What Is Due on Demand (DOD)?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- Due on demand (DOD) is a clause in loan agreements that gives the lender the right to call for repayment of the loan amount whenever they choose[1].

- The due on demand clause is a standard provision found in many loan agreements and contracts, compelling the borrower to repay the loan amount before the original due date if specific conditions are not fulfilled.

- Obligations due on demand refer to financial or legal obligations that must be fulfilled immediately or upon request by the creditor or beneficiary.

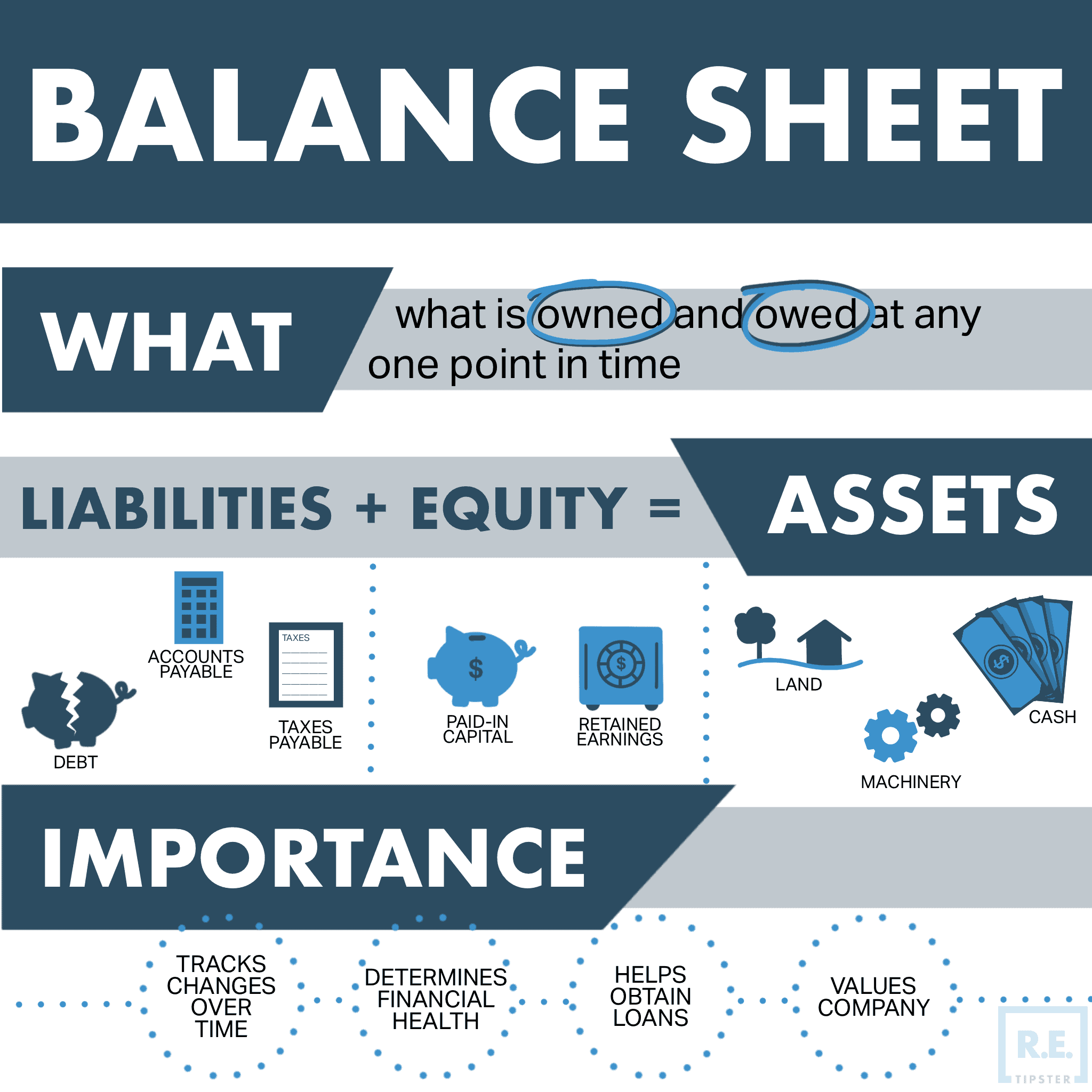

- Due on demand is generally considered a current liability.

- A due on demand expected to be settled within a year from the balance sheet date should be listed under the “Current Liabilities” section of the balance sheet.

What Is Due on Demand in Finance?

Due on demand is a clause that allows the lender to call for repayment whenever they choose, without being bound by a specific repayment schedule or timeline. It gives the lender greater control over the loan, as they can ultimately demand repayment if certain conditions are not fulfilled, or they need the funds back for any reason[2].

These clauses are commonly used in short-term loans, lines of credit, or business financing arrangements where the lender may need quick access to repayment funds or the borrower’s creditworthiness may be uncertain.

Therefore, borrowers should note the specific terms and conditions associated with a due on demand provision. Foremost are the consequences of non-compliance, as it can significantly impact their repayment obligations and financial flexibility.

What Does “On Demand” Mean in Law?

In the legal context, “on demand” typically refers to a contract condition or term requiring a party to perform an obligation or provide service immediately upon request, without delay or other conditions[3].

