What Is a 506(c) Offering?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts: 506(c) Offering

- A 506(c) offering is an exemption under Regulation D of the Securities Act, allowing companies to raise money exclusively from accredited investors without registering the securities with the SEC.

- Unlike a 506(b), companies raising money using 506(c) are allowed to freely advertise the endeavor in whichever legal way they choose.

- Securities in 506(c) offerings are “restricted” and cannot be freely resold without meeting certain conditions.

- 506(c) offerings are popular in real estate for funding projects and creating investment funds due to their flexibility and reduced regulation.

Understanding a 506(c) Offering

A 506(c) offering is an exemption under the Securities Act that allows companies to raise an unlimited amount of capital from accredited investors without registering the securities with the SEC or going public.

It’s named after Rule 506(c), an exemption under Regulation D of the U.S. securities law.

Here’s how a 506(c) offering works: Imagine you’re a business owner with a great idea but need money to make it happen. You could try getting a loan from a bank, but what if that’s not enough or not an option? Or you could try to get public and ask for investments from the general public, but going public is a little bit out of your budget (and will take too much time that you don’t have).

This is where a 506(c) offering comes in handy. It’s helpful because:

- It allows companies to raise as much money as they need.

- It’s faster and less expensive than going public.

- It lets companies keep their financial information private.

506(c) offerings are open only to accredited investors, typically wealthy individuals or large institutions considered financially savvy. Unlike 506(b) offerings, 506(c) doesn’t allow participation from non-accredited investors.

A key feature of 506(c) offerings is the ability to advertise the investment opportunity to the general public. Companies can use various marketing channels to find potential investors, expanding their reach beyond existing networks.

Who Can Participate in a 506(c) Offering?

When a company decides to raise money through a 506(c) offering, they can’t just accept money from anyone interested. There are rules about who can invest, which are designed to protect both the company and the investors.

A 506(c) Offering is only open to accredited investors. These are people or organizations that the government (specifically, the Securities and Exchange Commission or SEC) considers financially savvy enough to handle riskier investments.

Who counts as an accredited investor? Here are a few examples:

- People who earn $200,000 or more per year (or $300,000 together with a spouse).

- Individuals with a net worth of at least $1 million (not counting their primary home).

- Banks, insurance companies, and other large financial institutions.

- Executives or directors of the company offering the investment.

The idea is that these folks either have enough money to absorb potential losses or enough financial knowledge to understand the risks they’re taking.

For a more in-depth explanation of who or what can be an accredited investor, see our blog post on “What It Really Takes To Be A Qualified Investor.”

These rules aren’t there to exclude people for no reason. They’re designed to protect people from investing in high-risk situations they might not fully understand or can afford. At the same time, they allow companies to raise money from a wider pool of investors than just the ultra-wealthy.

506(c) Offerings in Real Estate

Real estate projects often require substantial capital, and the unlimited fundraising potential of 506(b) and 506(c) offerings typically meets this need. What makes 506(c) offerings special for real estate is that you can advertise your investment opportunity to a wide audience. This is perfect for real estate developers who want to reach more potential investors.

Real estate developers and investors use 506(c) offerings in ways like:

- Funding new construction or major renovation projects.

- Acquiring existing properties or portfolios.

- Establishing and operating private real estate investment trusts (REITs).

- Creating real estate funds for diverse property investments.

- Forming syndications for specific real estate projects.

Key Points to Consider in Real Estate 506(c) Offerings

When structuring a 506(c) offering for real estate, several factors come into play. First, ensure investors understand the complexities of the deal, especially non-professionals. Next, communicate with clarity about property valuation, projected returns, and liquidity concerns.

Since investors aren’t just buying property but also investing in your ability to manage it, you should highlight your team’s expertise in the offering documents.

Third, outline a realistic exit strategy. Investors will want to know how and when they can expect to get their money back.

