What Is Absolute Net Profit?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Absolute net profit refers to the amount of money a company has generated through its operations after paying all expenses.

- The absolute in absolute net profit describes that the figure is a standalone value and isn’t relative to other measures, such as net profit margin.

- Various factors can affect the final bottom line, such as revenue, cost of goods sold, operating expenses, tax rates, and financing costs.

- A company may turn a profit but have negative cash flow, like carrying accounts receivable in their books.

- Other related metrics, such as gross profit, operating profit, and EBITDA, provide additional insights into a company’s financial health and operations.

Understanding Absolute Net Profit

A company earns absolute net profit after accounting for and paying all of its financial obligations, such as debts, taxes, and other expenses. In general, this money can be distributed to business owners or shareholders or reinvested into the company.

To calculate absolute net profit, subtract total expenses from the total (or gross) revenue:

Net Profit = Total Revenue – Total Expenses

Why Is It Called “Absolute” Net Profit?

While absolute net profit is interchangeable with the terms “net profit” and “net income,” the word absolute in this sense is to emphasize the figure’s standalone value and not in comparison to another financial metric. However, this doesn’t change its underlying meaning or calculation.

Some businesses may refer to absolute net profit to differentiate the net profit of a specific division, product line, or time period from other relative financial performance measures. This usage is an outlier, however. In most cases (including for the purposes of this article), “absolute net profit” and “net profit” can be safely used to refer to the same thing.

What Is Net Profit Margin?

A related metric to absolute net profit is net profit margin. While absolute net profit means a specific, definite amount of money, net profit margin expresses how efficient a business is in generating revenue.

Net profit margin is particularly important when comparing the profitability of different businesses, especially if you want to invest in a public company. If you’re a business owner, it can also help you find opportunities and identify stumbling blocks in operations.

To calculate net profit margin, you divide net profit by the total revenue. Afterward, convert the result to a percentage.

The higher the net profit margin, the more profitable the company’s business is. For example, a 20% net profit margin means the company takes home a fifth of its total income.

What Affects Absolute Net Profit?

Several factors can affect how much profit a company earns:

- Total income: The total amount of sales a business generates is the primary driver of net profit. A business can increase total income by increasing business volume, raising prices, or launching new products or services.

- Cost of Goods Sold (COGS): COGS refers to how much the business is spending when producing its products and services. A company can lower COGS through several means, such as optimizing its supply chain or buying raw materials wholesale.

- Operating expenses: Operating expenses refer to the indirect costs of producing these goods. These include rent, utilities, payroll, marketing, and carrying costs.

- Tax rates: Taxes can eat into the company’s net profit. Taking advantage of tax deductions, credits, or tax planning strategies can preserve more of its net profit.

- Financing costs: This includes business debt, such as loans or lines of credit, and their associated interest.

RELATED: How to Use Debt to Buy Real Estate Properties and Make Money

Importance of the Net Profit Metric

Absolute net profit is a crucial metric for several key stakeholders.

For the owners, net profit is the ultimate measure of a company’s success and the effectiveness of its strategies and operations. It guides important decisions about investment, growth, and resource allocation.

Meanwhile, potential and current investors refer to net profit to evaluate a company’s financial strength, assess its risk profile, and determine the appropriate valuation. Strong, consistent net profits are attractive to investors.

On the other hand, lenders (such as banks and credit unions) rely on net profit to gauge a company’s ability to service debt and meet financial obligations. Healthy net profits demonstrate creditworthiness.

In addition, government agencies use net profit data to ensure businesses accurately report income and pay appropriate taxes.

Finally, employees or prospective applicants look at a company’s net profit to see how much compensation they can ask for, how secure the job is, or if there are opportunities for career advancement and growth.

Cash Flow in Absolute Net Profit

Absolute net profit and cash flow provide distinct perspectives on a company’s financial well-being. They are vital financial metrics. Net profit indicates overall profitability, while cash flow reflects the actual movement of cash in and out, impacting liquidity and operational efficiency.

