REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

As a real estate lender and investor, I get asked the same question all the time:

As a real estate lender and investor, I get asked the same question all the time:

What is a safe ratio for me and/or my real estate business?

One of the common misconceptions people have about private, asset-based lenders is that they only focus on the “loan-to-value ratio” of an asset, but a borrower’s personal financials still play a major part in qualifying for a loan, even when using private, asset-backed lenders.

It’s crucial to understand your debt-to-worth (aka – debt-to-equity) ratio to gauge the health of your financial situation and make a smart investment.

Debt-to-Equity is defined as:

A measure of financial leverage, indicating how much an entity relies on debt relative to shareholders’ equity to finance its operations, assets, and growth. The ratio is calculated by dividing a company's total liabilities by its stockholders' equity.

In other words, this is a measure of how much actual value there is relative to a person's or company's debt.

How Debt-to-Worth Affects Real Estate Investments

In business, debt-to-worth is better known as your debt-to-equity ratio, and every business in every industry has a different idea of what ratio they consider safe. With real estate investing, we’re comfortable with a higher debt-to-equity ratio because the collateral is a physical building that isn’t going anywhere.

Debt-to-worth is a determining factor used by lending institutions, and it even affects your credit rating. The basic formula is:

Total Debt (short- and long-term debt) / Net Worth (Total Assets – Total Liabilities)

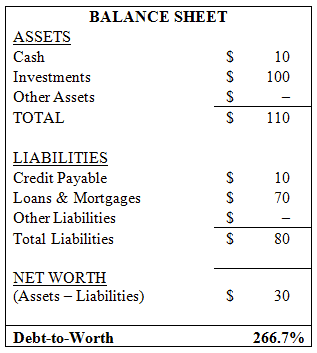

Here’s a more detailed example of a personal balance sheet that determines this ratio:

This simple formula is the basis for your overall financial health, showing how much leverage or negotiating power you currently maintain. The lower the ratio, the more creditworthy you’re considered to be because you have collateral to cover both current and future loans. In the event of a default, creditors want to know they won’t be left empty-handed.

Personally, I look for a maximum ratio of 300 percent in my investments, which is equivalent to a 75 percent LTV ratio. This isn’t the only determining factor in my investments, but it’s the foundation before I even begin due diligence to complete a thorough and complete analysis of the potential investment.

How Smart Investors Approach Real Estate

I invest in real estate because it gives me the ability to control an asset with less money out of my pocket than, say, investing in a startup or stock.

The best tip I have for investors is to only invest in things you actually understand. This doesn’t mean you have to be an expert — just be sure you know what you’re investing in and what makes it a smart investment. If you don’t have this knowledge, you’re better off investing in your own education to get to a level where you can make sound investment decisions without depending on the opinions of friends, family, colleagues, or “experts” in the media.

Be sure your investments are protected before focusing on potential returns. High-risk investments can yield great returns, but they can also lead to huge losses. If you can’t afford the loss, don’t invest. It also doesn’t hurt to diversify your investments in different asset classes or the same one to ensure your net worth isn’t tied to any one opportunity, but don’t mistake diversification for an effective way to manage risk.

Real estate investments are a popular addition to any savvy investor’s portfolio. The value of the property may go up or down, but there’s a real asset backing any loan. With this collateral available, lenders allow for a higher debt-to-worth ratio, but it’s still important to keep the ratio as low as possible because it determines your overall bankability.

Renowned value investor Benjamin Graham said it best, “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return.” If this approach worked for Graham and his protégé Warren Buffett, I’m confident it can work for the rest of us.