, “Oh no, you get it stolen.” And in Iowa, your neighbor would come grab it and go wash it for you and bring it back and all that. But you wouldn't do it because it's inefficient, it wastes gas, it's hard on the engine, et cetera, et cetera.

People will park their pay check in an account that earns no interest, all the while paying compound interest on many other debts. And it's the same kind of thing. This is about just where are you parking money, even temporarily. And again, I go back to the question, would you pay $100,000 in simple interest to borrow $5,000 if it could save you $20,000? People are like “All day every day.” Well, imagine doing that month after month after month after month. The efficiency speaks for itself when you see the numbers.

Seth: So, you can set up direct deposit from your employer to go right to your HELOC instead of your bank account. Or do you have to manually do this and stay on top of it?

Adam Carroll: It depends on the lender, depends on the bank. Some of them do have that capacity set up where it's literally just another account number. It's your account number, plus three more digits. And when those three digits are applied to your direct deposit, it goes right to the principal of the HELOC.

In my particular case, and in many of the Shred clients, we do have to manually just move the money. And so, paydays are a big deal around here and we know they're always on the calendar, they pop up. Or my payroll provider, we get an email that says “Hurray, you got paid today.” And so, whenever that email comes in, you could probably even set up an automation on this, but I like to go in and move it.

Seth: Is that Gusto, by the way?

Adam Carroll: It is Gusto.

Seth: Okay. I get the same email. I'm familiar.

Adam Carroll: When Gusto sends it, I'm like, “Oh, I got to move money.” I go in and I literally just take the exact amount and I move it from checking to HELOC. And my goal when I started, and maybe this is aspirational for some of you as well as it was for me, but I hated paying bills growing up.

When I got to post-college and I was on my own and not supported by parents and all that, I detested that day where I sat down, and I had to write checks for all these bills. It just sucked. And I kept saying to myself and to my wife, I want to get to a point where we have three bills to pay and that's it. And we can do it in 30 seconds and it's done and let's automate the whole thing.

And we got to a point where we have a mortgage payment, we have a HELOC payment and we have a credit card payment. And that's it. And so, the simplicity of payments today, I can't overstate. Jaren, you had mentioned too, a question about how do you make the HELOC payment. And technically every time that your income gets deposited in the HELOC, it is treated like a payment. So, when people say, well, have an extra payment on the HELOC. Candidly, you don't. You'll have a little bit of interest that will come off of what you put in there, but it will never feel like an additional payment.

Seth: Can you set up your auto credit card payments and auto-everything to come just from your HELOC instead of your bank account?

Adam Carroll: Yep.

Seth: Okay. Wonderful.

Jaren: Literally as we're talking, I just messaged my guy’s group. I'm like, this is a game-changer. I'm sending your website out to everybody on the Shred Method. I got open-up emails. I'm about to blast everybody about this. When this episode comes out, I'm about to become the Shred Method evangelist.

Adam Carroll: Well, I appreciate that, Jaren.

Jaren: I wanted to ask Adam, I know you said that any bank, especially local banks, credit unions will work, but do you have any go-to banks that you recommend for the Shred Method?

Adam Carroll: Honestly, none come to mind by name. No specific, “Oh, go use this one or this one” with the exception of possibly Navy Federal Credit Union. For all of our military folks out there and service members that have access to Navy Federal, their system, they're just such a large credit union that their inner workings, their technology is second to none.

And that's going to be the big delineator. The larger a financial is, the more resources and tools they'll have in the digital banking venue. The smaller a bank or credit union is, they may not have as many states of the tools because typically if a credit union as an example has $100 or $200 million in assets, their budget for technology is going to be different than the credit union that has a billion dollars in assets.

I would be looking for one that's somewhere in the neighborhood of $500 million to over a billion if you're looking at credit unions. And if it's a bank, a bank that has at least three to five branches is probably going to be of the right size that you could go get the kind of tools that you're looking for in terms of the HELOC and the technical stuff.

I will say the credit union I'm with is about $750 million in assets. So, they're kind of a midsize credit union. At one point, I had my mortgage, the HELOC, a credit card, savings account, checking account, and one other. We had a money market account I think with them. And literally on a monthly basis, you would just see money weaving in and out of all the accounts, to the extent the CFO of the company called me one day and said, "What are you doing?" And I said, "Why do you ask?" And he and I had become friends. And he just said, "There's more activity in your account than anybody else's. And I see money move on a daily basis." I go, "Is it a problem?" And he goes, "No, it's just, we're making no money on you whatsoever."

Jaren: That's awesome.

Seth: Doing something right.

