What Is a Triplex?

Shortcuts

- A triplex is a residential building with three units arranged in various configurations, such as side-by-side, top-to-bottom, or back-to-back.

- Triplexes can be either converted single-family homes or purpose-built multi-family structures.

- Triplexes are less common than duplexes or fourplexes but offer similar advantages and disadvantages.

- Triplexes generally have a higher potential for cash flow than duplexes, especially when all three units are rented out.

- Triplexes can be a good investment for those seeking multiple income streams and the potential for house hacking.

Triplex Definition

A triplex is a three-unit property with one owner. It’s similar to a duplex or fourplex but with three units.

Some triplexes are purpose-built, while others might have originally been built as large, single-family homes later divided into three separate dwellings[1] sharing one or two common walls. Triplexes, like duplexes, can be built either side-to-side or stacked. Each unit is self-sufficient, meaning each dwelling space has its respective kitchen, bathroom(s), living room, separate door to the outside, and address or unit number.

Most investors buy the triplex as a whole and then rent out all the units. Sometimes, though, they live in one unit and rent the other two (a method known as house hacking, see below[2]). While some triplex owners can live in one unit and have family members live in the other units, there is usually one reason to purchase a triplex: rental income[3].

House Hacking a Triplex

House hacking a triplex is a powerful strategy for real estate investors. By living in one unit and renting out the other two, you can potentially cover your mortgage and living expenses, effectively living for free or at a significantly reduced cost. This allows you to build equity in a valuable property while minimizing your out-of-pocket expenses.

Here’s a brief explanation of how it works and how you can live for free or for cheap with this technique:

However, house hacking a triplex requires careful planning and some real estate math. First of all, ensure that the rental income from the other units is sufficient to cover your mortgage, property taxes, insurance, and any other associated costs, including maintenance. Second, there’s always a potential for vacancy periods, so it’s a good idea to account for the occasional dry spell in terms of cash flow.

Check out our House Hacker University for a complete, A-to-Z guide on house hacking, including all the due diligence you need to make it work.

Advantages and Disadvantages of Owning a Triplex

There are a few key advantages and disadvantages to owning a triplex. Other than the obvious (such as increased rental income) and house hacking, a landlord who chooses to stay in one of the units has a few benefits:

Advantages

- The landlord is close by when repairs are required.

- The landlord has certain tax advantages, like writing off some maintenance costs, repairs, and depreciation for the rental units.

- Repairs and maintenance can be more efficient, with all three units sharing one roof, one yard, and other common areas.

- If the landlord pays utilities, they can also write off the utility bills for the rental units.

- The landlord can move out and then have three income-producing properties[4].

Disadvantages

That said, regardless of whether a landlord lives in one unit or rents all three units out and hires a triplex property management company, it has the following drawbacks:

- A triplex is typically more expensive than a single-family home or a duplex.

- It can be more difficult to sell a triplex since there are likely tenants involved who might have different lease end dates.

- It can be difficult for landlords to live so close to tenants. If there are any problems, the landlord is still a neighbor of the tenants.

Triplexes are also notably less common than duplexes and fourplexes, so if a buyer is looking specifically for a triplex, they may have a more difficult time finding them in many markets.

Buying a Triplex

A building with more than four units is considered by most lenders to be commercial real estate and thus, requiring a commercial real estate loan, which has a very different set of loan terms than a residential loan.

A triplex, because it has fewer than five units (as does a duplex and a fourplex) qualifies for a residential mortgage loan. Buildings with five or more units will almost always be financed with a commercial loan.

