REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

When you start making some serious coin on your real estate deals, you'll eventually come to a painful realization at tax time.

Uncle Sam has every intention of taking a big cut of your profits.

Especially when you have to make a quarterly estimated tax payment, it becomes harder to ignore how much is being pried out of your hands each year.

To add insult to injury, most land investors also have to pay state income taxes in the state(s) where their properties are located. This may require additional multi-state tax filings each year, which can be a lot more work and money that you won't have the privilege of spending.

The more money you make, the more you'll feel the pinch.

States With No Income Tax

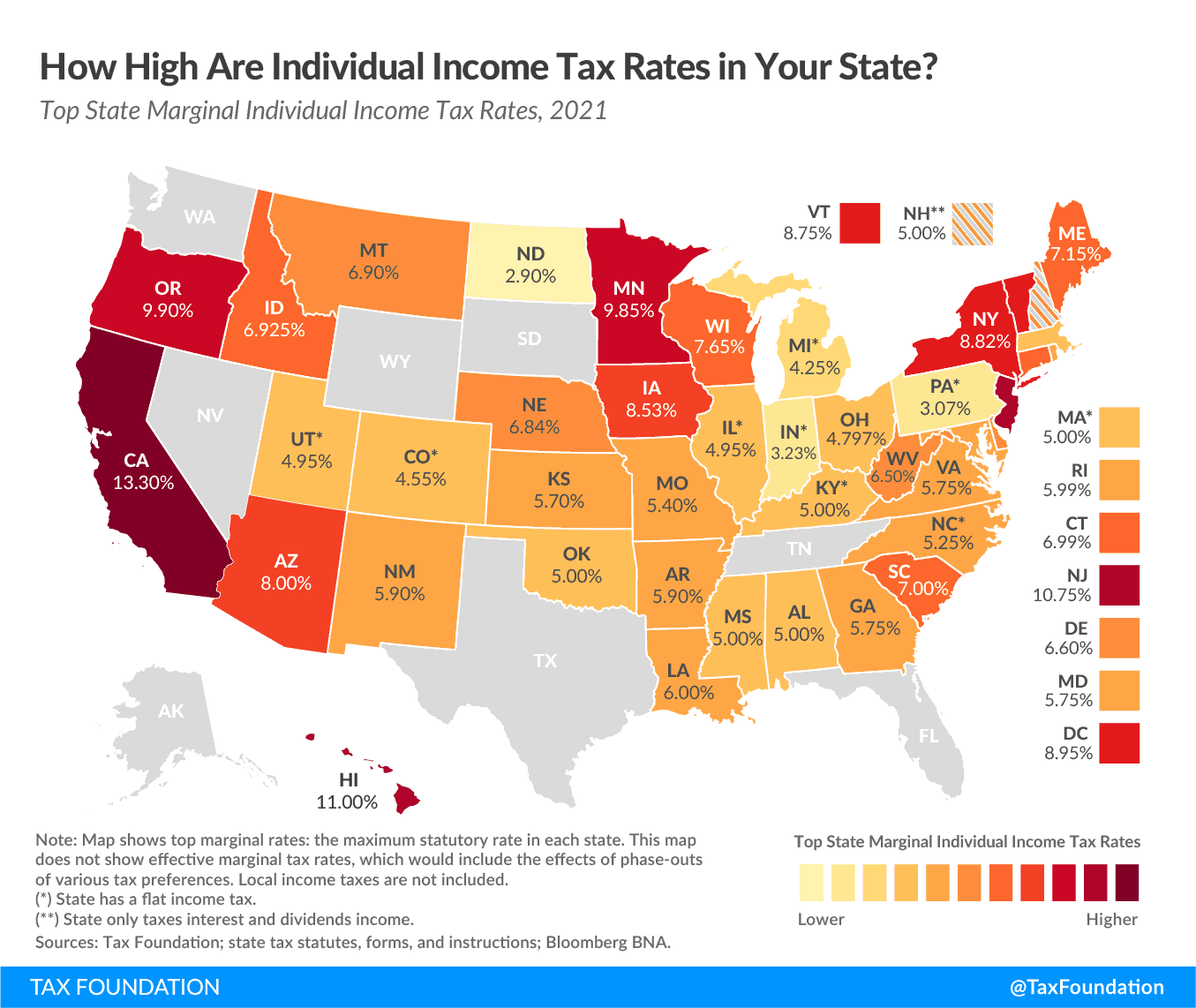

While it's certainly not the only factor to consider when deciding where to grow your land investing business, it's worth noting that there are a handful of states in the U.S. that don't require you to pay state income taxes on the profits you make.

That's right! Some states will allow you to keep a lot of tax dollars that other states would require you to pay just for doing business in their jurisdiction.

It's also worth noting that while many states do require you to pay income taxes, some of them require a substantially smaller percentage of your profits than others do (so even though you'll still have to go through the motions of filing a state tax return, a lower state income tax rate could still save you gobs of money in the end).

Map Source: TaxFoundation.org

At the time of this writing, there are 9 states that have no income tax at all:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

- Tennessee

- New Hampshire*

*Note that New Hampshire has a limited income tax on individuals, taxing only dividend and interest income, not earned income.