Adam Carroll: Yeah. I was like, "All right, carry on." I ended up moving my mortgage to someone because I felt bad about it. They weren't making literally any money on the mortgage. I don't feel bad about some of the big lenders not making any money on my mortgage.

Seth: I don't know if you've ever heard anything about Figure, Adam, but I'll mention it because I actually got a HELOC within the past year. I ended up going through my local credit union where my bank account is along the lines of what Adam was saying. But for what it's worth, I try to do this with Figure as well. And we do have an affiliate link with them, retipster.com/figure.

And the downsides that I found is that they're not the cheapest in terms of the interest rate. My bank is significantly less. However, they bring some value to the table in terms of speed and convenience in the maximum loan amount. I think most, and you probably know a lot more about this than me, Adam, but a lot of banks and credit unions, for whatever reason, limit their HELOC total to $250,000 and Figure goes up to $300,000. Is that accurate? Have you heard that number a lot? $250,000?

Jaren: I'm on their website right now. I think they borrow up to $400,000.

Seth: Oh, okay.

Adam Carroll: So, they've opted it even more. Yeah. I would say that's kind of on a case-by-case basis, Seth.

Seth: That might be my area. Maybe it's a market value thing.

Adam Carroll: Yeah, totally could be. We have clients right now that are literally leveraging $600,000 and $800,000 lines of credit, which is kind of staggering. And here's what I might add. I've mentioned that there are a few goals here. One is to blast away debt and some people are just debt diverse, don't want to have any debt. This is one of, if not the fastest way to do it. The second option is you're doing it to free up liquidity. So, if you are paying it down and you have an extra $50,000 or $100,000 invested in real estate, by all means do that.

The third reason you might do this is to minimize your monthly payments. At one point in time, my wife and I had refinanced our home. We had a $250,000 mortgage. The payment ended up being like $1,600 a month. And we got down to a point where we owed $85,000 on the mortgage.

I started doing the math and I said if we just flip-flop the HELOC for the mortgage, all we'll have is a simple interest payment on it every single month. And so, at $85,000 and we were paying 4%, our monthly amount to stay in the house was $283. Now that would be like renting your home, because it was an interest-only payment, but that's what the payment ended up getting down to. Instead of this $1,600 hurdle we had to leap, it was $283.

And so, for those that own real estate and you're really managing your cash flow and figuring out how to maximize and optimize cash flow, from some of it, you get a HELOC big enough eventually within a year or two, you flip-flopped the mortgage in the HELOC and you just have a simple interest payment on that property.

Seth: Got you. Yeah. Really, you're not even concerned about trying to bend over backwards to make extra principal payments, because it's going to happen just by nature of the fact that your pay check goes in there. That's just like a totally new way of thinking. I just never thought about it this way.

It sounds like because of the manual work, if you can call it that, of getting into your accountant manually putting the money in your HELOC, as crazy as it sounds, I literally know people who can't handle that. That's too much to ask to get them to pay that much attention to get in there and do that regularly. So, I guess if you can't handle that, is there any other solution or is this just not for you because you need to work a little bit to make it all happen?

Adam Carroll: Yeah. I would say, marry someone who has that proclivity that they could go do that for you.

Jaren: That was my solution. My wife recently started managing the money and I'm dedicated to making it. She manages it. It's a great team. It's magic. It's beautiful.

Adam Carroll: In our house we call it offense and defense. I got the same deal. I'm great at offense. She's great at defence. To your point, Seth, I think that someone who has trouble managing the day-to-day fine finances as it is, they would maybe be flustered or frustrated with this process at the very least for the first 90 days, because it does take some reconditioning. The software that powers the Shred Method, I call it a behavior modification tool because we really are. We're modifying your behavior as it relates to where checks come in and payments go out.

But once you've modified that, it takes about 66 days to create a new habit, according to scientists. Within two to three months, this is like an old habit. And you'll wonder why you ever functioned this way or the other way. Sometimes the metaphor I use too is listen, you can take the red pill or the blue pill. But just know that if you take the red pill, you're going into the Matrix and truth will be revealed and you'll never be able to look at reality again.

Seth: Yeah. Those can be kind of scary things in life. This happens with all kinds of different things. Just when you don't know what's on the other side, but it's pretty cool when you get to the other side and it's just a paradigm shift. Along these lines of people who can't manage money, is there anything about this that a person could get in trouble with? Are there “Gotchas” or “Don't do this if this situation exists for you?”

Adam Carroll: Yeah, it is a good question. Because we're leveraging your income and we don't have to over-leverage it. Even in the Jaren example, let's say, it's $10,000. We may only ever lever up to $7,000. And there would never be more than that ever on the line. Some people that, again, clients of mine that are in the $300,000, $400,000 range on their HELOC.

