REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

As a real estate investor, the key to a successful marketing campaign isn't spending more money to reach everyone; it's spending less money to reach the right people.

This is true no matter which data service you're using to get your list of property owners, but some data services offer a lot more flexibility than others.

In this blog post, I'll show you some examples of the unique filtering combinations you can use to find exactly who you're looking for without wasting time and money contracting the wrong people.

The goal here isn't to give you exact recipes to follow, but to spark your creativity and help you understand which levers to pull for your specific investment strategy.

1. Local Builders (High-Value Prospects for Land Sellers)

Why Target Builders? Builders are constant land buyers and represent some of the most qualified prospects for vacant lots. They also typically have corporate structures and buying patterns that make them easy to identify.

Filter Combination:

- Property Type: Vacant lots only

- Ownership Type: Corporate owners only (LLC, Inc., etc.)

- Portfolio Size: Property owners who currently own 5+ vacant lots

- Recent Activity: Properties purchased within the last 18-24 months

- Buildability: Include buildability filter (20%+ recommended)

Pro Tip: This filter will also capture timber companies and mortgage lenders, but you'll find a high concentration of active builders. If you're not seeing enough results, consider reducing the minimum lot count to 3 or more properties or extending the purchase timeframe.

2. Landlocked Properties (Easement Opportunities)

Why Target Landlocked Land? While most investors avoid landlocked properties, some niche investors will specifically target large landlocked parcels because they can often be purchased at steep discounts. If you can secure an easement on a larger, landlocked property, the value increase can be substantial.

Filter Combination:

- Geographic Scope: Entire state or multiple counties (landlocked properties are less common in many areas)

- Property Type: Vacant land

- Access: Landlocked properties only

- Size: 40+ acres (larger parcels justify easement costs)

Strategy Note: Focus on states and properties where you'll have a reliable legal means to get an easement (not every state makes this easy). Timber companies often own these properties and may be motivated sellers, especially after recent harvests.

3. Senior Homeowners with High Equity

Why This Works: Senior homeowners often have substantial equity built up and may be motivated to downsize or relocate closer to family.

Filter Combination:

- Property Type: Single-family residential

- Equity Percentage: 90-100%

- Bedroom Count: 2-3 bedrooms

- Market Value: $60K-$120K (adjust for your market)

- Occupancy: Owner-occupied

- Owner Age: 65+ years (if available in county data)

- Last Sale Date: 10+ Years Ago

4. High-Slope View Lots for Luxury Builds

Why Target Steep Slopes? While most builders avoid steep slopes due to construction costs, some luxury builders may specifically seek out these properties for the premium views they offer.

Filter Combination:

- Property Slope: 70%+ of parcel at 15%+ slope

- Land Use: Residential vacant

- Acreage: 0.25-2 acres

- Owner Location: Out-of-county owners preferred

- MLS Status: Exclude active listings (for off-market opportunities)

Market Note: These properties work best in areas with significant topography and luxury home markets.

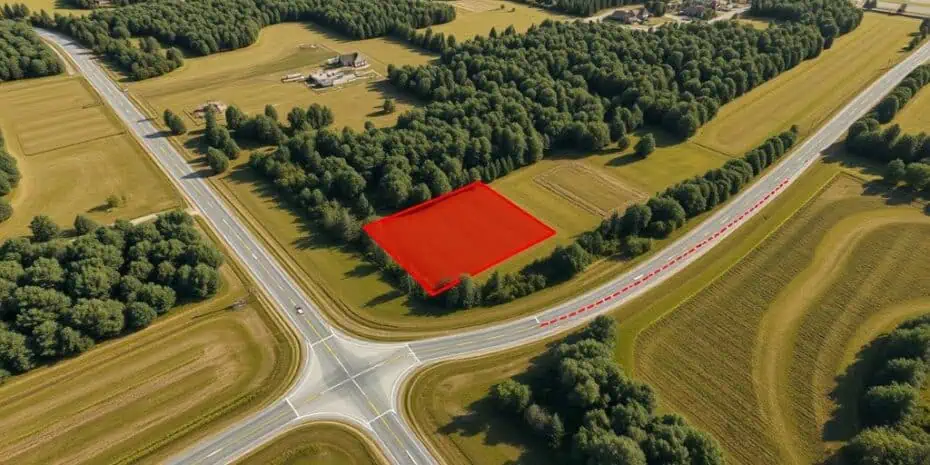

5. Industrial Sites Near Transportation Hubs

Why This Strategy Works: Industrial developers and warehouse REITs constantly seek well-positioned sites with good transportation access.

Filter Combination:

- Geographic Method: Draw a polygon around rail corridors or highway interchanges

- Land Use: Industrial vacant, commercial vacant

- Acreage: 5-50 acres

- Road Frontage: 300+ feet (for truck access)

- Owner Location: Out-of-state owners (Optional)

- MLS Status: Exclude active listings (Optional)

Pro Tip: Keep polygon boundaries within a single county to avoid database conflicts.

6. ARM Reset Sellers (Motivated Homeowners)

Why Target ARM Borrowers? Homeowners with adjustable-rate mortgages face payment increases when rates reset, creating motivation to sell quickly.

