What Is a 506(b) Offering?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts: 506(b) Offering

- 506(b) offering is an exemption under Regulation D of the Securities Act, allowing companies to raise money from investors without registering the securities with the SEC.

- A company uses 506(b) to raise unlimited capital from accredited investors and up to 35 non-accredited, sophisticated investors.

- Companies can only use existing relationships or networks to find investors and cannot advertise the offering.

- Securities in 506(b) offerings are “restricted” and cannot be freely resold without meeting certain conditions.

- 506(b) offerings are popular in real estate for funding projects and creating investment funds due to their flexibility and reduced regulation.

Understanding a 506(b) Offering

A 506(b) offering is an exemption under the Securities Act that allows companies to raise an unlimited amount of capital from accredited investors and up to 35 non-accredited, sophisticated investors without registering the securities with the SEC or going public.

It’s named after Rule 506(b), an exemption under Regulation D of the U.S. securities law.

Here’s how a 506(b) offering works: Imagine you’re a business owner with a great idea but need money to make it happen. You could try getting a loan from a bank, but what if that’s not enough or not an option? Or you could try to get public and ask for investments from the general public, but going public is a little bit out of your budget (and will take too much time that you don’t have).

This is where a 506(b) offering comes in handy. It’s helpful because:

- It allows companies to raise as much money as they need.

- It’s faster and less expensive than going public.

- It lets companies keep their financial information private.

Mainly, 506(b) is open to accredited investors, typically wealthy individuals or large institutions considered financially savvy. However, a 506(b) offering also allows up to 35 non-accredited investors to participate as long as they’re sufficiently knowledgeable about investing.

One key thing to remember is that companies using a 506(b) offering can’t advertise their investment opportunity to the general public. They need to rely on existing relationships or networks to find investors.

Who Can Participate in a 506(b) Offering?

When a company decides to raise money through a 506(b) offering, they can’t just accept money from anyone interested. There are rules about who can invest, which are designed to protect both the company and the investors.

Let’s break down the two main groups of people who can participate:

Accredited Investors

Accredited investors (also known as qualified investors) are the seasoned players. These are people or organizations that the government (specifically, the Securities and Exchange Commission or SEC) considers financially savvy enough to handle riskier investments.

Who counts as an accredited investor? Here are a few examples:

- People who earn $200,000 or more per year (or $300,000 together with a spouse).

- Individuals with a net worth of at least $1 million (not counting their primary home).

- Banks, insurance companies, and other large financial institutions.

- Executives or directors of the company offering the investment.

The idea is that these folks either have enough money to absorb potential losses or enough financial knowledge to understand the risks they’re taking.

For a more in-depth explanation of who or what can be an accredited investor, see our blog post on “What It Really Takes To Be A Qualified Investor.”

Sophisticated Investors

A 506(b) offering can also include up to 35 non-accredited investors. However, these individuals need to be “sophisticated” in financial matters.

What does “sophisticated” mean in this context? It’s someone who has:

- Enough knowledge about finance and business to understand the investment

- The ability to evaluate the pros and cons of the investment

- The capability to bear the economic risk of the investment

This could be someone like a business school professor, a former financial advisor, or an experienced small business owner. Despite not having accredited investor income or wealth, they’re smart enough to understand what they’re doing.

That said, it’s up to the company offering the investment to determine if a non-accredited investor is “sophisticated” enough to participate. They need to be careful about this because including non-accredited investors means they’ll have to provide even more detailed information about the investment.

These rules aren’t there to exclude people for no reason. They’re designed to protect people from investing in high-risk situations they might not fully understand or can afford. At the same time, they allow companies to raise money from a wider pool of investors than just the ultra-wealthy.

506(b) Offerings in Real Estate

Real estate projects often require substantial capital, and the unlimited fundraising potential of 506(b) offerings typically meets this need. Moreover, the real estate industry’s reliance on network-based relationships dovetails with the 506(b) structure, which prohibits general solicitation and instead leverages existing connections.

Real estate developers and investors use 506(b) offerings in ways like:

- Funding new construction or major renovation projects.

