What Is a Bona Fide Offer?

Shortcuts

- A bona fide offer is a proposal to buy real estate made honestly (hence the name) and without any harmful intent.

- Examples of this type of offer include a lump sum offer, earnest money deposit, government approval, or a lease-option agreement.

- You can make a bona fide offer in various ways, but it should clearly outline specifics like price, payment terms, conditions to fulfill, and a timeline for accepting or rejecting the offer.

RELATED: How Much Should You Offer For That Property? [Free Offer Calculator]

Understanding a Bona Fide Offer

A bona fide offer in real estate fulfills the requirements of both parties, covering price, financing terms, and contingencies. In addition, it’s made in good faith and legally binding, so it obliges both seller and buyer to uphold their end of the agreement.

The standard of good faith in a bona fide offer—stemming from the Latin bona fide, meaning in good faith[2]—demands honest, genuine intent from the offeror to buy the property and a willingness to negotiate terms reasonably.

These offers are intended to be fair and reasonable, with both parties fully understanding the terms involved. State law protects bona fide offers from fraud or misrepresentation. This protection guarantees buyers won’t be exploited and can purchase the property, confident they’ll receive what was stipulated in the offer[3]. The setup also safeguards sellers, allowing them to sell their property confident of receiving a fair price[4].

Thorough comprehension of such an agreement is crucial for a successful purchase or sale, as it helps guard against any dubious activity or false claims during the transaction.

Examples of a Bona Fide Offer

Below are a few examples of what may constitute a valid bona fide offer in real estate transactions.

Lump Sum Offer

A lump sum offer falls under the category of genuine intent. This is when the potential buyer offers to make a one-time payment for the property instead of installments.

Specific attributes distinguish this type of offer; they present a single, unified amount and, once accepted, generally become legally binding and irrevocable[5]. The settlement in its entirety becomes due upon the successful closure of the agreement between the two parties.

This concept speeds up negotiation resolution for both groups, ensuring the agreed payment will be settled on time. Additionally, this offer may be attractive to sellers who want to avoid lengthy negotiations but still want certainty when selling their property.

Earnest Money Deposit

An earnest money deposit (EMD) serves as a basis for making a real offer in property transactions. An EMD is an amount of money the potential buyer deposits to show they are serious about buying the property.

This financial transaction is important in creating a binding contract, demonstrating the buyer’s serious commitment to closing the deal[6].

Hence, sellers feel more inclined to sell, reassured by the deposit that they’ll receive payment upon closing. This deposit is proof of invoice and long-term commitment to the negotiation process and therefore meets the qualification for a bona fide offer.

Government Approval

Sometimes, a real estate agreement is subject to certain governmental approvals. This can be because of various reasons, such as zoning laws, environmental regulations, or other government agency requirements that must be met before the transaction is finalized[7].

If the buyer and seller agree the sale hinges on such approval, and the buyer proposes to proceed, this is deemed a bona fide offer. This instance requires both parties to agree to the transaction to move forward.