Finally, a 506(c) differs from a 506(b) in that you are allowed to advertise your 506(c) offering. This means you can use social media, websites, or even TV ads to find investors. Make sure you only accept money from accredited investors, so you also need to take steps to check that your investors really are accredited.

Regulatory compliance in real estate 506(b) offerings involves some unique aspects:

| Aspect | Description |

| Property-specific disclosures | Detailed information about properties, including condition reports and market analysis |

| Financial projections | Must be reasonable and based on solid assumptions |

| Ongoing reporting | Regular updates on project progress, occupancy rates, and financial performance |

RELATED: Land Funding Blueprint: Partnership Agreements, Terms and Conditions, and More

Key Features of a 506(c) Offering

When raising capital, companies should understand the key features of a 506(c) offering. These characteristics define how the offering works and set it apart from other fundraising methods.

Let’s break down these important characteristics:

General Solicitation or Advertising Allowed

Unlike 506(b) offerings, 506(c) offerings permit general solicitation and advertising. Companies can use public channels like TV commercials, newspaper ads, or unrestricted websites to attract investors. This broadens the potential investor base significantly.

Accredited Investors Only

506(c) offerings are limited to accredited investors. No non-accredited investors can participate, regardless of their sophistication level.

Exemption from Blue Sky Laws

Securities offered under Rule 506(c) are considered “covered securities” and are exempt from state registration requirements, also known as Blue Sky laws. This significantly reduces the regulatory burden on companies, as they don’t need to navigate the complex landscape of individual state securities regulations.

No Limit on Capital Raised

Unlike some other exemptions, there’s no cap on the amount of money a company can raise through a 506(c) offering. This makes it an attractive option for businesses with significant capital needs.

Disclosure Requirements

While 506(c) offerings have reduced regulatory requirements compared to public offerings, they still involve specific disclosure obligations, especially when non-accredited investors are involved. Companies typically provide these disclosures through a private placement memorandum (PPM) or offering memorandum, which includes information similar to that required in registered offerings to ensure investor protection.

Form D Filing

As part of SEC compliance for 506(c) offerings, companies must file a Form D with the SEC within 15 days after the first sale of securities. This form provides basic information about the offering and the company.

Restricted Securities

Securities sold in a 506(c) offering are considered “restricted,” meaning they cannot be freely resold without registration or qualifying for another exemption. This typically involves a holding period before the securities can be sold.

Differences Between 506(b) and 506(c) Offerings

Both 506(b) and 506(c) offerings fall under Regulation D and provide exemptions from SEC registration. However, they have distinct characteristics that make them suitable for different scenarios.

Here’s a comparison of the key differences:

| Feature | 506(b) Offering | 506(c) Offering |

| General solicitation | Prohibited | Allowed |

| Investor types | Accredited and up to 35 non-accredited sophisticated investors | Accredited investors only |

| Investor verification | Self-certification allowed | Requires issuer to take “reasonable steps” to verify accredited status |

| Disclosure requirements | More extensive if non-accredited investors are involved | Generally less stringent |

Let’s explore these differences in more detail below.

Advertising and Solicitation

The most significant difference between these offerings is how companies can market them:

- 506(b): Enforces a general solicitation prohibition. Companies must rely on preexisting relationships or networks to find investors.

- 506(c): Allows general solicitation and advertising, enabling companies to publicly promote their offering through various media channels.

Investor Types

Both offerings allow participation from accredited investors, but they differ in their treatment of non-accredited investors:

- 506(b): Allows up to 35 non-accredited but sophisticated investors.

- 506(c): Restricted to accredited investors only. No non-accredited investors are permitted.

Investor Verification

The methods for verifying investor status differ between the two exemptions:

- 506(b): Companies can rely on investor self-certification of accredited status.

- 506(c): Requires companies to take “reasonable steps” to verify the accredited status of all investors, often involving review of financial documents or third-party verification.

Disclosure Requirements

Both exemptions have disclosure requirements, but they vary:

- 506(b): If non-accredited investors are involved, companies must provide a private placement memorandum with disclosure documents similar to those used in registered offerings.