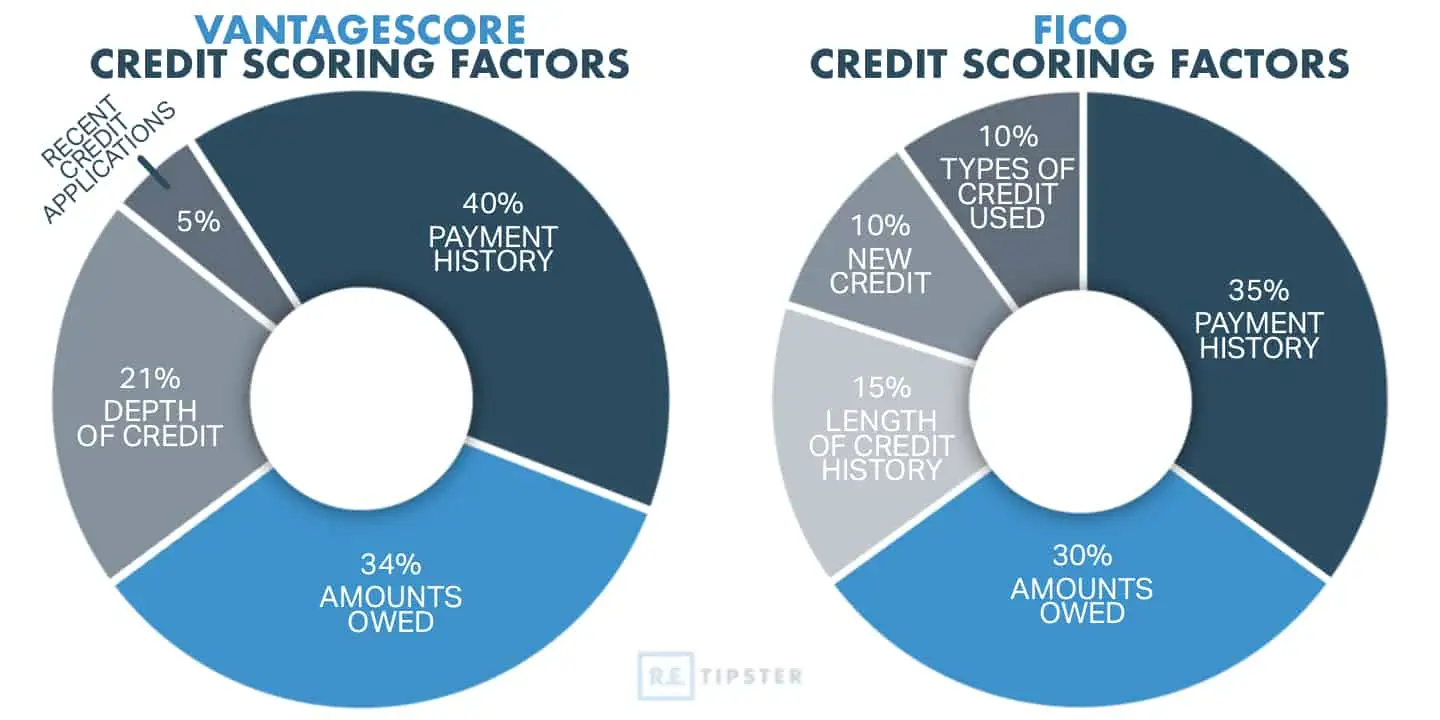

Typically, a commercial loan has a shorter amortization and is based more heavily on the property’s net operating income. In contrast, a residential loan is based more heavily on the applicant’s creditworthiness.

Check out this graphic, where we examine the credit scoring factors of FICO and VantageScore, the top two credit bureaus in the U.S.

Investors just starting out or familiar with only the more prevalent single-family home might be interested in investing in a duplex, triplex, or fourplex. Any building with two, three, or four units is considered a multifamily home.

To know more about which kind of income-producing property that’s right for your investing profile, read our guide on buying rental property, where we discuss single-family homes vs. triplexes and other considerations.

In any case, a real estate investor buying a multifamily property can get either a residential or a commercial loan[5], but it can be advantageous to get a residential loan whenever possible. A residential loan usually has a lower interest rate and a longer loan term than a commercial one[6]. Even if an investor isn’t interested in a long-term loan and plans to pay off a residential loan early, they can still finance the deal with a 30-year loan and pay it off whenever they like. This offers more flexibility.