- Acquiring existing properties or portfolios.

- Establishing and operating private real estate investment trusts (REITs).

- Creating real estate funds for diverse property investments.

- Forming syndications for specific real estate projects.

Key Points to Consider in Real Estate 506(b) Offerings

When structuring a 506(b) offering for real estate, several factors come into play. First, ensure investors understand the complexities of the deal, especially non-professionals. Next, communicate with clarity about property valuation, projected returns, and liquidity concerns.

Since investors aren’t just buying property but also investing in your ability to manage it, you should highlight your team’s expertise in the offering documents.

Lastly, outline a realistic exit strategy. Investors need to know how and when they can expect returns.

Regulatory compliance in real estate 506(b) offerings involves some unique aspects:

| Aspect | Description |

| Property-specific disclosures | Detailed information about properties, including condition reports and market analysis |

| Financial projections | Must be reasonable and based on solid assumptions |

| Ongoing reporting | Regular updates on project progress, occupancy rates, and financial performance |

RELATED: Land Funding Blueprint: Partnership Agreements, Terms and Conditions, and More

Key Features of a 506(b) Offering

When raising capital, companies should understand the key features of a 506(b) offering. These characteristics define how the offering works and set it apart from other fundraising methods.

Let’s break down these important characteristics:

No General Solicitation or Advertising

A defining feature of 506(b) offerings is the prohibition on general solicitation and advertising. Companies can’t use public channels like TV commercials, newspaper ads, or unrestricted websites to attract investors. Instead, they must rely on preexisting relationships or networks to find potential investors.

Unlimited Accredited Investors

There is no cap on the number of accredited investors who can participate in a 506(b) offering. This allows companies to raise large sums of capital from a broad base of qualified investors.

Limited Non-Accredited Investors

While accredited investors are unlimited, a 506(b) offering can include up to 35 non-accredited investors. These investors must be sophisticated, meaning they have sufficient knowledge and experience to evaluate the merits and risks of the investment.

Exemption from Blue Sky Laws

Securities offered under Rule 506(b) are considered “covered securities” and are exempt from state registration requirements, also known as Blue Sky laws. This significantly reduces the regulatory burden on companies, as they don’t need to navigate the complex landscape of individual state securities regulations.

No Limit on Capital Raised

Unlike some other exemptions, there’s no cap on the amount of money a company can raise through a 506(b) offering. This makes it an attractive option for businesses with significant capital needs.

Disclosure Requirements

While 506(b) offerings have reduced regulatory requirements compared to public offerings, they still involve specific disclosure obligations, especially when non-accredited investors are involved. Companies typically provide these disclosures through a private placement memorandum (PPM) or offering memorandum, which includes information similar to that required in registered offerings to ensure investor protection.

