REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

I'll never forget the time I bought a property for $4,587 and then sold it for $20,000.

That's a return of roughly 300%, which is a solid ROI by any standard. But here's the part that still makes me smile every time I think about it.

I didn't pay a single penny in taxes on that profit. Not one cent to the IRS.

100% of the profits went straight into my account, tax-free, and it was all completely legal, fully endorsed by the U.S. Government.

How? I bought and sold the property inside a Self-Directed Roth IRA.

If you've never heard of this before, or if you've heard the term but figured it was some complicated financial maneuver reserved for wealthy investors with teams of accountants… stick with me. It's simpler than you think, and by the time you finish reading this, you'll understand exactly how it works and why it might be the most overlooked wealth-building tool available to everyday investors.

A Quick Primer on the Roth IRA (Just the Essentials)

Most people are familiar with traditional retirement accounts like 401(k)s and Traditional IRAs.

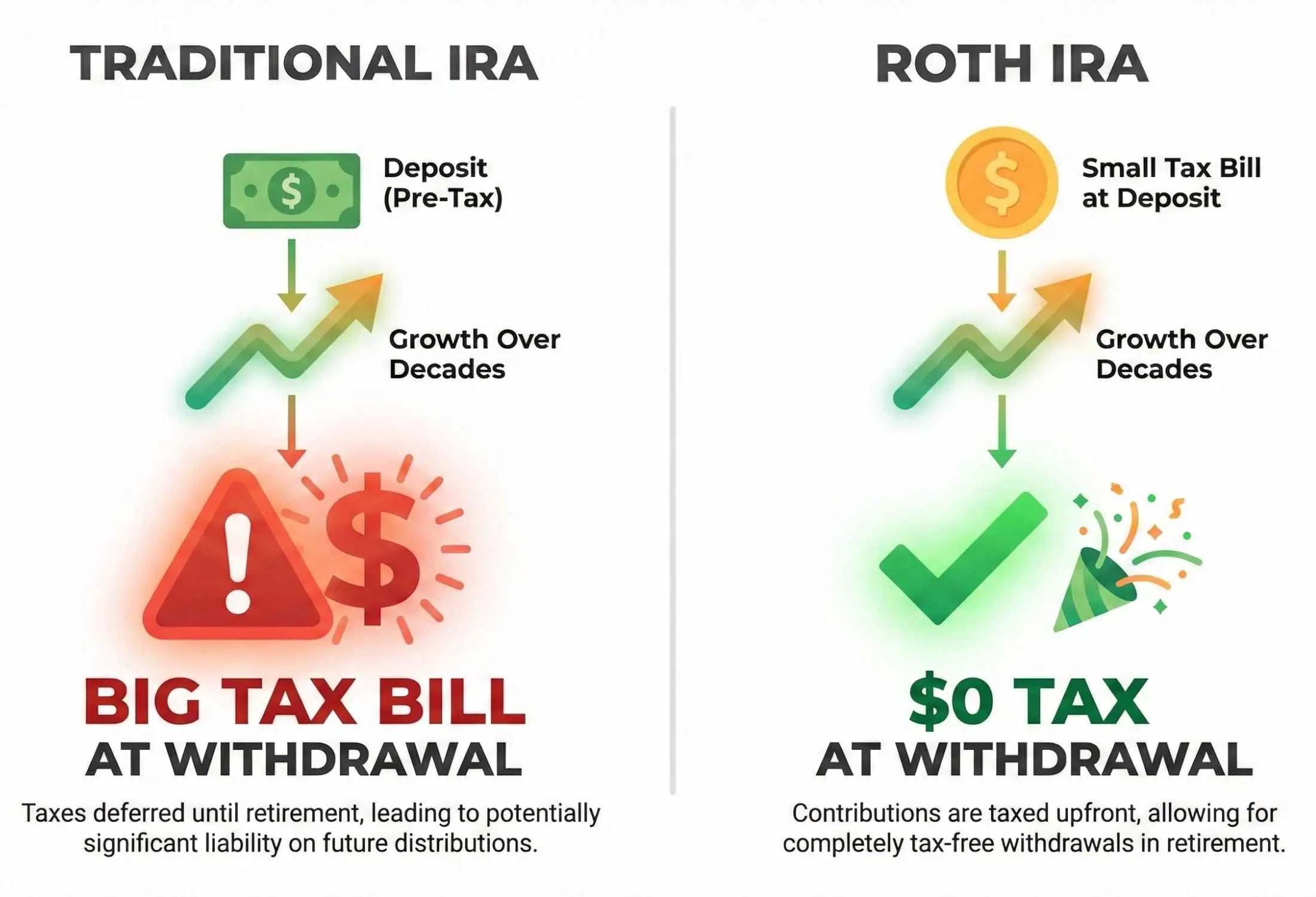

The basic idea is that you put money in before paying taxes, it grows over time, and you pay taxes when you withdraw it in retirement. The problem? By the time you withdraw that money, your account has (hopefully) grown significantly, which means you could be staring down a much bigger tax bill than you would've owed decades earlier.