Triplex vs. Duplex: Investment Considerations

Triplexes and duplexes are popular multifamily property types, but they have distinct characteristics that can significantly impact your investment strategy. Understanding these differences can help you make a sound investment decision.

The table below highlights key comparisons between triplexes and duplexes:

| Feature | Duplex | Triplex |

|---|---|---|

| Number of Units | 2 | 3 |

| Relative Cost | Lower | Higher |

| Financing Options | Similar (e.g., FHA loans when owner-occupied) | |

| Average Monthly Cash Flow (2023) | $543 | $837 |

| Management Effort | Lower | Higher |

| Potential Buyer Pool | Larger (investors and owner-occupants) | Smaller (primarily investors) |

| Vacancy Risk | Higher | Lower |

Otherwise, for maximum cash flow, an investor may choose to invest in a fourplex or a commercial apartment complex instead.

Frequently Asked Questions: Triplex

Is buying a triplex a good investment?

Buying a triplex can be a good investment for several reasons:

- Multiple income streams: With three units, you have the potential for higher overall rental income compared to single-family homes or duplexes.

- House hacking potential: As explained above, you can live in one unit and rent out the other two, potentially covering your mortgage and living expenses.

- Economies of scale: Maintenance and repair costs can be more efficient when spread across three units.

- Diversification: Having three units reduces the impact of vacancies on your overall cash flow.

However, triplexes also come with challenges, such as increased management responsibilities and potentially higher initial costs. Assess your financial goals, local market conditions, and personal management capabilities before investing.

How to find triplex properties for sale?

Finding triplex properties for sale may involve working with a real estate agent specializing in multi-family properties. These professionals have access to listings that may not be widely advertised and can provide valuable insights into the local multi-family market.

Otherwise, real estate platforms like Zillow and Realtor.com are often your best bet. Don’t overlook local multiple listing services (MLS) either, as these can be goldmines for finding triplexes that have just hit the market.

Finally, networking with other real estate investors, joining local investment groups, and searching for off-market properties can be rewarding. Consider direct mail campaigns to owners of triplexes in your target neighborhoods or driving for dollars to find potential properties. Real estate auctions and working with wholesalers can also provide opportunities to find triplex investments.

What are triplex zoning regulations?

Triplex zoning regulations vary by location but generally fall under multi-family or medium-density residential zoning.

Before investing in a triplex, consider the following:

- Ensure triplexes are allowed where you want to buy or build.

- Many areas have minimum lot size requirements for triplexes.

- Most zones require a certain number of off-street parking spaces per unit.

- Triplexes must meet specific building codes, including fire safety and accessibility standards.

- Some areas restrict the number of unrelated individuals who can live in each unit.

Always check with your local zoning department or a real estate attorney to understand specific regulations in your target area. These can significantly impact your ability to purchase, renovate, or operate a triplex.

References

- Asiba, M. (n.d.) What Is A Triplex Apartment? Apartment ABC. Retrieved from https://apartmentabc.com/triplex-apartment

- Mizes, B. (2017.) House Hacking— The Best Investment You Can Make. Medium. Retrieved from https://medium.com/@benmizes/house-hacking-the-best-investment-you-can-make-21f6b889f1b2

- Patterson, M. (2019.) Buying a Duplex, Triplex, or Fourplex—The Ultimate Guide. Fit Small Business. Retrieved from https://fitsmallbusiness.com/how-to-buy-a-duplex-triplex-fourplex/

- LoanShoppers. (n.d.) The Pros and Cons of Buying 2 to 4 unit Investment Properties. Retrieved from https://www.loanshoppers.net/blog/pros-cons-buying-2-4-unit-investment-properties/

- Wichter, Z. (2020.) How to finance a duplex or multifamily home. Bankrate. Retrieved from https://www.bankrate.com/finance/mortgages/how-to-finance-a-duplex-or-multi-unit-home.aspx

- Semi-Retired MD. (n.d.) Residential vs. Commercial Loans: What’s the Difference? Retrieved from https://semiretiredmd.com/residential-vs-commercial-loans-whats-the-difference/