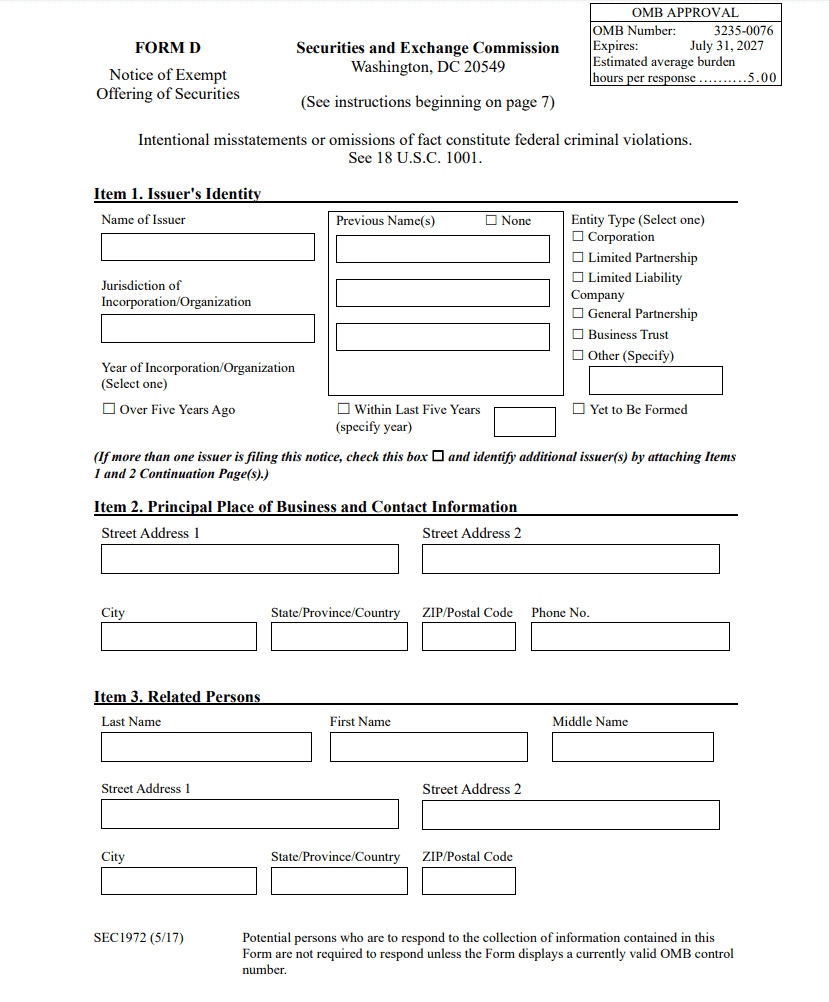

Form D Filing

As part of SEC compliance for 506(b) offerings, companies must file a Form D with the SEC within 15 days after the first sale of securities. This form provides basic information about the offering and the company.

Restricted Securities

Securities sold in a 506(b) offering are considered “restricted,” meaning they cannot be freely resold without registration or qualifying for another exemption. This typically involves a holding period before the securities can be sold.

Differences Between 506(b) and 506(c) Offerings

Both 506(b) and 506(c) offerings fall under Regulation D and provide exemptions from SEC registration. However, they have distinct characteristics that make them suitable for different scenarios.

Here’s a comparison of the key differences:

| Feature | 506(b) Offering | 506(c) Offering |

| General solicitation | Prohibited | Allowed |

| Investor types | Accredited and up to 35 non-accredited sophisticated investors | Accredited investors only |

| Investor verification | Self-certification allowed | Requires issuer to take “reasonable steps” to verify accredited status |

| Disclosure requirements | More extensive if non-accredited investors are involved | Generally less stringent |

Let’s explore these differences in more detail below.

Advertising and Solicitation

The most significant difference between these offerings is how companies can market them:

- 506(b): Enforces a general solicitation prohibition. Companies must rely on preexisting relationships or networks to find investors.

- 506(c): Allows general solicitation and advertising, enabling companies to publicly promote their offering through various media channels.

Investor Types

Both offerings allow participation from accredited investors, but they differ in their treatment of non-accredited investors:

- 506(b): Allows up to 35 non-accredited but sophisticated investors.

- 506(c): Restricted to accredited investors only. No non-accredited investors are permitted.

Investor Verification

The methods for verifying investor status differ between the two exemptions:

- 506(b): Companies can rely on investor self-certification of accredited status.

- 506(c): Requires companies to take “reasonable steps” to verify the accredited status of all investors, often involving review of financial documents or third-party verification.

Disclosure Requirements

Both exemptions have disclosure requirements, but they vary:

- 506(b): If non-accredited investors are involved, companies must provide a private placement memorandum with disclosure documents similar to those used in registered offerings.

- 506(c): Since only accredited investors can participate, the disclosure requirements are generally less stringent.

When to Use Each Type of Offering

The choice between 506(b) and 506(c) often depends on the company’s specific circumstances, target investor base, and marketing strategy.

506(b) is often preferred when:

- The company has a strong network of potential investors.

- The company wants to include some non-accredited investors.

- The company has a brief window of opportunity to raise funds, precluding the time to run ads.

506(c) is typically chosen when:

- The company wants to cast a wider net and publicly advertise the offering.

- The company is comfortable with the additional steps required to verify accredited investor status.

- The company is only targeting accredited investors.

