What is an FHA Loan?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Basic FHA Approval Requirements and Costs

The idea behind the FHA loan program was to encourage private lenders to extend loans to lower-income borrowers who could not otherwise obtain financing to purchase their first home. While many private lenders would not normally allow for such a low down payment or approve borrowers with lower income and credit scores, many are willing to participate in the loan program because the FHA guarantee protects the lenders and mitigates their risk against losses if the borrower defaults.

FHA loans are only issued by FHA-approved lenders. Like any government loan program, FHA loans have certain restrictions and limitations that do not apply in a conventional bank loan.

As of 2020, as long as a borrower maintains a 580 credit score or higher, they can get an FHA loan with as little as 3.5% down. The FHA will insure loans for borrowers with credit scores between 500 and 579, but the down payment requirement increases to 10%.

The borrower is required to pay two types of mortgage insurance in exchange for the FHA’s participation in each loan guarantee:

- The upfront mortgage insurance premium (currently 1.75% of the base loan amount), typically paid at closing, hence the term “upfront,” but occasionally, it can be rolled into the loan itself.

- The annual mortgage insurance premium, which is paid each month along with the mortgage payment. Annual MIP is also a percentage of the loan amount, ranging between 0.45% and 1.05% depending on the loan amount, term length, and loan-to-value (LTV) ratio.

Example: John borrowed $250,000 with an FHA loan. He paid $4,375 in upfront MIP at closing and 0.85% annual MIP, or $177 a month with his mortgage payment.

Different Types of FHA Loans

The Federal Housing Administration offers several different loan programs:

- Traditional first mortgages for the purchase of an owner-occupied home

- FHA 203(k) loans which allow borrowers to roll the costs of certain repairs and renovations into the mortgage

- FHA Energy Efficient mortgages, which are a variation of the 203(k) loan, and allow borrowers to roll the cost of solar or wind energy systems and insulation upgrades into the loan

- FHA Section 245(a) loans, which are graduated payment mortgages designed for borrowers who expect their incomes to go up

- FHA Home Equity Conversion Mortgages for seniors who want to cash out the equity in their home with a reverse mortgage

- FHA One-Time Close for new construction and lot purchase for one-unit, site-built primary residences (which includes new manufactured housing, excluding single wide mobile homes) and modular homes (source)

Depending on the unique needs of the borrower, there may be more than one viable option to choose from.

FHA Loan Limits

Each year, the FHA determines what the maximum and minimum loan limits will be. In 2020, for example, the minimum was set to $331,760 for single-family home loans and the maximum was set to $765,600.

This means that in counties that are more inexpensive than the majority of the country (where 115% of the median home price is less than the floor limit to be exact) homebuyers will only be able to borrow up to $331,760 while in higher priced counties, the FHA will loan as high as $765,600. (source)

Carol M. Highsmith / Public domain

The FHA loan limit is based on a percentage of the Fannie Mae and Freddie Mac conforming loan limit. Fannie Mae and Freddie Mac are legally bound to buy single-family mortgages with origination balances under a particular amount and this amount is referred to as the conforming loan limit.

There are roughly 70 high-cost counties across the country where the FHA loan limit is 150% of the national conforming loan limit.

In four areas—Alaska, Hawaii, Guam, and the US Virgin Islands—FHA applies a special exception to the loan ceiling because construction costs are exceptionally high. In these areas, the FHA loan limit is about $1.1 million.

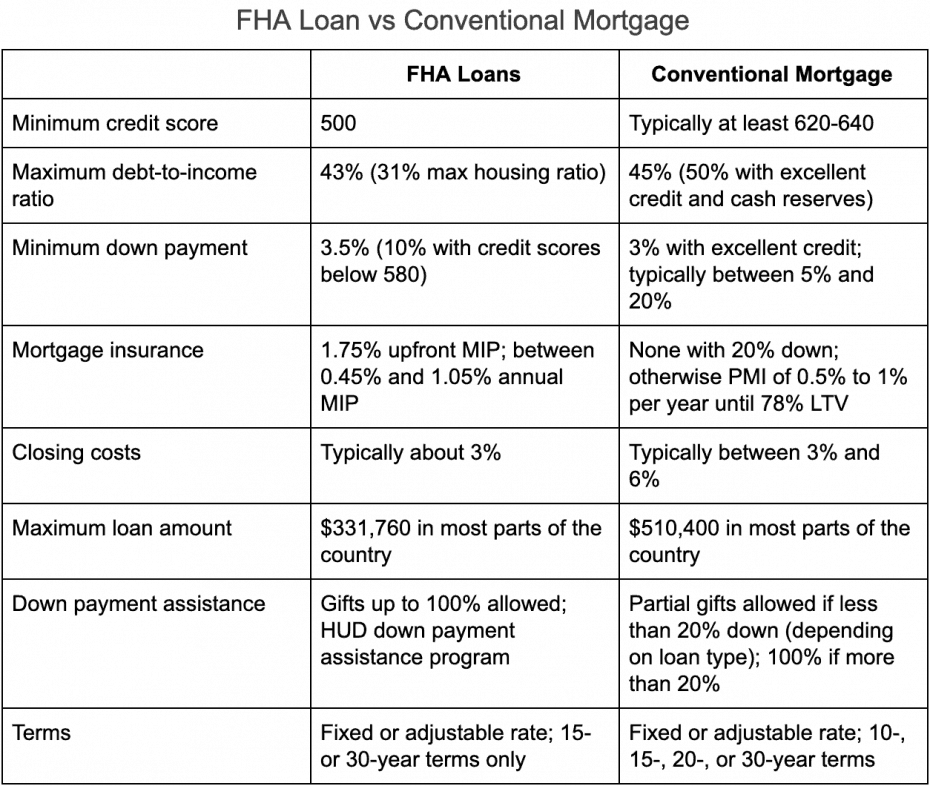

FHA Loans vs. Conventional Mortgages

The underwriting requirements are much stricter for conventional mortgages. Borrowers who can’t qualify for a conventional mortgage may be able to get financing through an FHA loan.

The chart below shows the main differences between the two types of mortgages.

Can FHA Loans be Used for Real Estate Investing?

FHA loans are designed for owner-occupied primary residences. If a prospective borrower wants to buy or build a multifamily property and live in one of the units, an FHA loan may be an option.

In the lending world, any property under four units is considered residential. Even if the subject property is a fourplex, as long as the borrower considers the property as their primary residence, then an FHA loan may be a viable option.

In fact, this is a common financing strategy for house hacking.

There are different loan limits for multifamily homes. In 2020, the following limits apply in most parts of the country:

- Single-family home = $331,760

- Two-unit home = $424,800

- Three-unit home = $513,450

- Four-unit home = $638,100

After the homeowner establishes occupancy in the home initially, it’s possible to convert it to a non-owner occupied rental property at a later date. Typically, an owner must live in the property for at least a year before moving and renting it out.

Advantages and Disadvantages of an FHA Loan

Let’s look at the pros and cons of FHA loans in a nutshell:

FHA Loan Advantages

- Available to borrowers with lower-than-average credit score

- Low down payment.

- It can be used to purchase a multifamily property, provided the owner resides in one of the units.

- It can be converted to a non-owner occupied investment property after establishing occupancy for a year.

FHA loan Disadvantages

- Lower loan limits.

- Higher MIP requirements.

- Only two term options available, 15-year and 30-year.

- Only available for primary residence.

While FHA loans aren’t the right fit for every borrower and situation, they are usually worth further investigation for any first-time homebuyer, simply because of the unique opportunity to purchase real estate with such a low down payment.