One of the things that I'm really adamant about is let's talk about the consistency and certainty of your income. Because if heaven forbid, some catastrophic thing happens and your income drops significantly, we don't want you left holding the bag on this massive number. So that's one thing. We're constantly mindful of how much income there is and is it consistent and predictable? One of the ways that could bite people, Seth is if they treat their HELOC like a credit card where if you have trouble going into Costco and not walking out with a kayak. This is challenging.

Seth: I’ll be like 20 kayaks in my garage.

Adam Carroll: Yeah. I'm like, “Oh, cool. Bounce house.” My wife's like, "Your kids are teenagers. They'll never use it." I'm like, "It looks cool." Again, offense, defence. But if someone is just prone to spending, it does feel like, “Oh, I have access to it. So, I might as well go do this.” The key, really, the key, I think to remember, if you're even entertaining Shred, is we're not changing the way that you function now in terms of your spending.

If you go out to eat every now and you like to take a vacation from time to time, those things will still occur. It's just going to shift the way that the income flows through and how much equity you're building along the way and debt you're paying. But if someone starts this and they're like, “Yay, now we can go out to eat all the time. Now we can go buy shoes and purses.” Time out, time out. You're not making more money necessarily.

My wife and I, we've now paid off our house twice in the last nine years. And it has afforded us the opportunity to go to Europe for a month and to buy new cars, writing a check for cars, those kinds of things. So, it does open up opportunities. It might just take 18 to 24, 36 months before you're like, “Okay, now I see the difference. And there's $100,000 that I didn't spend before that I now get to invest somewhere.”

Seth: This is giving me one of those OMG moments, kind of like what I had when I first discovered land. Just how much money have I thrown away in my life? Just for no reason, just because I didn't know any better.

Jaren: That's literally what I just texted my guy’s group. I'm like, “This is a shift. This is a moment, pay attention.”

Seth: It's not even really a discipline thing. It's not like you're cutting anything back. It's just changing the way that money flows. It's just being smarter about it really.

Jaren: Well, you still need that. I have come to terms with the fact that the 80/20 of being wealthy is living substantially underneath your means. If you can figure out a way to live on like 25% of your total income, something ridiculous like that, that is the biggest thing that you can do to generate wealth.

It is super important when you approach this to understand those kinds of basic discipline concepts when it comes to managing money because I didn’t and a lot of people don't. I'm very much a textbook. If we were having this conversation two or three years ago, I'd be the guy who's like, “I got more money now. Let's go buy some kayaks from Costco.”

But if you understand, you have to have that foundation. So, listeners out there, the key to making finances work, live substantially underneath your total income. And as long as you have that, and then you just use this as a method to completely manage your money differently, and cash flow differently, then you're going to be thriving. But you need that piece first.

Adam Carroll: Years ago, there was a book. Actually, they kind of got me started down this path. The book was by a guy named John Cummuta. He wrote a book called “Debt-Free & Prosperous Living.” And I think John was probably one of the OGs in the self-publishing world because he literally self-published this book and then sold it via radio station ads all over the country. And I think it was like $50 for the book. I got it and pored through it and followed every piece of advice that he gave. And in it he said, the two greatest expenses we have in life are taxes and the interest expense on debt.

Jaren: Wow.

Adam Carroll: And I started thinking, okay, so what would life be like if you could minimize taxes, which you guys do through real estate, and if you could minimize the interest expense on debt, which I do through Shred? And when you put those two together, man, it is powerful. Because that 25% maybe that you're saving now, Jaren, that could be where that comes from to build wealth.

Seth: Yeah. I do have one last big question before we wrap this up. Infinite Banking Concept. I had a conversation with M.C. Laubscher back in episode 25, this is years ago now, about what that is. And essentially, you're getting a very specific type of whole life insurance policy that allows you to borrow a high percentage of the cash basis or cash value of that policy.

And the key of why it's smart is that if the cost of those funds is low enough, like I don't know, 4% or something like that. And if you lend it out or you use it for anything really that brings you a higher return and then pay it back to the policy while you're borrowing the money, it still continues to grow as if it's fully funded, because you're not actually borrowing the cash. It's a collateralized loan using the cash as collateral.

Anyway, it reminds me of this. Just in that it's like a creative way to basically just maximize your wealth, building potential through a life insurance policy. But I'm wondering what are the pros and cons or differences or similarities of that versus this when you just look at the two next to each other.