- 506(c): Since only accredited investors can participate, the disclosure requirements are generally less stringent.

When to Use Each Type of Offering

The choice between 506(b) and 506(c) often depends on the company’s specific circumstances, target investor base, and marketing strategy.

506(b) is often preferred when:

- The company has a strong network of potential investors.

- The company wants to include some non-accredited investors.

- The company has a brief window of opportunity to raise funds, precluding the time to run ads.

506(c) is typically chosen when:

- The company wants to cast a wider net and publicly advertise the offering.

- The company is comfortable with the additional steps required to verify accredited investor status.

- The company is only targeting accredited investors.

Both 506(b) and 506(c) offerings have their advantages. Companies should carefully consider their goals, resources, and target investors when choosing between these two options for capital raising.

Verifying Accredited Investor Status in 506(c) Offerings

An important aspect of 506(c) offerings is the requirement for issuers to take “reasonable steps” to verify the accredited status of all investors. This is more stringent than the self-certification allowed in 506(b) offerings.

Verification Methods

The SEC provides a non-exclusive list of methods that issuers can use to verify accredited investor status:

- Income verification: Reviewing IRS forms for the past two years and obtaining a written representation for the current year.

- Net worth verification: Reviewing bank statements, brokerage statements, and consumer reports, and obtaining a written representation.

- Third-party verification: Receiving written confirmation from a registered broker-dealer, SEC-registered investment adviser, licensed attorney, or certified public accountant.

- Existing investor verification: For existing investors who invested in a company’s 506(b) offering as an accredited investor, obtaining a certification at the time of the new offering.

Proper verification is crucial because failure to take reasonable steps to verify accredited investor status could result in the loss of the exemption. This could lead to significant legal and financial consequences for the issuer. For example, the “bad actor” disqualification rule prohibits individuals and entities with a history of securities-related misconduct on or after September 23, 2013 from participating in Rule 506 offerings. This rule requires companies to conduct background checks on key participants and disclose certain past events, aiming to protect investors and maintain the integrity of these private offerings.

Disclosure Requirements for 506(c) Offerings

Disclosure requirements are a fundamental aspect of securities law, designed to protect investors by ensuring they have access to material information about their potential investments. These requirements are often summarized as “let the buyer beware, but let the seller disclose.”

In the context of 506(c) offerings, these requirements serve as a crucial balance between facilitating capital formation for businesses and safeguarding investor interests.

Rule 502 of Regulation D outlines the specific disclosure requirements for 506(c) offerings. These requirements are less stringent than those for public offerings but still significant, especially when non-accredited investors are involved.

Key Components of Disclosure

- Information provided: Companies must furnish investors with all material information necessary to make an informed investment decision. This typically includes:

- Business description and history

- Risk factors

- Use of proceeds

- Capital structure

- Management background

- Financial information

- Private Placement Memorandum: This document is the primary disclosure vehicle in most 506(c) offerings. It’s analogous to a prospectus in a public offering but tailored for a private placement context.

- Non-accredited investor considerations: Disclosure requirements become more rigorous when non-accredited investors are involved. Companies must provide information substantially similar to what would be required in a registered offering under the Securities Act.

- Financial statement requirements: The level of financial disclosure required can vary based on the offering size:

- For offerings up to $2 million: Only the most recent fiscal year’s balance sheet, audited if possible.

- For offerings up to $7.5 million: Audited financial statements for the most recent fiscal year and unaudited statements for the two prior years.

- For offerings over $7.5 million: Audited financial statements for the past three fiscal years.

- Ongoing disclosure: While 506(c) offerings don’t require the same level of ongoing reporting as public companies, issuers often provide periodic updates to maintain investor relations and comply with anti-fraud provisions.

- Anti-fraud provisions: All disclosures are subject to anti-fraud provisions of securities laws, particularly Rule 10b-5. This means that even if specific disclosures aren’t required, any information provided must not be misleading or contain material omissions.

