What Is the Infinite Banking Concept?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Understanding How Infinite Banking Works

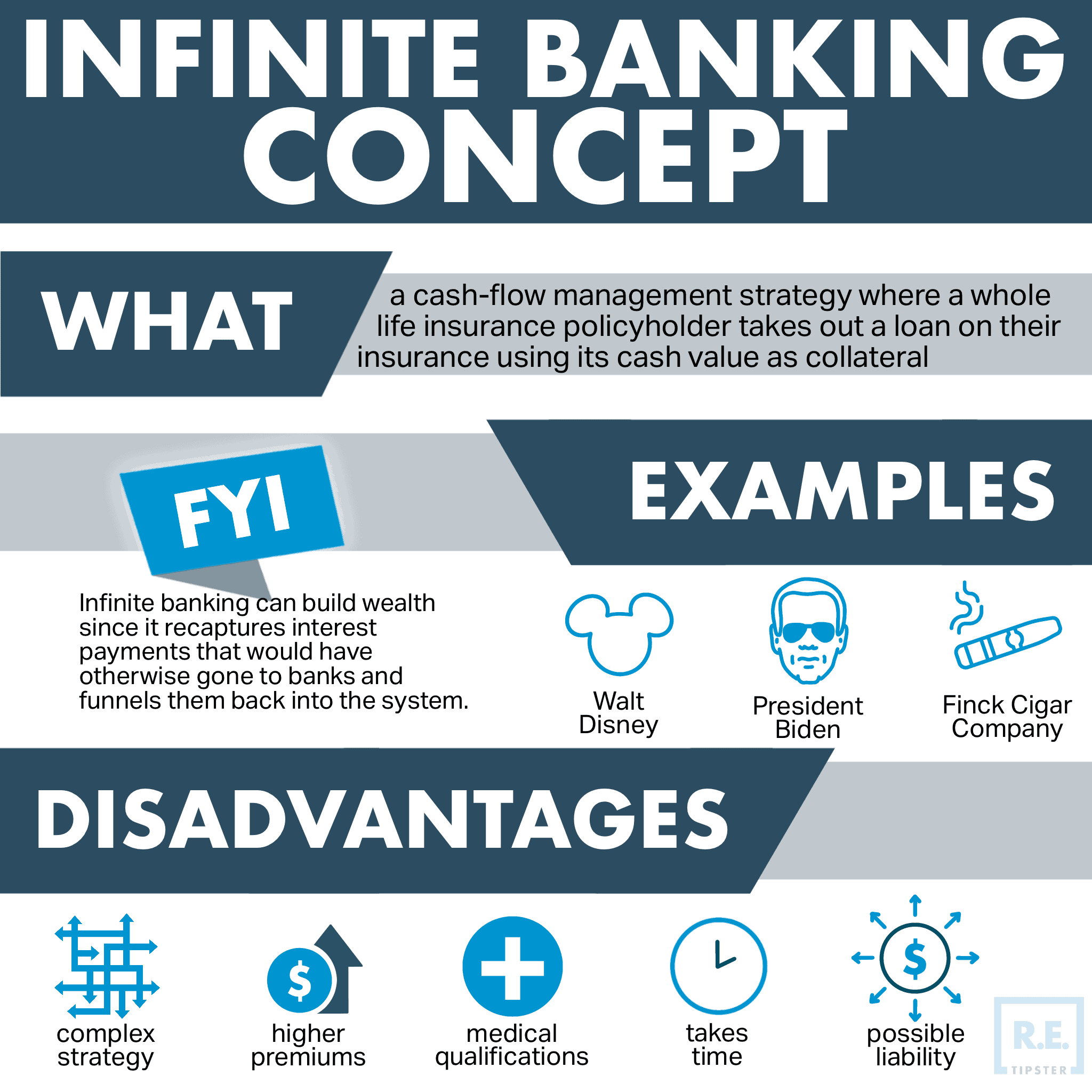

At its core, infinite banking allows one to leverage one’s cash value inside their whole life insurance policy instead of relying on traditional financing from banks or other creditors. It does this by using the individual’s insurance policy and its equivalent cash value as collateral for the loan.

“Insurance,” in this case, usually refers to whole life insurance, which covers an individual’s entire life (in contrast to term life insurance, which only covers the policyholder’s beneficiaries in the event of death[1]).