Both 506(b) and 506(c) offerings have their advantages. Companies should carefully consider their goals, resources, and target investors when choosing between these two options for capital raising.

Restrictions on Solicitation in 506(b) Offerings

One of the defining characteristics of a 506(b) offering is the general solicitation prohibition. This restriction ensures that securities are offered only to investors with whom the issuer has a preexisting relationship or who have been introduced through a trusted intermediary.

What Constitutes General Solicitation?

The SEC has not provided an exhaustive list of what constitutes general solicitation, but it generally includes any attempt to market securities to the general public. Some examples include:

- Advertisements in newspapers, magazines, or on television and radio.

- Unrestricted websites or social media posts about the offering.

- Mass mailings or email campaigns to lists of potential investors.

- Presentations at seminars or meetings where attendees have been invited through general solicitation.

Photo by Ruize Li

Permitted Methods of Reaching Investors

While general solicitation is prohibited, companies can still reach potential investors through several approved methods:

- Existing relationships: Offering securities to individuals or entities with whom the company or its broker-dealer has a pre-existing, substantive relationship.

- Network of associates: Reaching out to a network of business associates, including fellow executives, board members, or legal and financial advisors.

- Investor databases: Using pre-screened lists of accredited investors maintained by broker-dealers or other financial intermediaries.

- Private placement platforms: Utilizing password-protected online platforms that verify investor accreditation status before allowing access to offering information.

Disclosure Requirements for 506(b) Offerings

Disclosure requirements are a fundamental aspect of securities law, designed to protect investors by ensuring they have access to material information about their potential investments. These requirements are often summarized as “let the buyer beware, but let the seller disclose.”

In the context of 506(b) offerings, these requirements serve as a crucial balance between facilitating capital formation for businesses and safeguarding investor interests.

Rule 502 of Regulation D outlines the specific disclosure requirements for 506(b) offerings. These requirements are less stringent than those for public offerings but still significant, especially when non-accredited investors are involved.

Key Components of Disclosure

- Information provided: Companies must furnish investors with all material information necessary to make an informed investment decision. This typically includes:

- Business description and history

- Risk factors

- Use of proceeds

- Capital structure

- Management background

- Financial information

- Private Placement Memorandum: This document is the primary disclosure vehicle in most 506(b) offerings. It’s analogous to a prospectus in a public offering but tailored for a private placement context.

- Non-accredited investor considerations: Disclosure requirements become more rigorous when non-accredited investors are involved. Companies must provide information substantially similar to what would be required in a registered offering under the Securities Act.

- Financial statement requirements: The level of financial disclosure required can vary based on the offering size:

- For offerings up to $2 million: Only the most recent fiscal year’s balance sheet, audited if possible.

- For offerings up to $7.5 million: Audited financial statements for the most recent fiscal year and unaudited statements for the two prior years.

- For offerings over $7.5 million: Audited financial statements for the past three fiscal years.

- Ongoing disclosure: While 506(b) offerings don’t require the same level of ongoing reporting as public companies, issuers often provide periodic updates to maintain investor relations and comply with anti-fraud provisions.

- Anti-fraud provisions: All disclosures are subject to anti-fraud provisions of securities laws, particularly Rule 10b-5. This means that even if specific disclosures aren’t required, any information provided must not be misleading or contain material omissions.

The Importance of Filing Form D in a 506(b) Offering

Filing Form D is important for 506(b) offerings. Form D is a brief notice that includes basic information about the company and the offering. It’s filed with the SEC to notify them of an exempt offering of securities under Regulation D.

A screenshot of the first page of Form D.

While failing to file Form D doesn’t automatically disqualify an offering from relying on the 506(b) exemption, companies should still file it for regulatory and state-level compliance purposes. Form D also provides transparency and can increase investor confidence in the offering.

Note that the SEC may penalize the company when it opens a 506(b) offering without filing Form D.

When to File Form D

Companies must file Form D within 15 calendar days after the first sale of securities in the offering. The 15-day clock starts with the first sale, not when the offering begins.

In addition, if the offering continues for more than one year, the company must file an amendment to Form D at least annually.