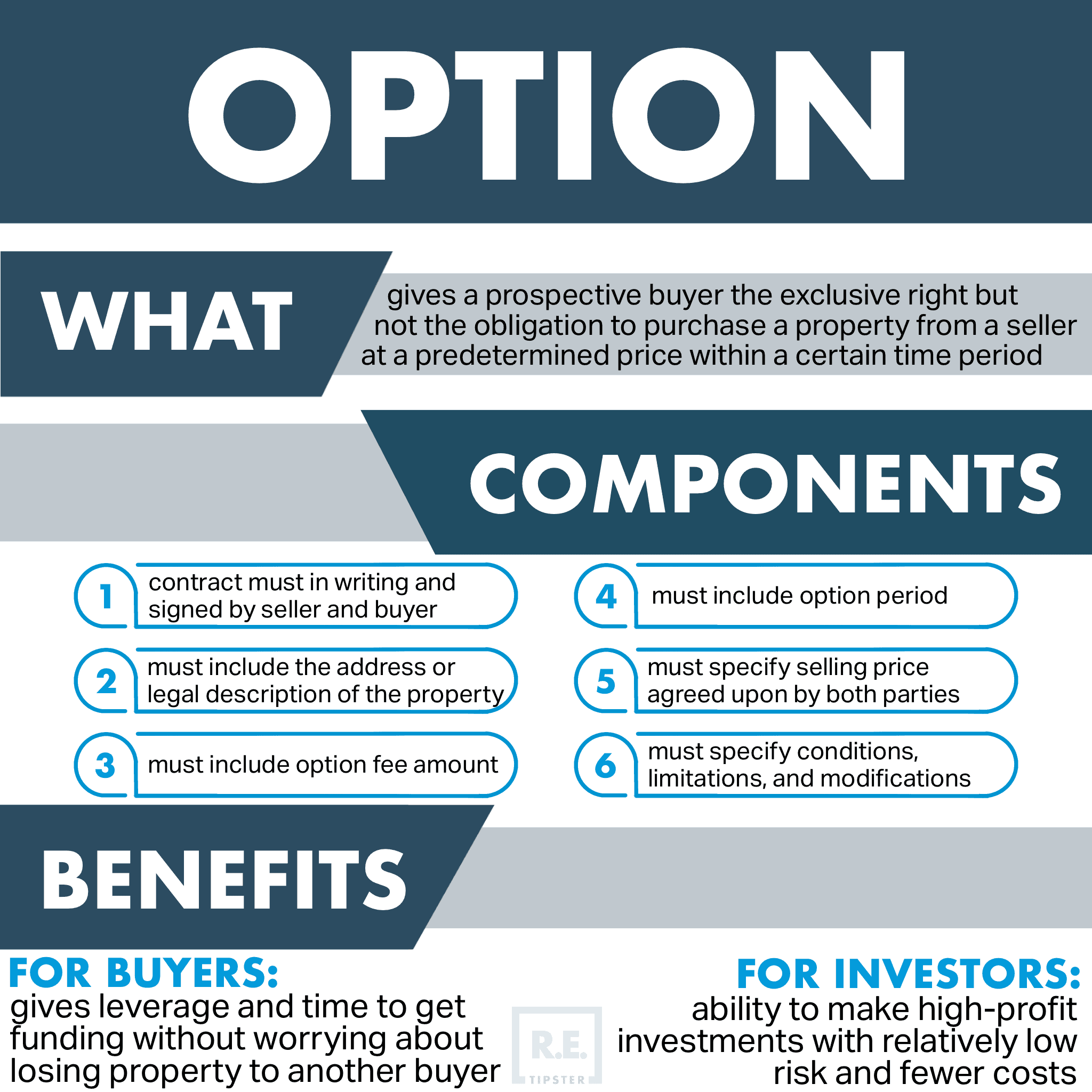

Lease Option Agreement

To be considered valid, a lease option agreement must adhere to certain specifications, one being that a bona fide offer has been made first by one of the parties[8]. This rule ensures the clear presentation of key terms and conditions for others involved to act upon[9].

Every bona fide offer comes with an implied promise of no significant defect or manipulation ensuing after acceptance. Thus, it shields each party from possible losses and encourages actions on the agreement at every stage of the transaction.

What Doesn’t Count as Bona Fide Offer?

Some offers do not count as bona fide offers, even though they may seem legitimate:

- Offers made in jest, as they lack the “made in good faith” requirement.

- Offers from individuals without legal capacity to contract.

- Offers with missing elements like price or payment terms.

How to Make a Bona Fide Offer

There are several ways to make a bona fide offer.

Bona fide offers should be specific, containing all relevant details about the property purchase, like price, payment terms, and necessary conditions. The offer should also specify an expiration date and a timeline for acceptance or rejection[10].

Keep in mind, both parties should document the offer in writing and sign it. This document serves as a legal contract and proof of commitment between both parties, safeguarding one’s interest in case of a dispute.

Pros and Cons of a Bona Fide Offer

Understanding the pros and cons of a bona fide offer equips you to make informed decisions about the transaction.

Advantages

- Streamlines the negotiation process — A properly utilized bona fide offer can set expectations, initiate meaningful discussions, and facilitate smoother decision-making.

- Protects both parties — A bona fide offer physically embodies promises made, minimizing ambiguity and clarifying roles, responsibilities, and expectations.

- Shows sellers that buyers are serious — This type of offer builds trust by demonstrating that buyers are clear about their interests and intend to proceed with the purchase. Also, it shows that buyers are ready to invest.

RELATED: The Best Response When a Seller Asks “Why is Your Offer So Low?”

Disadvantages

- Can lead to misunderstandings when not properly articulated — Misunderstandings can arise if you fail to communicate an offer clearly. Therefore, communication between the relevant parties must be explicit and informative to avoid confusion.

- There is no guarantee of acceptance — Approval depends on meeting all the prerequisites associated with the offer. Grasping the subtleties of accepting or declining offers legally can pave the way for successful future transactions.

- The time and effort required to create such offers can deter people — Creating a proper offer can be time-consuming if not done right. This can discourage some parties, which can be an obstacle to what would otherwise be a fruitful agreement.

Some obstacles are as subtle as a fallen tree on a road.

Sources

- Bona Fide Offer. (n.d.) Legal Information Institute, Cornell Law School. Retrieved from https://www.law.cornell.edu/definitions/index.php?width=840&height=800&iframe=true&def_id=ad18ea0d4a6d2c84c0b72bd5af91049f&term_occur=1&term_src=Title:24:Subtitle:B:Chapter:II:Subchapter:B:Part:248:Subpart:B:248.161

- Bona Fide. (n.d.) The Free Dictionary. Retrieved from https://legal-dictionary.thefreedictionary.com/Bona+Fide

- Straw Jr., R. (1967.) Off-Record Risks for Bona Fide Purchasers of Interests in Real Property. PennState Dickinson Law. Retrieved from https://ideas.dickinsonlaw.psu.edu/cgi/viewcontent.cgi?article=2416&context=dlra

- Transfer of Property Act: Bona Fide and Fraudulent Transfers. (2020, June 17) LexForti Legal News Network. Retrieved from https://lexforti.com/legal-news/transfer-of-property-act-bona-fide-and-fraudulent-transfers/

- Hayes, A. (2022, December 7.) What Is a Lump Sum Payment, and How Does It Work? Investopedia. Retrieved from https://www.investopedia.com/terms/l/lump-sum-payment.asp

- Chen, J. Earnest Money: What It Is and How Much It Is in Real Estate. (2022, August 10) Investopedia. Retrieved from https://www.investopedia.com/terms/e/earnest-money.asp

- Bona Fide Offer Legal Definition. (n.d.) Upcounsel. Retrieved from https://www.upcounsel.com/bona-fide-offer-legal-definition

- Lease Agreement With Option To Purchase. (n.d.) Securities and Exchange Commission. Retrieved from https://www.sec.gov/Archives/edgar/data/1542387/000119312512228720/d349756dex1012.htm

- Bona fide lease definition. (n.d.) Law Insider. Retrieved from https://www.lawinsider.com/dictionary/bona-fide-lease

- Tex. Prop. Code § 21.0113. (n.d.) Casetext. Retrieved from https://casetext.com/statute/texas-codes/property-code/title-4-actions-and-remedies/chapter-21-eminent-domain/subchapter-b-procedure/section-210113-bona-fide-offer-required