The Roth IRA flips this on its head. You contribute money you've already paid taxes on (when your income and tax bracket are likely lower), and then everything that grows inside the account, every dollar of profit, can be withdrawn tax-free in retirement. You pay a small tax bill now to avoid a potentially massive one later.

Here's a quick visual to illustrate the difference. With a Traditional IRA, your biggest tax hit comes at the end, right when you're trying to enjoy your money. With a Roth IRA, you've already paid the taxes up front, and everything that grows in the account is yours to keep.

That's the basic concept. If you want to dive deeper into contribution limits, age requirements, and withdrawal rules, there are plenty of great resources out there (and I'll link to some at the end). But for now, this is all you need to understand to appreciate what comes next.

Now Here's Where It Gets Really Interesting

A standard Roth IRA typically limits you to investing in stocks, bonds, and mutual funds. And look, there's nothing wrong with that. An 8% to 12% annual return is considered “good” in the stock market, and over decades, it can add up.

But what if you didn't have to settle for 8% to 12%?

A Self-Directed Roth IRA is a special type of Roth IRA that lets you invest in things beyond the stock market, including real estate, precious metals, private company stock, tax liens, and more. You're essentially taking the steering wheel instead of handing your money to a fund manager and hoping for the best.

And when you combine a Self-Directed Roth IRA with a business model like land investing (where it's not unusual to double, triple, or even quadruple your investment on a single deal), the math gets very exciting very fast.

Let me show you what I mean.

The Comparison That Changed How I Think About Retirement

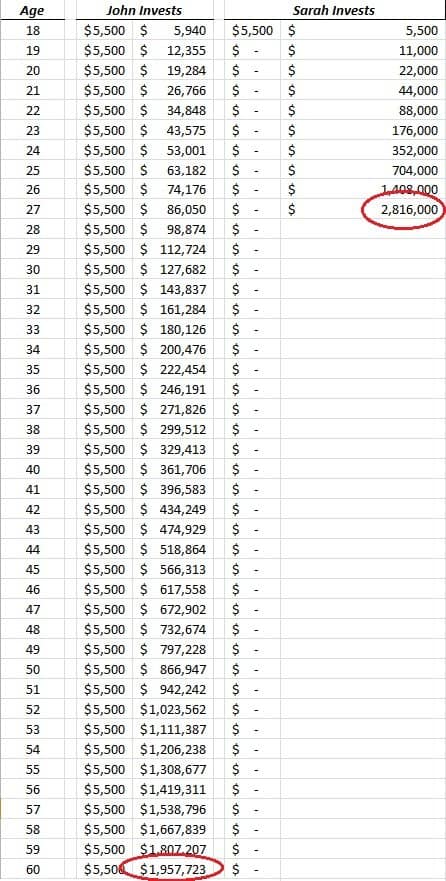

Meet John and Sarah. They both start with the same amount of money and want to reach $2,000,000 for retirement.

John takes the traditional route. He invests $5,500 in a mutual fund within a standard retirement account each year, earning an average annual return of 8%. He reinvests his returns and keeps at it year after year.

Sarah takes a different approach. She invests $5,500 once into a Self-Directed Roth IRA and uses it to buy and flip land. Using the land-investing model, she regularly finds properties at a fraction of market value and sells them within 12 months. Her average annual return is around 200% (for context, most of my own properties have sold within 6 months, yielding returns between 100% and 300%, so this isn't a fantasy number).

Here's how their paths compare:

Read those numbers again. Sarah hit her retirement goal by age 27. John was still working toward his goal at 60.

Now, I want to be completely honest with you. These projections require some broad assumptions. John's mutual fund won't return exactly 8% every year, and Sarah's land deals won't always produce exactly 200%. Some years will be better, some will be worse. Sometimes a property takes longer to sell than expected (as mine did in the deal I'll walk you through below).

But even with those fluctuations, the overall trajectory is what matters. When you can consistently earn returns that are 10x, 20x, or even 30x what the stock market offers, and those returns compound tax-free inside a Roth IRA, you're playing an entirely different game than everyone else.

My Real-Life Deal: A Step-by-Step Walkthrough

I don't just want to show you the theory here. I want to show you exactly how I did this, step by step, so you can see that it's real and that a normal person can pull it off.

Step 1: Finding the Deal

I found this property the way I usually do, through my standard direct mail process. After some back-and-forth with the seller via email, I was able to get the property under contract for less than $5,000. Based on my research, I estimated it was worth somewhere between $20,000 and $40,000.