In contract law, the term “on demand” can specify a timeframe or trigger where one party can demand immediate performance or payment from the other. The party entitled to make the demand can require the other party to fulfill their obligation or provide the service without waiting for any particular event or condition[4].

Understanding Due on Demand in Real Estate

Due on demand is a clause commonly included in real estate contracts and mortgage agreements. In this context, the clause grants the lender the right to demand full repayment of the balance before the scheduled due date if the borrower does not meet certain conditions.

DOD is similar to an “acceleration clause,” which allows the lender to demand loan repayment if there is a violation of the contractual provisions of the loan document. The presence of this clause can have significant implications for buyers and sellers in real estate transactions.

It’s important to review the terms and conditions of these clauses (or any clause, for that matter) before entering into any contractual agreement[5].

Why Is Understanding Due on Demand Clauses Important in Real Estate?

Understanding due on demand clauses is important in real estate transactions because they are enforceable in most jurisdictions. In other words, failure to comply with the lender’s demand for repayment can result in foreclosure or legal action against the borrower[6].

Current interest rates and market conditions can lead to a lender invoking the due on demand clause. For example, if interest rates are rising and the current loan rate is below market, the lender may call on the due on demand clause to reduce their risk.

For sellers, it’s essential that the transfer of ownership, whether through a traditional sale or a subject-to-transaction, observes the lender’s requirements and doesn’t activate this clause.

On the other hand, buyers must be aware of the DOD clause in the mortgage agreement, particularly the circumstances that may trigger its enforcement. Buyers should also ensure they can repay the loan in full if the clause is invoked and seek legal advice if they have concerns or questions[7].

What Are Obligations Due on Demand?

Obligations due on demand refer to financial or legal obligations that must be fulfilled immediately or upon request by the creditor or beneficiary. These obligations have no fixed timeline or maturity date, and the creditor or beneficiary can demand payment or performance at any time, typically with little or no prior notice.

Obligations due on demand can arise in various contexts, including contracts, loans, promissory notes, guarantees, letters of credit, and other legal agreements.

Examples of obligations due on demand include:

- Demand deposits — In banking, a demand deposit is a type of account where the funds deposited can be withdrawn by the account holder at any time, upon request, without prior notice or restriction[8].

- Demand loans — In a demand loan arrangement, the lender can require repayment of the loan in full at any time without having to provide a specific due date or notice period. The borrower must repay the loan immediately upon receiving a demand from the lender.

- Demand promissory notes — A demand promissory note is a written promise to pay a specified amount of money on demand by the payee or holder of the note. Its maker is obligated to pay the amount upon request[9].

- Demand guarantees — A bank or financial institution issues demand guarantees. They assure a beneficiary that a specified amount of money will be paid upon demand without needing the beneficiary to provide evidence of loan default. The guarantor is obligated to pay the beneficiary upon request[10].

Is Due on Demand a Liability?

Due on demand represents short-term borrowings payable at the creditor’s request. Commercial and business transactions often employ DOD clauses where the borrower may need access to immediate funds for working capital or other short-term financing needs.

In accounting, due on demand is generally considered a current liability. Since it is payable upon request of the creditor, it is typically expected to be settled within a short period, making it a current liability[11].

How Should Due on Demand be Classified on the Balance Sheet?

Due on demand is classified as a current liability. Therefore, it’s listed under the “Current Liabilities” section of the balance sheet, which includes obligations to be settled within the normal operating cycle of the business or one year, whichever is longer.

Note that its classification on the balance sheet depends on the specific circumstances and accounting standards that apply to the entity in question.

Sources

- Due on Demand Sample Clauses. (n.d.) Law Insider. Retrieved from https://www.lawinsider.com/clause/due-on-demand

- Weedmark, D. (n.d.) What Does Payable on Demand Mean? CHRON. Retrieved from https://smallbusiness.chron.com/payable-demand-mean-80329.html

- On Demand Definition and Legal Meaning. (n.d.) Legal Explanations. Retrieved from https://legal-explanations.com/definition/on-demand/

- On Demand Definition. (n.d.) Law Insider. Retrieved from https://www.lawinsider.com/dictionary/on-demand

- Acceleration Clause. (n.d.) Cornell Law School. Retrieved from https://www.law.cornell.edu/wex/acceleration_clause

- Fontinelle, A. (2022, July 27.) 7 Conditions You Must Have in Your Real Estate Contract. Investopedia. Retrieved from https://www.investopedia.com/financial-edge/0810/7-must-have-real-estate-contract-conditions.aspx.

- Due-On-Sale Clause Exceptions: Everything You Need to Know. (2020, October 30.) Upcounsel. Retrieved from https://www.upcounsel.com/due-on-sale-clause-exceptions

- Chen, J. (2022, May 25.) Demand Deposit Definition, Account Types, and Requirements. Investopedia. Retrieved from https://www.investopedia.com/terms/d/demanddeposit.asp

- Promissory Note Payable on Demand. (n.d.) Upcounsel. Retrieved from https://www.upcounsel.com/promissory-note-payable-on-demand

- Halton, C. (2022, May 5.) Demand Guarantee. Investopedia. Retrieved from https://www.investopedia.com/terms/d/demandguarantee.asp

- How to classify debt due on demand. (2022, July 14.) Accounting Tools. Retrieved from https://www.accountingtools.com/articles/how-should-i-classify-debt-due-on-demand.html