Filter Combination:

- Property Type: Single-family residential

- Mortgage Type: Adjustable/ARM

- Mortgage Origination: 5-7 years ago

- Equity Percentage: 20-60%

- Occupancy: Owner-occupied

7. Timber Tract Owners

Why Target Timber Owners: Long-term timber owners may be ready to harvest and sell, especially if they're absentee owners who inherited the property.

Filter Combination:

- Land Use: Timberland, forest, rural wooded

- Acreage: 80+ acres

- Last Sale Date: 15-30 years ago

- Improvement Value: $0

- Owner Location: Out-of-county (Optional)

8. Semi-Truck Parking Development Sites

Why This Niche Works: Growing demand for truck parking (Industrial Outdoor Storage or ‘IOS') creates opportunities for specialized industrial development. Flood-prone areas work well since parking doesn't require dry land.

Filter Combination:

- Geographic Method: Draw a polygon around major highways

- FEMA Flood Coverage: Up to 100% acceptable

- Land Use: Commercial/industrial

- Acreage: 4-100 acres

- Building Size: 0-10,000 sq ft (small existing buildings preferred)

- MLS Status: Exclude active listings (Optional)

9. Flat Infill Lots for Builders

Why Builders Love These: Easy-to-build infill lots near existing utilities are highly desirable for production builders.

Filter Combination:

- Location: City/metro core areas

- Acreage: 0.10-0.50 acres

- Property Slope: 90%+ of parcel at 5% slope or less

- Road Frontage: 40+ feet

- Land Use: Residential vacant, urban vacant

- MLS Status: Exclude active listings

10. Out-of-State Farmland Owners

Why This Works: Absentee farmland owners often never visit their properties and may be open to selling or long-term leasing arrangements.

Filter Combination:

- Land Use: Cropland, farmland, agricultural general

- Acreage: 40-640 acres

- Owner Location: Out-of-state

- Improvement Value: $0

- Last Sale Date: 10+ years ago

11. “Tired Heirs” (Estate Properties)

Why Target Inherited Properties: Heirs who inherit vacant land often live far away, have no emotional attachment, and want quick cash conversion.

Filter Combination:

- Owner Name Includes: “Estate of,” “Heirs of,” “TRUST,” “Personal Representative”

- Last Sale Date: 20+ years ago or unknown

- Occupancy: Absentee owner

- Owner Location: Out-of-county

- Land Use: Various vacant land categories

- Improvement Value: $0

12. Recent Cash Buyers (Future Sellers)

Why Target Recent Cash Buyers? Cash buyers often flip properties quickly and may become sellers within 6-18 months.

Filter Combination:

- Equity Percentage: 100%

- Last Sale Date: Last 6-12 months

- Occupancy: Absentee Owned, Unknown

13. Basic Vacant Land List

Core Vacant Land Strategy: This is your foundation list for general vacant land investing.

Filter Combination:

- Improvement Value: $0

- Land Market Value: $10K-$100K (adjust for market)

- Land Use: Agricultural, residential, mobile home, unimproved vacant, recreational

- Occupancy: Absentee, out-of-county, out-of-state owners

- Tax Status: Tax delinquent (Optional – greatly increases motivation but reduces list size)

Note: The Tax Delinquent Status is not available in about 50% of the country. If you apply this filter and it returns no results, remove it from your list of filters.

14. Single Family Homes (Equity-Rich Owners)

Why Target High-Equity Homeowners? Property owners with substantial equity and low mortgage balances often represent motivated sellers.

Filter Combination:

- Equity Percentage: 80-100%

- Market Value: $50K-$100K (adjust for market)

- Property Use: Single-family residential

- Tax Status: Tax delinquent properties only

- Occupancy: Absentee owned

Advanced Filtering Tips

There's a lot to think about when filtering your lists for a niche-specific group of properties and property owners. Here are a few things to keep in mind as you're doing this.

- Start Broad, Then Narrow: If your initial filters return zero results, your criteria may be too restrictive. Remove some filters and gradually add them back.

- County Data Quality Varies: Some counties have incomplete data. If you're not getting results in one county, try expanding to multiple counties or different regions.

- Combine Geographic and Demographic Filters: Use polygon tools around specific features (highways, rail lines, city centers) combined with property characteristics for highly targeted lists.

- Test and Adjust: Every market is different. Use these combinations as starting points and adjust based on your local conditions and investment strategy.

- Consider List Size vs. Quality: Smaller, highly targeted lists often outperform larger, broader lists. Focus on quality over quantity.

Maximizing Your Results

Once you've created your filtered list, the Land Portal's skip tracing feature allows you to immediately contact property owners with phone numbers and email addresses. For properties without skip trace data, you always have mailing addresses for direct mail campaigns.

Remember: The goal isn't to contact everyone. The goal is to contact the right people who are most likely to accept your offer (whether you're buying or selling). With the right filtering combinations, you'll be able to achieve exactly that while saving time, money, and avoiding burnout.

The key to success is understanding your target market and creatively combining filters to reach them efficiently. Use these examples as inspiration to develop your own unique filtering strategies based on your specific investment goals and local market conditions.

Do you have any creative filtering combinations that have worked well for you? Leave a comment below and let me know about it!

Excellent, focusing on the niches of land ownership characteristics and land attributes.

That’s the idea!