By paying premiums on a dividend-paying whole life policy, the policyholder can build up a cash value or equity as collateral for large loans. As long as premiums are current, policyholders can take out a loan against their equity to finance major expenses, such as vacations, cars, business equipment, mortgages, and investments.

Policyholders can even utilize the funds from the policy’s cash value in the form of a loan while simultaneously having those same dollars earn compounding interest inside of their policy. This allows them to earn interest in literally two different places with the same dollar.

Insurers usually process such requests without trouble since the collateral is already in their hands. They can easily take possession of it if the policyholder defaults on their payments.

Best of all, the system presents huge tax savings since dividends from cash-value life insurance policies are not subject to income tax[2].

The late Nelson Nash, a financing and life insurance pioneer, first demonstrated the infinite banking concept[3] in his book Becoming Your Own Banker: Unlock the Infinite Banking Concept[4]. Nash argued how specially designed life insurance contracts could accrue equity and function as dividend-paying assets. He further showed how it could create one’s own lending system for financing large purchases while simultaneously growing long-term wealth.

Creating an Individual Banking System

The Infinite Banking Concept is a viable framework for a personal banking system. The reason is that it is predicated on using one’s own assets as a source of capital, then funneling the loan payments back into the system to grow the underlying equity of the policy.

Under this structure, the “individual bank” consists of a few foundational elements—regular premium payments, dividend payments from policy, and a guaranteed interest rate. If a policyholder takes out a loan, they are essentially borrowing against themselves, thus becoming their own bank.

Moreover, with the correct type of policy, taking out a loan does not diminish the policy’s cash value. As long as the policyholder maintains their premium payments and pays back the principal plus interest on the loan, the equity value will continue to compound uninterrupted.

RELATED: 025: What Is the “Infinite Banking Concept” (And Is This Really Legit)?

What Problems Can Infinite Banking Solve?

Infinite banking is all about reducing costs and improving wealth generation potential.

Compare this to traditional banking, where the biggest cost associated with loans is the interest charged.

For instance, the average American consumer will pay over $8,000 in interest each year on credit cards, auto loans, mortgages, student loans, business loans, and other types of credit[5]. In other words, around 14% of the median household’s income is spent obtaining funding from banks and traditional lenders.

Under infinite banking, interest rates on loans may be lower than those charged under traditional financing since the loan is secured using liquid cash value that already belongs to the policyholder.

By recapturing all this interest and then moving them through an asset they control, policyholders can borrow funds and earn interest on the amount at the same time. Under favorable conditions, the cash value of the policy can continue to grow until it is greater than the cost of loan interest. The policyholder then nets positive growth even while making the loan repayments.

Implementing the Infinite Banking Concept

There are some creative ways to implement infinite banking. The important thing is that the approach adheres to the fundamentals of the strategy, which is choosing the right kind of whole life insurance policy.

A properly structured whole life insurance policy can become a high-performance savings vehicle. One reason is that it is designed to gain equity with each premium payment.

In addition to carrying a cash value that builds over time, whole life insurance remains active over the policyholder’s lifetime. Upon their demise, death benefits are also paid out to designated beneficiaries.

For infinite banking, it is important to choose a policy from a mutual insurance company. This is because mutual companies are owned by their policyholders and therefore pay out a portion of profits as dividends to owners every year. These dividend payments immensely add to the policyholder’s bottom line over time.

Growing Wealth

Once premiums start flowing into the cash value account, it becomes a personal pool of money that earns a guaranteed rate of return on the policy’s cash value.

Even with an average annual rate of return on a whole life policy of 1.5%[6], it is still much better than the national average interest rate for savings accounts at 0.07% or even lower[7].

The policyholder just needs to redirect their savings, investing, and living dollars through this “private banking system” to further increase the equity or cash value of the policy. The bigger the equity value, the bigger the loan amounts they can afford to take out.

The infinite banking strategy can also be a component of a diversified investment portfolio, making it an integral contributor to wealth building and preservation.

What Are the Disadvantages of Infinite Banking?

For all its benefits, infinite banking is not without disadvantages or limitations. These include:

- It is a complex strategy — Setting up infinite banking often requires working with an expert consultant. It is not something that one can just structure on their own.

- It requires higher premiums — Whole life insurance premiums are generally higher than term life insurance policies (hundreds or even thousands of dollars per month). Not everyone can afford such payments, so creating an individual banking system is not always feasible, as proponents of the concept claim.