The Importance of Filing Form D in a 506(c) Offering

Filing Form D is an essential component of both 506(b) and 506(c) offerings. Form D is a brief notice that includes basic information about the company and the offering. It’s filed with the SEC to notify them of an exempt offering of securities under Regulation D.

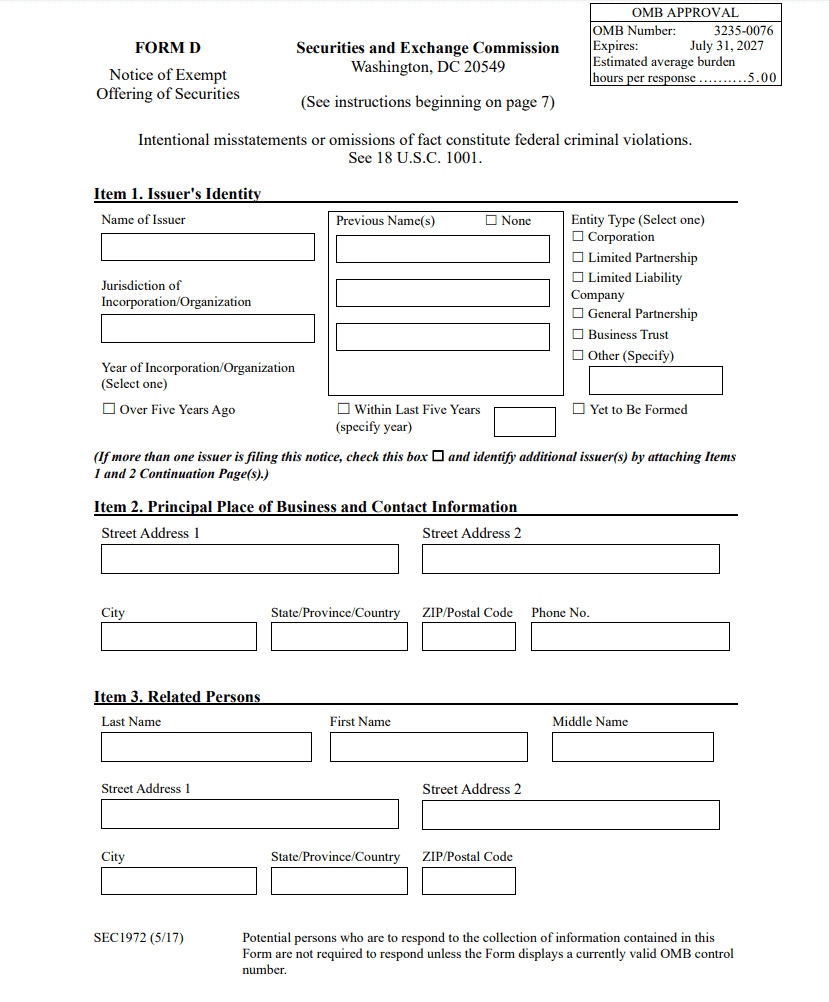

A screenshot of the first page of Form D.

While failing to file Form D doesn’t automatically disqualify an offering from relying on the 506(c) exemption, companies should still file it for regulatory and state-level compliance purposes. Form D also provides transparency and can increase investor confidence in the offering.

Note that the SEC may penalize the company when it opens a 506(c) offering without filing Form D.

When to File Form D

Companies must file Form D within 15 calendar days after the first sale of securities in the offering. The 15-day clock starts with the first sale, not when the offering begins.

In addition, if the offering continues for more than one year, the company must file an amendment to Form D at least annually.

Information Required in Form D

Form D requires various pieces of information, including:

- The names and addresses of the company’s executives and directors.

- Some details about the offering, such as the type of securities offered and the offering amount.

- The number of accredited investors.

- Use of proceeds from the offering.

- Information about any brokers or finders used in the offering.

FAQs: 506(c) Offering

Is there a limit to how much money can be raised through a 506(c) offering?