A business can report strong net profits yet face cash flow challenges. The disconnect stems from net profit accounting for non-cash expenses like depreciation, while cash flow depends on the timing of income and expenses. For instance, a company with large amounts of accounts receivable, which can be considered “profit,” may lack cash flow to cover immediate obligations.

Effective cash flow management is vital for any business. It keeps them afloat and allows them to take advantage of profitable opportunities. Forecasting cash flow helps companies predict their financial needs and prevent shortages. In addition, aligning cash flow strategies with profit goals helps businesses maintain a strong financial position and ensure long-term stability.

In other words, net profit shows how much money a company has made, but cash flow paints a deeper picture of its financial health. Both are important for making smart decisions and financial forecasting.

Absolute Net Profit vs. Other Profitability Metrics

Several metrics related to absolute net profit can provide additional insights into a company’s profitability:

Gross Profit vs. Absolute Net Profit

Gross profit refers to what’s left of the revenue after subtracting the cost of goods sold. This metric is a “big picture” indication of a company’s products or services before accounting for operating expenses. On the other hand, absolute net profit accounts for all expenses, not just the COGS.

Operating Profit

Operating profit is the profit generated from a company’s core business operations, exclusive of interest and taxes. Like net profit margin, this shows the efficiency of a business to generate revenue without the impact of financial and tax-related decisions.

Operating profit is useful for gauging the operational performance of different companies or business units.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

EBITDA measures a company’s overall financial performance and cash flow potential, excluding the impact of financing and accounting decisions. This condenses the business’s underlying profitability and ability to generate cash without the effects of interest, taxes, depreciation, and amortization.

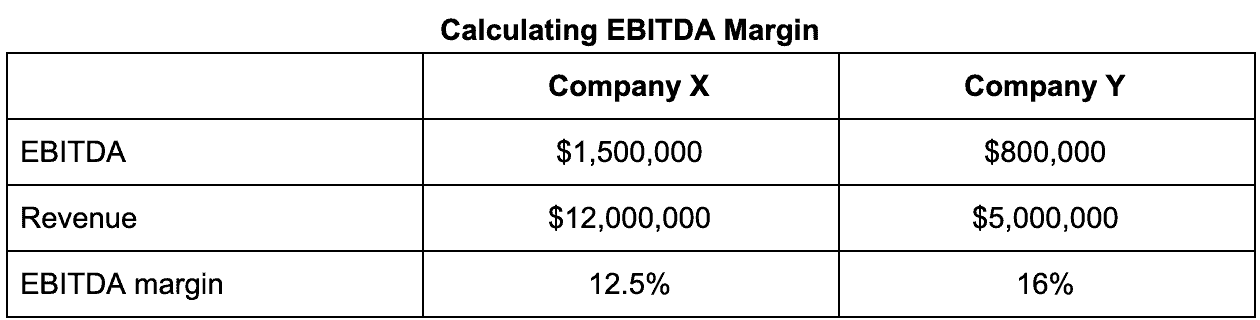

Investors and lenders frequently use this metric to assess a company’s financial health and long-term viability. For example, shareholders use EBITDA and EBITDA margins in a merger and acquisition scenario to measure the merging companies’ operating profits, which they can get by dividing EBITDA by the total revenue. This number describes how much of their operating expenses comprise their total income.

Here’s an example of this calculation:

Frequently Asked Questions: Net Profit

What is the difference between net income and net profit?

Net income and net profit (or absolute net profit) are generally used interchangeably to refer to the same metric—the bottom line figure that represents a company’s overall profitability after accounting for all expenses. They both represent the final amount of money a business has earned or retained after subtracting costs from revenue.

Is a higher net profit margin always better?

A high profit margin is usually a good thing, but it doesn’t always tell the whole story. Sometimes, really high profits might mean there’s not much competition. At other times, it may mean the business isn’t built to last. The ideal profit margin depends on the industry and things like how much money the business needs, what the market is like, and how it plans to grow.

Is monitoring absolute net profit trends important?

Yes, monitoring absolute net profit trends is important because it gives you a clear picture of your financial performance and helps you identify patterns. However, consistent tracking using repeatable, objective metrics is just as essential, allowing you to spot financial challenges before they happen and course-correct if necessary.