What Is a Comparative Market Analysis (CMA)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does a CMA Determine?

A comparative market analysis or CMA (also called “competitive market analysis”) enables real estate agents and brokers to assist their clients in pricing their properties appropriately or making reasonable counteroffers. A CMA can generate a range of prices that may appeal to three tiers of buyers: conservative, moderate, and aggressive.

To predict the price range that can make the subject property as marketable as possible, a real estate professional needs to gather data about it first. An investor or anyone who prepares a CMA will typically collect data from several sources, such as multiple listing services (MLSs), public records, and homeowner interviews.

A CMA evaluates the following data about the subject property:

- Location[1].

- Age[2].

- Condition[3].

- Lot size or acreage[4].

- Square footage[5].

- Room count.

- Special features[6].

- Home improvements[7].

- Terms of financing and sale.

- Tax or millage rate[8].

After creating the subject property’s profile, a real estate professional can look for comparables, also known as “comps” in real estate jargon.

What Are Comps?

Comps are local houses that share most, if not all, of the qualities of the subject property. They can be recently sold, active, and expired listings within the past three to six months, depending on the temperature of the market.

The rationale behind a comp is to estimate the fair market value of the subject property by seeing how much similar properties are selling for. In other words, comps (or a combination of comps) can be used as a valuation tool.

Comps are also useful in other ways. For example, an investor may use comps information to measure what is happening in the subject property’s neighborhood. Evaluating these local trends can drive up or down present and future property values.

BY THE NUMBERS: The ideal number of recently sold and actively listed comps in a CMA is three to five.

Source: The Close

What Does a CMA Not Include?

Real estate agents and brokers do not have to conform to any standards. Instead, they commonly rely on the industry’s best practices.

Moreover, there is no universal or required format CMA preparers must use. For example, a CMA may be an exhaustive report that contains specific details about the subject property, comps, and hot local market trends or a bare-bones written opinion on the fair market value of properties in a given neighborhood.

For these reasons, two CMAs of a property for sale can vary when prepared by different individuals. Their authors may include or exclude certain factors as they see fit, resulting in (sometimes) glaring disparity in price predictions in reports.

Is a CMA Accurate?

In a perfect world, every CMA can establish the price range that gets a house sold while satisfying both the buyer and the seller.

Unfortunately, no CMA is 100% objective.

To prepare a CMA, the professional has to make a series of subjective decisions, like which types of property data carry weight, which listings should be considered, and how much value adjustment is necessary to fill the price gaps between the subject property and the comps. For instance, erroneously treating unpopular features as a plus will boost a house’s value on paper, but may chase away prospective buyers[9].

Ultimately, the accuracy of a CMA depends on how well researched it is, how recent the property data used, and how knowledgeable its preparer is about the local area[10].

A solid indicator that a CMA is inaccurate is when the range of prices is too broad. It can happen when a real estate agent or broker:

- Picked comps that are not similar enough to the subject property.

- Used relatively old property data.

- Erroneously estimated how high or low the subject property’s price has moved since its last sale.

Usually, a CMA becomes inaccurate when its preparer adds too many comps just to impress a client. There is nothing wrong with more comps, but they might do more harm than good when they force a real estate professional to make significant adjustments to make up for the characteristics that the comps do not share with the subject property.

