REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Today I wanted to give the stage to Joe Edgar, co-founder of TenantCloud.

Joe took some time this past week to write a guest post for the REtipster Blog, and I thought his perspective was pretty brilliant. Why? Because he illustrates that a great real estate investment doesn't always boil down to the “buy low, sell high” mentality that we've all come to know. Your ability to make a profit on any property isn't always what meets the eye… and it is entirely possible to sell a property “at a loss” while still making a killing along the way.

My hope is that you'll walk away from this blog post with an entirely new perspective on what can be done if/when you're ever in a situation where you need to sell a property for LESS than you paid for it. With the power of seller financing and a little ingenuity, you can turn this kind of situation into a very profitable outcome. Take it away Joe!

During the recent recession, selling real estate at a loss became a common (and usually very unwelcome) event for many real estate investors. Some may think that selling investment property at a loss means you “bought a lemon” but in many cases, you can use lemons to make lemonade.

I experienced my first “squeeze” in real estate when I was just 14 years old. I had bought an old, run-down house, fixed it up, and added some “sweat equity” to the property. I put down $3,000 I had saved from mowing lawns and then convinced my local hardware store to extend a line of credit so that I could buy my supplies (this was very difficult, but it's a subject for another time). After some long, hard nights and 60 days later, I managed to sell the house for a profit.

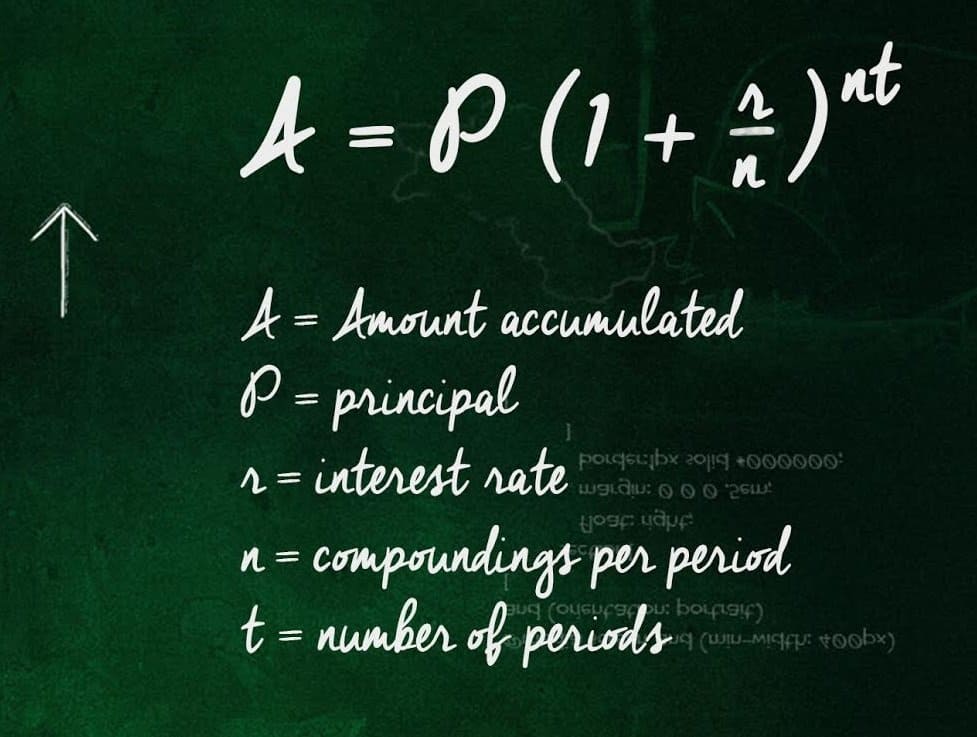

This sale wasn't just my first real estate deal, it was my introduction to compound interest and the bitter taste of capital gains tax. If being a teenager from an impecunious family of 13 (who wore his sister’s hand me down jeans) wasn't already unripe, I now had to figure out taxes and interest. What started as an acidic experience with mathematical formulas, soon became a once I peeled back the math.

As it turns out, these sour-looking formulas aren't nearly as complicated as they appear, and the capital gains tax structure is focused solely on the selling price and costs accumulated along the way. The two formulas are uniquely different in taste. One flavor has price minus expenses as the sole focus and the other, rate and time. Once I understood the receipt, I was able to mass-produce deals like lemon bars.

I could buy a house that needed some work and put $3,000 as a down payment for a loan from a bank. The loan terms had to include a fixed rate and time no longer than 15 years. I would then drop the price by $5,000 and try to sell it right away. The selling terms were:

- $3,000 down

- 0.5% more than my original loan’s interest rate

- 20-year term (for homes valued $200,000 or less)

I would not require the buyer to get a loan. Instead, they would make payments to me through a title company, who would track the loan, make the payments for my original loan and then send me the difference for a small fee (this is otherwise known as a “wrap”).

Just like water and ice are the same substance (and a necessary part of any glass of lemonade), so is taking a loss at the right time. By selling a house at a loss, I was able to report a capital loss (tax deduction) instead of a capital gain. It also enticed buyers to purchase the house quickly, and the fact that my properties came with their own built-in financing, the selling process became much easier. By increasing the interest rate, the buyer’s payments covered my loan payment and like a spoon full of sugar, and a 20-year loan meant the buyer would be paying me for 5 years after they paid off my loan.

And to top it off like an added strawberry, I wasn't the owner any longer. This meant that I wasn't responsible for property taxes, insurance or any maintenance issues on these properties. The home was fully sold but was still collecting the juice.

I don’t recommend a full glass of this strategy to any real estate investors, but rather a sip of the principle. Don’t be so focused on the price… because the real value is in the terms. If you find yourself underwater on an investment property, start by looking at the terms you can offer and start making some lemonade!