Adam Carroll: This is such an astute question, Seth, because what I realized years ago was if you use these two methods in tandem, they become unbelievably powerful. As an example, lots of folks are sold whole life policies and they're sold under the guise of, “Well, it builds cash value, and eventually down the road, you'll be able to gain this” and blah, blah, blah.

And what most insurance sales people will do is they'll rope their prospect, or their client into a monthly amount that has to go into that policy every single month. And so, it could be, I've seen $200 to $300 and I've seen up to $25,000 a month. When I look at what most people are up against in terms of clearing the nut that they've already created for themselves. It's like, “Why would I add more to that every single month that I have to pay in?”

And when I learned about Infinite Banking and read R. Nelson Nash's book, “Becoming Your Own Banker,” what really clicked for me was what Nelson Nash talked about. It was how do you use compound interest within a life insurance product to work for you, but work way faster than what most life insurance products that are sold will do?

Because if you're buying a dollar-cost average life insurance policy where $500 a month goes in, at the end of your one year, you got $6,000. You get excited. End of year two, maybe $13,000, if you're lucky. End of year three, okay, we might be pushing $20,000. But what we do with Infinite Banking and leveraging Shred is we want one lumpsum large premium that goes in. And I say one, one per year, but we do that over maybe three or four years. And then at the end of the fourth year, you scale the premium way, way back.

But at this point let's say it's a $25,000 a year premium. Within four years, you got $100,000 sitting in that account that you can borrow from anytime you want. And the benefit of it is you get to choose when, how, and if it's paid back. So, there are no payments on that $100,000, unless you wanted to make them. There is no due date necessarily on paying that debt back. You just have to make the next year's premium and pay the interest on it. And it's earning a dividend on the amount that you had in there originally, no matter how much you have borrowed against it or not.

So, if on $100,000, most of the dividends they're paying on those policies are somewhere in the neighborhood of 5% or 6%. The interest rates on those loans are around four to 5%. So, the policy I have as a 1% spread, if I borrow out $100,000 at 5%, I pay $5,000 a year in interest, but I make $6,000 in dividends. So, we're always money ahead. What it effectively becomes is a liquidity pool for us to leverage.

And what's nice is I've had opportunities come up. I'm doing a hard money loan with a friend who tends to get in cash crunches. And he'll text me. He's like, "Dude, I need $30,000, six months, 10%. Can you get me a check by Friday?" And I just go online and I request a check from the life insurance. I know that I'm going to make 10% in six months, which is 20% a year if you're doing the math. For me, that's where the liquidity and the advantage of the liquidity is.

But I think in order for people to get there, to use Infinite Banking, one of the things I would recommend they do is look at Shred first to create equity, because it's hard for some people to write a $25,000 premium check, but easy if you have a HELOC available to you.

Seth: I had a similar thought when I started learning about it and really trying to understand it. Actually, just today or this week, I'm getting my first policy for that purpose of IVC, but something that struck me was that it's not a good first step for everybody, for a lot of people really. You have to have money already to plough into that and then start squeezing value out of that. For just the average person who's making minimum wage to sign up for that really, I don't see how it's a smart financial move, but I see what you're saying. If you can build up a nest egg and get somewhere first with the Shred Method or Velocity Banking or whatever you want to call it. It's a much better, much firmer footing to have before you decide to dive into something like that.

Adam Carroll: Yeah. I think your observation is correct, that the medicine can become poison, if someone is looking at using Infinite Banking and maybe they don't have sufficient income to really overfund one, it just feels like another monthly check they got to write. And I've encountered situations where I'm like, “Hey, if you didn't have that, you would have an extra $1,200. You could blast away these payments and free up yourself and be completely mortgage-free in 3.5 years.” And they're like, "What? Say what?"

So, know that there are some folks out there that will pitch Infinite Banking as a cure-all and catchall for everybody. And I think it is not one size fits all. And if you have a really great strategist, you can build a wealth plan that includes it, but maybe isn't dependent on it. Because if it's dependent on it, somebody's probably making a fat commission off you.

Seth: Yeah, totally. And that whole other thing, I mean, I know it's getting beyond the topic of what we're talking about here. But if anybody's ever interested in Infinite Banking, it's really important to get the right policy from somebody who actually understands Infinite Banking. It's very easy for somebody who doesn't understand it, to sign the wrong kind of policy that costs too much to borrow or you can't borrow very much.

There are a couple of people I know who specialize in the Infinite Banking Concept. One of them is M.C. Laubscher. Again, you can check him out on episode 25 at retipster.com/25. I'm going to include a link to another guy I met at REWBCON actually who also specializes in that. I've learned it's important to be talking to the right person, because some people will kind of act like they understand it when they don't really, and they don't sell you the right kind of thing. Anyway, just side note on that.

