REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Most investors don’t like to brag about their losses, they focus solely on the upside… but in the world of taxes and real estate – a penny saved is a penny earned.

Investing in real estate brings some incredible tax benefits, and savvy real estate investors understand that losses can actually put some serious cash in your pocket in the long run.

The key to maximizing the benefit of your real estate investment to increase cash flow while lowering your taxable income. Your AGI (Adjusted Gross Income) is the final number the IRS recognizes as the amount of income on which you need to pay taxes. It starts out with your wage income and then allows you to take out a few deductions before you are left with your final AGI. These deductions are essential to lowering your AGI and rental properties provide some serious deductions that you wouldn’t otherwise be able to deduct from your final taxable income. The deductions that will provide the best bang for your buck are an active participant, depreciation and interest expense.

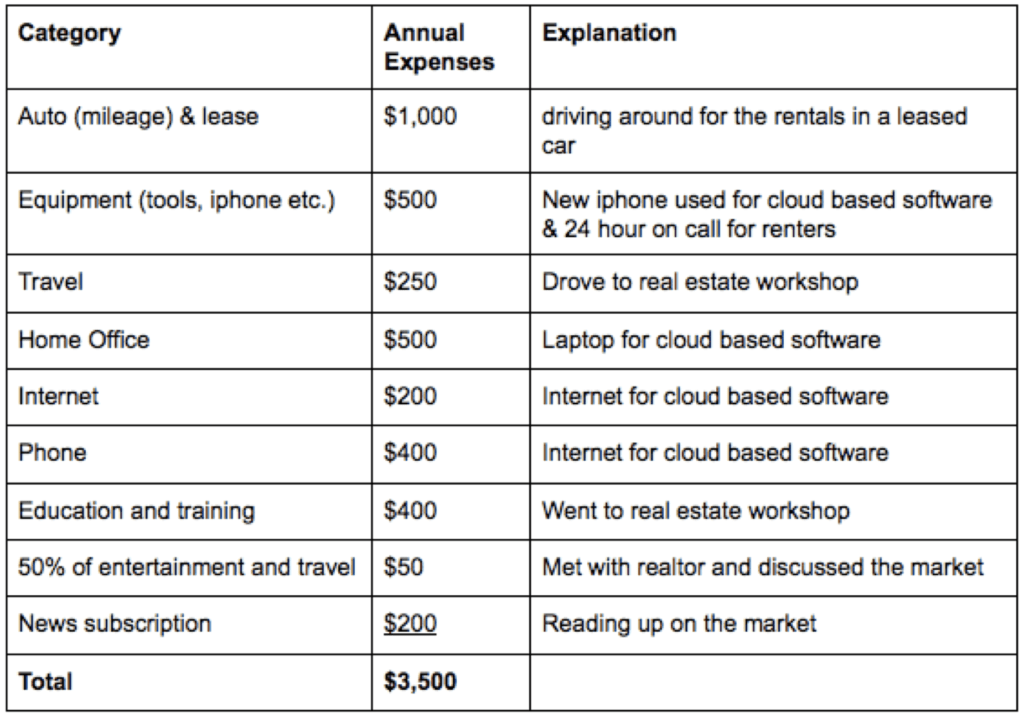

As a real estate investor, you must prove to be an Active Participant. This is defined by the IRS and allows you to take up to $25,000 (married) of rental losses, which can offset your regular income. If you have anything to do with your properties then you can qualify. Below are some examples of itemized deductions for your small business as a landlord (whether registered as a business or not, you get to claim them with the IRS):

Do any of these look familiar? You can probably see where many of these everyday expenses can be put to work as tax deductions in managing your rental properties. Without your rental real estate, they're nothing more than regular expenses that can't be deducted from your AGI (amounts above are portions of the full expense).

These expenses get added to each property's depreciation expense, which is a non-cash expense and therefore already designed to lower AGI and increase cash flow. Depreciation is a deduction allowance based on the purchase price of the property and divided equally over 27.5 years (to get the annual depreciation expense, simply divide the purchase price by 27.5). This expense is utilized best when you can purchase a rental with a lower down payment, because you put less cash into the property, but get the full purchase price of the property in calculating the expense.

Example:

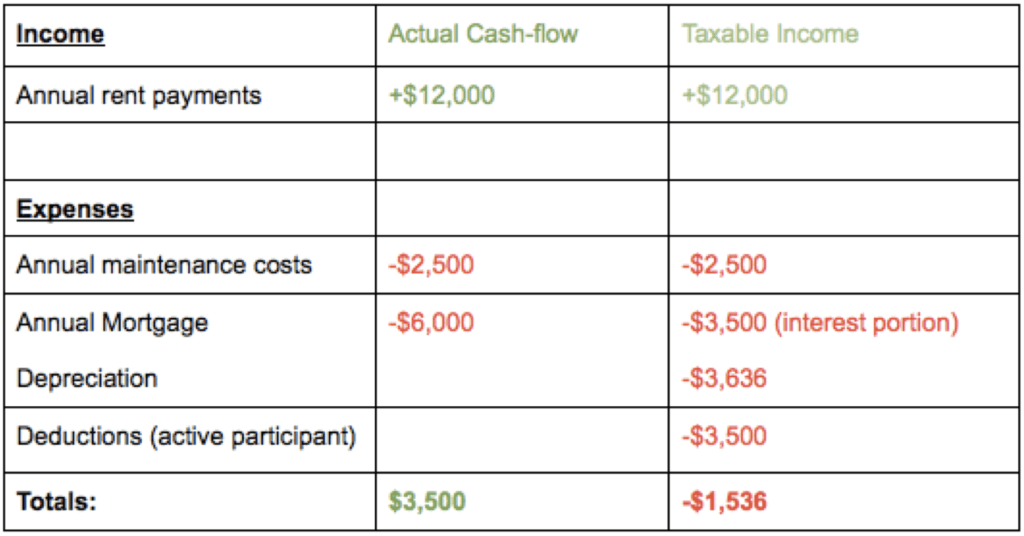

You purchase a house for $100,000, with a $20,000 down payment and $80,000 loan – so the annual depreciation expense is $100,000 / 27.5 = $3,636

The third deduction to utilize in real estate is from your financing. A real estate mortgage allows you to use other people's money (OPM) to finance your profits, but they come with a hitch – you have to pay them back. The interest expense on a real estate loan creates an additional advantage for your deductions because interest expense is also tax-deductible. Had you not taken out the loan, you would have purchased the property for the same amount, but lost out on this deduction and therefore paid higher taxes, which costs you in cash flow. This interest expense provides an additional deduction for lowering your AGI while requiring less of your cash out-of-pocket when acquiring each new property.

By the numbers:

What does all this mean? You technically now have $3,500 more per year in cash flow, but your taxable income is simultaneously going down by $1,536.

The best part of all this is – your tenant is paying for an asset that is growing in value. And this is only with one property… imagine how the numbers will look when you own 5 or 6 (or more), all increasing your global cash flow and lowering your AGI (and by the way, this is another advantage of financing – you can buy 5x more properties based on 20% down).

Sounds easy, but the part many forget to do is keep track of their income and expenses, so they can take advantage of such a strategy. Tracking your costs is the most important part, which I know seems difficult, but software, your phone, and the cloud have now made this extremely easy. You have now just made a profit by utilizing one of real estates’ best-kept secrets – the losses.