Information Required in Form D

Form D requires various pieces of information, including:

- The names and addresses of the company’s executives and directors.

- Some details about the offering, such as the type of securities offered and the offering amount.

- The number and types of investors (accredited vs. non-accredited).

- Use of proceeds from the offering.

- Information about any brokers or finders used in the offering.

FAQs: 506(b) Offering

How do I verify accredited investor status for a 506(b) offering?

In 506(b) offerings, self-certification is typically sufficient. Investors can complete a questionnaire or provide a signed statement confirming their accredited status.

However, issuers should document their reasonable belief in the investor’s status. For example, you can request financial statements or tax returns (with sensitive information redacted) or obtain the required information from a third party, such as a licensed attorney or a CPA.

While 506(b) doesn’t mandate the same rigorous verification as 506(c), maintaining thorough documentation of your verification process can protect you in case of future audits or disputes.

What are the risks of investing in a 506(b) real estate offering?

Key risks include illiquidity, market fluctuations, project-specific challenges, and potential loss of capital. Real estate investments may also face operational risks, such as property management issues or unexpected maintenance costs.

How does a 506(b) offering compare to crowdfunding for real estate?

506(b) offerings and real estate crowdfunding differ in several key aspects:

- Investor pool: 506(b) is primarily for accredited investors, while crowdfunding is open to a broader range of investors

- Fundraising limits: 506(b) has no cap, while crowdfunding is typically limited (e.g., $5 million annually under Regulation CF)

- Disclosure requirements: 506(b) has fewer requirements, especially with only accredited investors

- Marketing: 506(b) prohibits general solicitation, while crowdfunding allows public advertising

- Investment minimums: 506(b) often has higher minimums, while crowdfunding can offer lower entry points

- Regulatory oversight: Crowdfunding platforms must be registered with the SEC, adding a layer of oversight

- Deal structure: 506(b) offers more flexibility in structuring investments

Each method has its advantages, and the choice depends on the issuer’s goals, target investors, and capital needs.

References

- Code of Federal Regulations, “Regulation D—Rules Governing the Limited Offer and Sale of Securities.” https://www.ecfr.gov/current/title-17/chapter-II/part-230/subject-group-ECFR6e651a4c86c0174/section-230.501

- Securities and Exchange Commission, “Private Placements – Rule 506(b).” https://www.sec.gov/resources-small-businesses/exempt-offerings/private-placements-rule-506b

- SmartAsset, “What Is a Sophisticated Investor? Definition and Requirements.” https://smartasset.com/investing/sophisticated-investor

- Mayer Brown, “General Solicitation and General Advertising.” https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2019/08/on-point–general-solicitation.pdf

- GoodEgg Investments, “506b vs. 506c: Comparing Rule 506(b) & Rule 506(c) – A Capital Raising Overview For Real Estate Syndicators.” https://goodegginvestments.com/blog/506b-506c/

- Cornell Law School – Legal Information Institute, “Uniform Commercial Code § 8-102(14). Definitions.” https://www.law.cornell.edu/ucc/8/8-102

- Washington State Department of Financial Institutions, “The Role of Disclosure in a Securities Offering.” https://dfi.wa.gov/small-business/role-of-disclosure

- J.D. Supra, “Changes to Disclosure Requirements for Rule 506(b) and Regulation A Offerings.” https://www.jdsupra.com/legalnews/changes-to-disclosure-requirements-for-8134841/

- Bloomberg Law, “M&A, Clause Description – Representations: Full Disclosure or ’10b-5 Representation’.” https://www.bloomberglaw.com/external/document/X8LTJKN0000000/m-a-clause-description-representations-full-disclosure-or-10b-5-

- The Corporate Counsel, “Form D: Why Don’t Issuers File?” https://www.thecorporatecounsel.net/blog/2023/03/form-d-why-dont-issuers-file.html

- Deloitte, “Filing and Amending a Form D Notice — A Compliance Guide for Small Entities and Others.” https://dart.deloitte.com/USDART/home/accounting/sec/sec-material-supplement/small-entity-compliance-guides/filing-amending-a-form-d-notice