Individual vs. Corporate Income Tax

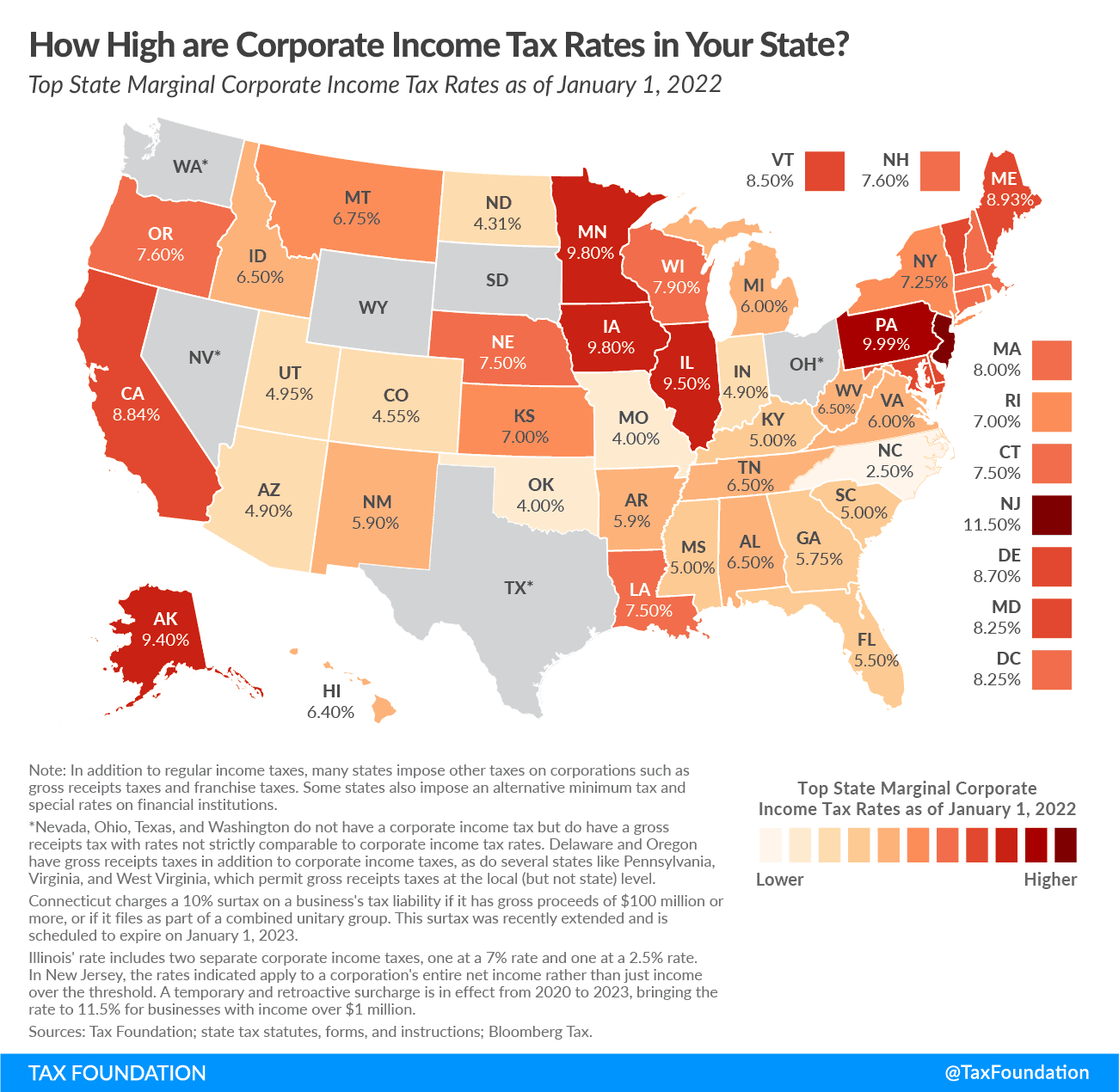

It's important to note that there is a difference between “Individual Income Tax” and “Corporate Income Tax”.

If you're buying and selling your properties in your personal name, or if you're using a single-member LLC filing as a disregarded entity and not as a corporation (which means the LLC income simply flows through to you personally), you'll be paying your taxes based on your state's individual income tax rate.

If however, you're buying and selling your properties in the name of a more complex corporate entity (like a C-Corporation), then you'll have to pay Corporate Income Taxes based on the Corporate Income Tax Rates listed here…

Map Source: TaxFoundation.org

Of course, I can't speak directly to your situation (you'll need to talk with your CPA to verify how your taxes work), but most of the real estate investors I know pay their income taxes based on the Individual Income Tax Rate because they either buy and sell properties in a disregarded entity single-member LLC or in their personal names.

RELATED: How to Start Your Own LLC or Corporation (It's Easier Than You Think!)

What's the Catch?

While it's great to work in a state with no income tax, this single factor usually isn't painting the full picture of what your tax liability will be in that state.

Most states without an income tax will employ other taxes or have higher taxes in other areas to generate this lost revenue.

- Washington has higher gasoline taxes and higher state and local sales tax.

- Nevada has a gross receipts tax that other states don't have.

- Texas has higher property taxes.

- Florida imposes a corporate income tax.

- Tennessee has high sales taxes and the highest beer tax.

- New Hampshire has taxes on interest and dividend income.

- Alaska has many localities that impose sales taxes.

If you're doing business in these states remotely, then some of these taxes may still not apply to you (for example, high sales taxes and beer tax still won't apply to you as a real estate investor if you aren't actively selling products or buying beer there. Likewise, the higher gasoline tax in Washington won't affect you if you aren't buying your gas in Washington).

As always, you'll have to look at your unique situation to assess how a state's taxes will impact you.

How Much Does State Income Tax Matter?

It's also worth noting that a state's income taxes are absolutely not the most important factor to weigh when choosing a market to work in.

Case in point, California may have the highest income tax rate in the country, but there are still some amazing deals and vast opportunities to be found there. Opportunities that arguably don't exist in any other state.

Similarly, I wouldn't go out of my way to seek out deals in New Hampshire simply because there is no income tax there. If there are plenty of other desirable factors about that market, then sure! But the decision doesn't boil down to the tax situation. It's just one of many things to consider when making this decision.

RELATED: Finding Your Best Market for Land Investing

RELATED: How to Find the Perfect Market for Flipping Vacant Land