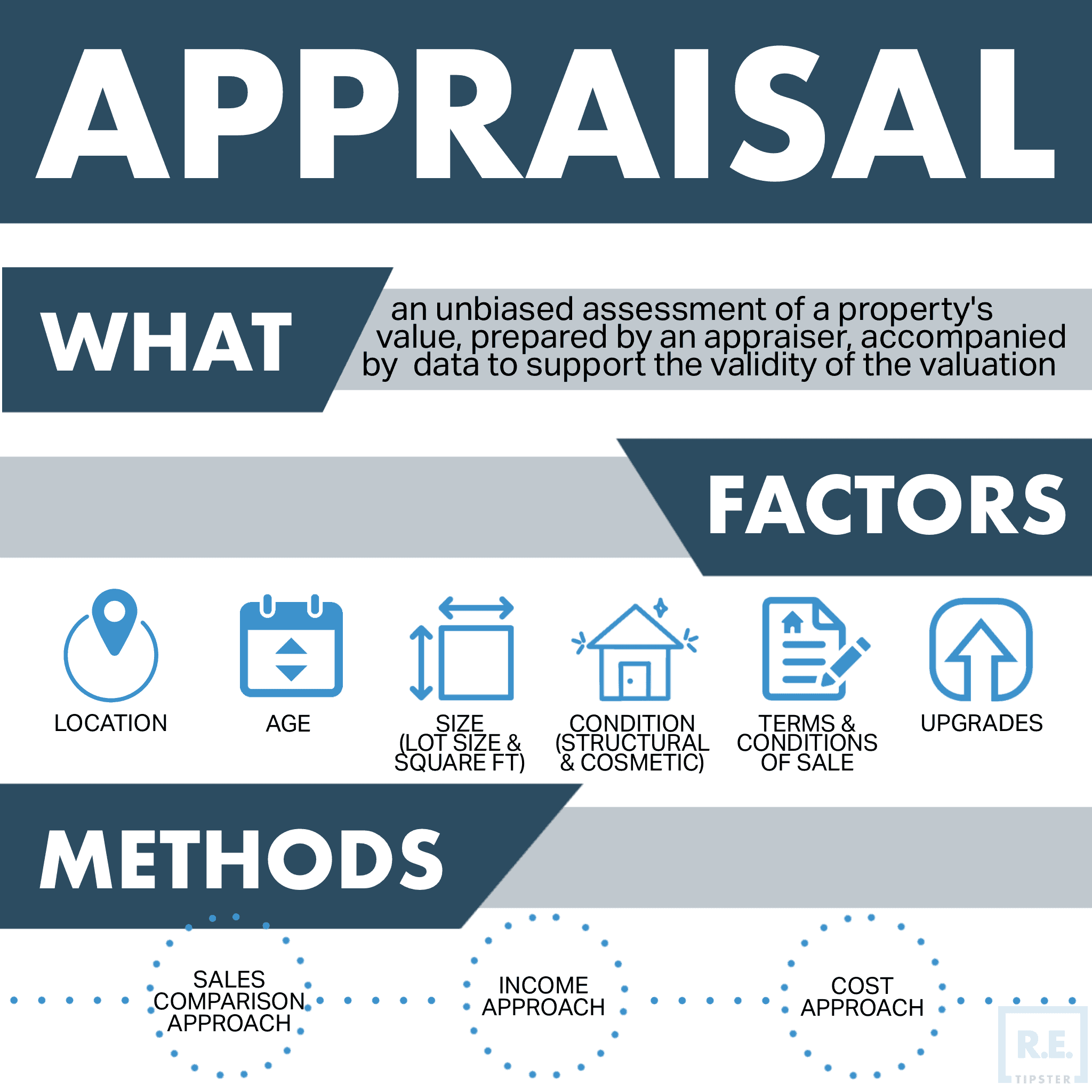

CMA vs. Appraisal

To avoid misinformation, some real estate industry regulators may demand real estate professionals include a disclaimer in every CMA that it is not an appraisal. For example, the state of New Jersey requires this statement on CMAs[11].

The biggest reason for this disclaimer is that a CMA may easily be misconstrued as an official appraisal. There are important differences between them, as discussed below.

Who Needs the Report

Property buyers and sellers benefit from the insights CMAs provide. Whereas mortgage lenders commonly require appraisals to avoid financing houses more than they are actually worth.

Cash buyers do not borrow money to close the deal, so no appraisal is required. However, such buyers may still want to hire an appraiser to avoid overpaying for the property.

Who Prepares the Report

The professionals preparing CMAs may or may not have a deep understanding of the concept of property valuation and a strong grasp of the market the subject property belongs to. Since they have a vested interest in the outcome of the home sale[12], they may be inclined to push the price of the subject property as high as possible.

