As I’ve heard recession chatter explode over the last year or two, I’ve heard experienced investors increasingly mentioning self-storage facilities.

But even though most people get the gist of how the business model works, they don’t grasp all the pros and cons of owning storage units.

Strap in for a lightning overview of self-storage and what you need to know before jumping in.

How Does Self-Storage Investing Work?

You can invest in self-storage facilities in many ways. The easiest of those is to buy shares in a publicly-traded REIT that owns and operates storage facilities.

While less liquid, you can also access self-storage investments through real estate crowdfunding websites. For example, EquityMultiple, RealtyMogul, and CrowdStreet sometimes feature these investments. But only accredited investors can participate in these private equity investments.

Non-accredited investors may be able to find real estate syndications that allow them to participate. While I’ve never invested with him and am not endorsing him in any way (CYA, as they say), Tom Dunkel of Belrose Storage Group sometimes allows non-accredited investors.

Or, at the furthest end of the simplicity spectrum, you can build or buy a storage facility yourself. It may not be easy per se, but it can be profitable, which offers the perfect segue into the pros and cons of owning storage units.

RELATED: Concreit Review: Most Flexible Real Estate Crowdfunding Investment?

Pros and Cons of Owning Storage Units

Like the idea of self-storage investing but don’t fully understand the industry?

Glad you’re taking the time to ask questions and do your due diligence!

Pros of Self-Storage Investing

Investors park money in self-storage facilities for the following reasons.

