The atrocious underwriting behind most subdivision deals across the land industry has been driving me nuts.

Offended? Fine, but for operators who want to improve, keep reading.

Having reviewed thousands of “potential” subdivisions (and successfully bought and sold them), I think fewer than 5%, probably even less than 1%, of the land industry has a good handle on land subdivision analysis. The focus here is on minor subdivisions, or majors that are not being sold as paper lots to a developer or builder.

This article aims to be as bare-bones as possible, since I want to reference these guidelines regularly, including with my team.

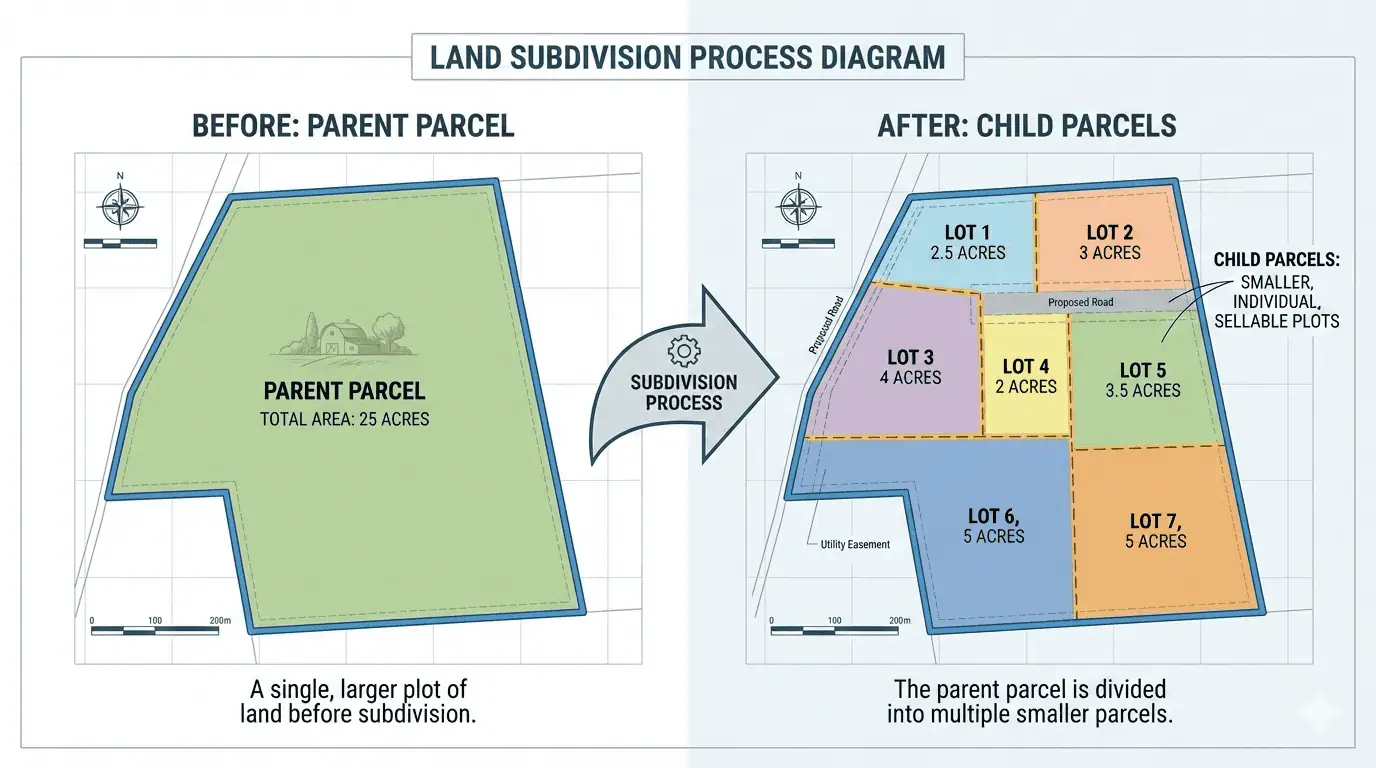

A few quick definitions:

- Minor subdivisions typically involve splitting land into fewer lots (typically 3-5), with limited or no infrastructure required, and allow for a quick approval process.

- Major subdivisions involve splitting land into more total lots (varies widely but potentially into the hundreds), often with heavier infrastructure regulatory requirements.

- Parent parcels are the original subject property prior to a subdivision.

- Child parcels are the new lots created from the parent parcel after a subdivision.

RELATED: What Are Parent and Child Parcels?

Caveat: This is a STARTING point. These are table stakes that apply ~99% of the time, anywhere in the country. But every piece of land will have its own unique features, its own market, and its own set of regulations. Adjust accordingly; subdivisions are complex.