On the other hand, licensed appraisers are independent parties in the transaction. In fact, they get paid to be totally impartial. They have one job: to determine a property’s fair market value through intensive research.

The Data Used in the Report

CMA reports stem from relatively superficial numbers of comps and vague local real estate market trends. Despite being based on more or less similar factors, home appraisals come from specific and verifiable variables.

Therefore, the house prices a CMA establishes are merely ballpark figures. By contrast, the property value written in a home appraisal is defensible since it is backed by careful documentation.

The Price of the Report

A CMA is largely free[13]. However, “premium CMAs” may cost four times the regular appraisal fee[14].

BY THE NUMBERS: The appraised property value matches the house’s contract price 24% to 29% of the time.

Source: CoreLogic

Takeaways

- A CMA helps establish the price range where a property is likely to be sold based on the values of comps and current local market trends.

- It is not always possible to make a purely objective CMA, as the professional who prepares a CMA makes subjective judgments on which data to include or interpret.

- CMAs are not official appraisals. Some states require additional disclaimers on CMAs that state they are not done by an appraiser.

Sources

- Merrill, T. (2014.) Location: The Most Important Factor In Real Estate. FortuneBuilders. Retrieved from https://www.fortunebuilders.com/location-important-factor-real-estate/

- Gleisner, T. (2020.) House Age: What It Does & Doesn’t Tell Us. Home Tips for Women. Retrieved from https://hometipsforwomen.com/house-age-what-it-does-doesnt-tell-us

- Molitor, B. (2020.) Evaluating a Home Checklist. FindLaw. Retrieved from https://www.findlaw.com/realestate/buying-a-home/evaluating-a-home-checklist.html

- Wiley. J. (2010.) How to Calculate Lot Sizes Into Acres. Hunker. Retrieved from https://www.hunker.com/13425958/how-to-calculate-lot-sizes-into-acres

- Clawson, M. (2016.) How to Calculate a Home’s Square Footage. New Hampshire Home Magazine. Retrieved from https://www.nhhomemagazine.com/how-to-calculate-a-homes-square-footage/

- Esswein, P. & Taylor, A. (2021.) 15 Home Features Today’s Buyers Want Most. Kiplinger. Retrieved from https://www.kiplinger.com/personal-finance/shopping/home/603217/home-features-todays-buyers-want-most

- Lacoma, T. (2022.) The Best (and Worst) Projects for Your Home’s Resale Value. The Family Handyman. Retrieved from https://www.familyhandyman.com/list/the-best-and-worst-projects-to-improve-your-home-resale-value/

- Langland, C. (2015.) What is a millage rate and how does it affect school funding? WHYY. Retrieved from https://whyy.org/articles/what-is-a-millage-rate-and-how-does-it-affect-school-funding/

- Ragone, G. (2021.) Features That Could Wreck Your Home’s Value. House Digest. Retrieved from https://www.housedigest.com/363475/features-that-could-wreck-your-homes-value/

- Hymer, D. (2008.) How accurate is a CMA? Inman. Retrieved from https://www.inman.com/2008/03/10/how-accurate-cma/

- Goodman, B. (2011.) Clarifying the Muddy Waters Concerning CMAs, BPOs, and Appraisals. Greenbaum, Rowe, Smith & Davis. Retrieved from https://www.greenbaumlaw.com/media/publication/98_ClarifyingMuddyWaters.pdf

- Lerner, M. (2022.) How Much Do Real Estate Agents Make? Commissions, Explained. realtor.com®. Retrieved from https://www.realtor.com/advice/sell/how-do-real-estate-agents-get-paid/

- Blake, A. (2022.) How Do I Get a Comparative Market Analysis and What Does a CMA Cost? HomeLight. Retrieved from https://www.homelight.com/blog/how-do-i-get-a-comparative-market-analysis/

- Marquand, B. (2021.) How a Home Appraisal Works and How Much It Costs. NerdWallet. Retrieved from https://www.nerdwallet.com/article/mortgages/home-appraisal