- Policyholders need to qualify medically — When setting up a whole life insurance policy, the insured party will usually be required to undergo a battery of medical tests to ascertain their health before the insurance company confirms a quote. In other words, the value and potential savings of a whole life policy can often depend on non-banking factors such as health and age.

- Cash value on policies takes time to build — It will usually take several years until the cash value of a whole life policy is substantial enough to serve as collateral for large loans.

- Possible tax liability from funding the policy too quickly — People with enough money may want to pay a lump sum into their policy to build up the cash value quickly. There is nothing wrong with this approach, but doing it incorrectly can trigger tax liabilities as the IRS can deem the payment as exceeding legal tax limits and therefore label it as a modified endowment contract (MEC)[8]. In such cases, the life insurance policy’s tax-saving benefits no longer apply.

Notable Real World Applications of Infinite Banking

Case Study #1: Walt Disney

After failing to obtain traditional financing to build Disneyland, founder Walt Disney took out a loan from his cash-value life insurance[9]. Today, Disneyland is known worldwide, making Walt’s application of the Infinite Banking Concept hugely successful.

Case Study #2: U.S. President Joe Biden

During his term as Vice President, Joe Biden took out policy loans against his whole life insurance policies with MassMutual to finance some of his large purchases. These transactions were recorded in his public financial disclosure report[10] released by the White House in May 2012.

Case Study #3: Finck Cigar Company

The Finck Cigar Company is a well-known cigar brand with a tremendous selection of cigars and related accessories. To get the company off the ground, founder Henry William Finck took out a $1,000 loan on his life insurance policy in 1893[11].

Takeaways

- The Infinite Banking Concept is a cash-flow management method that allows individuals to leverage dividend-paying, whole life insurance policies to create their own banking system. This strategy involves policyholders taking out loans on their insurance using its cash value as collateral.

- Infinite banking can build wealth since it recaptures interest payments that would have otherwise gone to banks and funnels them back into the system.

- As a drawback, the Infinite Banking Concept is complex and often requires outside expertise to set up. Plus, it can take several years to grow the cash value of the life insurance policy to sizable and suitable security against policy loans.

Sources

- Danise, A and Masterson, L. (2022) What Is Term Life Insurance? Forbes. Retrieved from https://www.forbes.com/advisor/life-insurance/choosing-the-right-term-life-insurance/

- Kuepper, J. (2022). A Guide to Dividend-Paying Whole Life Insurance. Investopedia. Retrieved from https://www.investopedia.com/articles/personal-finance/011816/guide-dividendpaying-whole-life-insurance.asp

- Living Wealth. (n.d.) Nelson Nash the Father of Infinite Banking. Retrieved from https://livingwealth.com/who-is-nelson-nash/

- Nelson Nash Institute. (n.d.) Becoming Your Own Banker. Retrieved from https://infinitebanking.org/product/becoming-your-own-banker/

- Johnson, H. (2020). Here’s How Much the Average American Pays in Interest Each Year. The Simple Dollar. Retrieved from https://www.thesimpledollar.com/loans/personal/heres-how-much-the-average-american-pays-in-interest-each-year/

- Consumer Reports. (2015.) Is whole life insurance right for you? Retrieved from https://www.consumerreports.org/cro/news/2015/04/is-whole-life-insurance-right-for-you/index.htm

- Goldberg, M. (2022) What is the average interest rate for savings accounts? Bankrate. Retrieved from https://www.bankrate.com/banking/savings/average-savings-interest-rates/

- Adams, R. (2021). What Is a Modified Endowment Contract? Retrieved from https://www.prudential.com/financial-education/what-is-a-modified-endowment-contract

- Anderson, B. (2012). Slideshow: 6 famous brands started or saved by life insurance. ThinkAdvisor. Retrieved from https://www.thinkadvisor.com/2012/04/06/slideshow-6-famous-brands-started-or-saved-by-life-insurance/

- U.S. Office of Government Ethics. (2012). Executive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT. Retrieved from https://s3-us-west-2.amazonaws.com/lifebenefits/website/blog-resources/Joe+Biden+May+2012+Financial+Statement.pdf

- Finck Cigar Company. (1991.) Interview with Henry William Finck Sr. Retrieved from http://www.finckcigarcompany.com/about/interview_with_henry_william_finck_ii/