And if you only take one thing away from this, never forget that the market does not care about your VISION; it only rewards the TRUTH.

=====

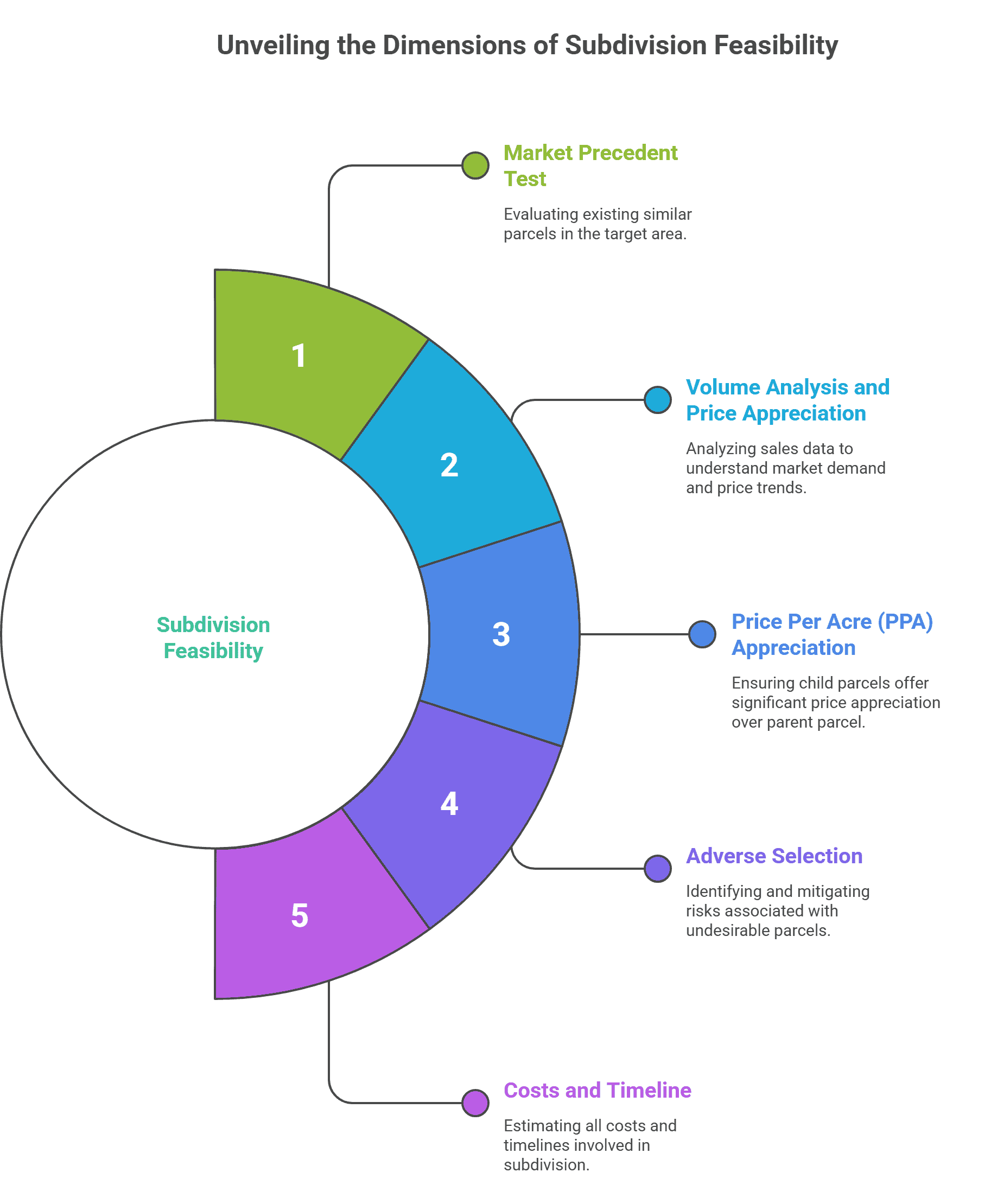

Step 1: The market precedent test

On the aerial map, are there already existing parcels with similar acreages (within ~1-2 acres) as your proposed child parcel plan within a ~5-10 mile radius, with similar characteristics, such as contour and street frontage?

- If “Yes”: That's a good sign. The market has proven it accepts that product.

- If “No”: You are a first mover. That is a massive red flag unless you have patient capital and an appetite for extended hold times, potentially for years.

Understanding whether comparable subdivisions exist in your target area is the foundation of effective parcel split feasibility research. Without existing market precedent, you are essentially experimenting with buyer appetite using your own capital.

Step 2: Volume analysis and price appreciation

For step 2, check the sold, pending, and active listings within a ~5-10 mile radius. The closer, the better. Some areas will justify extended search radii.