Step 2: Signing the Purchase Agreement

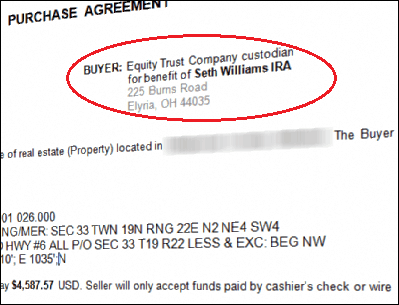

The purchase agreement looked almost identical to what I normally use, with one small but important difference. Since I was buying the property through my Self-Directed Roth IRA (with Equity Trust as my custodian at the time), the “Buyer” on the contract had to be listed in the IRA's name, not my personal name.

This is where having a good custodian really pays off. Equity Trust coached me through this part, letting me know exactly how the documentation needed to look and what was and wasn't allowed. Without their guidance, I probably would've gotten tripped up on the paperwork.

Step 3: Closing the Purchase

When you buy real estate inside a Self-Directed Roth IRA, you have to use a third-party closing agent (a title company or real estate attorney). You can't close these deals in-house, even on cheaper properties.

The process involves three parties working together: you, your closing agent, and your IRA custodian. You communicate what needs to happen through a “Direction of Investment” form, which is basically a set of instructions for your custodian on which documents to sign and how much money to send.

I'll be completely honest with you: I found these forms a bit confusing the first time, and I probably would've filled them out incorrectly if I hadn't called Equity Trust for help. But with a little hand-holding, I got through it just fine. Once I submitted the form, the closing agent mailed the documents to Equity Trust, they signed everything, sent a cashier's check from my IRA to pay for the property, and the deal was done.

Step 4: Selling the Property

The selling process was the most time-consuming part of this particular deal. It took longer than usual to find a buyer, but honestly, I wasn't marketing it very aggressively. The property was large and valuable, and it cost me only $66 a year in property taxes, so I wasn't losing sleep over it. I knew the right buyer would come along eventually.

Step 5: Finding the Buyer and Closing the Sale

When the right buyer finally showed up, everything fell into place quickly. They were actively pursuing me (always a good sign), and the closing process mirrored the buying process. I filled out another Direction of Investment form, Equity Trust signed the necessary documents, and about a week later, a cashier's check for the full $20,000 purchase price was deposited into my IRA.

Tax-free. Every dollar of it.

A Few Things to Know Before You Jump In

I've painted a pretty exciting picture here, and I stand behind all of it. But I'd be doing you a disservice if I didn't mention a few important things to keep in mind.

Your money is locked up until retirement. The profits you earn inside a Roth IRA generally can't be touched penalty-free until you're 59½ and the account has been open for at least 5 years. If you need immediate access to your investment returns, this isn't the right vehicle. (You can withdraw your original contributions anytime, just not the earnings.)

You cannot mix IRA funds with personal funds. This is a big one. If you own a property inside your Self-Directed Roth IRA, every expense related to that property (property taxes, closing costs, maintenance, everything) must be paid from the IRA. If you accidentally use personal funds for any of it, even by mistake, you could face serious penalties from the IRS. Keep everything completely separate.

Transactions take a little longer to close. Getting your custodian and a third-party closing agent involved adds some extra days to the process. It's not a dealbreaker, and for many people it feels completely normal, but if you're used to closing land deals quickly, be prepared for a slightly longer timeline.

You'll need a custodian. Not every brokerage firm supports Self-Directed IRAs. You'll need to work with a custodian who specializes in alternative investments. Some well-known options include Equity Trust, Quest IRA, Pacific Premier Trust, The Entrust Group, and Horizon Trust.

None of these are reasons not to do this. They're just things you should understand going in so you can plan accordingly.

The Bigger Picture

Here's what I keep coming back to.

Most people accept the idea that retirement has to be a 30 or 40-year grind. You hand your money over to a fund manager, cross your fingers, and hope the market cooperates. And if everything goes perfectly, you might have enough to retire comfortably in your 60s.

But with a Self-Directed Roth IRA and a business model that can generate the kinds of returns land investing offers, you don't have to play by those rules. You can take your retirement savings into your own hands, earn returns that would be unthinkable in the stock market, and keep every dollar of profit without sharing it with the IRS.

I'm not telling you this because I read about it in a book. I'm telling you because I've actually done it. And if I can do it, there's no reason you can't, too.

It wasn't easy, but it was achievable. And that's really the whole story, isn't it?

Disclaimer: I'm not a tax accountant or attorney, and this post isn't intended as tax or legal advice. The information here is based on my personal experience, and your situation may differ. Talk to your accountant or attorney before taking action, and contact a qualified IRA custodian if you want to learn more about the specific rules that apply to Self-Directed Roth IRAs.

If you're looking for a custodian to help you open and manage your Self-Directed Roth IRA, some of the well-known IRA custodians are:

That said, not all self-directed IRA custodians offer services for the types of assets in a given account. A good custodian provides services to manage the specific asset(s) that can be invested in. They should have years of experience handling self-directed IRAs and understand the IRS rules governing them.