No, there’s no cap on the amount of money a company can raise through a 506(c) offering.

One key advantage of this type of offering is that companies can raise as much capital as they need, provided they comply with the other requirements of the 506(c) exemption. These requirements include selling securities only to accredited investors, taking reasonable steps to verify their accredited status, and complying with the general anti-fraud provisions of securities laws.

The absence of a funding limit makes 506(c) offerings attractive for companies with substantial capital needs, such as real estate developers working on large-scale projects or tech startups requiring significant investment for rapid growth.

How long does a 506(c) offering typically last?

A Rule 506(c) offering typically lasts until the issuer decides to close it, often influenced by how quickly they can raise the desired capital. Some offerings might conclude within a few weeks or months if the company raises its target amount. Others might remain open for a year or more, allowing for ongoing fundraising.

However, companies must file an amendment to their Form D at least annually while the offering remains open. This flexibility in timing is another advantage of 506(c) offerings for many businesses.

What types of securities can be offered in a 506(c) offering?

506(c) offerings allow companies to offer various types of securities. Common options include:

- Equity securities: These represent ownership in the company, such as common or preferred stock.

- Debt securities: These are loans to the company, like corporate bonds or promissory notes.

- Convertible securities: These start as one type (often debt) and can be converted to another (often equity) under certain conditions.

- Limited partnership interests: These are common in real estate investments.

- Real estate: Direct investments in properties or real estate projects can be offered.

- Membership units in LLCs: These represent ownership in a limited liability company.

The choice of security type depends on the company’s structure, goals, and investor preferences. For example, a real estate project might offer limited partnership interests, while a tech startup might offer preferred stock.

References

- Code of Federal Regulations, “Regulation D—Rules Governing the Limited Offer and Sale of Securities.” https://www.ecfr.gov/current/title-17/chapter-II/part-230/subject-group-ECFR6e651a4c86c0174/section-230.501

- Mayer Brown, “General Solicitation and General Advertising.” https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2019/08/on-point–general-solicitation.pdf

- GoodEgg Investments, “506b vs. 506c: Comparing Rule 506(b) & Rule 506(c) – A Capital Raising Overview For Real Estate Syndicators.” https://goodegginvestments.com/blog/506b-506c/

- Securities and Exchange Commission, “Disqualification of Felons and Other ‘Bad Actors’ from Rule 506 Offerings and Related Disclosure Requirements.” https://www.sec.gov/resources-small-businesses/small-business-compliance-guides/disqualification-felons-other-bad-actors-rule-506-offerings-related-disclosure-requirements

- Washington State Department of Financial Institutions, “The Role of Disclosure in a Securities Offering.” https://dfi.wa.gov/small-business/role-of-disclosure

- J.D. Supra, “Changes to Disclosure Requirements for Rule 506(b) and Regulation A Offerings.” https://www.jdsupra.com/legalnews/changes-to-disclosure-requirements-for-8134841/

- Bloomberg Law, “M&A, Clause Description – Representations: Full Disclosure or ’10b-5 Representation’.” https://www.bloomberglaw.com/external/document/X8LTJKN0000000/m-a-clause-description-representations-full-disclosure-or-10b-5-

- The Corporate Counsel, “Form D: Why Don’t Issuers File?” https://www.thecorporatecounsel.net/blog/2023/03/form-d-why-dont-issuers-file.html

- Deloitte, “Filing and Amending a Form D Notice — A Compliance Guide for Small Entities and Others.” https://dart.deloitte.com/USDART/home/accounting/sec/sec-material-supplement/small-entity-compliance-guides/filing-amending-a-form-d-notice

- Carta, “Rule 506(b) vs. Rule 506(c).” https://carta.com/learn/private-funds/regulations/regulation-d/506b-vs-506c/

- YieldStreet, “Rules 506(c) and 506(b) Explained for Investors.” https://www.yieldstreet.com/blog/article/506c-vs-506b/