If you are creating 2 child parcels of similar acreage, have at least 2x the child parcels (compared to parent parcel acreage) sold or pending in the past 3-6 months, max 12, in that area. Bonus points if the sold or pending comparables are from another subdivide project.

Creating 3 child parcels? You need 3x the sold or pending comparable volume compared to the parent parcel acreage.

If child parcels are distributed across multiple acreages, such as three 5-acre parcels and two 20-acre parcels, adjust the multiples of sold or pending comparables for each acreage band.

The active market is effectively the inverse. If you see a bunch of active child parcels (particularly if they are grouped together as part of another subdivide project and have similar characteristics), be more cautious about introducing additional inventory, unless you can significantly undercut the market. The longer the collective days on market (DOM) of the active listings, the more cautious you need to be.

Ask yourself:

- Are they all closer to an interstate or city limits? Account for where child parcels are moving. If your project is much more rural, your project may blow up in your face.

- Are child parcels moving significantly faster (e.g., 2x as fast) than parent parcel acreage? While uncommon, that can offset lower sold or pending volume, but be extra conservative if making a decision from this standpoint.

Step 3: Price-per-acre (PPA) appreciation must be real

For step 3 in the subdivision analysis process, as a rule of thumb for child parcels above ~2-3 acres, PPA should show at least 1.5x appreciation over parent parcel pricing. For child parcels below that acreage threshold, the raw price should be at least a 1.5x premium, since PPA falls apart.

To be crystal clear: If my parent parcel acreage of 50 acres trades at $10K PPA, then my single split pair of 25-acre child parcels should trade at $15K PPA minimum. Anything less and you do not have enough of a risk premium accounting for subdivision timeline and cost, potential adverse selection, and DOM.

The more child parcels you are bringing to market (particularly if they are about the same acreage), the higher the PPA appreciation should be.

The mechanics of the deal can make a key difference here. If you are buying a parent parcel outright, you will want a higher PPA appreciation. If you are partnering with the seller and your capital outlay is less, a smaller margin may be acceptable. This is an entirely different discussion, but it's worth mentioning here.

Step 4: Account for adverse selection

Are all your child parcels relatively uniform in physical characteristics, or will one or more parcels be significantly more or less desirable than the others?

If you are creating 3 parcels and one needs significant grading to account for a nasty contour and is also impacted by wetlands, while the others are flat and clear, you cannot average the pricing. The inferior parcels will drag down your blended return and potentially lengthen your total DOM dramatically. Model each child parcel separately with conservative assumptions on the weakest offerings.

RELATED: How to Identify (and Avoid) Wetlands

Remember, if you are introducing a parcel that is in the bottom 25% from a characteristic perspective across everything that has been sold and is on market, then you should think twice before you buy it.

Step 5: Know your true all-in costs and timeline

For the final step, assuming you have passed the above 4 hurdles, what is the actual, total cost to subdivide? Include filing fees, surveys, engineering, legal, and carrying costs during approval.

What is the approval process? Are there hearings? Planning commission reviews? Environmental assessments?

Most operators underestimate both cost AND timeline or have done zero research into either. If doing horizontal development work (e.g., clearing and driveways), add a minimum 25% cost buffer to soft quotes to be safe… and triple the quoted timeline.

Thorough subdivision cost analysis requires accounting for every soft and hard expense, plus the opportunity cost of capital during extended approval periods. The difference between projected and actual expenses often determines whether your deal generates profit or loss.

The Bottom Line

More often than not, after rigorously applying the above steps, the market will let you know if you are better off attempting to sell the parent parcel versus attempting a subdivide.

Even if the data indicates a subdivision is a good play, the market may surprise you (as it so often does), where the only serious buyers want the total acreage. So having optionality is ideal, where you can at least break even selling the parent parcel acreage, net of all value-add and closing costs.

Almost nobody who sends us subdivision deals has worked through even ONE of the above steps. I realize the steps above are not as simple as I intended. Ultimately, there is so much nuance in land that it is hard to boil things down to hard-and-fast rules. So you have to get the reps in to start seeing things as clearly as my team and I do.

Subdividing works… when you follow the guidelines. Otherwise, the market will beat you into the ground. Tough.

Whether you are considering partnering with us or evaluating a subdivision on your own, run through this checklist first.

If you cannot answer each section confidently with data, the subdivide probably will not work.

=====

Need funding for a properly-structured subdivision (or any land deal)? Work with the most data-driven land-funding team, with an industry-leading 41% operating margin. $50K minimum purchase price, ~2x conservative gross margin. We close 100% of deals we commit to.

Get Your Property Analyzed Today

Originally published at https://seriousland.capital on November 24, 2025.

This was sick🙌. Chris you’re a stud💪

Great analysis. Learned some things I had not considered before.