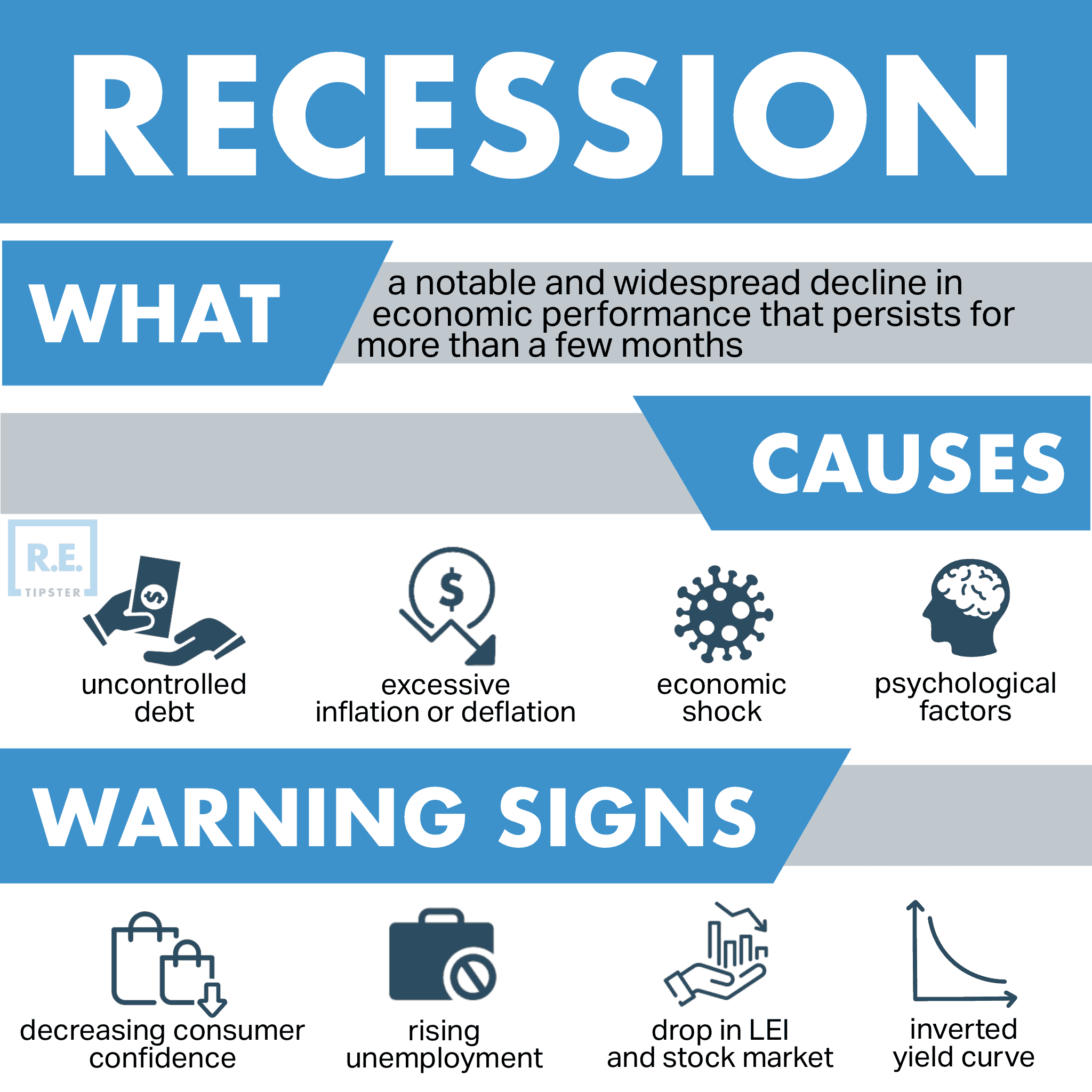

Recession Resistance

When the economy contracts, many people downsize. Others move in with friends or family, which is a phenomenon known as “household bundling.”

Either way, they end up with less space for all their stuff. Some may sell, but others don’t mind paying a small monthly fee to store their precious trinkets and knick-knacks.

That’s precisely why the only REIT sector that delivered a positive return during the Great Recession was, you guessed it, self-storage.

Low Maintenance Properties

Storage facilities don’t need many of the mechanical systems or structural complexity that houses or commercial buildings do.

They don’t need plumbing, basements, or multiple stories. In many markets, they don’t need HVAC. And while they do need electricity in some cases, they only need the simplest wiring to ensure each unit is well-lit. That makes for easy (and cheap!) buildings to maintain.

Low Maintenance Renters

Storage renters don’t call you about plugged toilets or leaky faucets. They pay their rent each month, and they don’t, and you eject them.

Easy Evictions

Every state and many major cities impose eviction laws as part of their landlord-tenant code. Some are more landlord- or tenant-friendly than others, but they all require a series of legal notices, a court hearing, and a scheduled put-out date. In some cases, this takes many months—I’ve had evictions take 11 months before.

None of that happens with storage units. If the renter stops paying, you can auction off the contents of their unit after a brief grace period and a notification attempt or two.

Minimal Regulation

This raises a broader point: self-storage facilities don’t have nearly the same regulatory headaches as residential real estate. You don’t have to worry about complex landlord-tenant laws, rent control, rent stabilization, or 30-page leases. It’s a simple contract: you pay me, I hold your stuff, the end.

Automation and Minimal Labor Costs

Unlike multifamily properties with 100+ units, storage facilities often don’t need an on-site manager. You can automate entry and exit from the facility and renters’ access to their units.

Sure, a manager should check on the buildings for maintenance periodically, and you may need some security depending on the area. But the simpler buildings and business model mean less labor all around.

Cheap Land

You don’t need to buy space in the middle of the downtown business district to attract tenants for self-storage. Quite the opposite—you only need land that doesn’t sit too far from residential areas. That means you can buy cheap land far from any foot traffic.

High Profit Margins

Self-storage facilities can pay high profit margins. According to Investment Real Estate LLC, the average profit margin for storage facilities is 41%. You can see how AJ Osborne went from comatose to a multi-millionaire with self-storage!

Downsides to Storage Investing

Before pulling the proverbial trigger on a self-storage investment, consider the cons as well.

Cost to Acquire

If you plan on directly buying or building a storage facility, plan on paying a pretty penny. Cheap land aside, you’ll still shell out hundreds of thousands of dollars at a minimum and possibly seven figures.

Variable Operating Costs by Market

Sure, self-storage costs less to operate than residential properties. But operating costs do vary by the market where you set up shop.

You might need air conditioning if you're operating a climate-controlled facility in a hotter climate. In colder climates, you might need heat. And in high-crime areas, you probably need more advanced security.

Marketing Costs

Self-storage operators often need complex and costly marketing campaigns to reach and maintain high occupancy. That could include pay-per-click advertising, billboards, and even radio or TV ads. And because you’ll have constant turnovers, some of these marketing costs must continue indefinitely.

Risk of Oversupply and Hyperlocal Market Shifts

The barriers to entry for self-storage facilities just aren’t very high. Read: competitors can enter the market at any time.

That says nothing of how shifts in your micro market can change demand. That expected military base or new employer opening a headquarters could fail to materialize. The developer planning on building a thousand new homes could pull the plug. If you were counting on future demand growth, that could leave you in serious trouble.

Are Storage Units a Good Investment?

Yes—with caveats.

All investments, real estate and otherwise, come with risk. Ignore those risks at your peril.

That said, self-storage facilities offer operational simplicity in a recession-resistant asset class. It’s a counter-cyclical niche that does well even when the rest of the economy stumbles. Consider starting small with REITs, real estate crowdfunding, or syndications, and as you learn more about the industry, you can explore buying or building your self-storage property.