So, one final question here, Adam. I heard that you're working on a new book project about how to raise kids around money when tangible money like paper dollars is never around. How do kids grasp these money concepts with money when it's mostly digital these days? What are your thoughts on that?

Adam Carroll: I think if you're raising children out there, it is the Wild West in terms of what kids are experiencing. I have been on 750 college campuses across the country speaking and I found that there is a wide disparity of kids who either fully get it. They grasp it. And those who don't. Like the woman I mentioned at the beginning, who said, “What's a stock? I don't even understand what you're talking about.”

I realized that there is an abstraction of money happening in society where we're moving to Venmo. And certainly, PayPal's been around for a very long time, but Venmo and cryptos. Ask a kid today how money is spent and they'll say you swipe a card or you put a card in a system or you tap your phone, tap your watch to a reader and that's it. And there is a part of your brain that fires differently if you hand over a $50 bill.

Jaren: Yeah, it's painful.

Adam Carroll: It is. It’s a pain sensor that goes off versus a pleasure sensor that goes off when you hit one click ship on Amazon for $47. And then the pain happens when you get your credit card bill. And if you don't understand how much interest it's being charged, that's again where it gets more and more painful. And so, we want to go shopping to make ourselves feel better, which just adds to the pain.

I maintain in the book that I'm writing on this, Seth, that kids today need to handle money. They need to handle tangible cash and they need to be given or earned allowances on a regular basis. And then save. “If you want something, that's on you. - Well, I forgot my money. - Well, sorry. I mean, if you don't have your money, you can't buy it.” These are hard lessons learned.

Seth: Or if they ever do pay with digital currency, just punch them when they do it so that they feel the pain.

Adam Carroll: So, they feel the pain. Yeah. That's it. Yeah. Pinch, punch, whatever. I want you to feel the physical pain of this thing.

Seth: That's not actual parenting advice.

Jaren: Yeah. That's a joke.

Adam Carroll: But I've raised three, what I consider to be very financially responsible savvy kids who are all given money for chores done early on. And then they'd say, "Can we go get ice cream?" And I'd say, "Well, I'll fly if you buy, but it's on you." And we'd go to Dairy Queen and they'd buy their own things.

And interestingly, they're more conservative. Kids are more conservative when they're spending their own money than when they're spending their parents' money. I did some research on this. It costs upwards of $300,000 to raise a child from zero to 18, according to the USDA and that's not including college costs. So, when we talk about how do you save, I got a really easy way. Don't let your kids bleed you dry.

My son asked me at one point. He was in sixth grade at the time and somebody's parents got a new car and they were talking about this new car. “Oh, they must be rich.” And my son said, "Are we rich, dad?" And I said, “Listen, bud. Your mom and I are very comfortable. You have nothing.” So, let's not conflate those two.

Seth: I'm rich. You are not.

Adam Carroll: “We've done all right. You have not been in a working world yet. So, you really don't have much.” And there's a difference because some kids will grow up thinking that they have their parents' money, because they do. If they want something, their parents flip the bill for it with no questions asked. And it's a really hard lesson learned for kids who haven't had the squeeze put on them, so to speak. You know what I mean? You have to feel lack in order to appreciate lack. And most kids today are being raised in an environment where it's like, “Well, I don't want my kids to struggle.” And we have a theory here. No pressure, no diamonds. So, we want you to struggle. Struggle is good. It actually hardens people to be successful in life.

Jaren: Yeah. Jocko talks about that. Jocko Willink. I like his podcast, the Jocko podcast. He says that with your kids, you should let them brush up against the pain in life. Not necessarily throw them in front of a bus that's driving to teach them to look both ways before they cross the street, but you should definitely let them feel the pain, and within a controlled environment for sure. Because that's the best way to prepare them.

Seth: Jaren actually had added a last question in here. Why doesn't Dave Ramsey talk about this?

Jaren: Yeah. This is the fastest way to pay down on massive amounts of debt. So, why isn't Dave Ramsey shouting from the rooftops about this?

Adam Carroll: Yeah, it's a really good question. In fact, if you went out and you asked Dave Ramsey about mortgage acceleration or anything like that, he would slam it. He would say, “No, just make an extra payment. You'll be fine. Don't worry about that.” The challenge is, and I think this is the tiny little differentiator is that we're basically giving the same advice. I mean, I'm saying, “Hey, blast away your mortgage.” Although his whole thing is, “Get rid of all the debt. You never need any credit. You never need any of that.”